October Market Newsletter

Christopher Bowlby - Oct 16, 2023

The month of September saw continued rhetoric from central bankers in both Canada and the US that rates may continue to be hiked to bring inflation back to its target.

The month of September saw continued rhetoric from central bankers in both Canada and the US that rates may continue to be hiked to bring inflation back to its target. We saw that while inflation has ticked up due to base effects running off, strong employment figures continue to show resilience in the economy and continue to give the green like for an additional rate hike if necessary. The biggest shock over the month was the updated Summary of Economic Projections as expectations from FOMC members for 2024 and 2025 were guided higher reinforcing the narrative of higher for longer. As we enter Q3 earnings on October 13, the markets continue to focus on broader economic data to give guidance on overarching monetary policy going forward.

During October, we saw bond yields spike higher with the higher for longer narrative and saw US 10 year yields hit 16 year highs. Additionally, we saw PE multiples, especially for growth sectors of the market, contract heading into Q3 earnings. The recent weakness continues to provide a buying opportunity for both fixed income and equities.

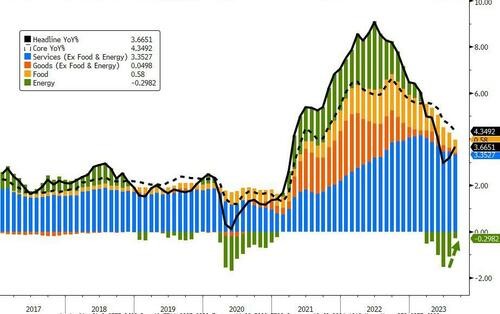

US Inflation

Since Federal Reserve Chairman Jerome Powell’s speech at Jackson Hole, financial market participants had been anticipating a hawkish pause by the Federal Reserve at their September meeting. While that occurred, the commentary and forward dot plot projection hammered home the hawkish rhetoric from the Fed and their willingness to continue raising interest rates to combat stubborn core inflation. Additionally, in August we saw an increase in headline inflation, up 0.5% to 3.7% , driven by rising energy prices with gasoline contributing for over half of the increase. Core inflation still remains above 4% with Shelter being the largest factor for all items less food and energy.

(Source: Bloomberg)

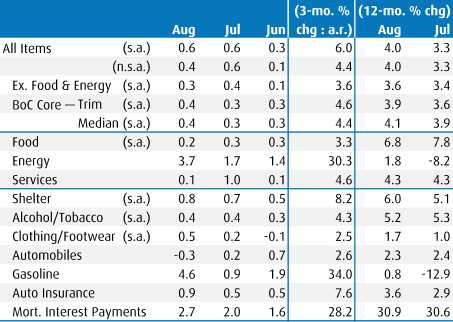

Canadian Inflation

Canadian headline CPI rose 0.4% in August and saw trailing 12 month inflation increase back to 4.0%. Similar to the US, core inflation still remains stubborn at 3.9%. The largest drivers of inflation in August were gasoline followed by mortgage interest costs and rent. Even when discounting shelter costs, core inflation is still above the target range at 3.2%. The next Bank of Canada meeting at the end of October with another data set of CPI data for September before the rate decision. With inflation remaining stubborn, we expect continued hawkish rhetoric from the Bank of Canada despite pausing rate increases, at 5% (the highest level since March 2001), after hiking 25 bps at the last two meetings.

(Source: BMO Capital Markets)

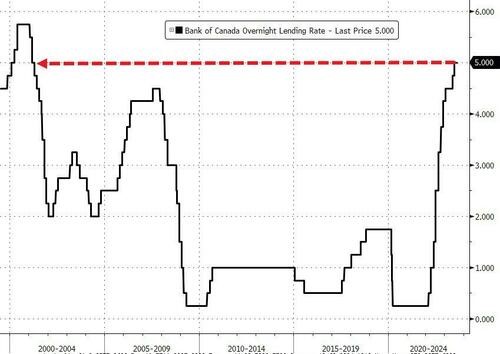

Bank of Canada

At the September meeting, the Bank of Canada saw evidence that excess demand is easing, as shown by a weaker-than-expected Q2 real GDP report, slowing credit growth, and softer consumer spending and housing activity. Monetary Policy is a broad policy tool to combat inflation and these are all signs that past tightening of monetary policy is working. The Bank of Canada has shown that it will pause to allow for the full impact of these moves to filter through the economy, which is what they have done at their September meeting.

(Source: Bloomberg)

Additionally, the bank commented that while there is some softening around the edges of the labour market, this has not yet translated into softer wage growth as "members still view annual wage increases in the current range as inconsistent with achieving price stability without a large increase in productivity".

As mentioned above, with CPI remaining above trend, the Bank reiterated at the September meeting that they are “prepared to increase the policy interest rate further if needed” and that "the lack of progress in underlying inflation remained a significant concern".

The Bank of Canada is trying to guide the economy to a soft landing by balancing decelerating economic activity, the impact of past rate hikes still working through the economy and stubborn above target core inflation. This is leaving the Bank of Canada with a dilemma that either the overnight policy rate is not yet high enough to combat inflation, or that they have not been high enough for long enough. As such, their decision to pause rates in September indicates that they are testing the later hypothesis.

After the pause in rates earlier this year, at the September meeting, the Bank reiterated that they do “not want to raise expectations of a near-term reduction in interest rates, given that they only considered keeping the policy rate where it is or raising it further."

Overall, while the Bank of Canada has taken their foot of the gas pedal for the time being, they want to clearly indicate that it doesn’t mean that the next move is hitting the brakes but instead staying on cruise control and might accelerate again if wages and inflation don’t cooperate.

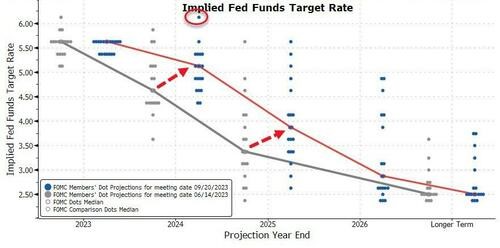

Federal Reserve

At their September meeting, the Federal Reserve kept the Fed Funds target rate unchanged at 5.25%-to-5.50%, as expected. Similar to the Bank of Canada, they left the door open for additional potential rate hikes at their November meeting and beyond.

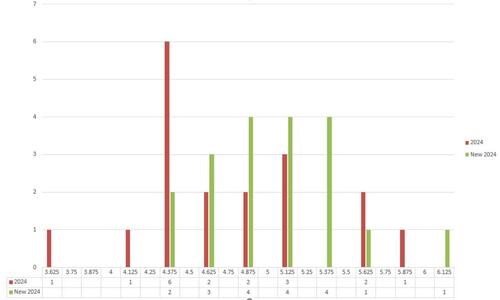

With the September meeting, there was also the release of the Summary of Economic Projections (SEP). With the SEP, the median estimate for the end of 2023 was one additional hike to 5.50%-5.75% with only 50bps of cuts expected in 2024 (from 100 bps at the previous SEP release) and 125 bps of cuts expected in 2025 (up 50 bps from the last SEP release). Finally, this SEP release included a projection for 2026 for the first time. The projection for 2026 indicated that FOMC participants still believe that interest rates should remain above the longer term projection.

(Source: Bloomberg)

The biggest shock from the meeting was the stark shift higher in forward expectations for the Fed Funds rate for the end of 2024, moving from 4.5% to 5.125%.

(Source: Bloomberg)

The Summary of Economic Projections and the Press Conference from Chairman Powell continued the narrative of higher for longer. The Fed continues to state that they could raise policy rates another 25bps notch at their November meeting but that it depends on the data. Until that meeting we have two more labour reports and another CPI report to digest and will lead to over reactions from Market Participants.