January 2024 Market Newsletter

Christopher Bowlby - Jan 18, 2024

2023 was a year defined by the markets climbing the wall of worry to recover from the 2022 drawdown.

2023 was a year defined by the markets climbing the wall of worry to recover from the 2022 drawdown. Although the Federal Reserve, European Central Bank, and Bank of Canada raised policy rates to 20-year highs, the hard recession many strategists and economists predicted did not materialize. Central Banks are currently maintaining a delicate balance to achieve their dual mandates of controlling inflation and maintaining full employment in the economy. In 2022, we observed supply constraints pushing inflation to multi-decade highs, with Central Banks equipped with policy tools to effectively combat demand-pull inflation.

A major concern throughout 2023 was that Central Banks might push the economy into a recession by raising policy rates too high, despite inflation moderating due to strong base effects, and corporate earnings and employment remaining robust. This concern peaked in September and October when the return of the Bond Vigilantes pushed the US 10-Year yield above 5%, signaling to the Federal Reserve that continued aggressive policy rate increases could suffocate the economy and induce a hard landing.

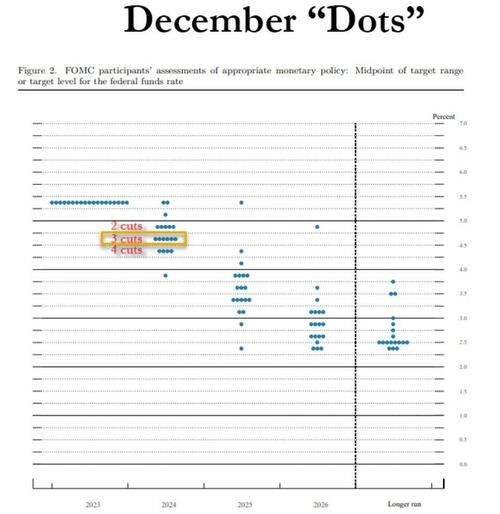

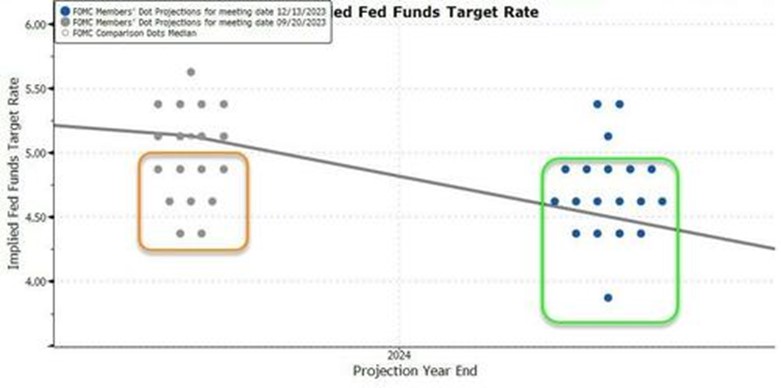

At their November meeting, the FOMC shifted their stance, indicating they believed they had reached the terminal rate and did not need to continue raising rates above 5.25% unless there was a major shift in economic data. Financial markets, always forecasting 12-18 months ahead, saw a major expansion of multiples as the narrative shifted from an out-of-touch Fed potentially crashing the economy to discussions on when Quantitative Easing would begin. The Santa Claus rally continued at the December meeting with the updated Summary of Economic Projections, where the dot plot showed a shift in the median expectations of rate cuts in 2024 from two 25 basis point cuts to three.

This brings us to our expectations for the markets in 2024. We believe that corporate fundamentals will continue to drive market performance. While we expect monetary policy rates to decrease this year, the current rhetoric about the first cut in March by the FOMC does not align with what we have seen from the Chairman Powell-led Federal Reserve. Over the last 24 months, we have seen an FOMC that was delayed in raising interest rates despite indications of high inflation post-pandemic, then playing catch-up with rates being aggressively raised by 5% over 16 months.

One concern is the diminishing deflation and disinflation from goods and energy prices, with a notable absence of a measurable reduction in inflation in housing or most service components. The Federal Reserve has clearly communicated to markets that their ultimate objective is for US CPI to return to a long-run target of 2%. If CPI remains above 3%, we expect rates to be held at 5.25% until there is more capitulation in services and shelter inflation before they can declare the inflation mandate achieved.

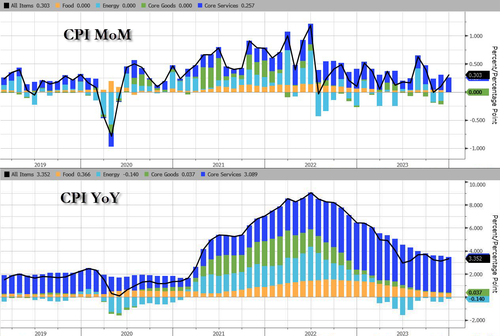

US CPI

In December, the US CPI printed hotter than expected, with headline CPI increasing by 0.3% and pushing the year-over-year figure to 3.4%. This higher figure was primarily due to an increase in services inflation, with Shelter being the largest component in this category.

Source (Bloomberg)

Source (Bloomberg)

For Core Inflation, the figure increased 0.3% but saw the year over year figure drop below 4% to 3.93%.

Source (Bloomberg)

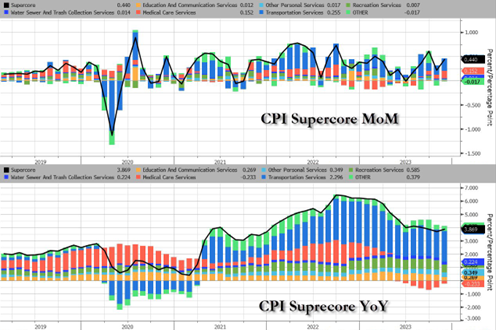

Finally, for Core CPI Services Ex-Shelter (SuperCore) which is one of the main data points of focus for the FOMC saw a 0.4% monthly increase and a YoY figure of 4.09%

Source (Bloomberg)

Source (Bloomberg)

Although December’s CPI report is unlikely to alter the path of monetary policy for the January meeting — with the FOMC expected to maintain the rate at 5.25% for a fourth consecutive meeting — it does reinforce our thesis of 'higher for longer'. We need to see more significant reductions in services and shelter inflation before we can confidently declare that the inflation mandate has been successfully addressed.

Federal Reserve

At their December 13th meeting, the FOMC held rates steady for a third consecutive meeting at 5.25%. During this meeting, they also released their updated Summary of Economic Projections (SEP). The SEP was a key data point, as the updated projections indicated a shift in the median projection for 2024 since September, now forecasting three 25 basis point (bps) rate cuts, up from two previously.

Source: Bloomberg

Source: Bloomberg

The Federal Reserve's primary concern remains stubborn inflation and financial markets that have eased considerably since their November meeting. Although the Federal Reserve has softened its stance towards further rate hikes, this does not signal a shift to Quantitative Easing in the first half of 2024. The next FOMC meeting on January 31st will be particularly informative for markets, as the Fed will have had time to assess the impact of the increase reported in the December CPI.

Canadian CPI

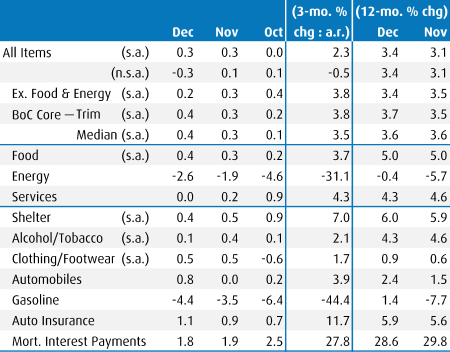

For December, Canadian CPI experienced a similar increase to that of the US, with headline CPI rising by 0.3% for the month and bringing the annual figure to 3.4%. Core CPI saw a 0.2% increase in December, elevating the year-over-year figure to 3.7%. Although the trend of higher inflation, hovering in the mid-3s, aligns with the US economy, it poses a challenge for the Bank of Canada. Despite a significant decrease in inflation throughout 2023, it appears that in both Canada and the US, reducing the final percentage will be the most challenging, especially given that wage trends are entrenched in the 4%-5% range. Canada continues to move in lockstep with the US. We do not anticipate a rate cut at next week’s BoC meeting, with the potential for the first cut emerging in the second half of 2024, dependent, of course, on economic data.

Source: BMO Economics

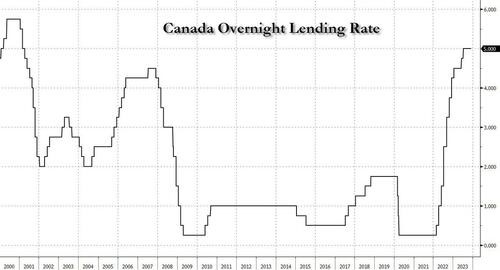

Bank of Canada

At their December meeting, the Bank of Canada maintained the policy rate at 5% for a third consecutive meeting, balancing a weakening economic backdrop with still-elevated levels of inflation and wage growth. While the BoC reiterated its willingness to increase the policy rate if necessary, the focus has shifted towards the potential initiation of Quantitative Easing, given the weakening economic conditions. Economically, Canada’s GDP has stalled, consumption is weakening, and the unemployment rate has risen to 5.8% from 5% in the last seven months. Although this economic slowdown will alleviate inflationary pressures, prematurely declaring victory over inflation, only to restart rate hikes later, would severely undermine the central bank’s credibility.

We believe that, considering the Bank's goal of reinforcing its inflation-fighting credibility among the broader public, the BoC might delay shifting to a dovish bias and then to cuts as long as possible. Assuming no significant further weakening of the economy in the coming months, the policy rate trajectory will hinge entirely on the evolution of inflation. We suspect that, although the underlying trend in inflation will improve in 2024, there will be intermittent challenges, such as the December 2023 report released earlier this month. These challenges are likely to keep the Bank from altering its stance sooner than the market currently expects.

Source: Bloomberg