November Market Newsletter

Christopher Bowlby - Nov 30, 2023

The month of November has seen a big change in financial markets with equity markets rallying aggressively.

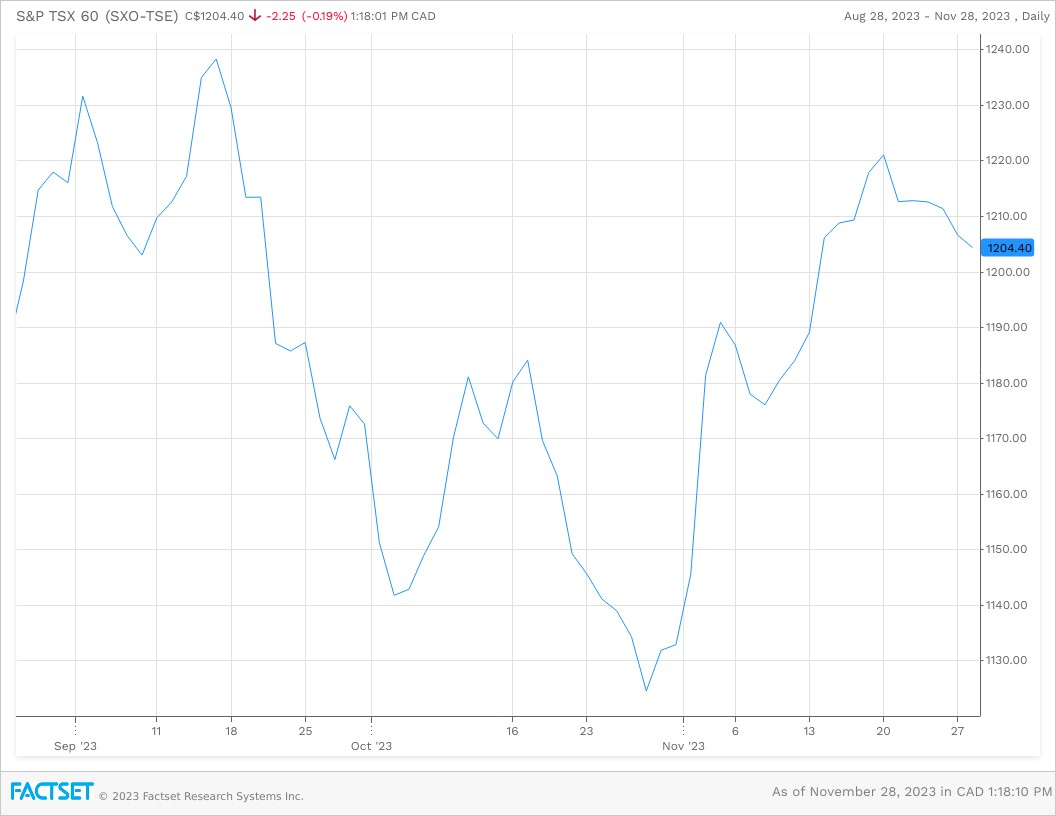

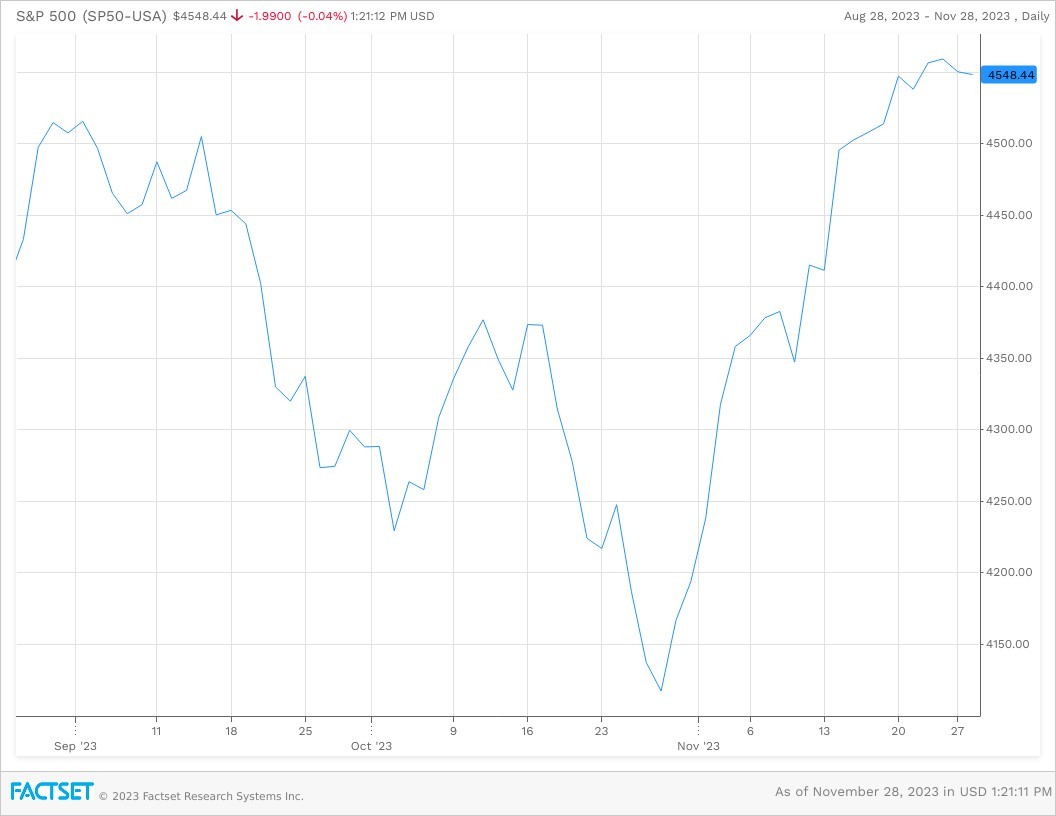

The month of November has seen a big change in financial markets with equity markets rallying aggressively, powered by the Big 7, and rates moving lower as market participants begin to price in that we have reached the end of the rate hiking cycle by the Federal Reserve. In the month of November, we saw the S&P 500 and Nasdaq push up against the highs of 2023 on the back of Mega-Cap Technology stocks. Looking forward, the outlook for 2024 continues to be similar to the messaging we have been stating throughout 2023, that inflation continues to move down, wage inflation and the job market remains strong, consumer spending remains strong and Central Banks continue to try and navigate a soft landing. The story now that we have reached the terminal rate of this hiking cycle now become when will we see rate cuts and how much more of the rate hikes still need to flow through the economy.

TSX 60

S&P 500

Federal Reserve Meeting

The biggest event of the month was the Federal Reserve meeting on November 1st where besides holding rates steady between 5.25%-5.50%, there was a much more dovish tone from Chairman Powell during the press conference. Chairman Powell stated that the FOMC will continue to monitor economic developments and be date dependant, which is no change from their previous positioning. During his speech, Chair Powell noted that financial conditions have “tightened significantly in recent months driven by higher, longer—term bond yields, among other factors.” He repeatedly said the committee was moving “carefully,” a wording that often has signaled a low likelihood of any immediate change in policy, while adding that risks to the outlook have become more two-sided as the tightening campaign nears its end. The next FOMC meeting will be on December 13th.

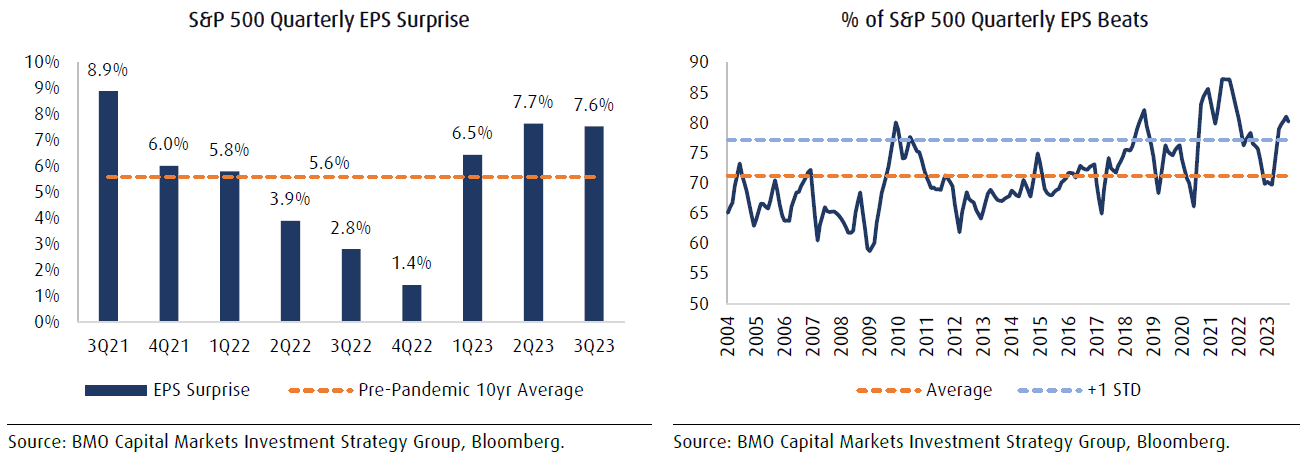

Earnings Season

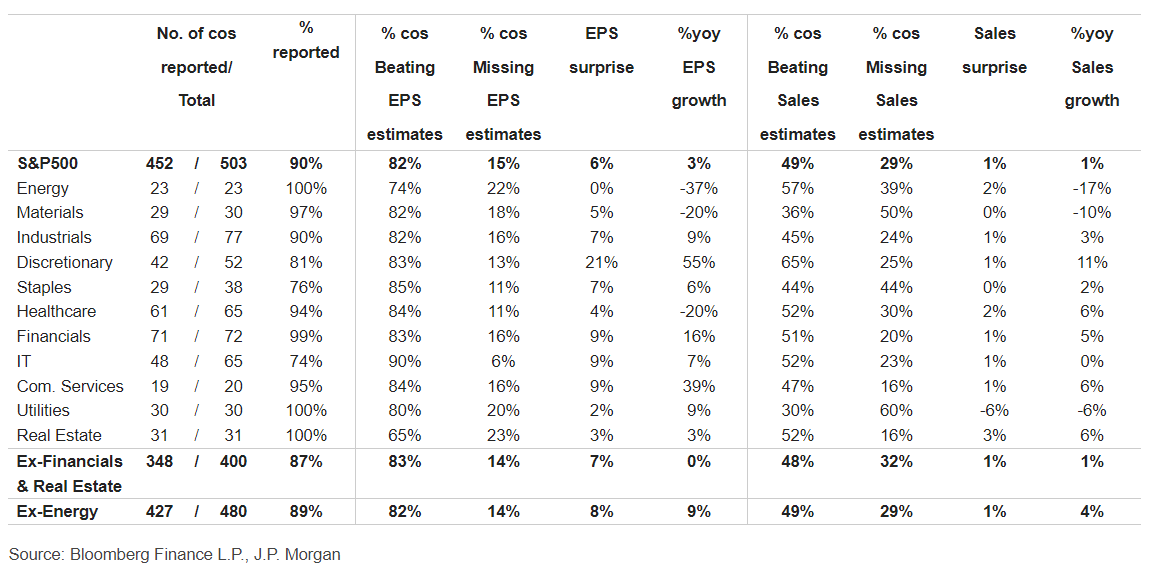

With Q3 earnings season in its final states, we saw strong earnings with weaker than expected top line revenue growth. With 90% of S&P500 companies have reported their Q3 earnings: 82% beat EPS estimates, surprising positively by 6%. Average EPS growth was at +3% y/y with 8 out of the 11 sectors are printing healthy EPS growth, while Commodity and Healthcare sectors were down on a year over year basis. On the top line, 49% of companies are beat revenue estimates with overall revenue growth is +1% y/y. On the sector level, Energy, Materials, Tech and Utilities are flat or down on a year over year basis.

US CPI

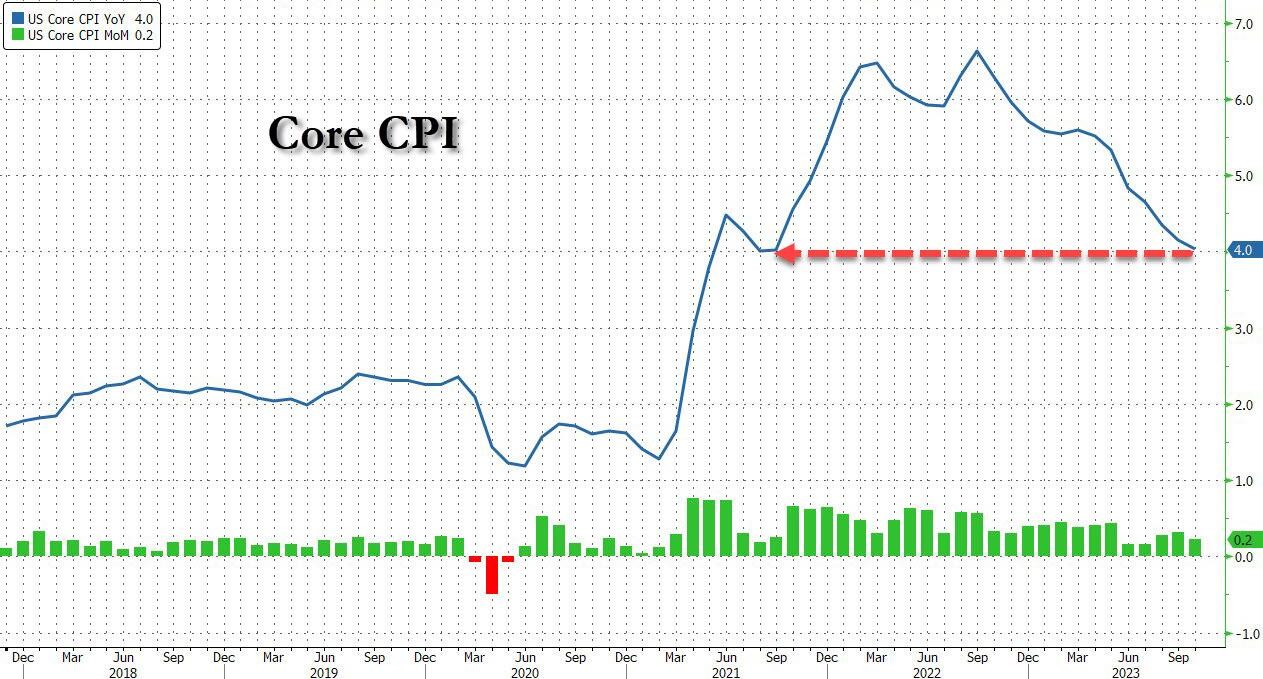

For the month of October, CPI missed across the board with headline inflation and core measures coming in below expectations. Core CPI for October rose just 0.2% month-over-month, below the expected 0.3%. Year-over-year, it dropped from 4.1% to 4.0%, the lowest since September 2021.

• Shift in Inflation Components: The report highlighted a significant change in the components contributing to inflation. Core goods inflation has almost vanished, with a negative trend observed over the past five months. This shift indicates a move away from goods inflation towards service-driven inflation, primarily in housing.

Source: Bloomberg

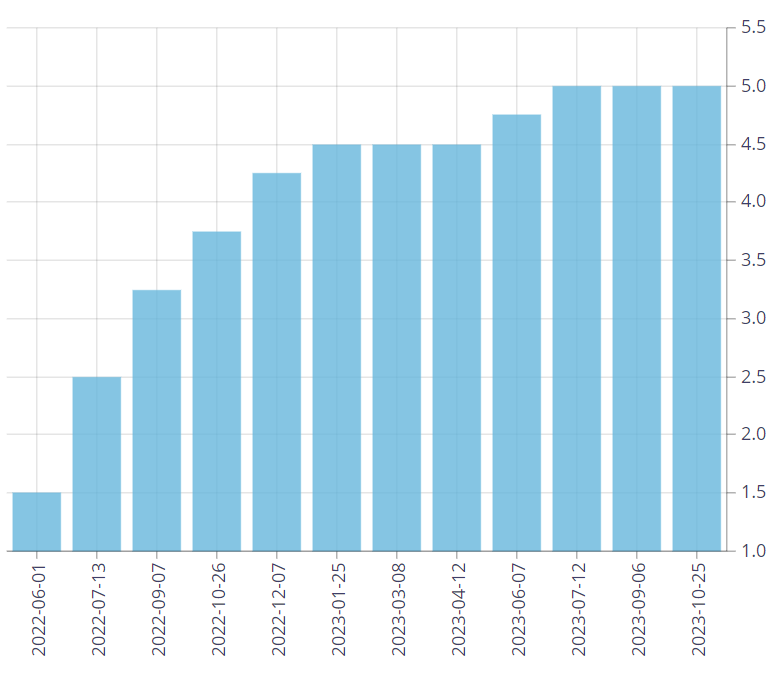

Bank of Canada

At the end of October, the Band of Canada held it’s policy rate at 5% as widely expected for the second consecutive meeting. The next meeting will be on December 6th. While pointing to the many signs of cooler demand and some relief on price pressures, strong wage growth and firm core inflation trends are going to test the Bank's patience. Looking into the notes from the October 25th meeting, the BoC notes that growth in the economy is clearly stalling, but inflation remains sticky, and there is some concern that above-target price gains are becoming entrenched. The BoC is in a waiting game as they watch growth clearly struggling, but is also nervously watching core inflation trends hold above their target. Going forward either break more convincingly, or the Bank will be willing go back to rate-hikes and force the economy closer to recession.

Source: Bank of Canada

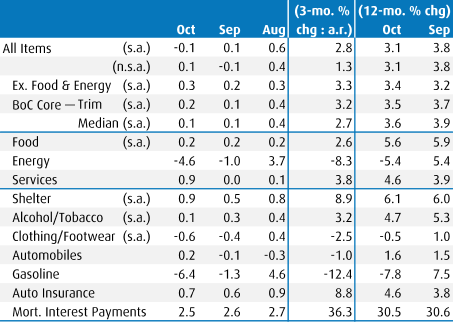

Canadian CPI

Canadian consumer prices edged up just 0.1% in October, mild enough to carve the headline inflation rate to 3.1% from 3.8% the prior month. In seasonally adjusted terms, prices fell 0.1%, the first such decline since the opening months of the pandemic in 2020. The October CPI reports was a step in the right direction with three provinces now having an inflation rate below two (although the two largest provinces remain elevated - Quebec at 4.2% and Ontario at 3.3%). The lower October CPI report continues to signal to the BoC that there is no additional need for further tightening.

Source: BMO Capital Markets