June Federal Reserve Meeting

Christopher Bowlby - Jun 13, 2024

At the June meeting, the FOMC announced that they would continue to hold the Fed Funds rate at 5.25%-5.5% for the seventh straight meeting

Against the backdrop of the better-than-expected May CPI report, the June FOMC meeting was more of a mixed bag. At the meeting, the FOMC announced that they would continue to hold the Fed Funds rate at 5.25%-5.5% for the seventh straight meeting. Prior to the May CPI report, which was released on the morning of the second day of the FOMC meeting, this was to be expected as there had not been enough progress on inflation.

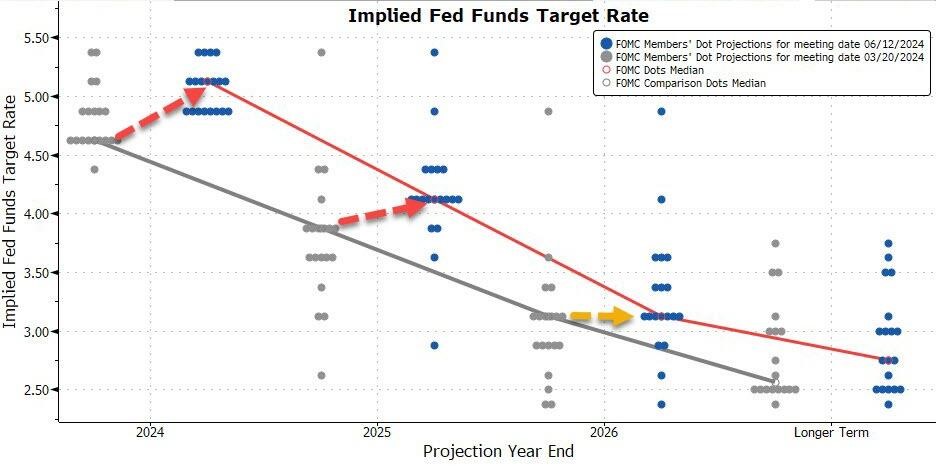

More importantly, with the June meeting, the FOMC released an updated Summary of Economic Projections (SEP), which saw a change to the median forecast for 2024 and 2025. The updated SEP now shows a new median forecast of only one 25 bps rate cut in 2024 compared to three cuts at the March meeting, and for 2025, four cuts versus an estimate of three cuts at the March meeting. Overall, the exit Fed Funds rate for the end of 2025 is now 25 bps higher than the previous SEP, while 2026 remained unchanged.

Source: Bloomberg

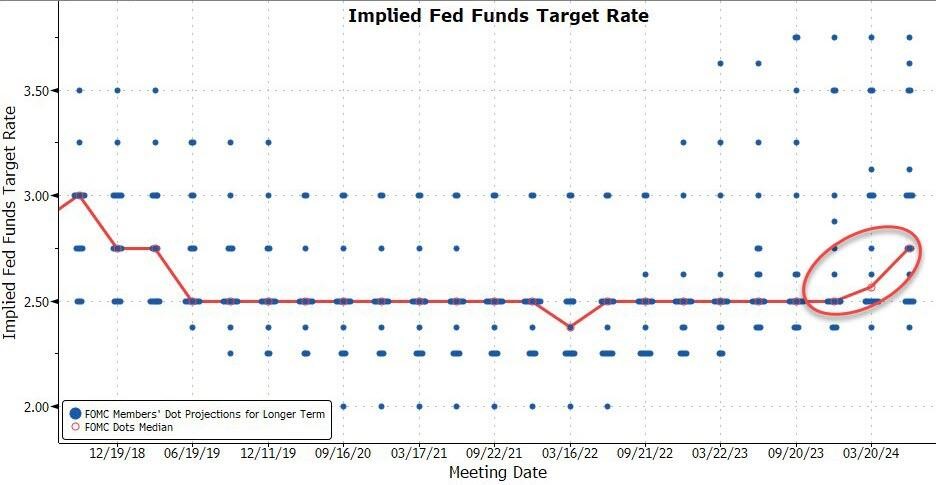

Surprisingly, we saw a continued trend of the longer-term Fed Funds target continuing to creep higher. The longer-term estimate went up to 2.8%, up from 2.6% at the March meeting and 2.5% at the start of the year. This is important as the Fed has increased the long-term neutral rate. It remains to be seen if the FOMC will still stick to their inflation target of 2%.

Source: Bloomberg

Overall, with headline inflation still over 3%, Supercore inflation still above 5%, and the unemployment rate at 4%, it makes sense that the Federal Reserve is still cautious and not reacting to Wednesday morning’s CPI release. The Federal Reserve was slow at first reacting to soaring inflation and has made it clear to markets that they need to see a meaningful and consistent move towards their inflation goal before they cut rates. Reprieve from the recent inflation spike in the first half of 2024 was not enough for them to follow the Bank of Canada and the ECB in cutting rates.

Our base case still remains that there will be two cuts in 2024, which will be back-loaded to the September and December meetings. There will be three CPI and employment reports between now and the September meeting, which should allow the FOMC enough data points to feel confident in easing monetary policy.