The Three Behaviours Causing You to Panic in Turbulent Markets

BMO Private Wealth - Feb 29, 2024

Everyone knows that markets can rise and fall, but that doesn’t make the ups and downs any easier to stomach. Your first instinct when markets drop might be to reach for an antacid and look for ways to cut your losses, but while that could provide so

Everyone knows that markets can rise and fall, but that doesn’t make the ups and downs any easier to stomach. Your first instinct when markets drop might be to reach for an antacid and look for ways to cut your losses, but while that could provide some short-term emotional relief, it can have lasting side effects on the health of your portfolio.

A 2021 report from Morningstar suggests that exiting your position during bouts of intense market volatility might be one of the last things you want to do. The analysis found that an investor who missed the two best trading days between June 20, 2008 and April 16, 2021 would find their portfolio down 19% compared with someone who stayed invested on those days. That’s important because those two days – October 14, 2008 and March 24, 2020 – followed steep market declines.

Staying calm in the face of volatile markets is easier said than done, partly because human nature forces us to worry. So, how can you stay the course during the ups and downs? Here are some ideas.

Don’t follow the crowd

Behavioural finance teaches us that one of the reasons people feel panic in a falling market is because everyone else feels panic, too. If others start liquidating their portfolios, you’ll be more inclined to follow the crowd. It’s called herd behaviour. In 2022, a research study found that this behaviour happens when people disregard their own private signals or prevailing market fundamentals and follow the behaviour of others.

To avoid herd behaviour, you need to be mindful of your own beliefs. According to business school INSEAD, it’s important to foster independent thought by asking questions and educating yourself, continually evaluating your own opinions, knowing that large numbers of people can be wrong and, perhaps most importantly, wait before reacting. “Delay taking action until (you) have assessed the situation and are fully aware of what’s happening,” wrote leadership professor Manfred F.R. Kets de Vries in an INSEAD article.

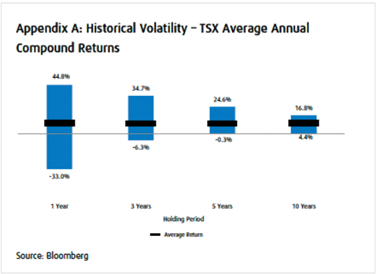

Also, keep in mind that while volatility is always stressful in the moment, the ups and downs rarely have a lasting impact if you have a long time horizon. As you can see in this chart, volatility decreases the longer you stay invested.

The past doesn’t predict the future

Most financial experts look to the past to try and glean insights for the future, but investors need to be careful about putting too much weight in what’s happened before. There’s a behavioural concept called experiential bias – also known as recency bias – that causes people to believe that a recent event they experienced is likely to occur again.

For example, those who lived through the 2008 recession may have felt a little more panicked than others over the last couple of years when markets were falling and everyone was talking about a recession. However, if those memories caused you to sell, you would have missed out on the strong gains in a recession-free 2023. Remember, just because memories of past market events flood back in bad times doesn’t mean things are going to unfold like they did previously.

Take a walk

The last time you were in a stressful situation, you likely sprang into action, sending emails and putting your brain into overdrive, trying to figure out the best way to defuse the problem. The same thing happens in turbulent markets. It’s called activity bias and it causes many investors to try and fix an issue they should likely leave alone. While that could include selling out of an investment, it can also involve buying stocks to diversify your holdings at the last minute.

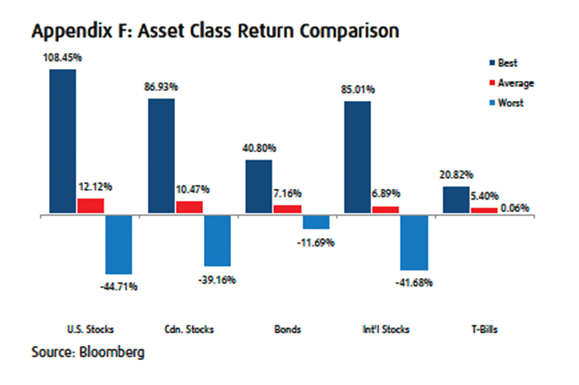

You want to be diversified, of course, but you also shouldn’t be making any rash moves that may be out of line with your investment plans and philosophies. Diversifying works best if you do it before volatility spikes. That’s because different asset classes move up or down at different times, and, as this chart shows, sometimes those moves can be significant.

As for what to do in the here and now, the solution is to sit back and do nothing. You may need to adjust your portfolio at some point – potentially increasing diversification or lowering your risk tolerance level if you’re feeling too jittery – but don’t do it to simply lower your state of panic. Turn off the television and take a long walk around the block instead.

While fighting your emotions and understanding how behaviours can impact the way you react to market volatility is important, it’s also imperative you keep some basic personal finance lessons in mind. Stay calm, focus on long-term goals, make sure you’re diversified before a crisis hits and you may not even feel those sick-to-your-stomach feelings in the first place.

BMO Private Wealth is a brand name for a business group consisting of Bank of Montreal and certain of its affiliates in providing private wealth management products and services. Not all products and services are offered by all legal entities within BMO Private Wealth. Banking services are offered through Bank of Montreal. Investment management, wealth planning, tax planning, philanthropy planning services are offered through BMO Nesbitt Burns Inc. and BMO Private Investment Counsel Inc. If you are already a client of BMO Nesbitt Burns Inc., please contact your Investment Advisor for more information. Estate, trust, and custodial services are offered through BMO Trust Company. BMO Private Wealth legal entities do not offer tax advice. BMO Trust Company and BMO Bank of Montreal are Members of CDIC.

® Registered trademark of Bank of Montreal, used under license.