Unlocking the Potential of Private Equity

Christopher Bowlby - Nov 27, 2023

In the ever-evolving world of investment, private equity (PE) stands out as a segment that has witnessed substantial growth and interest.

In the ever-evolving world of investment, private equity (PE) stands out as a segment that has witnessed substantial growth and interest. This blog post delves into the core aspects of private equity investing, highlighting why investors are increasingly gravitating towards this asset class, the importance of diversification in PE, and the various investment strategies available.

Private Equity involves the purchase of private companies by professional management teams (General Partners - GP). These investment are typically funded by both institutional investors and qualified high net worth individuals and families. Typically, the investments are held for a time horizon of five years before the GP executes an exit strategy such as selling the investment to another GP or strategic partner or taking the company public.

With a PE investment, the company benefits from having access to operational expertise from the GP and the GP has the ability to affect change on the company and create value without the pressures of the investment continually being marked-to-market.

Why Private Equity?

Private equity represents an enticing opportunity for investors seeking returns that potentially outpace those of public markets. This allure is grounded in two fundamental characteristics:

Higher Returns Potential: PE investments offer the potential for higher returns due to the hands-on approach of PE firms in steering companies towards long-term, sustainable growth.

Focus on Operational Improvements: Unlike the short-term pressures of public markets, private equity firms can focus on long-term operational enhancements, driving significant value creation over the lifespan of the investment.

Types of Private Equity Investment Strategies

Private equity offers investors a range of strategies to suit different risk appetites and investment goals:

Primaries: Involves committing capital to new PE funds. This approach is foundational in PE investing. In the early years of the investment, as capital is put to work by the GPs into the companies and the GP takes a management fee. As the GP successfully executes

its value-add strategies, investors receive returns in the form of distributions.

Secondaries: Involves buying existing PE investments in the secondary market. This strategy offers a blend of risk mitigation and potential for quicker liquidity. Traditional secondary

transactions involve purchasing stakes in mature funds that are typically four to six years

into their life span. Since capital is already being put to work, investors usually have good visibility on the underlying assets and performance track record. Additionally, investors typically expect a shorter time horizon with a quicker return on invested capital much sooner than the case

of primaries or co-investments.

Co-Investments: Direct investments alongside PE firms allowing for significant exposure to particular deals while typically having low or no management fee or performance related fee.

The Power of Diversification in Private Equity

Diversification is a cornerstone of successful investing, and this is particularly true in the realm of private equity:

Strategy Diversification: Investing across various PE strategies like buyouts, growth, and venture capital can help mitigate risk.

- Buyouts: Typically involve purchasing a mature business with well-established revenue, operating costs and profitability. GPs add value through operational efficiencies and M&A

- Growth Equity: Typically involve purchasing fast-growing businesses that have yet to reach their full potential. GPs work with management to build a strategy to achieve and maintain profitability

- Venture Capital: Typically involve investing in start-ups. This strategy is the riskiest but offers significant return potential.

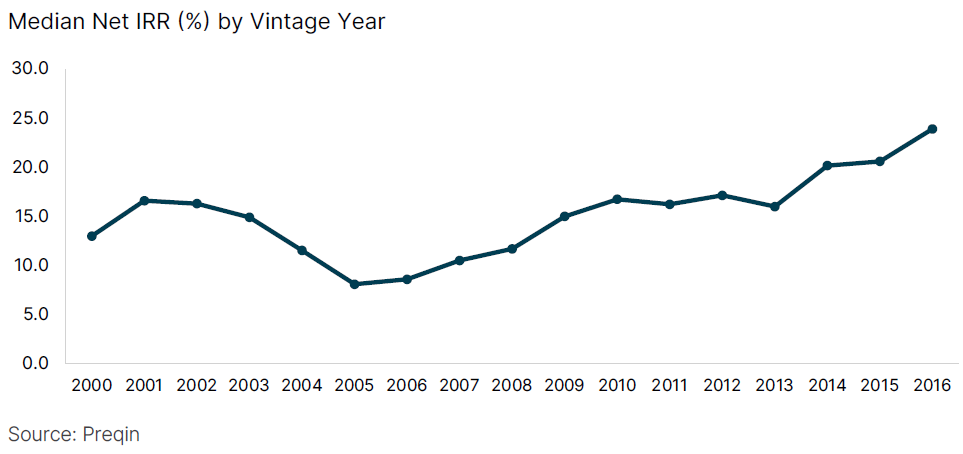

Vintage Year Diversification: By investing in funds from different years, investors can buffer against market cycle fluctuations.

Sector and Stage Diversification: Spreading investments across multiple sectors and stages of company development guards against industry-specific downturns.

Geographical Diversification: A global investment approach reduces the impact of regional market instabilities.

Private equity presents a compelling avenue for investors seeking diversification and potentially higher returns. By understanding the nuances of why private equity can be a lucrative investment, the importance of a diversified investment approach, and the various strategies available, investors can make more informed decisions in this dynamic investment landscape.

Like any investment, private equity comes with its own set of risks and complexities. It is crucial to thoroughly understand these before diving in.