December Market Newsletter: Outlook for 2026

Christopher Bowlby - Dec 17, 2025

We have lived through a year where the headlines and the fundamentals often pointed in different directions. Trade drama and policy uncertainty dominated the narrative.

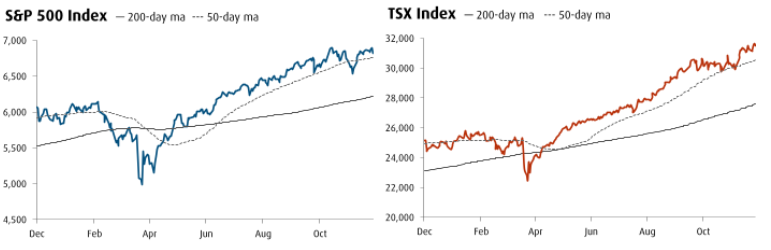

Markets are closing out the year in a familiar place: equities near highs, volatility muted, and investors debating whether the economy is "slowing" or "holding up." The surface looks calm. The map underneath has changed.

We have lived through a year where the headlines and the fundamentals often pointed in different directions. Trade drama and policy uncertainty dominated the narrative. But earnings resilience and an accelerating AI investment cycle did a lot of the real economic work. That tension matters because it likely carries into 2026: more noise than usual, and a market that keeps rewarding what is durable.

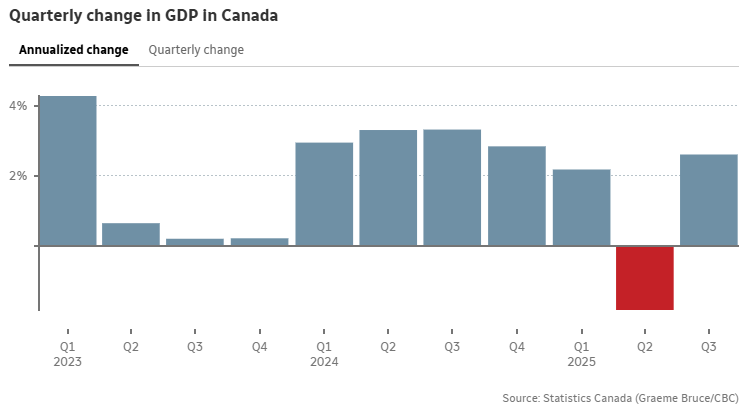

Canada has been the late-year surprise. A stronger third quarter GDP print, revisions that improved the productivity story, and a labour market that rebounded quickly forced a reset in expectations. The currency firmed. Yields repriced. Recession talk faded.

The U.S. picture has been messier. Real spending has cooled beneath still decent headline sales. Payrolls have been choppy. Hiring has become more selective. The signal is not "crack" so much as "downshift," and the policy implications are no longer obvious because rates have moved closer to neutral.

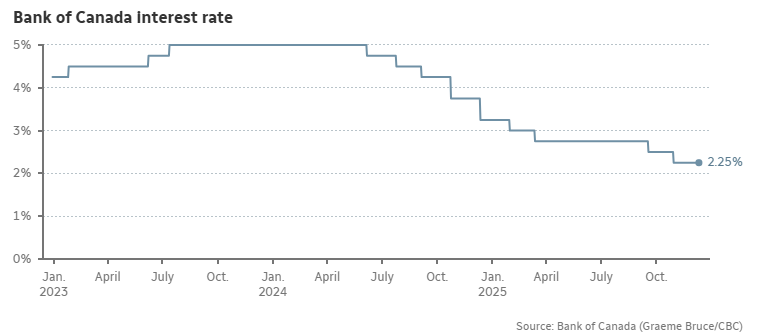

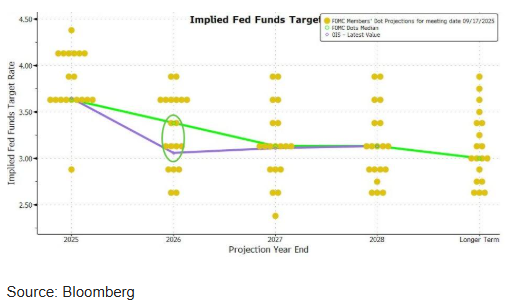

That is why the final central bank decisions of the year mattered. Not because a quarter point up or down changes anyone's long-term plan. But because the market is now trying to price a world where the Fed and the Bank of Canada are no longer moving in sync, and where the next move depends less on urgency and more on interpretation.

The core point for clients is simple. 2026 will not be won by guessing the exact path of policy rates. It will be won by staying focused on what actually drives returns: earnings, productivity, capital discipline, fiscal support, and the ability of companies and investors to adapt as the cycle bends.

Debbie, Chris, Mark and Rosemary

Canada: Resilience, Revisions, and the Quiet Turn

Canada spent much of the year looking weaker than it actually was. Then the data changed the story quickly.

The third quarter GDP report delivered a strong rebound. Part of the strength came from trade dynamics and a pullback in imports, but the broader message was still clear: the economy absorbed the shock better than expected and kept moving forward. Even with a softer start to the fourth quarter, the improvement in the growth trajectory was real.

Then came the productivity revisions. Statistics Canada's revisions were meaningful, lifting output per hour across the past several years. Canada is not suddenly a productivity leader, but the narrative of steady deterioration softened. A stronger productivity base matters because it supports income growth and reduces the risk that supply constraints become a binding limit.

The labour market was the third surprise. Employment strengthened, unemployment fell from late-summer highs, and hours worked rebounded. Population growth slowed, which helped, but the job gains also broadened. Private-sector hiring improved. Services held up. Youth unemployment dropped sharply. Manufacturing was weaker, but the overall picture looked better than the mood implied.

Canada's resilience has been more practical than mysterious. Policy support has been meaningful. The trade impact has been concentrated in specific industries rather than broad-based across the economy. Domestic spending rotated in ways that kept activity steadier than expected. And the TSX benefited from its sector mix, particularly financials and commodities, which supported sentiment even while the headlines stayed gloomy.

On the monetary policy side, the Bank of Canada held interest rates at 2.25% as expected at their December meeting. Canada is still dealing with the heavy cloud of U.S. trade uncertainty, a cloud that is very unlikely to disperse anytime soon and as such we are expecting rates to hold for 2026 on the back of strong fundamentals but increased uncertainty.

There are still important risks. Inflation has been sticky. The curve has steepened as longer yields moved higher. Fiscal deficits widened meaningfully at both federal and provincial levels, using up some policy room that would normally be available for the next crisis. And the trade calendar matters. The USMCA review sits on the horizon, and trade policy will remain a source of periodic volatility.

But stepping back, the message is simple. Canada looked soft. It was not. Canada looked at risk of recession. It avoided it. The Canadian cycle often turns quietly, and then all at once. We may be in that phase.

The United States: A Downshift, Not a Break

The U.S. economy did not fall off a cliff this year. It did lose momentum, and the most important shift showed up in real spending.

Nominal sales can still look healthy, especially around the holidays. But after inflation, demand has cooled. Durable goods weakened into the fourth quarter. Nondurable goods softened too. This is the kind of slowdown you only see when you stop watching the headlines and start watching the underlying trend.

Real incomes tell a related story. Wages are still rising, but the cost of living has taken its toll. After a long stretch where consumption carried the cycle, households are showing fatigue. Consumer surveys have slipped even while equity prices hover near highs. That gap between what people feel and what markets do is not new, but it becomes more important late in a cycle.

The labour market has been unusually hard to read. Hiring is slower, but layoffs remain low. Wage growth is cooling, but still positive in real terms. Some indicators are soft, others steady. It is a labour market that is both easing and stable, and that can keep markets oscillating between "soft landing" and "something worse."

One theme worth watching in 2026 is the possibility of jobless growth. Not because AI is "taking all the jobs" tomorrow, but because some of the forces supporting profits and productivity do not require large incremental headcount. Automation, data-centre buildouts, and margin discipline can lift earnings without lifting employment in the same way past cycles did. If that dynamic persists, we can see a strange mix: decent earnings and GDP outcomes alongside slower job creation. That is not a recession signal by itself, but it changes how we interpret labour-market data and consumer confidence.

AI is part of this story, but not the whole story. The early impact is subtle and uneven. It appears most visible in entry-level hiring and certain repeatable roles, while experienced workers and occupations that complement AI tools remain in demand. The realistic base case is gradual change with uneven timing by industry.

This brings us to the Federal Reserve. The key shift is not that the Fed cut again. It is that policy is now close enough to neutral that the committee can legitimately disagree. When rates are far from neutral, the path is usually clearer. When they are near it, the debate becomes more balanced, and the communication gets noisier.

That matters because bond markets are more sensitive to the rationale for policy than equity markets are. More visible disagreement among policymakers can produce short-term volatility in yields even if the underlying economic trend stays intact.

The takeaway is straightforward. The U.S. economy is cooling, but not cracking. Policy is easing, but not in a straight line. The market will continue to reward earnings durability over optimism, and it will remain quick to punish anything that looks like "priced for perfect."

Equities: Earnings Do the Heavy Lifting

Source: BMO Economics

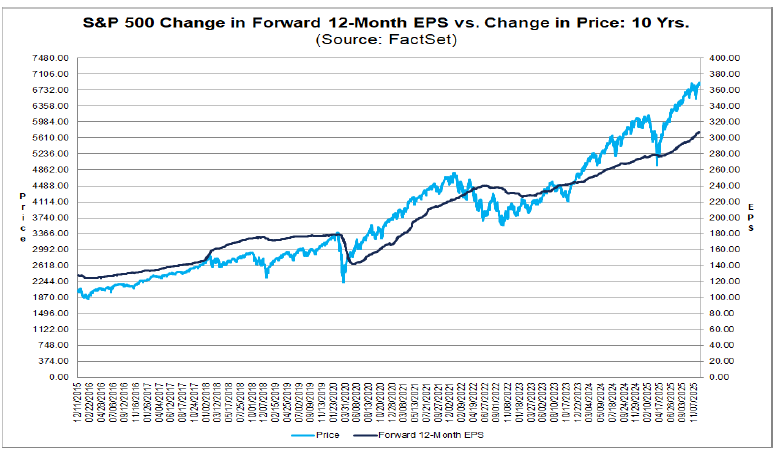

Equity markets rose through uncertainty this year because earnings and investment held up better than expected. That remains the backbone heading into 2026.

In the U.S., the dominant theme is still the AI capex cycle. Chips, servers, cloud infrastructure, and data centres are driving one of the largest corporate investment waves in years. That spending supports earnings directly through revenues for the builders and enablers, and indirectly through productivity gains over time.

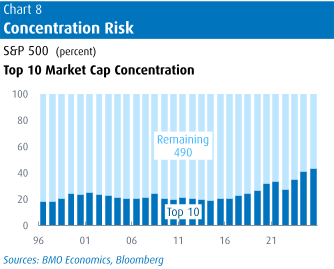

The challenge is valuation. The index is expensive, and the earnings bar is high. Breadth has improved at the margin, but leadership remains concentrated in the companies most directly tied to the AI ecosystem. This is not inherently bearish. It is a reminder that the room for disappointment is smaller.

Here is the constructive point that matters for clients: the equity case does not require multiple expansion if earnings continue to do the heavy lifting. The more credible forecasts for 2026 and 2027 are built around a simple mix: steady revenue growth, modest margin improvement, and a small but rising contribution from productivity gains tied to early AI adoption. The exact number is less important than the framework. Returns can still be earned through earnings even if valuations stop helping.

The other feature to watch is whether earnings strength broadens beyond the largest technology names. The biggest stocks still represent an outsized share of index value and index earnings. If the economic backdrop remains stable, the "rest of the market" can gradually catch up. A broadening of earnings would not mean the leaders disappear. It would mean the foundation improves.

Canada has had a different experience. Financials, materials, and energy carried much of the performance, supported by higher gold prices, stable credit conditions, and a domestic economy that ended the year sturdier than expected. The TSX remains less expensive than U.S. equities, and its leadership reflects different drivers. The wild card is trade. The USMCA review and sector-specific tariff risks will matter for sentiment across metals, autos, and forestry. But as long as the domestic data stays constructive, the Canadian equity backdrop is not as fragile as the narrative implies.

Across both markets, quality has been the common thread. Investors have rewarded strong balance sheets, durable cash flow, and disciplined capital allocation. More cyclical and levered parts of the market have faced a tougher path.

Going into 2026, the equity narrative becomes more balanced. AI investment remains real, but execution will matter. Earnings expectations need to be met. Fiscal policy is supportive, but markets will watch how deficits and long-term yields evolve. This is not the environment for indiscriminate risk-taking. It is the environment for owning businesses that can compound through noise.

Bonds and Credit: Duration Is Back, Credit Is Tight

Fixed income looks different today than it did two years ago. After a long adjustment to higher rates, bonds can once again play a real role in portfolio construction.

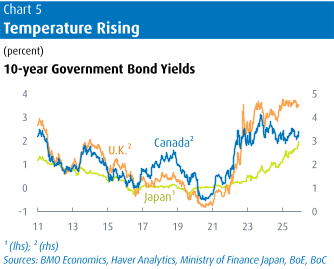

The front end of the curve has moved lower as central banks cut rates and approached neutral. At the same time, long-term yields have risen as term premium rebuilt and fiscal realities became harder to ignore. The result is a steeper curve and a better balance between income and risk.

In Canada, that shift has been clear. Short-term yields came down as rate cuts worked through the system. Longer yields moved higher as investors demanded more compensation for holding duration in an environment of widening deficits and heavier supply. That steepening improves the entry point for high-quality long-term bonds. They now offer yields that can absorb volatility while still providing ballast if growth slows.

Credit markets tell a different story. Spreads are tight. Corporate bonds are not offering much compensation for late-cycle risks or for the uncertainty that can come from trade flare-ups, a softer U.S., or shifting liquidity conditions. This is why we remain selective in adding corporate credit.

There is also a structural reason to be careful. We are seeing more complexity in how certain types of financing are packaged and distributed, particularly around large infrastructure builds tied to the AI cycle. As more risk is syndicated or moved into structures that are harder to see in aggregate, underwriting becomes less about headline spreads and more about understanding where the risk ultimately sits. This is not a prediction of stress. It is a reminder that late-cycle credit surprises rarely arrive with clean labels.

A final point that matters for 2026: even if the Fed eases further, it does not guarantee sharply lower long-term yields. Fiscal fundamentals are deteriorating, debt servicing costs are rising, and investors are demanding more compensation for holding duration over a multi-year horizon. In other words, the front end can move lower while the long end stays sticky. That is another reason we prefer high-quality duration for balance and remain selective in credit.

2026: The Year of Interpretation

The coming year will not be driven by one dominant force. It will be shaped by how investors interpret overlapping trends that do not always move in the same direction.

First, policy divergence. The Fed and the Bank of Canada are entering 2026 with different starting points. The U.S. is managing a slowdown in real spending and a labour market that is easing. Canada is digesting a rebound in growth and a more resilient labour market than expected. Markets will need to interpret two cycles, not one. That will influence currencies, yields, and relative market performance.

Second, trade policy. Trade uncertainty will likely remain a source of periodic volatility, even if the intensity fades from 2025 levels. Several 2026 milestones matter, including legal and negotiation events tied to tariff authority and the USMCA review. The base case is not peak chaos again, but a year where trade headlines recur and businesses continue adapting supply chains and capital plans around a more transactional framework. Markets tend to price the end-state faster than they price the headlines, and investors should remember that when the noise returns.

Third, the AI investment cycle. One useful way to frame the past year is that trade uncertainty dominated the headlines while AI investment did much of the real economic work. That balance likely persists into 2026. AI spending supports growth through direct capex and through the wealth effect from strong equities.

It is also worth keeping expectations grounded. AI adoption is real, but the measurable impact on aggregate earnings is still early. Productivity gains take time because organizations need to change workflows and learn how to deploy tools at scale. Progress is likely to arrive in uneven steps, not a straight line.

Fourth, the consumer. Inflation is cooler than it was, but it still absorbs a meaningful share of income. Real spending has slowed in the U.S., and value-oriented behaviour is visible in both countries. Households remain the swing factor. If real incomes stabilize and job growth holds up, the earnings backdrop can stay firm. If not, the slowdown becomes more visible.

Fifth, Canada's productivity story. The revisions do not solve the long-term challenge, but they soften the narrative. Continued investment in infrastructure, housing supply, defence, and technology could support a more durable path. Investors should watch for early signs that efficiency improves as population growth normalizes and capacity constraints ease.

Finally, fixed income. With higher starting yields and a steeper curve, duration is relevant again. In a year where policy paths may diverge and growth may slow at different speeds, bonds can play a larger role in smoothing portfolio outcomes.

Closing

This year reminded investors that cycles rarely move in straight lines. Data can mislead. Narratives can dominate. Markets can remain calm while the map changes underneath.

The discipline that works is not complicated: stay diversified, rebalance when markets move too far in one direction, and keep the focus on quality. Let time and compounding do what short-term predictions cannot.

Thank you for your trust and partnership this year. We look forward to guiding you through 2026 with clarity, discipline, and a steady focus on what matters most for your long-term goals.