Flying Through the Fog

Christopher Bowlby - Nov 10, 2025

Markets appeared calm in October as equities rose, volatility stayed low, and both the Federal Reserve and the Bank of Canada trimmed rates. Beneath the surface, visibility is limited and calm is not the same as certainty.

Markets Are Calm, but the Map Just Changed

Equities finished October higher. The S&P 500, the TSX, and most global indexes posted gains. Volatility is low, credit spreads are tight, and bond yields eased as both the Federal Reserve and the Bank of Canada trimmed rates by a quarter point.

At first glance, that sounds like calm. But the calm is deceptive. The U.S. government remains shut down, leaving investors without fresh jobs or inflation data. Ottawa just tabled its largest investment plan in a generation. Central banks are easing cautiously, not confidently.

Markets are learning to function without clear visibility, guided by earnings, liquidity, and the hope that policy remains predictable enough to steer by. Investors are flying through the fog.

Earnings Are Doing the Heavy Lifting

With the usual U.S. data on hold, earnings have taken center stage, and they have been strong.

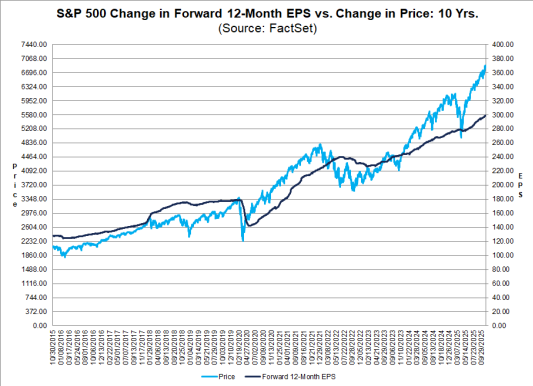

FactSet reports that with roughly two-thirds of the S&P 500 having reported, eighty-three percent of companies beat earnings expectations and seventy-nine percent beat revenue forecasts. Earnings are up more than ten percent year over year, the fourth straight quarter of double-digit growth. Revenue growth came in near eight percent, the best since 2022.

Margins widened slightly to almost thirteen percent, above both last quarter and the five-year average. Technology, financials, and utilities led the gains, while even consumer and materials firms delivered positive surprises.

Analysts now expect another seven to eight percent earnings gain in the fourth quarter and about eleven percent for 2025. That keeps valuations elevated but still defensible.

Corporate America is still pulling its weight.

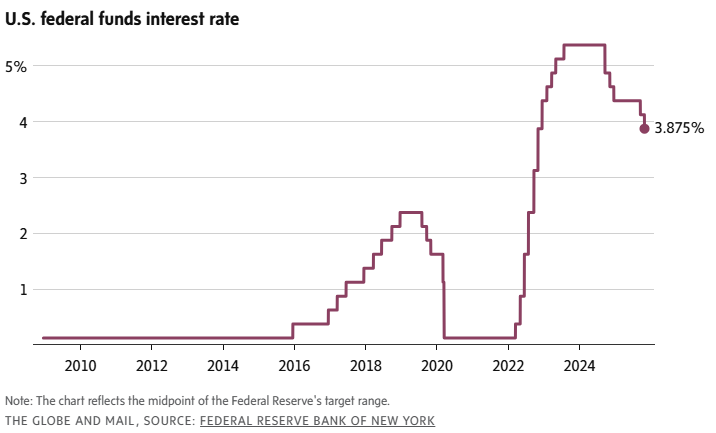

The Federal Reserve: Easing Without Over-Promising

The Federal Reserve cut rates by a quarter point to a range of 3.75 to 4.00 percent, acknowledging softer hiring and slower growth. Chair Powell said policy remains data-dependent but will not wait forever for clarity. The data blackout has forced policymakers to make judgment calls based on private indicators rather than official reports.

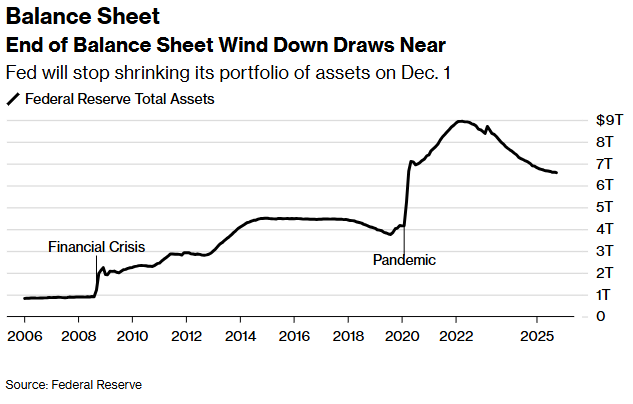

The Fed also announced it will stop shrinking its balance sheet on December 1, ending the quantitative-tightening phase and adding a small liquidity tailwind for markets.

Investors expect another cut in December, but Powell avoided pre-committing. His message was clear. The Fed wants to keep the recovery on track without reigniting inflation.

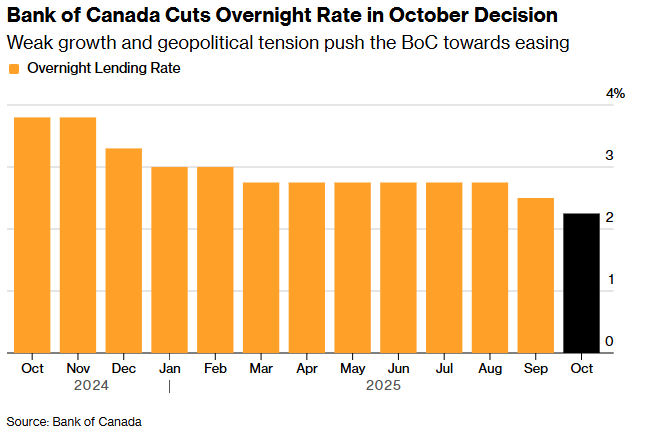

The Bank of Canada: Watching the Fiscal Shift

The Bank of Canada matched the Fed’s move, cutting the overnight rate to 2.25 percent. Inflation has cooled toward three percent, but shelter costs and services inflation remain sticky. GDP growth is modest, with hiring still steady.

Governor Macklem called this cut insurance and hinted at patience ahead. With Ottawa now leaning on fiscal policy to support growth, the Bank may pause here for a while.

Monetary and fiscal policy are no longer pulling in opposite directions, but they are not perfectly aligned either.

Canada’s Budget: The Investment Decade Begins

Source: Bloomberg

This is the first time in more than a decade that a Canadian government has clearly said growth through productivity, not population or housing, will drive the next cycle.

Prime Minister Mark Carney’s first budget, Building Canada Strong, marks a shift toward long-term investment. The 2025–26 deficit is about seventy-eight billion dollars, or roughly two and a half percent of GDP. The number is large, but the composition is key. Ottawa plans to borrow for infrastructure, innovation, and defence rather than for ongoing consumption.

A new fiscal framework separates operating from capital spending. The plan aims to balance the operating budget by 2028, while keeping capital investment high for projects that improve productivity. The federal debt-to-GDP ratio stays near forty-three percent, comfortably within international norms.

What’s inside

Infrastructure and energy transition

Billions are committed to clean power, transport, and digital networks. That supports construction, engineering, and technology firms and provides a steady demand backdrop for the TSX.

Defence and security

More than sixty billion dollars will be spent over five years on Arctic sovereignty, shipbuilding, and cybersecurity. These programs anchor high-skill jobs and strengthen supply-chain resilience.

Innovation incentives

The budget expands SR&ED credits and introduces a Productivity Super Deduction that lets companies immediately expense certain capital investments. These incentives narrow Canada’s tax gap with the United States and encourage domestic reinvestment.

Housing and affordability

GST relief for first-time buyers, new support for purpose-built rentals, and expanded training for skilled trades all aim to increase housing supply and ease long-term pressure on affordability.

Workforce and immigration

A moderated immigration path is paired with programs that recognize credentials and train Canadians for skilled jobs.

Why it matters for markets

This budget means slightly higher bond issuance but no fiscal stress. The investment focus should support sectors tied to infrastructure, defence, and clean energy. For the Bank of Canada, it complicates rate decisions by adding growth momentum just as inflation pressure fades. Expect fewer rate cuts, but a stronger base for future expansion.

Why it matters for the country

This is a pivot toward capacity over consumption. If Ottawa executes well, the payoff could be a more balanced economy that is less dependent on housing and credit cycles and more driven by real productivity gains.

For households, that means steadier borrowing costs, more predictable job growth, and gradual progress on housing affordability.

For investors, it signals that Canada is entering an investment decade in which fiscal and capital markets pull in the same direction.

For investors and families, this shift will not change life overnight. But it could mean steadier interest rates, more opportunities in Canadian infrastructure and clean-energy investments, and a healthier balance between growth and affordability. It is a fiscal plan that rewards patience rather than speculation.

The U.S. Economy: Soft Landing Still in Sight

Even with partial data due to the government shutdown, growth remains around two percent and inflation continues to cool. Core CPI is near three percent, while the Fed’s preferred measure, core PCE, sits around 2.7 percent.

Hiring has slowed but not stalled. Wages are rising at a manageable pace. Consumer spending has softened but remains resilient. It is not a boom, but it is not a contraction either. That is what a soft landing looks like.

Source: Getty

Markets: Calm, Supported, and Still Confident

The S&P 500 gained just over two percent in October and more than ten percent year to date. The TSX added nearly one percent, supported by energy, utilities, and financials.

Bond markets rallied modestly. The U.S. ten-year yield ended the month near 3.9 percent, while Canada’s ten-year sits close to 2.8 percent. Credit spreads remain tight, showing no signs of stress.

The Canadian dollar climbed into the low-mid-seventy-cent range, helped by narrowing rate differentials. Oil traded between 60 and 62 dollars per barrel, while gold eased to 1,960 dollars per ounce.

Valuations remain elevated. The S&P 500 forward price-to-earnings ratio is near twenty-three times, above its ten-year average of just under nineteen. Analysts’ consensus forecasts still point to roughly twelve percent upside over the next year, assuming earnings hold and inflation continues to moderate.

Stocks are higher, volatility is contained, and bonds are quietly firming. Investors continue to believe in the soft-landing story. The test will come when full data returns and markets must trade on evidence instead of instinct.

Source: Getty

What to Watch Next

- The end of the U.S. shutdown, which will release a backlog of data and could spark short-term volatility.

- Central-bank meetings in December, where both the Fed and the Bank of Canada will reassess with complete information.

- The rollout of Canada’s infrastructure and housing projects, a key measure of how well the new budget translates into growth.

- Fourth-quarter earnings guidance, which will shape expectations for early 2026.

The Takeaway

Markets can handle fog. What matters is whether portfolios are built to navigate through it.

Earnings remain strong, inflation is drifting lower, and central banks are easing carefully. Fiscal policy in Canada has turned toward building, not patching.

The environment rewards preparation over prediction, balanced portfolios, durable businesses, and patience through noise. That is where we are focused right now.