Understanding Risk

Debbie Bongard - Jan 25, 2018

Selling a business is a transition that not only includes the financial aspect but also many other considerations to take place in the transition.

Risk and Your Tolerance for It

In the midst of recent market volatility, clients have increasingly been asking us questions about their personal risk tolerance.

The reality is, there are many factors that affect your tolerance for risk and there is a minimum amount of risk you need to take to achieve your financial goals. In this article, I will discuss some of these risk factors and how they change over time.

Difference Between Ability and Willingness

Your ability to take on risk is based on empirical factors, such as your time horizon, your assets versus liabilities, your cash flow, and other quantitative factors. Quantitative factors can be reviewed in a financial plan much easier than qualitative factors like willingness to accept risk which is highly subjective.

Recent Market Trends

Recently, the financial news has been filled with stories of people making large profits month after month on crypto-currencies, marijuana stocks and the stock market, especially in the United States. These kinds of market trends and news stories have an effect on your willingness to accept risk. This willingness to accept risk, according to behavioural finance is because people are scared of missing out, are greedy and expect higher returns or are feeling richer because of current market trends and want to continue to extrapolate on the returns.

Your Personal Investing History

Your investing history can have a large impact r on how you view risk and how much risk you are willing to take. For example, if you started investing in the 1980s, you likely entered the financial environment with high interest rates and lower debt. With this perspective, you may look at the current financial environment, especially interest rates, and consider them to be extremely below what is considered normal.

you were an investor that started prior to the dot-com bubble of 2001, or the housing crisis of 2008, you may nervous after a few years of positive market growth because your conditioning has taught you that bull markets lead to catastrophe. Also,your success or failure with investing will impact your ability to take risk and the investments you feel comfortable with.

Your Goals

Your risk tolerance is also going to be impacted how important and how long it takes you to achieve your financial goals. If you view your financial goals as extremely important and have a short time frame in which you want to achieve them, such as a down-payment on your house or funding your child’s university education, your willingness to take risk is going to be significantly lower than if it is less specific and has a longer time horizon – such as, saving for retirement.

The Risk You Need

Recent market trends, your personal investing history, the importance and timeframe of achieving your financial goals all strongly impact your willingness to accept risk. These factors lead investors to have very difference risk tolerances at each port of their business cycle.

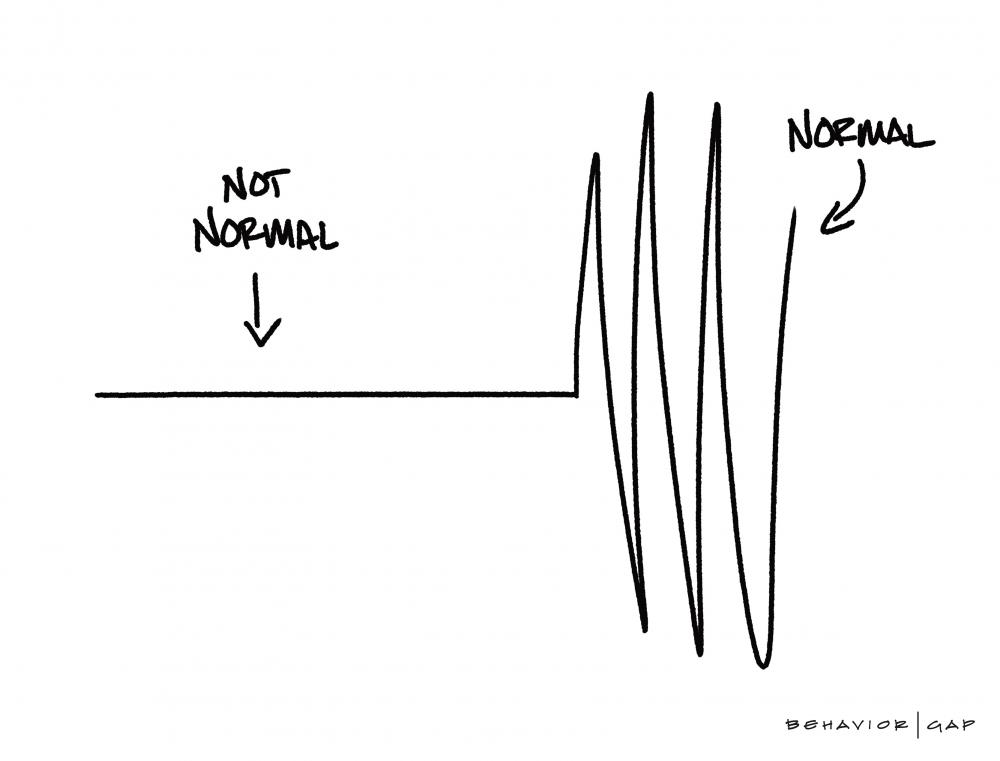

Part of our job as investment professionals, is to help you regular your risk tolerance to your baseline level. This includes calming you down in times of market turmoil and explaining why your risk profile may not exactly match t the market in times on market euphoria.

With a financial plan, we empirically determine your ability to take on risk and determine the risk required in your portfolio to reach your financial goals. Sometimes, you may need to take on more or less risk than you are comfortable with to achieve your financial targets which means either modifying your goals or getting support from a professional on what the additional risk may look like.

The role of a financial advisor is to help you regulate your willingness to take risk to keep you on track to meet your long-term goals. Advisors provide you with a strategy and open communication to make you feel comfortable with your decisions and help you meet your financial targets.