Winter 2023 Market Newsletter

Christopher Bowlby - Jan 20, 2023

2022 was volatile and difficult to navigate with seemingly very few places to hide in both equity and bonds.

Happy New Year! We hope you had an enjoyable holiday season with family and friends.

Firstly, we would like to announce that our team was selected by the Globe and Mail for the second year in a row as one of the top IA teams in the province. We are very honoured to be recognized again by the Globe and Mail and believe it is a testament of being able to work so many outstanding clients and amazing partners, both inside BMO and externally.

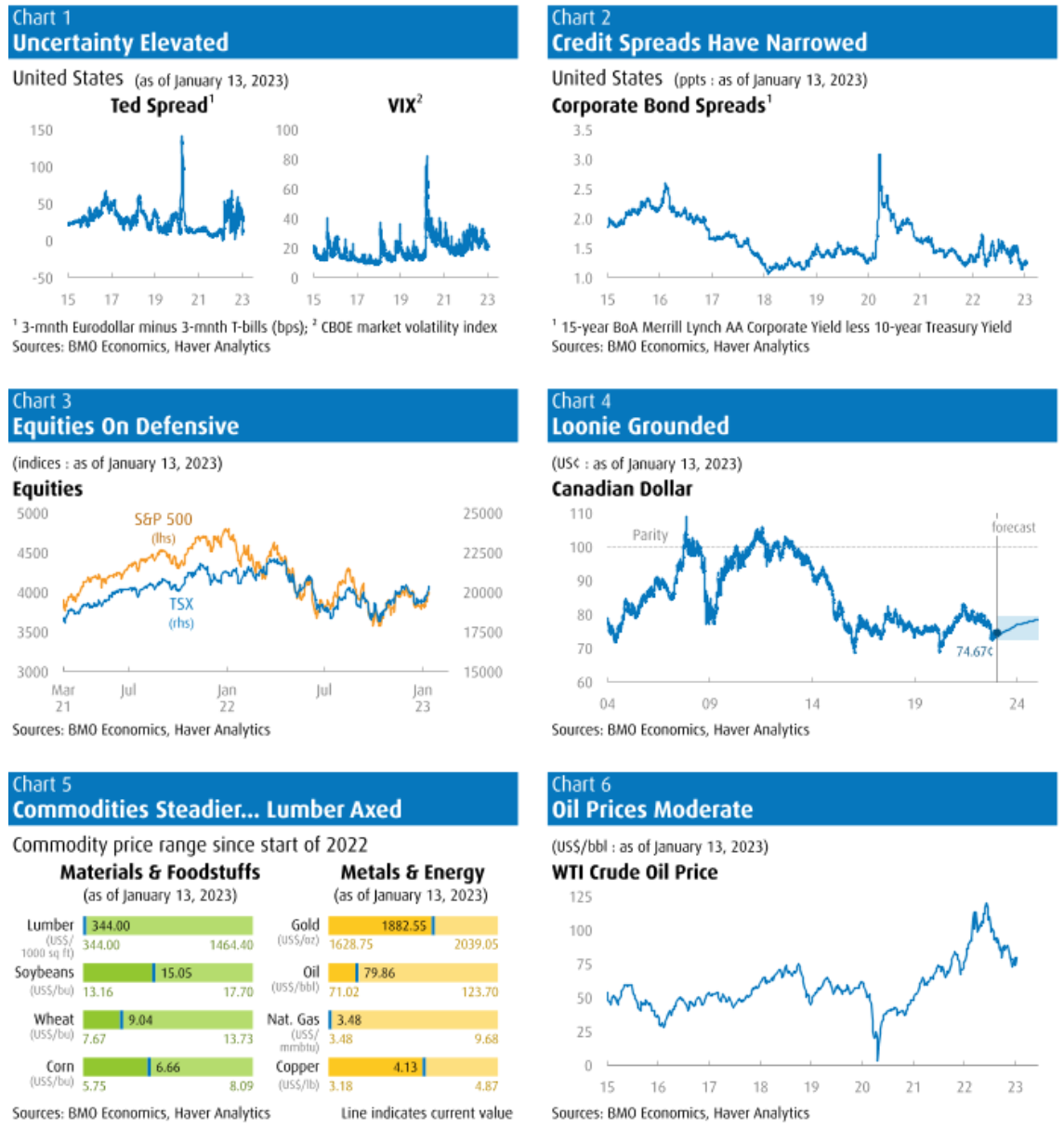

2022 was volatile and difficult to navigate with seemingly very few places to hide in both equity and bonds. As inflation continues to move slowly back to the long term target of 2-3%, we expect that financial conditions will continue to improve once we reach the terminal rates of hiking in both Canada and the US. The volatility that has characterized the last 12 months looks to continue over the medium term as markets discount economic improvements well before we see the evidence in the year over year data points used by central bankers. As such, we continue to look for opportunities for clients in both equities and fixed income as we enter a period of economic normalization back to the long term targets.

As always, we are happy to answer any questions you may have. Also, please feel free to share this newsletter with whomever you feel may be interested.

Debbie, Chris, Mark and Rosemary

Outlook for 2023

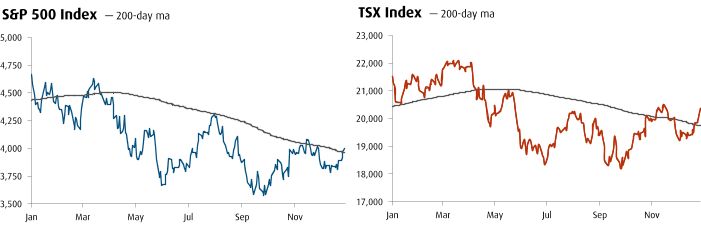

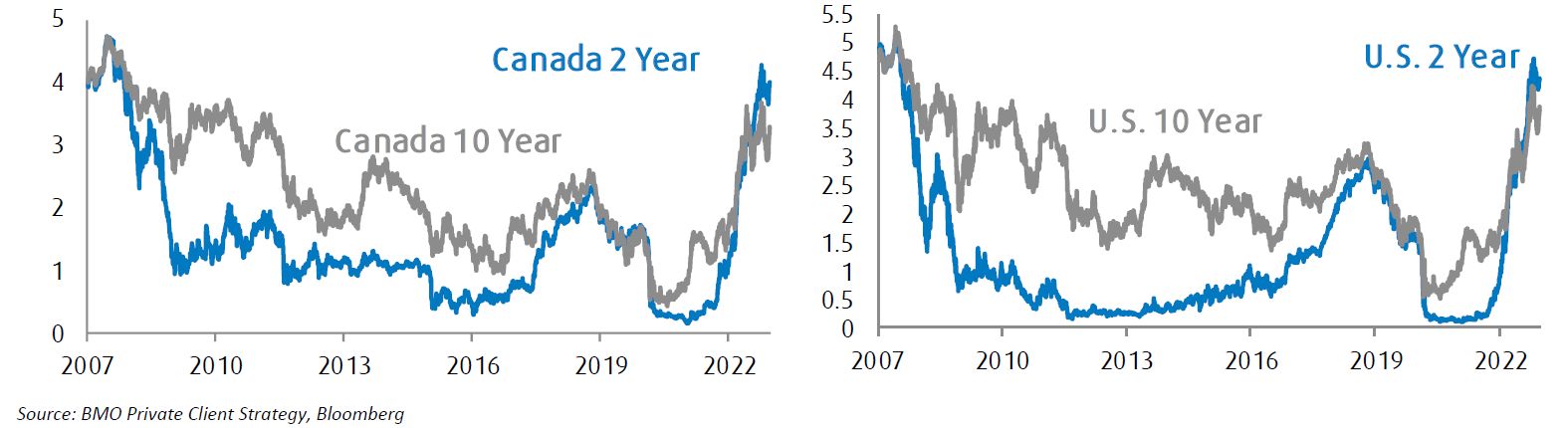

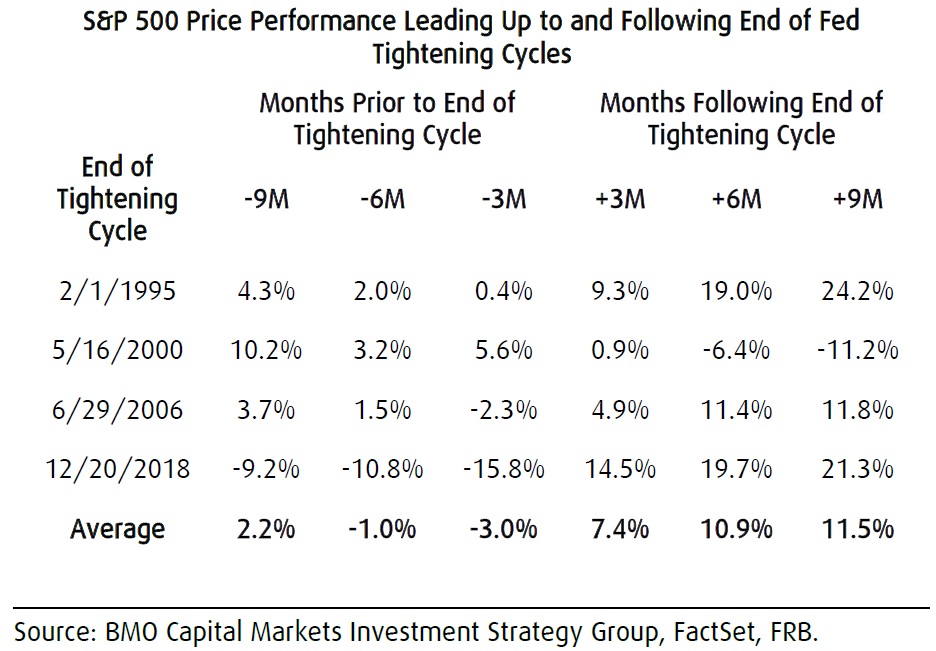

The story of 2022 was the end of Zero Interest Rate Policy and catalysts forcing inflation to 40-year highs. There were knock-on effects across capital markets as fixed income and equities both had negative performances and aggressive interest rate increases shocked the markets as the battle to control inflation mimicked frantic firefighters working to put out a wildfire. Following a volatile 2022, which saw the most hawkish monetary policy moves across the Western world, 2023 looks to continue the trend of markets hanging on the release of each data point as they try to extrapolate the path of monetary policy in the backdrop of a Federal Reserve that is steadfastly hawkish and believes that inflation is entrenched in the economy. Over the last five months, markets have flipped their view that the massive shocks of interest rate increases have significantly slowed the pace of inflation and that with the coming base effect changes, the economy is closer to the long-term target than shown in the YoY inflation figures. Over the last 5 months, inflation has consistently trended lower with the annualized rate of inflation for that period in the US measuring at 2.5%. Monetary Policy is widely regarded as a blunt instrument when it comes to fighting inflation, which operates with a lag effect on the economy as financial conditions tighten but cause high levels of volatility in financial markets. As financial conditions tightened and inflation rose in both Canada and the US, we have seen a decline in housing and consumer spending activity as people have been forced to tighten their spending. Corporations adjusted by decreasing capex and headcount in an effort to maintain margins while passing costs along to consumers. With declining levels of consumer and corporate spending and higher anticipation of an official recession in the first half of 2023, markets are left wondering whether central banks made a policy mistake with continued hiking while heading into a recession and if this will result in a hard landing economically. With key economic data points being released weekly and the Q4 earning season kicking off after Martin Luther King Day, investors and markets continue to be jittery as they read the tea leaves as to whether we have reached the terminal rate of this hiking cycle and when we may start to see a normalization of central bank rates.

We believe the story of 2023 will be a normalization from the two extremes of liquidity over the last three years. This normalization process continues to be a marathon and not a sprint as base effects of macroeconomic data points unwind. The short term trading strategies that control market sentiment will continue to bring elevated levels of volatility as every data point is dissected and overanalysed. It is our belief that we will be much closer to a normal market environment characterized with higher-than-zero interest rate scenario, single-digit earnings growth, a moderation of valuation, and historical average stock market performance by the end of 2023. We believe that high environment will benefit active-stock selection strategies instead of momentum chasing and macro-drivers which have dominated market performance over the last few years. With fixed income now becoming a realistic alternative to equities, we have re-entered an environment in which quality companies with balance sheet strength, cash flow generation, and earnings stability will be rewarded by investors and the wheat will be separated from the chaff. While we are expecting equity markets to increase over 2023, the path will be anything but linear as the market’s near constant focus on headlines, macro economic data, and the ongoing tug of war between Fed messaging and market expectations will create high levels of volatility for a good part of 2023. The Federal Reserve has been crystal clear in their intentions throughout 2022 and it remains our base case that we see at least a few more rate hikes followed by a prolonged pause period. In the coming months we will see the peak of the Fed Funds rate, a plateau of higher interest rates for 2023 and head into a normalizing environment in 2024. This paradigm is likely to be a positive catalyst for market performance based upon our research as it is the delta of interest rate policy, which is the largest contributing factor to market performance i.e., if financial conditions are tightening or loosening from current levels rather than the absolute level of interest rates which determines market sentiment. It is our view that if the Federal Reserve and Bank of Canada began raising rates in 2021 but at a slower pace to current levels we would not have seen the same level of market volatility than what was seen in 2022.

Finally, it is our base case that the economy will enter a slight recession in 2023 due to the high level of inversion across the yield curve and the weakening amount of consumer and corporate expenditure over the last few quarters. The last three recessions have been quite severe, which has caused investors to have an extremely bearish outlook, which we believe is overdone. We believe that due to the historically strong level of employment and strong consumer and corporate balance sheets, we are mostly likely to witness a technical recession unless there is a significant change to those trends.

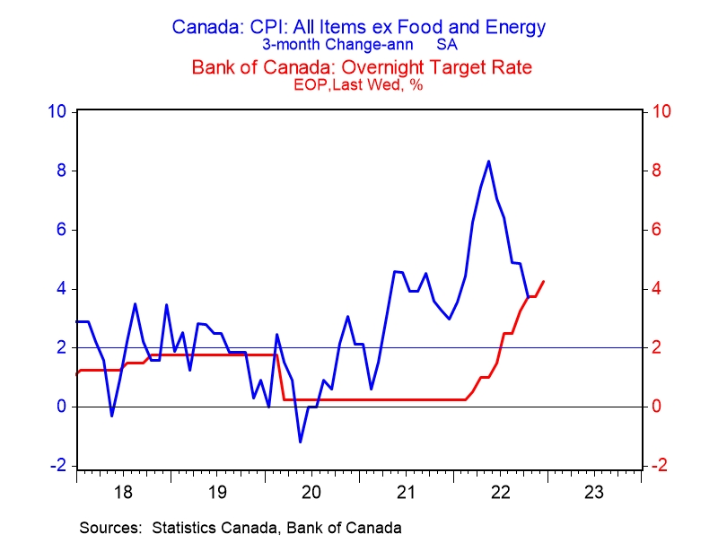

Canada

In December, the Bank of Canada raised the key overnight interest rate to 4.25% for its seventh consecutive hike, bringing this year's cumulative rate hike to 400 basis points. During their press conference, the Bank stating that the “Governing Council will be considering whether the policy interest rate needs to rise further to bring supply and demand back into balance and return inflation to target." As such, the Bank of Canada indicated that this may be the final move and markets are split roughly 50/50 on whether we may see an additional 25bps increase at the January meeting. The Bank remains acutely concerned about still-high inflation expectations, even amid a clear cooling in domestic demand and some early indications that underlying inflation is losing momentum and as such the Bank has opened the door to the possibility that this could be the last rate hike of the cycle.

Additionally, the labour market remains quite strong with employment surged by 104,000 in December, blowing past expectations and coming in over 100,000 for job gains for the second time in three months. The recent employment statistics are showing that while the tighter financial conditions are having an impact on the economy, there still remains strong economic performance in the labour economy. The labour market is typically the last to turn when conditions soften broadly, but the most recent reports are still showing wages running around 5% and the jobless rate holding at 5%.

In January, we got a look at the December inflation data which showed that prices slowed by 0.6% for the month and YoY inflation decreased to 6.5%. Headline inflation is down 1.8 ppts from the 8.1% peak hit in June. The biggest detractor to inflation was energy prices while core inflation remained slightly elevated at 5.3% for the last 12 months. With core inflation remaining well above the Bank of Canada's 2% target and the strong labour data, it is our view that the Bank will raise rates one more time in January, bringing interest rates to the terminal level of 4.50%.

United States

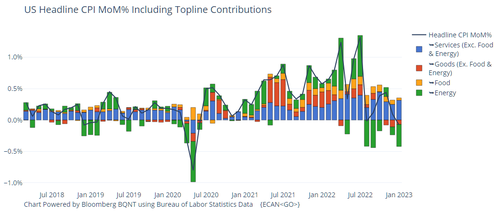

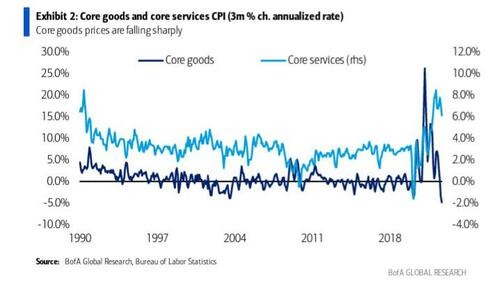

In January, the December CPI report showed that two out of three of Federal Reserve Chairman Powell’s key inflation categories (core goods, shelter and core services ex-shelter) are moving lower.

While goods inflation continues to slow, services inflation remains quite strong.

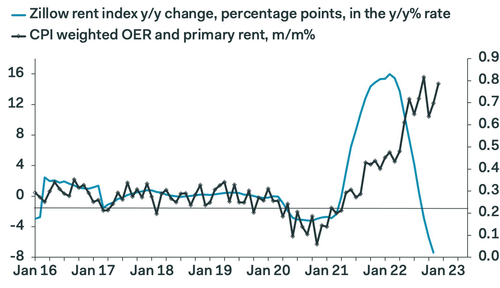

Much of the strength was in the shelter component of the index which as previously discussed in the newsletter is expected to roll over in the coming months due to a lag between the real time rent data and the numbers used in CPI.

Ultimately, what this means for the macro environment is that while we still believe that the Fed is going to raise rates again at their meeting on February 1st, the last three months have delivered light inflation data providing the Federal Reserve an off ramp which could spur the Fed to reduce the pace of tightening at their next meeting. As of the most recent data, we are expecting a 25bps increase on February 1st and 50/50 odds of a final 25bps increase at the March meeting. Since the December meeting, Chairman Powell and other Federal Reserve voting members have stated that it would be appropriate to scale back the pace of interest rate increases. In our view, we are in the 8th inning of this cycle of tightening and that after the next 1 or 2 increases, rates will plateau for the remainder of 2023. The Fed still wants to see signs of labour market cooling before letting down its guard, but terminal rates now appear lower than earlier expected, and feared.