ESG: A Year of Growth

Debbie Bongard - Dec 22, 2021

ESG has been one of the hottest trends in the investment world over the last few years, but veins of criticism began to emerge in 2021 and new questions are being asked about the integrity of ESG data, the transparency of ESG ratings and the real wor

2021 was a key year for the growth of ESG investing as shareholder activism reached new heights and net zero targets went mainstream. Engine No. 1’s successful activist campaign at Exxon Mobil was one of the defining ESG moments of 2021, despite owning just 0.02% of Exxon’s float, the hedge fund won a battle to install three new directors on Exxon’s board and speed up the company’s energy transition plan.

Headline events included COP26, which delivered several promising agreements even though it failed, as largely expected, to produce a new round of greenhouse gas (GHG) targets to keep global missions on a 1.5°C pathway. The November launch of the International Sustainability Standards Board (ISSB) by the International Financial Reporting Standards (IFRS) Foundation is another pivotal development. Looking forward to 2022, we expect that the ESG industry will continue to mature.

ESG has been one of the hottest trends in the investment world over the last few years, but veins of criticism began to emerge in 2021 and new questions are being asked about the integrity of ESG data, the transparency of ESG ratings and the real world impact of ESG and climate funds. ESG is still in an early stage of its life cycle and has a lot of growing up to do. We believe ESG is poised to take a leap in its maturity in 2022 due to the growing attention of securities regulators, the launch of new reporting frameworks and the demands of investors for higher quality ESG information.

We are expecting seven trends to dominate the world of ESG investing.

-

Net Zero Targets: Over the last year, net zero targets have increased significantly with ~3,000 companies, 140 countries and 450 investors having committed to net zero in one form or another. There is just one problem – there is no clear definition about what net zero means. As a result, companies, investors and policymakers are approaching net zero in vastly different ways. There are disparities around net zero timelines (US by 2050, China by 2060, India by 2070), the proportion of investor assets covered by net zero pledges and even basic measurement, particularly with corporate plans as nearly half of corporate net zero plans fail to explain how they will use carbon offsets and only 8 percent of corporate net zero goals include interim targets.

Net zero protocols have started to develop, including the Climate Action 100+ Net Zero Company Benchmark, the Starting Line criteria for the UN Race to Zero, and the recently launched SBTi Net-Zero Standard. The SBTi framework is becoming the gold standard for certifying corporate net zero targets, and it is one that we are increasingly incorporating into ESG assessments and research. In 2022, we believe that companies whose net zero plans significantly trail these best practices are likely to face heightened scrutiny from investors, regulators and other stakeholders. -

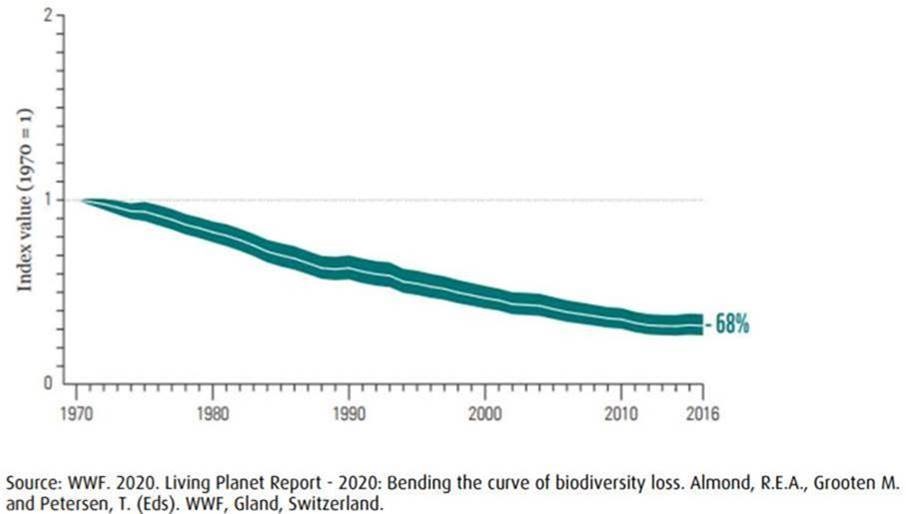

Increased Focus on Biodiversity: We expect biodiversity and natural capital to become a much more important theme for ESG investors in 2022 due to regulatory momentum and the launch of the Taskforce on Nature related Financial Disclosures (TNFD). A global biodiversity framework could be finalized within the next six months. The first phase of the UN Biodiversity Conference (COP 15), which was held in Kunming, China in October 2021, produced the Kunming Declaration – an agreement by more than 100 countries to implement a global biodiversity framework. The framework is scheduled to be finalized during the second phase of COP 15 in April and May 2022, but the general aim will be to stabilize biodiversity loss by 2030 by, among other things, integrating biodiversity principals into country policies, regulations, planning processes and economic accounting. The draft agreement also commits countries to phasing out or reforming subsidies that are harmful to biodiversity and to align financial flows in support of the sustainable use of biodiversity.

-

The TNFD aims to develop a disclosure framework for issuers and investors to report on their nature related dependencies and impacts. The TNFD launched in June 2021 with support from the G7 Finance Ministers and the G20 Sustainable Finance Roadmap. The organization intends to build upon the success and structure of the Task Force on Climate-related Financial Disclosures (TCFD) and promote consistency for nature-related reporting. Ultimately, we expect companies in high-impact sectors (construction materials, food products, forestry, metals & mining and oil & gas) will be required to measure and disclose their biodiversity impacts, and in 2022 we believe investors will increasingly scan their portfolios for biodiversity and natural capital related risks and opportunities.

-

Energy Efficiency: Energy efficiency is often overlooked as an emissions reduction solution. Investors often focus on the build out of renewable energy capacity (e.g., wind and solar) and emerging technologies (e.g., hydrogen in transportation, carbon capture and storage, etc.), but energy efficiency – using existing energy resources more efficiently – is frequently found to be the most cost-effective emissions reduction resource The potential for energy efficiency improvements in commercial buildings, residential homes, transport and industry to reduce global GHGs is enormous; in the IEA’s Sustainable Development Scenario, for example, energy efficiency delivers more than 40% of the reduction in energy-related GHGs over the next 20 years.

Energy efficiency is poised to bounce back in 2022 as a key investment theme with catalysts like the Glasgow Climate Pact, which calls upon signatories to rapidly scale up energy efficiency measures, the sheer volume of companies looking to hit net zero reduction targets and the renewed spotlight that the pandemic has put on green buildings. Over 130 countries are targeting emissions from buildings as part of their plan for meeting their Paris Agreement commitments, with varying levels of grants and support programs, and there is growing evidence that corporate tenants increasingly prefer sustainable and healthy buildings. In the Canadian REIT sector, Dream Office, First Capital and RioCan have the highest green building exposure (LEED or BOMA BEST standards) with 81%, 79% and 50%, respectively. -

Enterprise value vs. double materiality: The debate between enterprise value vs. double materiality reflects two different approaches to ESG reporting: enterprise value focuses on how environmental and social factors can influence a company’s valuation and financial performance, while double materiality takes a broader stance and considers the impact of environmental and social issues on a company but also a company’s impact on society and the environment.

The International Sustainability Suitability Board, which is being developed by the International Financial Reporting Standards (regulatory industry which governs the financial reporting standards in 144 countries around the world) is expected to launch its first set of standards covering climate change-related disclosures by mid-2022 and will take an enterprise value approach. The European Financial Reporting Advisory Group (EFRAG), which is developing sustainability disclosure standards that will underpin the EU’s proposed Corporate Sustainability Reporting Directive (CSRD), is following a double materiality approach. While these dual reporting standards may cause some issues as double materiality asks for more information and imposes a higher reporting burden on issuers.

The forthcoming ISSB standards are likely to serve as a global baseline and double materiality considerations could be layered on by different reporting jurisdictions over time. The main difference between these two standards is that the EFRAG standards will be mandatory in EU legislation, whereas the ISSB standards are unlikely to be fully operationalized unless securities regulators, policymakers or legislators make them mandatory. -

Addressing Greenwashing: In 2022 we expect the ESG industry to continue to mature and as such we expect to see securities regulators increasingly scrutinize the ESG practices of asset managers and the ESG disclosures of issuers. In October 2021, the Canadian Securities Administrators (CSA) published a proposal for mandatory climate change-related disclosures for reporting issuers in Canada, broadly in line with the TCFD framework. The consultation period ends in January 2022, and we expect the CSA to ultimately move forward with a new climate change disclosure regime. In the US, the SEC is expected to publish proposals for new ESG disclosures in early 2022, covering climate change, workforce and corporate board diversity disclosure.

-

Use of Underlying ESG Data: Additionally, as part of continued growth of the ESG industry, we believe that many investors in 2022 are likely to move away from using composite ESG scores to implement their ESG strategy and use the growing supply of underlying ESG data. This is partly because the volume and integrity of quantitative ESG data continues to expand and increase, a trend that is likely to accelerate as regulators increasingly scrutinize ESG information. One of the many issues with broad based ESG scores is that it creates a black box approach to how the scores are calculated, leading to doubt amongst investors due to a lack of transparency around the results. We expect that investors and research departments, like what BMO Capital Markets has been doing, will build out their own methodologies that rely on observable ESG performance metrics.

-

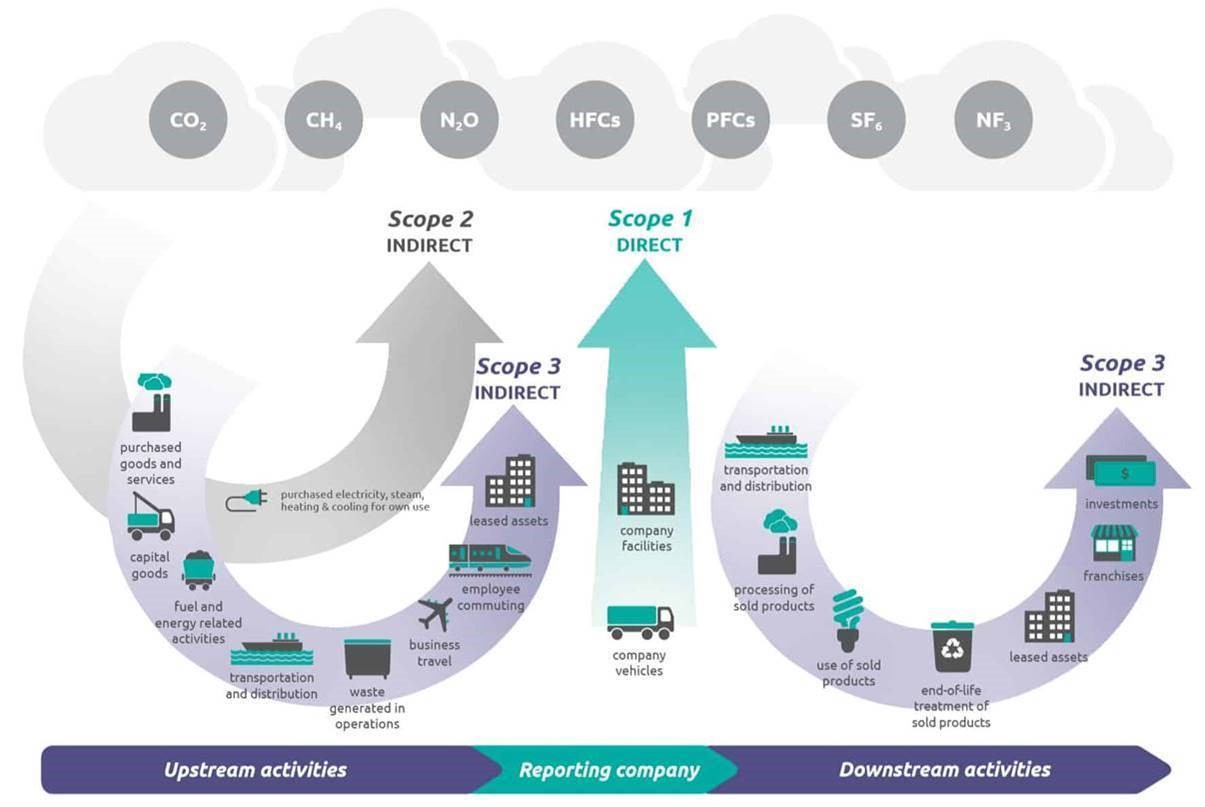

Scope 3 Emissions: Along with the push for more credible net zero targets and higher reporting standards, we believe 2022 will witness a marked increase in the number of companies that measure and publicly report their Scope 3 emissions.

Scope 3 emissions are the result of activities from assets not owned or controlled by the reporting organization, but that the organization indirectly impacts in its value chain.

Of the 8,000 companies that comprise the MSCI ACWI IMI Index, only 14% currently report their Scope 3 emissions. However, we believe this proportion is likely to significantly increase in the future as investors increasingly demand a full value-chain approach to emissions reductions.

Although reducing Scope 3 emissions poses obvious challenges for management teams as they are outside of a company’s operational control, we expect to see a growing number of companies develop innovative and collaborative approaches to mitigate these emissions.

Walmart, for example, recently developed a new finance platform to incentivize its suppliers to cut emissions. General Mills collaborates with its suppliers, farmers, packaging producers, transport providers and retailers, partly through its regenerative agriculture strategy, to reduce value-chain emissions by 30% by 2030 compared to a 2020 baseline.