Retiring as an Incorporated Professional

Debbie Bongard - Aug 26, 2019

Retirement planning is a complicated, yet hugely important part of financial planning. For incorporated professionals, this process can get even more complicated. This article aims to provide you with insight into various sources of income available

Planning for retirement is a critical component of financial planning. Retirement planning is a lengthy and complicated process due to the vast amount of things you need to account for. What do you want your retirement to look like? Where do you want to live? Do you want to leave anything behind for your children or grandchildren? How much money will you need to cover all of your expenses? What will your sources of income be? How do you minimize taxes on your estate? The list of questions to ask when planning for retirement seems endless.

While everyone has to grapple with these questions, incorporated professionals have to manage an extra layer of complexity, as they must consider how their corporation fits into their retirement plan, as well. For instance, what is the future of the corporation (if any) after you retire? What will happen to your corporation’s assets, and what are the associated tax consequences with either holding or selling them? How might your corporation help to fund your retirement?

Being proactive and developing a thorough financial plan will allow you to retire the way you envisioned. This article aims to provide you with some insight into income sources for incorporated professionals who are retiring and how you can effectively integrate your corporation into your retirement plan.

What does it mean to be an incorporated professional?

Licensed professionals such as attorneys, architects, engineers, physicians, dentists, and massage therapists, can set their practise up as a professional corporation. By doing so, the practise will function as a separate corporate entity and experience different legal and tax regulations. All professional corporations are regulated by their respective provincial governing body, such as the Law Society of Ontario, the Association of Professional Engineers of Ontario, or the College of Physiotherapists of Ontario.

Advantages of Incorporating your Practise

I have outlined a few of the advantages of incorporating your practise. Check out our other blog post for a more detailed list.

Limited liability

By incorporating your practise you are ensuring that you are not personally liable for business obligations. In the event your company goes bankrupt or is struck with a lawsuit, only the company’s assets can be seized to pay creditors. Further, incorporating your practise protects you from personal liability if any other owners act criminally or negligent.

Tax advantages

There are many tax advantages for professional corporations that earn less than $15 million in revenue annually. Firstly, the first $500,000 of taxable practice income in each fiscal year is subject to a much lower tax rate than if it were a sole proprietorship or several other forms of business. In 2019, professional corporations in Ontario owe 9% on the first $500,000 of income and 15% on any income above that. If this amount was claimed as personal income it would be subject to approximately 46%. For example, let’s say your company earned $500,000 this year. If your practise is registered as a professional corporation, you would have to pay $45,000 in taxes, whereas you would be subject to pay up to $230,000 if the income was claimed as personal income. That is $185,000 that you have the opportunity to either save or invest back into your business.

Furthermore, shareholders are eligible for the lifetime capital gains exemption (LCGE). The LCGE allows you to sell your shares and not pay capital gains tax if they have experienced an increase in value. Shareholders can also pay themselves through dividends, thus positioning themselves in a lower income bracket and having to pay fewer taxes.

Income splitting

Lastly, income-splitting with family members is another common way to reduce the amount of taxes you have to pay to the government.

Other advantages

Employees of professional corporations can also access various types of employee benefits that would otherwise not be available in general partnerships or sole proprietorships. Retirement savings vehicles in the form of Individual Pension Plans (IPP) and Retirement Compensation Arrangements (RCA) can provide you with greater contribution room to save for retirement, employer matching programs, and creditor-protection benefits.

What does retirement look like for incorporated professionals?

The first step is to consider your retirement goals. What do you want your retirement lifestyle to look like? What activities do you want to be involved with? Where do you want to live? Moreover, are you on track financially to afford this desired lifestyle? This is an often overlooked, yet crucial step of retirement planning because your goals and priorities will help you determine how you should structure your income in retirement.

Once you understand your goals, conduct an assessment of your investments. Take a look at your personal investments and savings portfolio, your corporate investments, TFSAs, RRSPs, CPP, private pensions, life insurance policy, and any other assets. Determine how much you have in your accounts and if there is any extra contribution room you can top up.

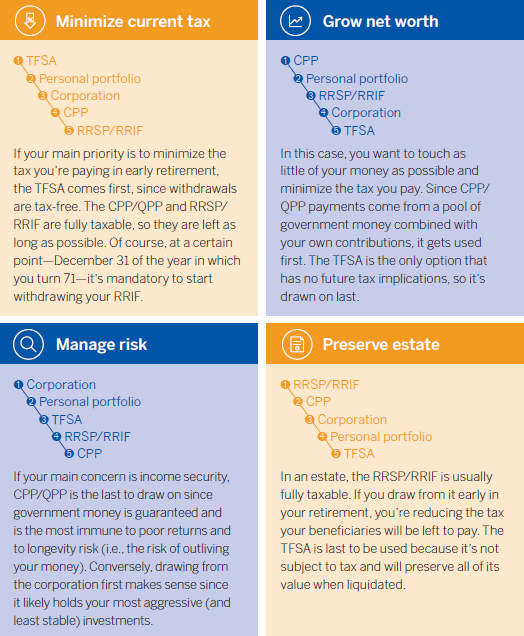

By considering what is important to you in retirement you can begin to make decisions about your sources of cash flow and the sequence that you will withdraw from your various accounts. Take a look at the table below created by MD Financial Management that explores four potential retirement goals that could be your first priority – minimizing current tax on your assets, growing your net worth, managing risk, and preserving your estate.

How does your corporation fit into this?

Generally, once you retire and your license to practice is no longer valid, your corporation will no longer be able to be classified as an operating corporation. You might be starting to think: “what should I do with my corporation?” There are two main options. You can either shut down your operation or convert your professional corporation into a holding company with a new name. Let’s explore both options.

1) Sell your business

There are two main ways to sell your incorporated business – either through the sale of your company’s assets or the sale of your company’s shares.

Sell your shares. Instead of selling off all of your company’s individual assets, you can sell all of your corporate shares. When your company’s shares are sold, ownership is transferred to the purchaser. There are some things to consider for tax purposes such as capital gains tax and your eligibility to utilize your $500,000 lifetime capital gains exemption on the sale of your shares.

Sell your assets. Another option is to sell all your company’s assets – both tangible and intangible. Tangible assets would include things such as inventory, equipment, office space, and furniture. Intangible assets would include items such as customer lists, goodwill, and trademarks. After selling off assets, you have to pay your creditors what they are owed and dissolve your company.

2) Convert your operating corporation into a holding company

The second option is to convert your operating professional corporation into a holding company with a new name. This company will become a non-practising corporation that essentially exists to house your assets. Holding companies offer businesses protection from creditors. By moving your company investments into a holding company, you are protecting your assets from creditors and don’t have to pay capital gains taxes, as you would with the sale of your assets.

If you do decide to go this route, you are responsible to notify all appropriate parties regarding the change of status of your corporation. This may include provincial and federal governing body for profession, partners, hospitals and pharmacies.

With the holding company, you have the option to pay yourself in the form of dividends throughout your retirement. Dividends are also a tax-efficient way to withdraw investment income and retained earnings because they aren’t reported as income, and therefore do not influence the tax bracket they fall into.

Conclusion

To summarize, as an incorporated professional, you have a unique opportunity to supplement your personal retirement savings with earning from your corporate investments. Through the sale of your company’s assets or corporate shares, or through the use of a holding company, you can align your sources of cash flow to align with your personal priorities in retirement.

Due to the complexities of retiring as an incorporated professional, it is highly advised that you speak with a financial advisor. If you don’t currently have one and are seeking some guidance, please don’t hesitate to reach out to any of our team members at the Bongard Wealth Advisory.