ESG and Sustainable Investing

Debbie Bongard - Aug 17, 2021

Over the last few years, we have seen a shift in corporations and industries worldwide incorporating social responsibility and the environment into their corporate philosophy and policies. This trend has permeated into the financial sector and has be

ESG and Sustainable Investing

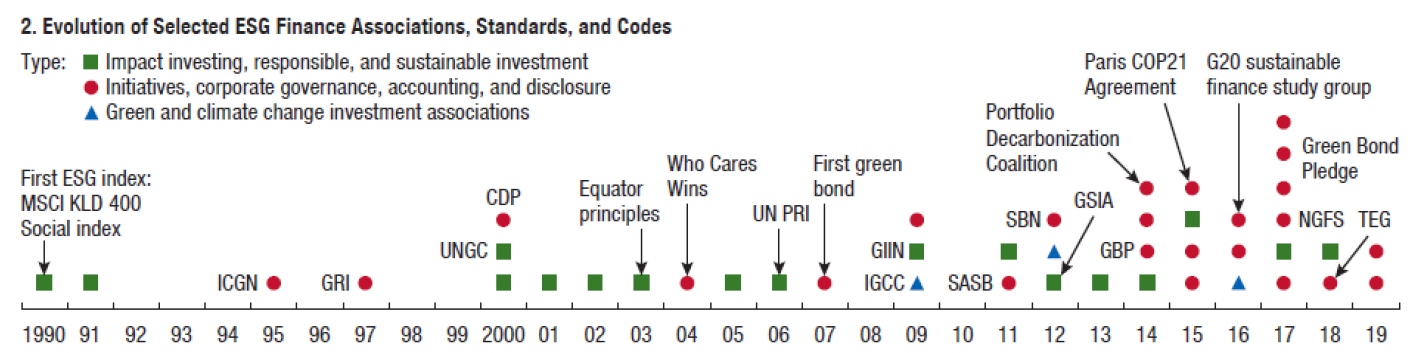

Over the last the decade, we have seen a rise of ESG as a theme in financial markets, which has risen dramatically over the previous five years as society has become more aware of climate change and become more socially responsible. ESG investing is an opportunity for investors to align their money with their feelings on environmental and societal causes and be more informed on the companies they are invested in.

There has been a shift in corporations and industries worldwide incorporating Corporate Social Responsibility (CSR) into their corporate philosophy and policies. This trend has permeated into investing and has become one of the fastest grown sectors in the financial markets, with both institutions and individual investors beginning to incorporate ESG into their practices.

As the trend of ESG has parabolically risen, we have seen a corresponding increase in financial firms offering ESG products. A recent report from Bloomberg states that “global ESG assets are on track to exceed $53 trillion by 2025, representing more than a third of the $140.5 trillion in projected total assets under management.”

Additionally, we have seen an exponential increase in the tools and products available to investors which have allowed for more detailed analysis of ESG considerations. Organizations such as Sustainalytics, Bloomberg, Thomson Reuters, S&P Global and MSCI have created and broadened their product services to include ESG data.

Furthermore, we have seen indexes such as the Nasdaq begun to implement index wide changes. For example, in December 2020, the Nasdaq announced a proposed listing rule requiring the more than 3,000 companies listed on its stock exchange to improve boardroom diversity by appointing at least one woman and at least one minority or LGBTQ+ person to their boards.

Source: MSCI

What is ESG?

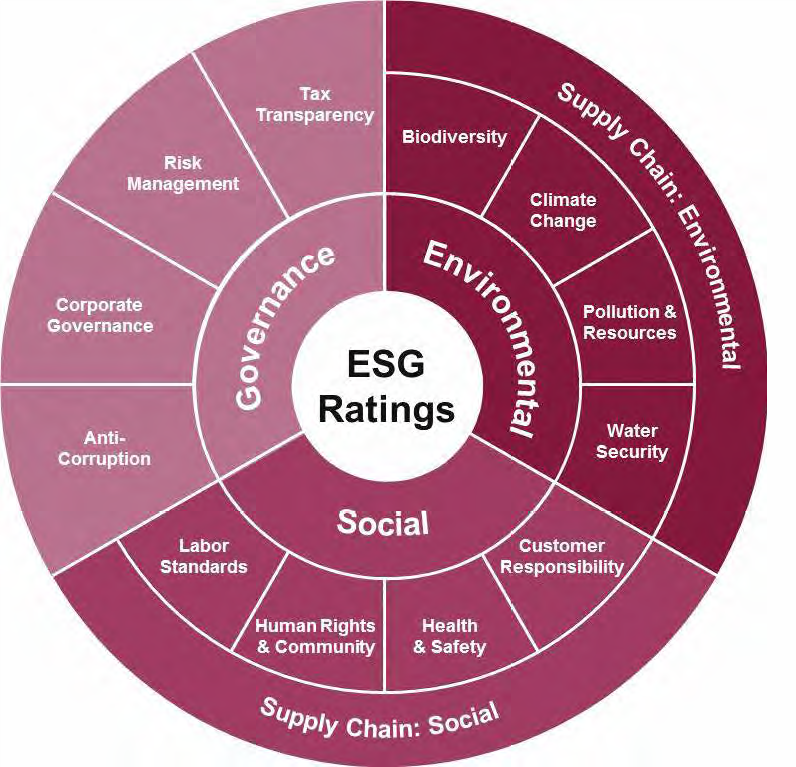

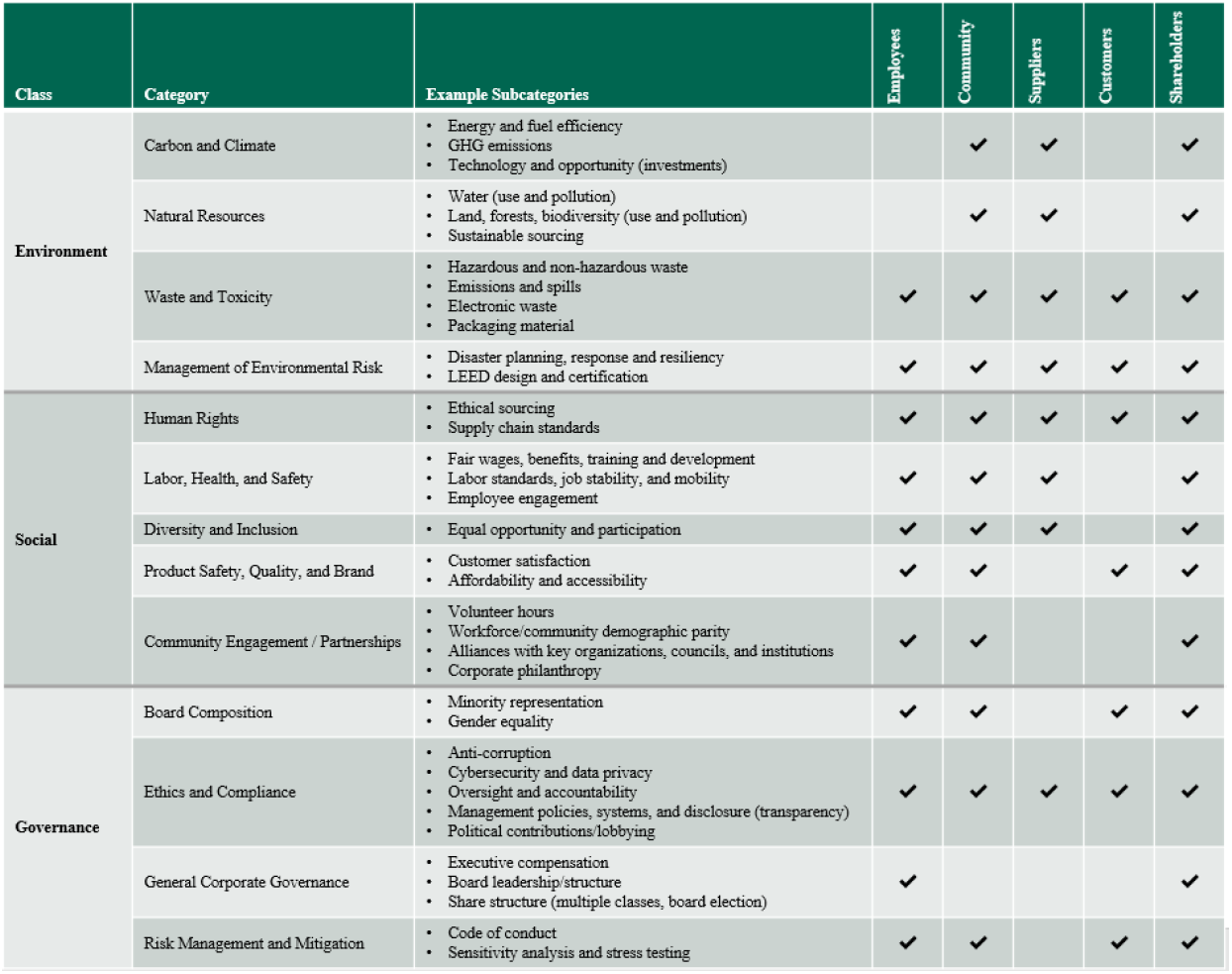

With ESG being pushed to the forefront of investing, many investors have begun to ask, “What is ESG?” ESG is a catch-all term that incorporates all facets of a sub-sector of investing, including the analysis of Environmental, Social, and Governance issues.

-

Environment: the environmental impact a company has, considering factors like their energy usage, the amount of waste they produce and their impact on natural environments or resources. Typically, Environmental issues have been the first topic investors think of when considering ESG investing. Environmental considerations include climate change, resource depletion, waste, pollution and deforestation.

-

Social: the impact a company has on their community and society. The social evaluation of a company considers their efforts to promote equality and diversity, both within and outside of its business. Social considerations include human rights, modern slavery, child labour, working conditions and employee relations.

-

Governance: the assessment of how effectively the company is run. This criterion could look at internal leadership, profitable previous decisions and a history of satisfying key stakeholders. People are looking to see if the company’s leadership is driving positive change, including a company’s diversity amongst upper management and board of directors. Governance considerations include bribery and corruption, executive pay, board diversity and structure, political lobbying and donations and tax strategy.

Source: CFA Institute

What is Sustainable Investing?

Sustainable investing is a sub-sector of ESG investing which focuses on companies that are adopting progressive environmental, social and governance practices that align shareholder and stakeholder interests to enhance the value of all parties involved.

Typically, Sustainable Investing includes the incorporation and integration of ESG considerations into the investment process, i.e. the consideration of how ESG issues may impact a securities risk and return profile and the investment of companies with a positive impact or companies that will benefit from sustainable macro-trends.

Additionally, Sustainable Investing incorporates screening out companies acting contrary to long-term environmental and social sustainability, such as coal mining. Sustainable Investing aims to enhance long-term value by using the incorporation of ESG criteria into the investment process to mitigate ESG risks and identify growth opportunities.

Source: Guidance and Case Studies for ESG Integration: Equities and Fixed Income (CFA Institute 2018 in collaboration with Principles for Responsible Investment (PRI).

What Is the Bongard Wealth Advisory Group Doing?

As part of our fiduciary duty to our clients, our team has begun incorporating sustainable investment into our investment process and our investment decisions for our clients. Our fiduciary duty to our clients means that we are required to always act in the best interest of our clients and as such, it was natural for our team to begin incorporating ESG into our investment decisions by broadening the scope of our investment philosophy.

This shift that we have seen across financial markets to a stakeholder value creation is apparent in management calls and quarterly and annual earnings report with management where sustainable practices and efforts to become more sustainable are being highlighted.

We believe that it is important for the companies that we invest in to not only be financially profitable but also be planning for a sustainable future which is in the best interest of both their shareholders and their various stakeholders. The integration of ESG into our Investment Decisions was the natural next step after using the traditional financial metrics. Most often, the companies that are leaders in their peer groups through an ESG lens are also the companies that are then best managed and have the best future growth trajectories over their peers and the companies that have negative ESG metrics typically are companies that are in industries or sub-sectors which are in secular decline.

Source: Harvard Law and Bank of New York Mellon

Conclusion

We believe that the efforts by companies to incorporate ESG into their business practice will allow companies to drive long-term sustainable performance for both shareholders while also positively benefiting the world around us. It is our belief that it is part of our fiduciary duty to incorporate sustainable investing into our investment process and that through this additional screening tool, we will be able to better align the interest of our clients to invest in a more socially responsible way while continuing to generate long-term value by in best-in-class companies.