May 2024 Canada and US CPI

Christopher Bowlby - May 21, 2024

In the month of April, inflation reports on both sides of the border showed a moderation from the increases in recent months.

In the month of April, inflation reports on both sides of the border showed a moderation from the increases in recent months.

Canada CPI

In Canada, CPI rose by 0.5% MoM in April, but due to the higher reading in April 2023, the YoY headline inflation rate decreased to 2.7%. Additionally, core inflation decreased below 3% to 2.8% YoY, which is back within the Bank of Canada's preferred range of 2% +/- 1%. Overall, we have seen four consecutive soft CPI readings to start 2024, which leaves the door open for a rate cut in June or July. Restrictive monetary policy seems to have tamed inflation, but the question remains of what will happen once the foot starts to come off the brake. We continue to believe that the Bank of Canada will shift monetary policy but will be limited by the Federal Reserve on how quickly they can normalize rates to avoid upsetting foreign exchange markets and the macroeconomic environment.

Source: BMO Economics

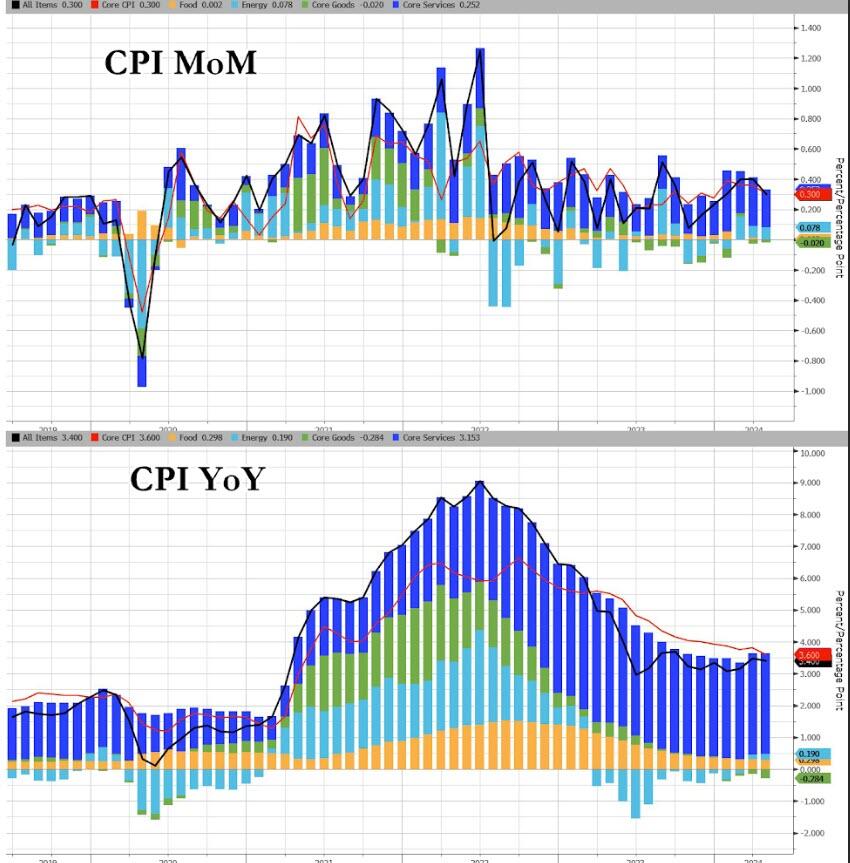

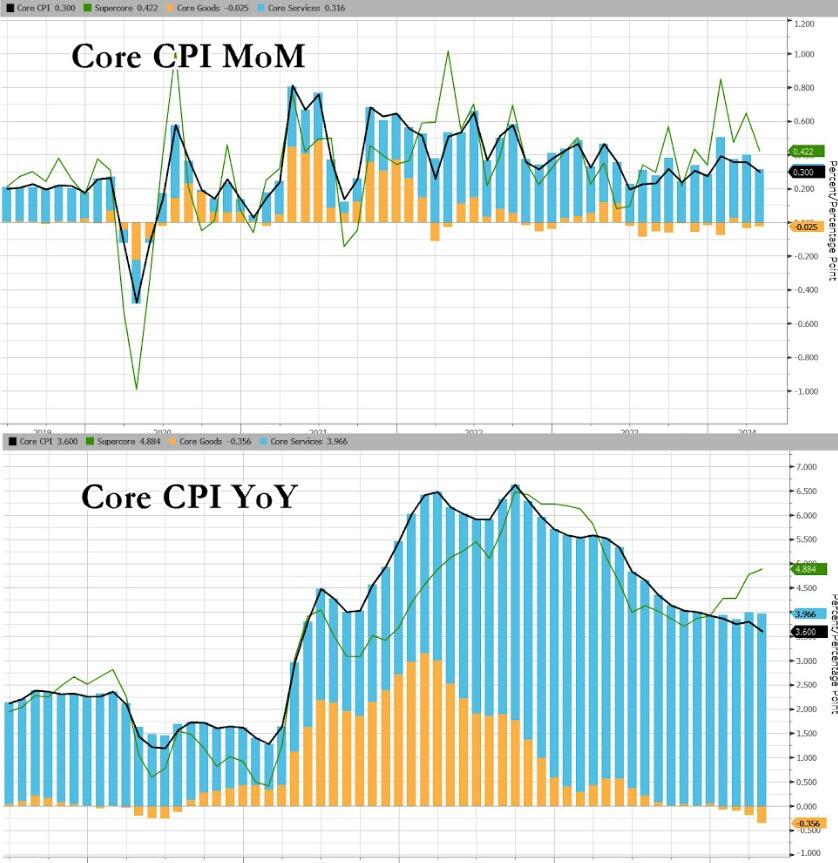

US CPI

In the US, CPI moderated to 0.3% MoM, with headline inflation dropping to 3.4% YoY after four straight months of higher-than-expected CPI results. Additionally, core CPI increased by 0.3% in April and saw the annual figure drop 0.2% to 3.4%, the lowest it has been in three years. Finally, Supercore Inflation (Core CPI Services Ex-Shelter) continued to move higher, up 0.5% to 5.05%, the highest level since last year.

Overall, April's CPI figures came in line with expectations and showed signs that headline and core inflation continue to moderate a bit. The continual spike in Supercore continues to show that restrictive monetary policy still has more work to do and that the Federal Reserve will maintain their patient and measured approach to rate cuts. As such, we continue our expectations that there will be 1-2 rate cuts in 2024, but they will be backloaded to the end of the year. We expect the FOMC to keep rates at current levels at their meeting in a few weeks.

Source: Bloomberg