Summer Market Newsletter

Christopher Bowlby - Aug 09, 2023

The first half of 2023 has been characterized in a reprisal of animal spirits in the US and rebound in the more interest sensitive names as the central banks in Canada and the US move closer to their terminal rate hikes.

First Half of 2023 Market Review and Q2 Earnings Updates

The first half of 2023 has been characterized in a reprisal of animal spirits in the US and rebound in the more interest sensitive names as the central banks in Canada and the US move closer to their terminal rate hikes. The market recovery in the US markets in particular have been quite impressive with the S&P 500 rebounding 19% and the Nasdaq rebounding 36% for the end of July. Throughout 2023, the equity markets have climbed the wall of worry as investors feared that the aggressive rate increases by the Federal Reserve and other central banks would push economies into severe recessions. In actuality, despite the 5% of rate increases, inflation has subsided from highs in June of 2022 and yet the labour market remains strong and the corporate earnings remain intact. Looking forward, we continue to recommend a balanced barbell approach to the portfolios as this strategy produces a favourable long term track record relative to the market indices.

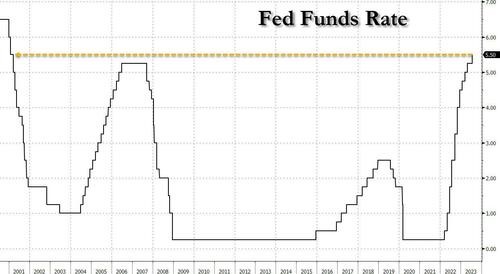

Federal Reserve

On July 26th, the FOMC had their summer FOMC meeting and decided to raise rates an additional 25 bps after a “skip” at their June meeting. This rate increase marked the 11th consecutive rate increase by the FOMC, raising the benchmark rate to 5.50%, and surpassed the highs of the 2006-2008 hiking cycle where the Fed peaked at 5.25%.

(Source: Bloomberg)

The FOMC stated that they would “continue to assess additional information and its implications for monetary policy” and that additional policy tightening might be necessary to achieve their 2% target. Additionally, they mentioned that the FOMC will take into account the cumulative effect of policy tightening which lags monetary policy and affects economic activity, inflation and economic and financial developments.

Overall, the policy hike has been priced into markets for the month and have been anticipating this meeting as the potentially the final rate increase in the US. Looking forward, the FOMC looks to be data dependent and before their next meeting in September there is 2 more rounds of employment and inflation readings along with other monthly indicators. Tail risk remains that while inflation is ebbing that it is not coming down fast enough and that the base effects from energy disinflation coming off will leave the committee looking at an similar economic situation and feel forced to raise again. If inflation continues to move lower with the soft landing story in tact, we would most likely see another pause in rates with attention shifting to the November 1st meeting.

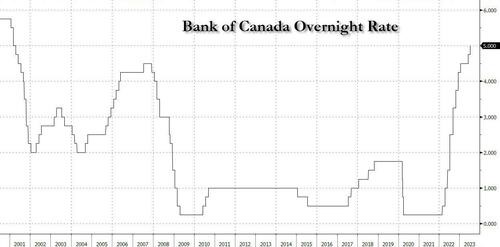

Bank of Canada

At their July meeting, the Bank of Canada continued their post-pause rate hikes raising interest rates an additional 0.25% to 5.00%, their 10th consecutive increase and bringing the overnight interest rate to its highest level since April 2001. More surprisingly than the rate increase was the hawkish tone of the statement with the Bank of Canada now seeing core inflation returning to the 2% target by the middle of 2025, six months later than the previous expectations in January and April this year.

(Source: Bloomberg)

While Canadian CPI has come down in 2023, there remains concerns by the Bank of Canada that the progress on bringing down inflation could stall as most of the downward momentum in inflation has come from energy prices. Additionally, June 2022 was the peak of the CPI increase cycle and now with the year over year data rolling off, there will be less downward momentum and a greater focus on the easing of underlying inflation date.

Going forward, the Bank of Canada repeated that they will continue to assess the dynamics of inflation and the outlook for CPI as the key data point for monetary policy. Additionally, they remained resolute in their commitment to bring core inflation back to their 2% target.

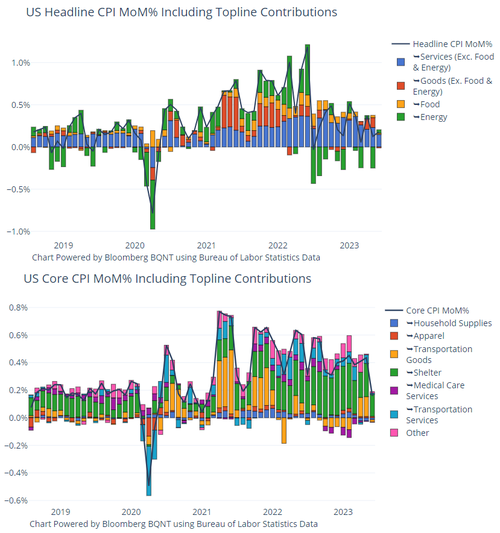

US CPI

The June reading of US inflation brought the lowest rise in Month over Month Core Services CPI ex-Shelter since September 2021 with an increase of 0.09%. Headline CPI rose only 0.2% MoM in June, the lowest reading since March 2021. Additionally, June 2023 was the 12th straight month of YoY declines in headline CPI, equalling the longest streak since 1921.

(Source: Bloomberg)

Core Services Ex-Shelter

(Source: Bloomberg)

Headline CPI

(Source: Bloomberg)

Core CPI

Finally, we have seen a stabilization in the M2 Money supply which historically has a strong correlation with CPI as it is a leading economic indication by approximately 16 months. As such, this data supports our belief that we will begin seeing normalization of monetary policy by the Federal Reserve in the second half of 2024.

(Source: Bloomberg)

Overall, while the Federal Reserve continued to raise interest rates at their July meeting and are projected to keep rates high throughout the remainder of 2023, the leading indicator of inflation continue to point to additional easing of CPI and strengthen our belief of normalization of monetary policy in 2023. It is this forward expectation of rate cuts which drives equity market multiple and is what has fueled the recovery in the first half of this year.

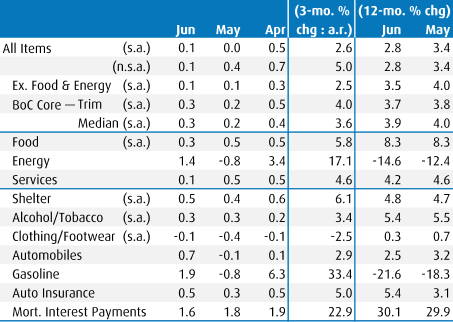

Canadian CPI

June’s CPI report showed some encouraging signs with consumer prices increasing 0.1% to 2.8% YoY in June, slightly below consensus and the slowest yearly pace since March 2021. Similar to the US CPI, June 2022 was the peak of the most recent CPI cycle and this latest report was the end of the declining base effects which have slowed inflation in 2023. The second half of 2022 were much tamer and it will be more challenging for inflation to continue to slow in the near term. Overall, the better than expected headline figures is an encouraging step in the right direction to bring down embedded inflation expectations. While headline inflation has been driven below 3%, core inflation remains sticky at 4%. With one more CPI report in August before the September BoC meeting, markets and the bank officials will be waiting to see if the taming of inflation in 2023 sticks or if it was mainly from base effects and whether further increases are warranted.

(Source: BMO Capital Markets)