US CPI March 2024 and Bank of Canada April Meeting

Christopher Bowlby - Apr 10, 2024

A stubborn CPI report continues to erode rate cut expectations by the Fed for 2024 while the Bank of Canada holds rates steady for a sixth consecutive meeting while laying the groundwork for a rate cut in June or July.

US CPI

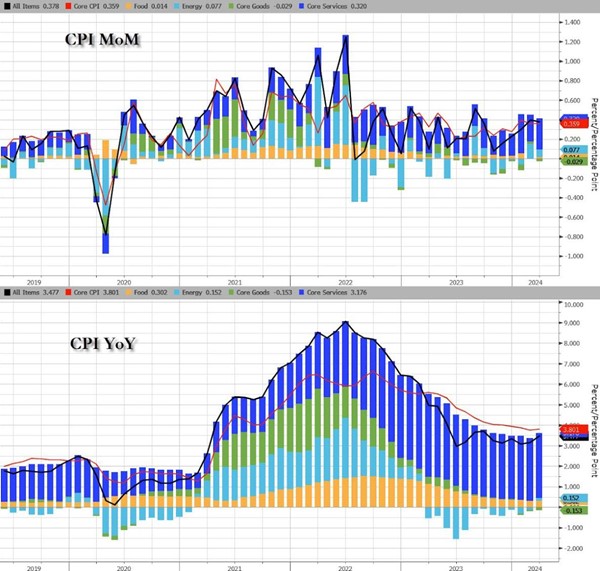

Source: Bloomberg

This morning, US CPI report for March 2024 came in above estimates with an increase of 0.4%, although slightly lower than the March reading, pushing headline CPI to 3.5% YoY. This increase was dominated by energy and services inflation. The BLS noted that over half of the increase in inflation last month came from just two components: gasoline (+1.7%) and shelter (+0.4%). The details of the report were a mixed bag. We saw strong monthly price increases in many of the usual categories like services ex. energy (+0.5%), owners’ equivalent rent (+0.4%), and transportation services (+1.5%), while inflation appeared to heat up for medical care services (+0.6%), apparel (+0.7%), and electricity (+0.9%). Inflation cooled or remained subdued for food at home (flat), new (-0.2%) and used vehicle prices (-1.1%), and core commodities (-0.2%).

Source: Bloomberg

Additionally, we saw core inflation pick up with an increase of 0.4% for the month of March and pushing up the YoY number to 3.8%. This was the fourth month in a row for stronger than expected core CPI.

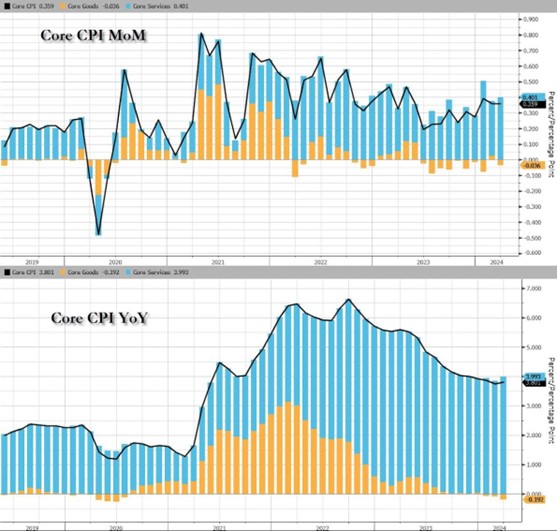

Source: Bloomberg

The most shocking portion of the CPI report has been the dramatic increase was in Supercore inflation (Core CPI Services Ex-Shelter) which increased 0.7% in March and is back up to 5.0% YoY.

Source: Bloomberg

Looking forward, the increase in Supercore CPI is quite worrying and we have so far seen a decrease in rate cut expectations across the US bond market to now only pricing in 45bps of rate cuts in 2024. Additionally, fixed income markets are now expecting only a 20% chance of the first rate cut coming at the June FOMC meeting. This is inline with our expectations that the markets were too aggressive in pricing in cuts at the beginning of the year and that rate cuts would be back loaded to the end of 2024 and that the Fed would be cautious to see the whites of inflation’s eyes before cuts begin. The Fed’s inflation fight is far from over. Clearly restrictive monetary policy is not fully working to combat services inflation.

Going back to President of the Minneapolis Fed Neel Kashkari’s comments last week, that no rate cuts may be required by year end if inflation continues to stall and that further rate hikes are not off the table either. This inflation report will only strength those voices. The next Federal Reserve meeting will be on April 28th and 29th with the June meeting taking place on June 10th. With May CPI not being released until June 12th, this only gives the FOMC one more data point before the meeting. Unless Chair Powell continues a dovish tone in a few weeks time and is seeing something we don’t, we come to the same conclusion as the fixed income markets that a June cut is off the table and will be pushed to end of 2024, if at all.

Bank of Canada

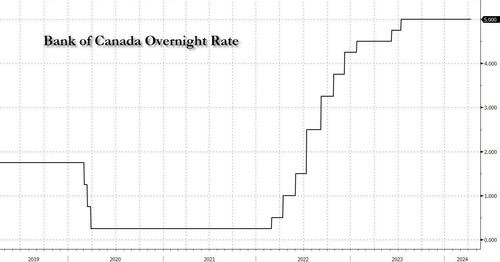

Source: Bloomberg

For the sixth consecutive meeting in a row, the Bank of Canada held rates at 5.0%, as expected, even as officials signaled that they are getting closer to rate cuts but need more evidence of slowing inflation. Furthermore, the BoC decreased their 2024 CPI forecast to 2.2% from 2.4% and increased their 2024 GDP forecast to 2.1% from 1.6%.

Governor Macklem stated in his press conference, that while CPI has decreased recently, they want to ensure that recent readings were “not a temporary dip” and that the BoC will closely watch the coming readings. Markets are currently pricing in a 66% chance that there is a 25 bps cut at the June meeting with a 25 bps cut fully priced in for the July meeting.

Additionally, similar to the Fed earlier this year, we saw the BoC raise their estimates of the neutral policy range by 25bps to 2.25% - 3.25%.

Overall, the Bank of Canada continued to hit a dovish tone with their April meeting and noted the encouraging core inflation trend and a softening labour market. They continued to walk the balance beam stating that they need this trend to continue before that are willing to start easing. While we are starting to see a divergence between the Canadian the US economies, there will be a limit on how far the two banks differ. This morning we are seeing the CAD breakthrough the support level of $0.7350 and could see a retest of the $0.72 we saw in Q4 of 2023.

The next Bank of Canada meeting will take place on June 5th and the BoC will get to see two more CPI reports before the meeting (March and April data) and an additional jobs report. The bottom line is that while a rate cut in June is a possibility, if the data continues the proceed as the trend so far for 2024, the BoC overnight rate will be 4.75% by July 24, 2024.