Growing Divergences

Christopher Bowlby - Apr 09, 2024

There is growing divergences between the Canadian and US economies with the US economy being surprisingly resilient versus a struggling Canadian economy.

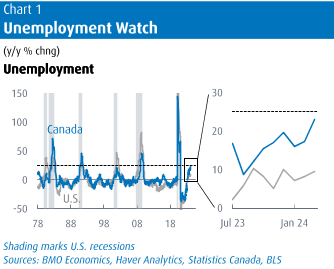

There is growing divergences between the Canadian and US economies with the US economy being surprisingly resilient versus a struggling Canadian economy. The March employment reports highlighted the dichotomy between the two economies with the US posting a 4 sigma beat of 303,000 jobs gain with an unemployment rate of 3.8% and an uptick in the participation rate as well. On the northern side of the border, Canada posted a 2,200 loss which sent the unemployment rate up to 6.1%. The 2.3% divide between the jobless rates is now at the upper end of the range set over the last 20 years.

As such, the struggling Canadian economy looks like it could use an economic boost and this reinforces our conviction that the Bank of Canada will cut rates ahead of the Federal Reserve, in tune with them leading the Fed in the hiking cycle two years ago. While the timing of the rate cuts will become clearer following the Bank of Canada meeting on Wednesday the 10th. The strong GDP growth for Q1 coupled with strong financial markets, an uptick in housing and declining Fed rate cut expectations, has given the Bank of Canada the ability to continue to monitor the weakening jobs market and the effects on wage inflation. With the unemployment rate above 6%, the job market is no longer as tight.

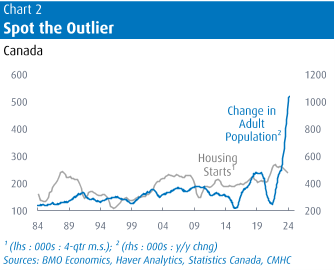

The other consideration for the Bank of Canada is that rate cuts will cause a stoking of the housing market fire characterised with a lot of pent up demand. Major metro areas in Canada continue to be plagued by under supply and the CMHC expects new building to actually decrease for a third year in a row to below 225,000 units.

Overall, the separation between the underlying fundamentals between the Canadian and US economies will lead to a divergence in monetary policy in the coming months.