The term sheet arrives. Your company is valued at an impressive number. You've spent years building this business, and now someone is putting a dollar figure on all that work. It feels like validation. It feels like the finish line.

It's not.

What most business owners don't realize until much later is that the headline valuation and the cash you actually receive are two completely different numbers. By the time you discover the gap, you've already committed. The lawyers are drafting documents. The bankers are coordinating diligence. You're negotiating details, not fundamentals.

This is the problem we set out to solve.

The Invisible Waterfall

Here's what happens between "your company is worth X" and "here's your wire transfer."

First, the headline number gets adjusted. Transaction fees come out. If you have debt on the balance sheet, that gets paid at close. Escrow holdbacks get set aside, typically 10-15% of the purchase price, locked up for 12-18 months to cover any indemnification claims. Earnouts get structured as contingent payments tied to future performance. Sometimes 20-30% of the stated deal value is deferred or conditional.

The headline shrinks fast.

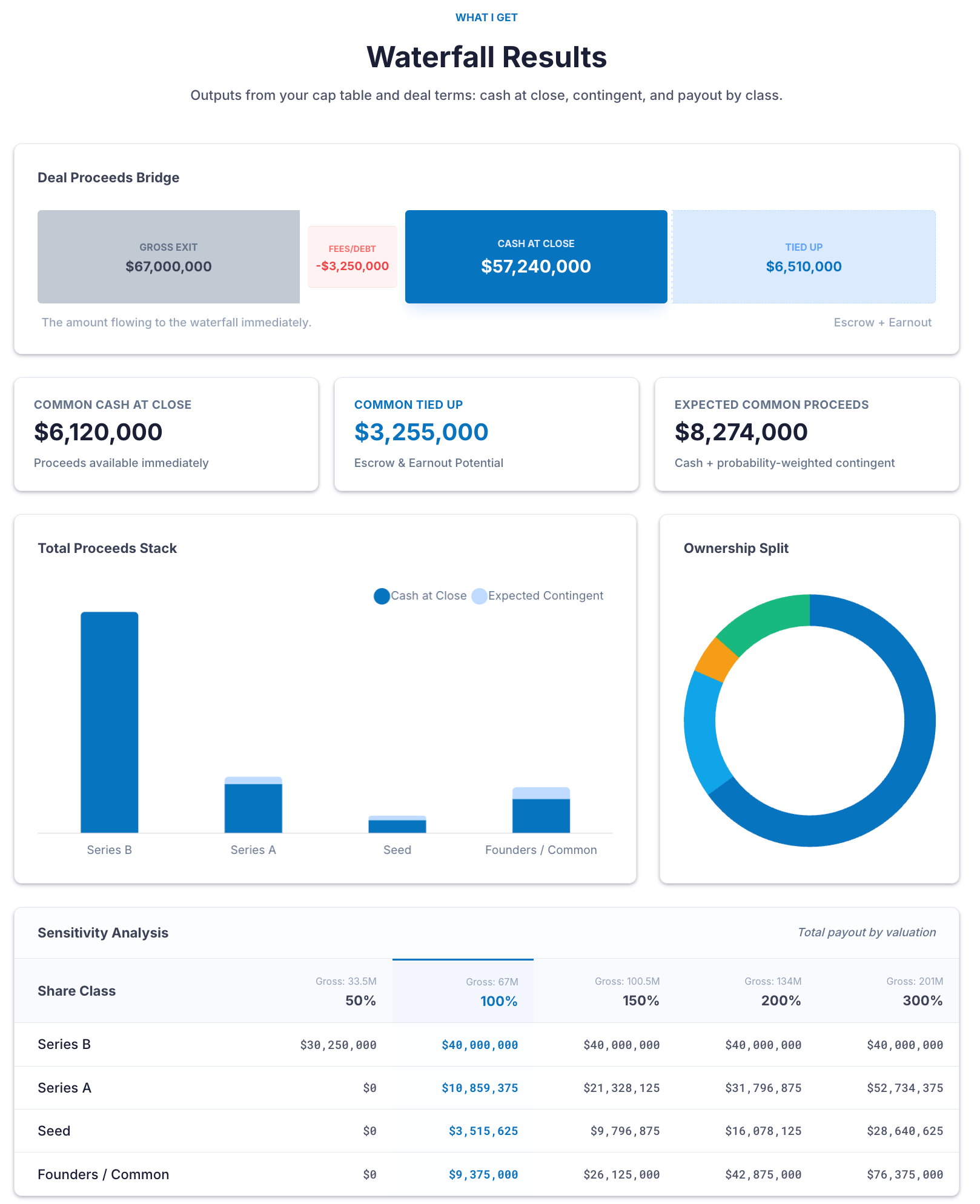

Then the cap table waterfall runs. This is where most founders get surprised.

If you've raised institutional capital, you have preferred shareholders. They get paid before you do. Their liquidation preferences determine the order and amount of distribution. A Series B investor with a 2x participating preference gets twice their money back, then participates in the remaining proceeds alongside common. A Series A investor with 1x non-participating gets their money back, then steps aside.

These terms seemed abstract when you were raising capital and desperate for growth funding. They become very concrete when the exit happens.

Your ownership percentage, let's say 40%, doesn't mean you receive 40% of the exit proceeds. It means you own 40% of the common equity, which gets paid after everyone with contractual preferences gets made whole.

Most founders are shocked by what actually reaches them.

The Question That Matters

Meanwhile, you have a different calculation running. You know what you spend annually. You know what large purchases you want to make: paying off the mortgage, buying the cottage, funding your kids' education. You know you want to invest in your next venture. You have a planning horizon, a sense of how long this capital needs to last.

You've done rough math on what you need in hand, after tax, to make the next chapter work.

The question that actually matters is simple: Does this exit deliver that number?

Most business owners don't answer this question until after they've signed. They discover the gap when it's too late to renegotiate structure, adjust the cap table, or walk away and wait for a better offer.

Reverse-Engineering From Your Goals

We built the Exit Planning Analysis tool to solve this problem.

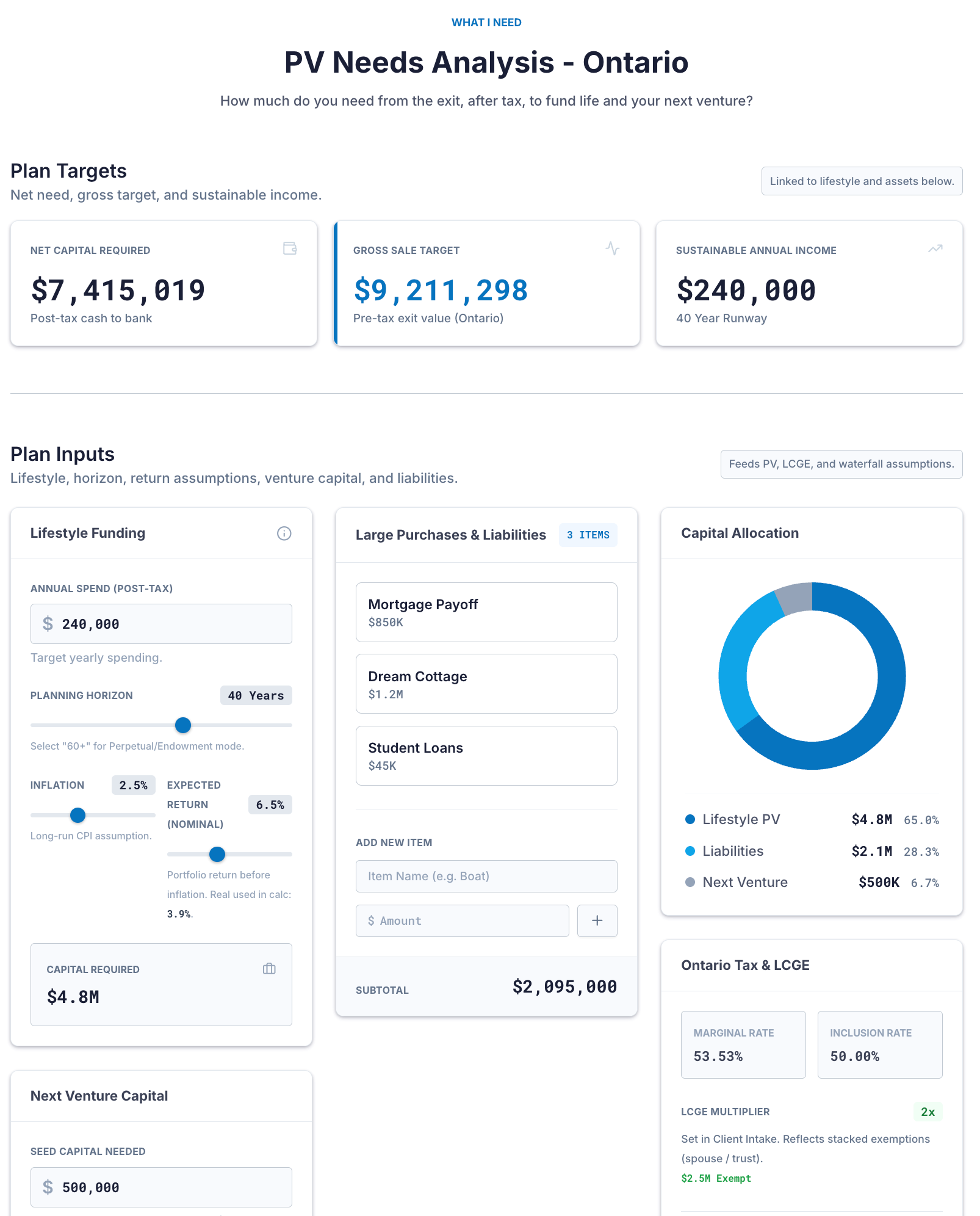

Instead of starting with what someone thinks your business is worth and hoping the math works out, we start with what you actually need. Your post-exit lifestyle spending. Your planning horizon. Your large purchases and liabilities. Your next venture capital requirements.

The tool calculates your after-tax capital requirement. This becomes your benchmark.

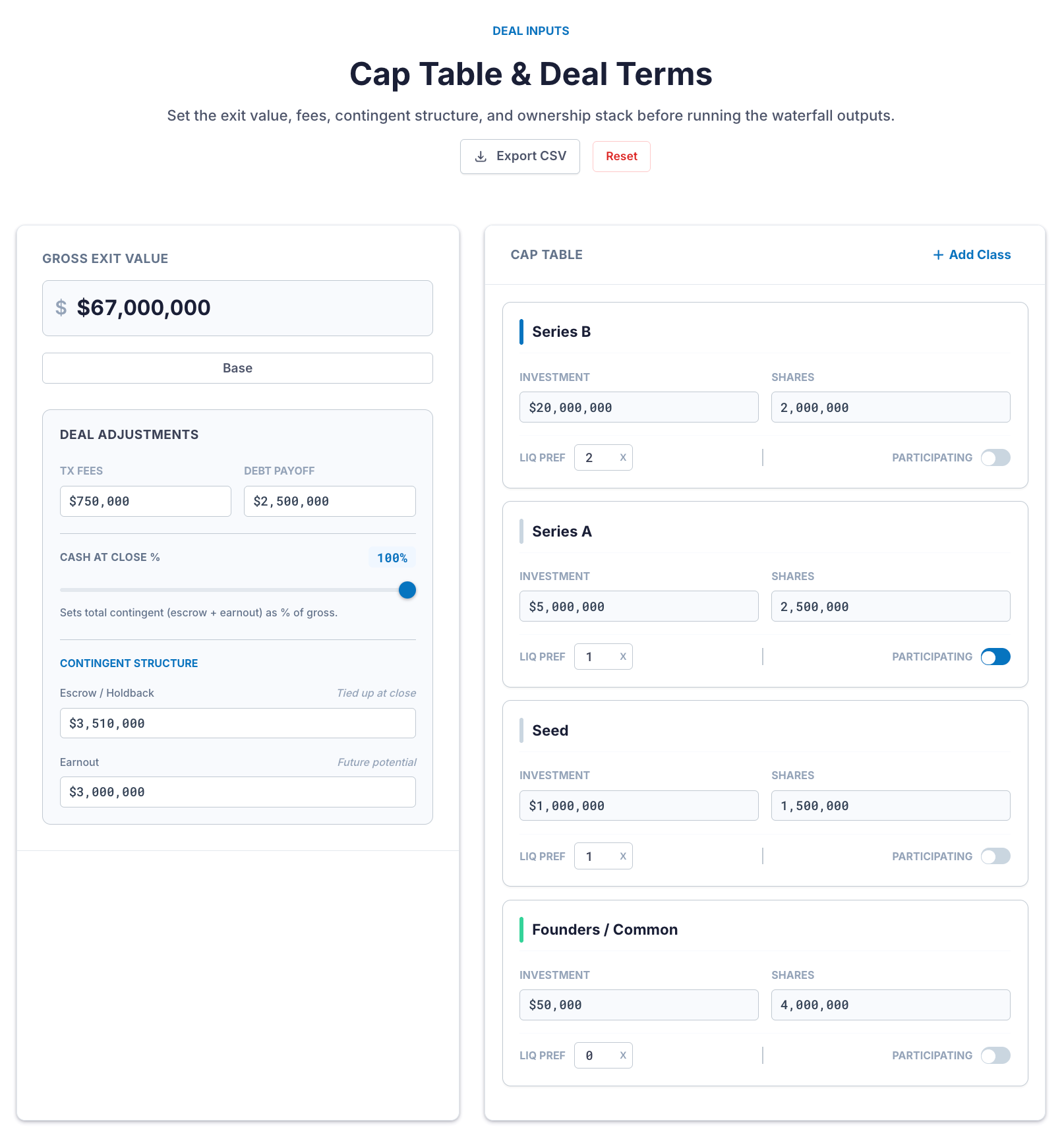

Then we model your real cap table. Not the simple ownership percentages, but the actual capital structure with all its complexity. Preferred share classes, liquidation preferences, participation rights, option pools. We run the waterfall to show you the distribution sequence and what lands in each bucket.

Then we layer in deal terms. Gross exit value, transaction fees, debt payoff, escrow structure, earnout conditions, rollover equity requirements. We show you the bridge from headline valuation to actual cash at close.

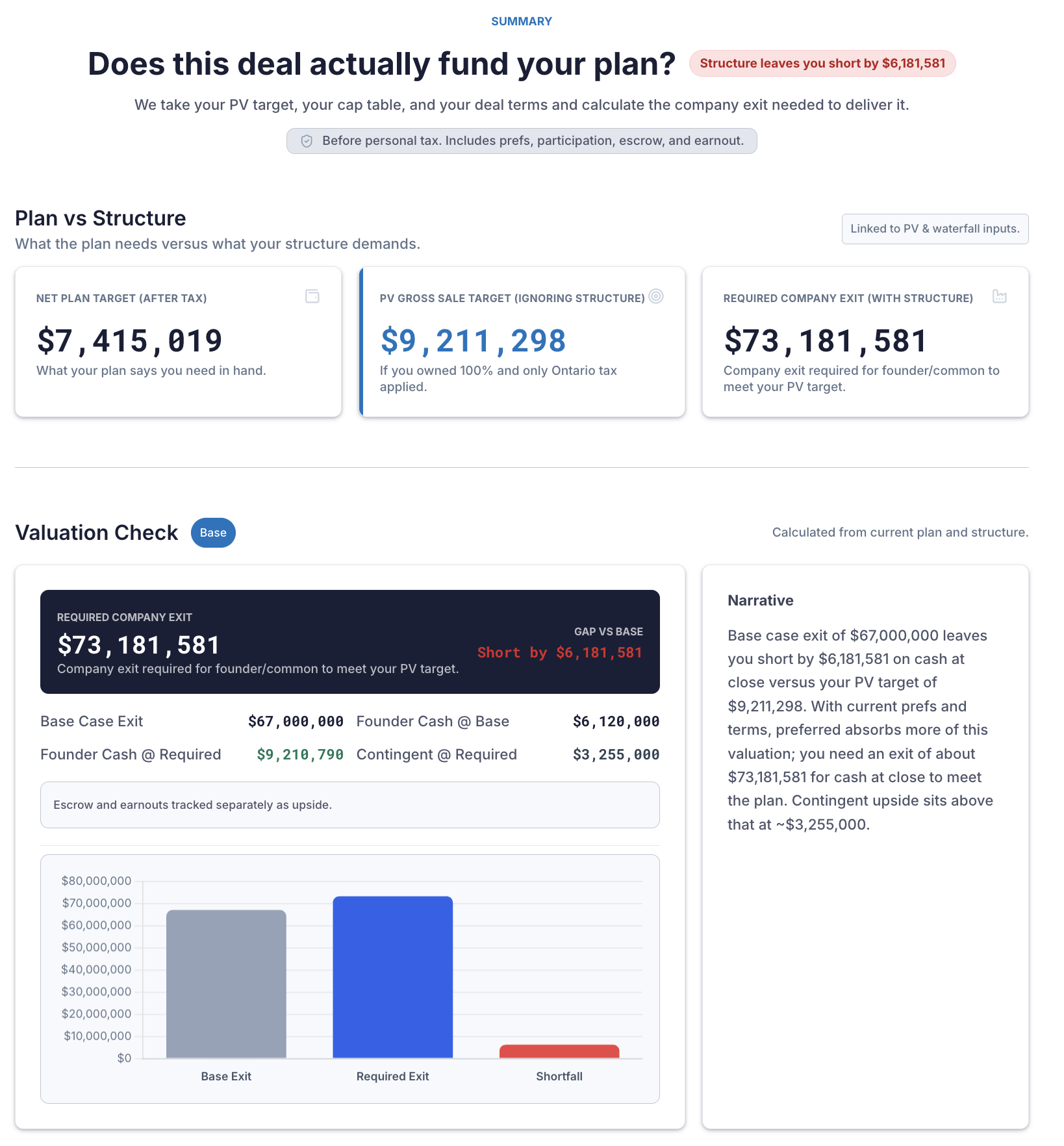

The output is clarity. Does this exit deliver your goals, or does it reveal a gap?

If you need a certain amount in hand and the structure leaves you short, you know immediately. Maybe you need a higher valuation. Maybe you need to renegotiate the cap table with existing investors before bringing in a buyer. Maybe your post-exit spending assumptions need adjustment.

Whatever the answer, you're making the decision with full information. You're not negotiating blind.

Why This Matters

We've watched business owners navigate exits for decades. The ones who struggle aren't the ones who get lower valuations. They're the ones who discover too late that the deal doesn't actually work for their life.

They sold at the wrong time. They accepted terms that sounded reasonable but destroyed their economics. They committed to rollover equity that tied up capital they needed for lifestyle. They agreed to earnouts that never materialized.

All of this was avoidable. The math was knowable upfront.

Exit planning isn't about maximizing enterprise value. It's about ensuring the exit actually delivers what you need for your next chapter. That requires modeling the complexity before you're under pressure, not after you've already committed.

How the Exit Planning Analysis Tool Works

Ready to Model Your Exit?

We reserve this analysis for business owners exploring whether a potential exit genuinely supports their next chapter.

Book a Strategy Session