April 2024 Market Newsletter

Christopher Bowlby - Apr 01, 2024

We are entering a period of globally synchronized Quantitative Easing as we expect global rate cuts in the coming months. As such, financial markets have continued their bull run, supported by stronger than anticipated Q4 earnings and the resumption

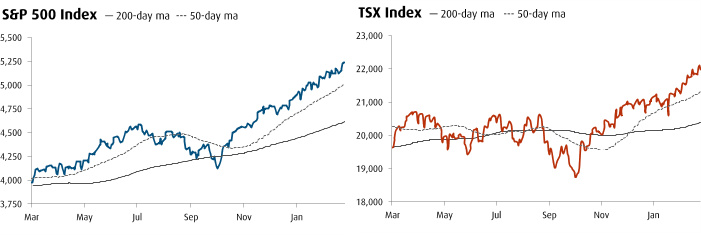

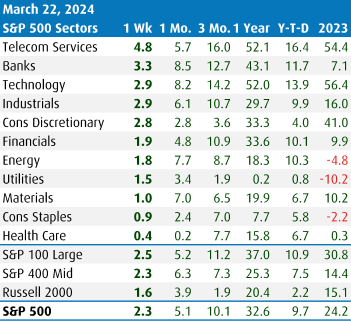

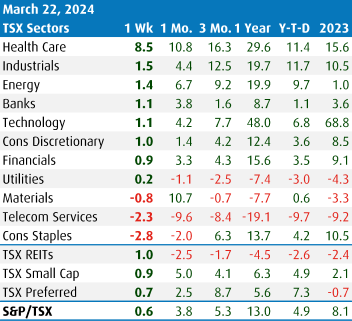

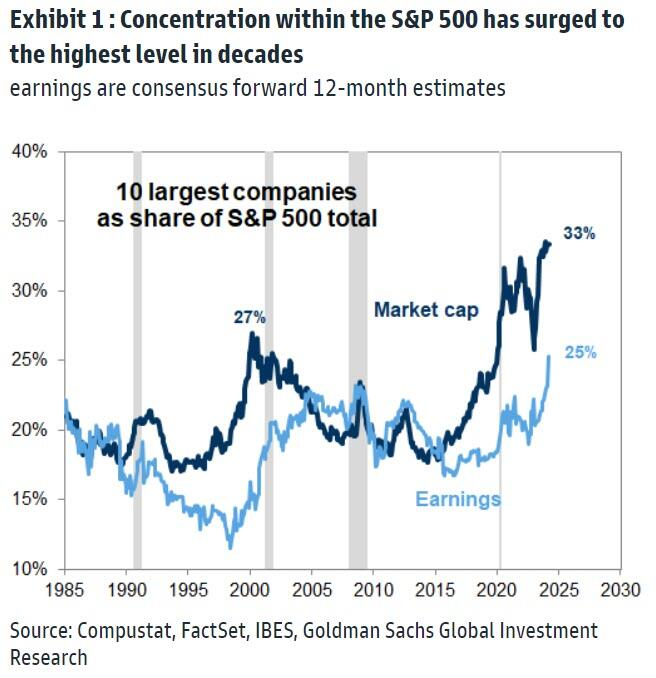

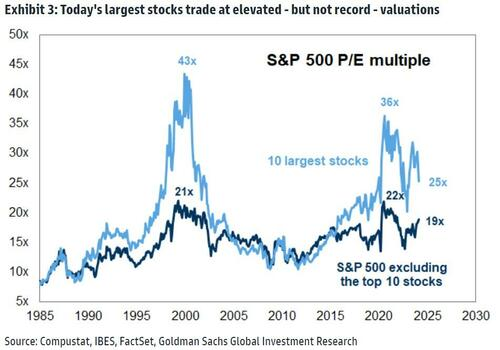

Since the last newsletter in January, we have seen the conclusion of Q4 earnings, the continued release of economic data, and meetings from the Bank of Canada, the ECB, and the Federal Reserve. We are entering a period of globally synchronized Quantitative Easing as we expect global rate cuts in the coming months. As such, financial markets have continued their bull run, supported by stronger than anticipated Q4 earnings and the resumption of buybacks. One of the biggest issues we are watching is the continued crowding into the AI trade, which has caused a major displacement in market dynamics as the performance of the largest 10 stocks has eclipsed the rest of the market. This momentum trade has been fueled by the quality of the 5 LLM stocks and the stubbornness of inflation, leading to a "higher for longer" sentiment on Quantitative Easing across market participants. As we reach the final stages of Quantitative Tightening that has taken place since 2022, we are seeing a stretched market environment primed for rotation once rate cuts begin in earnest.

Overall, there is a reason why the saying "the trend is your friend" holds true, and as such, we continue to maintain our overweight position in technology names that we have held over the last few years. However, at the present moment, we do anticipate deploying more capital into the AI theme. Moreover, we continue to look for other opportunities in high-quality companies with attractive free cash flow profiles that are trading at reasonable prices and will benefit in the coming 18-24 months as we see interest rate cuts and globally synchronized monetary policy easing. We anticipate a broadening of stock participation throughout the second half of 2024 and believe that it is imperative to own both growth and value in the portfolios. In our experience, when we see large crowding in the market, there is usually a rotation that results in a consolidation period in the crowded names, which leaves room for other parts of the market to catch up.

Chris, Debbie, Mark and Rosemary

Market and Earnings Season Recap

Looking back at the January and February earnings season, we saw earnings growth continue to remain strong in North America. In the US, EPS growth was up 8% YoY and beat expectations by 7%. Topline revenue beat by 4% YoY. In the stock market, a combination of "higher for longer" interest rates and a halo effect for stocks tied to Large Language Models (AI) have created dislocations with crowding in momentum names reaching levels not seen since the 2001 dotcom bubble and the Great Financial Crisis. In contrast to these previous levels of stretched crowding, this market has centered around the quality mega-cap technology companies with the highest liquidity, strongest balance sheets, durable pricing power, and sustainable growth at a time when most companies in the US and globally are struggling to hold margins and grow earnings.

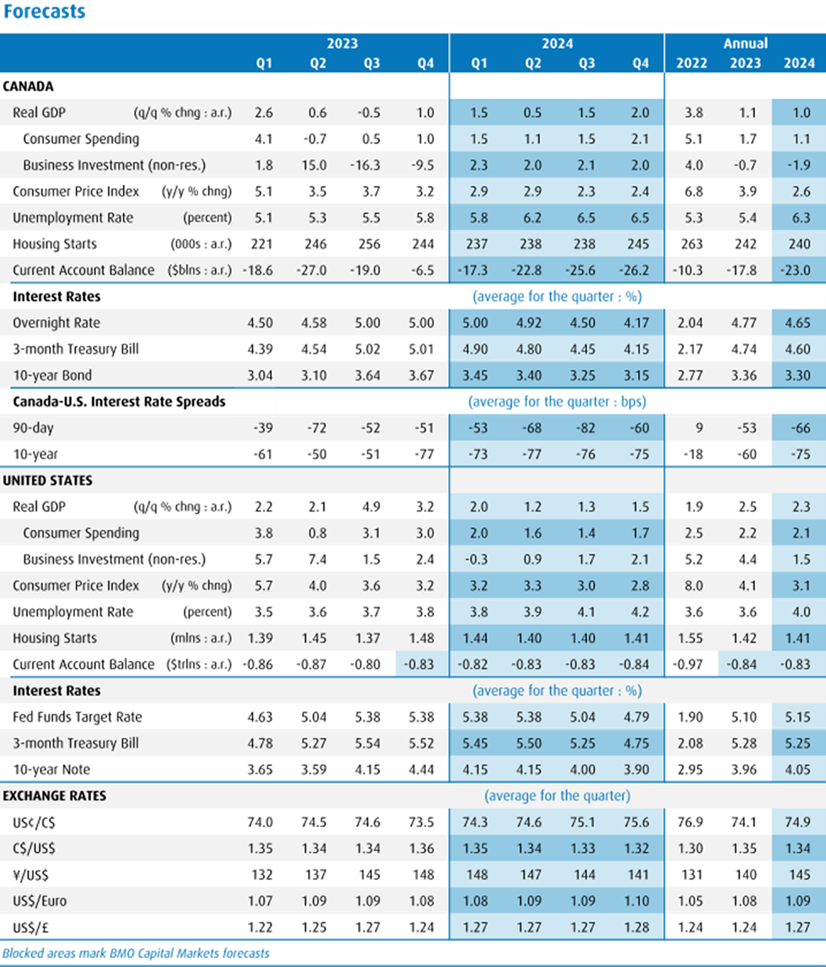

Source: BMO Economics

From our research over the last few weeks, we have begun to become cautious about the correlation of the bull market to the large LLM stocks, especially Nvidia, which has seen an increase of 81% in 2024 on top of its astronomical growth in 2023. As such, in the last few weeks, our team has been looking for opportunities in sectors and stocks that are relatively under performing the large 5 LLM stocks but have strong fundamentals, especially after reviewing Q4 earnings and 2024 guidance from management, to work to mitigate tail risk for when we see a rotation of market leadership.

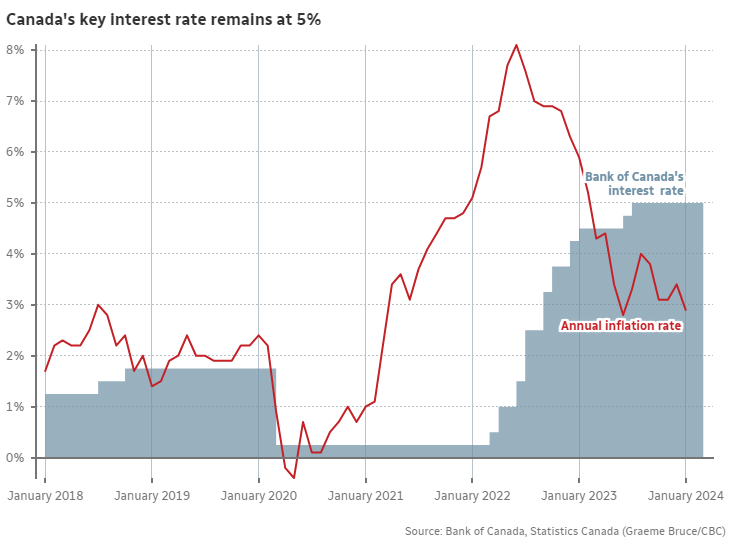

Canada: Bank of Canada Moves Towards Quantitative Easing

At the beginning of March, the Bank of Canada held their policy rate at 5% while maintaining a balanced statement. Inflation remains the key to monetary policy easing. The Bank of Canada expects that inflation above 3% will continue for the first half of 2024 before easing into the 2% range in the second half of the year. The Bank of Canada made it clear that they are comfortable keeping rates steady throughout the spring. The Bank of Canada also mentioned that while Canada experienced better than anticipated growth in Q4, there remains softness in the economy due to a modest excess in supply, which is expected to help drive disinflationary pressures. Additionally, the statement mentioned a better balance in the labor market, which should assist in fighting the stickiest part of inflation, which has been in the services sector most tied to wage inflation.

The Bank of Canada is tasked with walking a tightrope between maintaining full employment and strength in the economy and anchoring inflation to their target of 2%. In February, Canadian CPI rose 0.3%, below expectations for the second month in a row, and decreased headline inflation to 2.8% and core inflation to 3.2%. With core inflation still above its 3% target, the BoC continues to be cautious with their timeline for QE. As such, if inflation eases as the Bank of Canada expects, we anticipate rate cuts to not start until June or even in the second half of 2024.

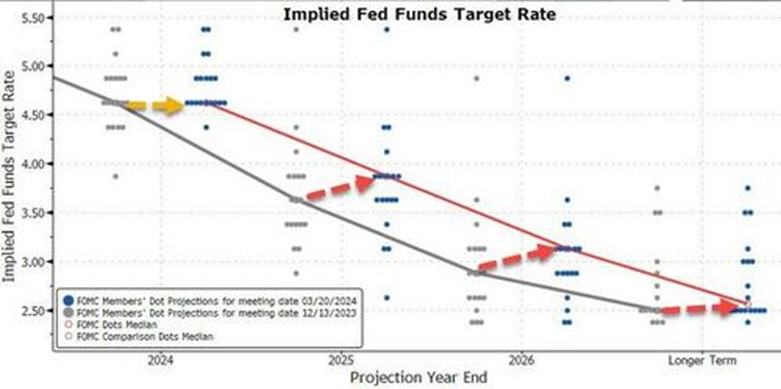

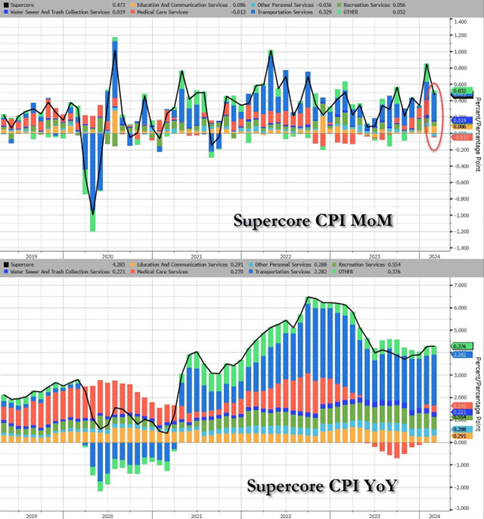

US: Stubborn Inflation and Economic Resiliency Give Runway for Fed Cautiousness

At the end of the month, the Federal Reserve concluded their March meeting and kept policy rates unchanged for the fifth consecutive meeting. Overall, the Federal Reserve maintained the same policy stance where the Fed does not expect to reduce policy rates until they have greater confidence that inflation is sustainably moving towards its 2% goal. Additionally, the March meeting featured the updated Summary of Economic Projections, and the dot plot remained at 4.675% for the end of 2024, implying a median projection of 75 bps of cuts in the second half of this year. Looking toward 2025, 2026, and beyond, the SEP continues to expect additional rate cuts in 2025 and 2026 before reaching a long-term equilibrium at 2.625%.

Source: Bloomberg

In the February CPI report, we saw inflation come in hot once again, with core inflation rising to 3.8% and headline inflation to 3.2%.

Source: Bloomberg

During his post-statement press conference, Chairman Powell said that it would be appropriate to ease rates fairly soon. The resiliency of the US economy and the stubbornness of inflation in January and February have continued to give the Fed a runway to remain cautious on rate cuts. As such, we continue to anticipate that the FOMC will begin rate cuts at their June or July meeting.

Source: BMO Capital Markets