MWW - Still Tarrific

DHL Wealth Advisory - Feb 20, 2026

- Investment Services

- Portfolio Management

- Special Reports and Newsletters

- Total Client Experience

- Wealth Management

It turned into a positive week for North American equities following a rally on Friday with news that the US Supreme Court struck down a huge chunk of President Donald Trump’s far-reaching tariff agenda...

It turned into a positive week for North American equities following a rally on Friday with news that the US Supreme Court struck down a huge chunk of President Donald Trump’s far-reaching tariff agenda, delivering a major rebuke of the president’s key economic policy.

The law that undergirds those import duties “does not authorize the President to impose tariffs,” the majority ruled six to three in the long-awaited decision. The ruling is a massive loss for Trump, who has made tariffs — and his asserted power to impose them on any country at any time, without congressional input — a central feature of his second presidential term.

Trump’s legal stance “would represent a transformative expansion of the President’s authority over tariff policy,” the majority concluded. And they highlighted that Trump imposed the tariffs without Congress, which has the power to tax under the Constitution.

The decision noted that before Trump, no president had ever used the statute in question “to impose any tariffs, let alone tariffs of this magnitude and scope.” To justify the “extraordinary” tariff powers, Trump must “point to clear congressional authorization,” the court wrote. “He cannot.”

Importantly, the ruling was silent on whether tariffs that have been paid under the higher rates will need to be refunded. That sum could total $175 billion, according to a new estimate from the Penn-Wharton Budget Model.

Since retaking the White House, Trump has rapidly reshaped America’s longstanding trade relationships by imposing a staggering array of import duties that have touched nearly every country on earth. Many of those tariffs were invoked using a novel reading of the International Emergency Economic Powers Act, or IEEPA. They include Trump’s near-global “reciprocal” tariffs, and separate duties related to the alleged trafficking of deadly drugs into the U.S.

IEEPA does not explicitly mention tariffs, as the Supreme Court noted Friday. Instead, it allows the president to “regulate … importation” of foreign property transactions after declaring a national emergency in order to deal with certain “unusual and extraordinary” threats.

Trade experts expect the administration to ramp up the use of sectoral tariffs, which are imposed using Section 232 of the U.S. Trade Expansion Act of 1962. The U.S. Department of Commerce has already launched a number of additional Section 232 investigations into various industries, including aircraft, critical minerals and pharmaceuticals.

The administration has at least three other laws it could potentially turn to: Section 301 of Trade Act of 1974, which permits country-specific tariffs following an investigation into alleged unfair trading practices; Section 122 of the Trade Act of 1974, which allows for tariffs up to 15%for 150 days before Congress must vote to extend them; and Section 338 of the Tariff Act of 1930, which authorizes tariffs of up to 50% in certain circumstances.

Meanwhile, last week we saw US inflation data for the month of January that provided some upbeat headlines, even if price growth, in our view, remains a little too hot for comfort for the time being. Headline inflation came in lower than expected at 0.2% m/m in January, taking the year-over-year (y/y) change down to just 2.4%. This slowdown was helped by lower energy prices, and the core measure that excludes these volatile components was firmer at 0.3% m/m and 2.5% in y/y terms.

The slowdown in the y/y consumer price index (CPI) inflation rates brings us closer to the 2% Fed target and sparked a positive reaction in bond markets. However, there are a couple of caveats here. First, inflation has been dampened by the effects of the government shutdown, with the Bureau of Labor Statistics (BLS) assuming that some prices it could not collect in October were flat. Second, the Fed targets the personal consumption expenditures (PCE) measure of inflation, which captures consumer spending across a broader range of goods and services. The December core PCE reading is forecast to remain elevated at 2.9% y/y.

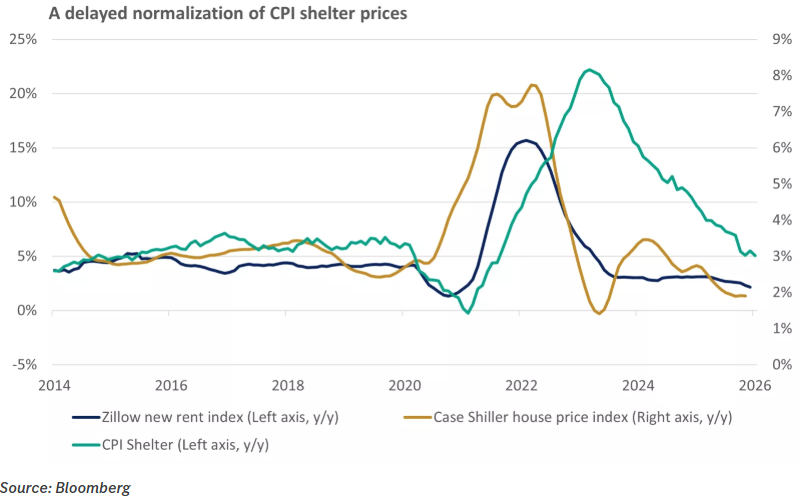

Still, there were encouraging signs in last week's CPI report, particularly the continued easing in shelter inflation*. We know that house prices and rents have slowed over recent years, but this takes time to show up in official CPI figures. We are now seeing clearer evidence of slower shelter inflation, which should help drag inflation rates back toward target in our view, especially when some of the impacts of tariff inflation fade.

On tariffs, there were further signs of a pass-through from higher tariff rates to goods prices. Excluding used car prices, which fell sharply at the start of the year, core goods prices increased 0.4% m/m. There may be more tariff inflation on the way in coming months in our view, especially after a 10% decline in the dollar over the past 12 months, which has also made foreign goods more expensive. However, we do expect these pressures to moderate as we move through 2026.

Overall, the CPI report looks to be consistent with still somewhat elevated short-term inflation pressures, but the trajectory for price growth remains lower in our view, even if this continues to be a bumpy and uneven process.

For the Fed, we don't think the CPI report will shift its thinking in the near term. Jerome Powell has clearly telegraphed that the central bank is on hold for the time being, and we think the better labour-market data this week will likely cement that stance at his final two meetings as chair (March, April).

Markets expect Powell's proposed successor, Kevin Warsh, to deliver at least a couple of cuts over 2026 after he takes the hotseat in June. We agree that there is scope to cut rates once or twice more this year, albeit the urgency to ease policy is lower given signs of improving labour-market conditions. The exact timing of these adjustments will depend on how much more progress on inflation the Fed sees in coming months, in our view. By contrast, we think the Bank of Canada has finished its easing cycle, with interest rates having already fallen to 2.25%, a level at which we expect them to stay through 2026.

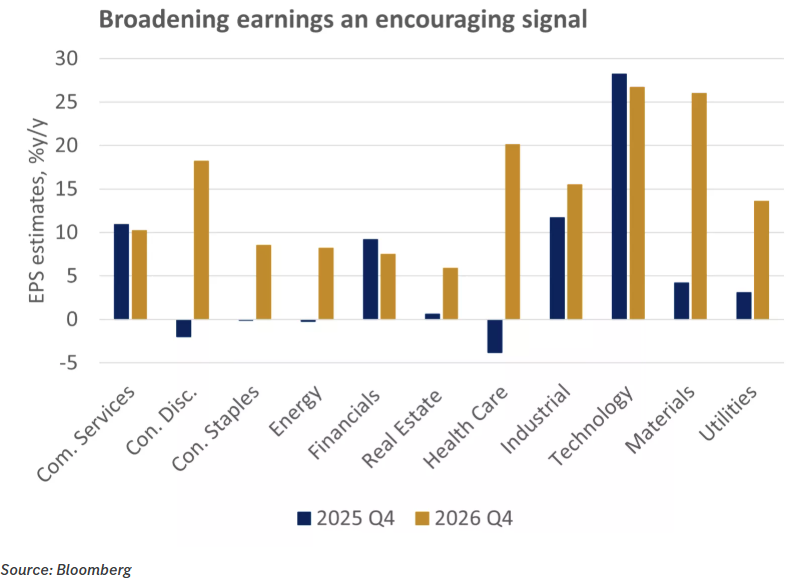

All in, the catalysts that we think will underpin a broadening in U.S. corporate earnings this year – namely tax cuts, lower interest rates, and solid growth – all remain in place, in our view. And consistent with this, we have seen generally solid earnings reports in early 2026, and expectations for further gains.

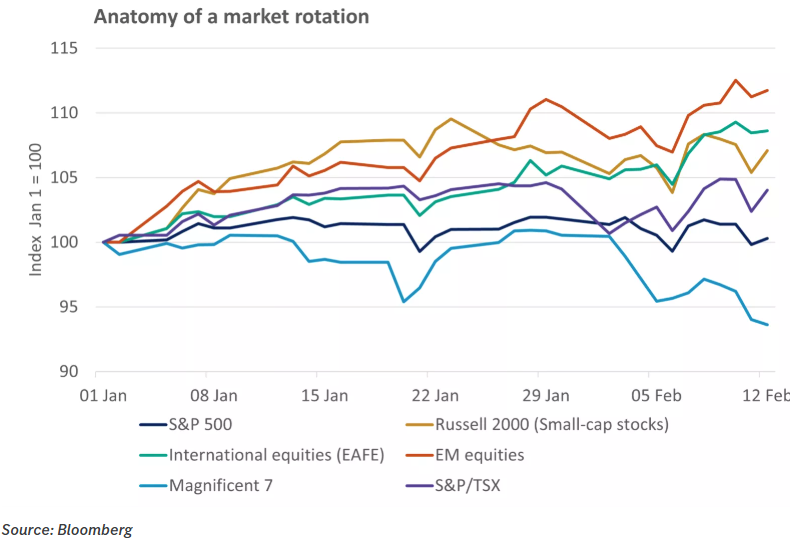

However, while this backdrop remains positive, volatility has started to pick up over recent weeks. This has been led by selling across the mega-cap technology companies, with the Magnificent 7 down 2% last week, taking losses in 2026 to near 7%.

Last week we saw signs of broader spillovers from this weakness as investors start to price disruptions from AI across other parts of the corporate sector, highlighted by sell-offs in financial services and insurers, real estate and even trucking and logistics.

Thus far, these fears are speculative and not reflected in changes to revenues or business models, in our view. However, they seemingly represent a shift toward choppier trading in risk markets broadly. Last week's equity sell-off included other risk assets like cryptocurrencies and precious metals, while we also saw a push into more 'safe haven' like assets, such as U.S. Treasury bonds and defensive equity sectors such as utilities.

Stepping back, despite the market rotations and volatility, we continue to remain constructive on equities given the solid fundamental drivers of a growing economy and healthy corporate profitability.

However, amid episodes of volatility, and increasingly abrupt rotations within equity markets, we continue to argue for a diversified, quality approach across equity allocations that span market-cap, sectors and regions.

More specifically, we think alongside domestic investments, exposure to larger- mid- and small cap U.S. equities, and emerging-market equities should help ease concentration risks and tap into the broadening in market leadership we are seeing emerge in 2026.

Sources: BMO Economics Talking Points: High AI-nxiety

The opinions, estimates and projections contained herein are those of the author as of the date hereof and are subject to change without notice and may not reflect those of BMO Nesbitt Burns Inc. ("BMO NBI"). Every effort has been made to ensure that the contents have been compiled or derived from sources believed to be reliable and contain information and opinions that are accurate and complete. Information may be available to BMO Nesbitt Burns or its affiliates that is not reflected herein. However, neither the author nor BMO NBI makes any representation or warranty, express or implied, in respect thereof, takes any responsibility for any errors or omissions which may be contained herein or accepts any liability whatsoever for any loss arising from any use of or reliance on this report or its contents. This report is not to be construed as an offer to sell or a solicitation for or an offer to buy any securities. BMO NBI, its affiliates and/or their respective officers, directors or employees may from time to time acquire, hold or sell securities mentioned herein as principal or agent. NBI will buy from or sell to customers securities of issuers mentioned herein on a principal basis. BMO NBI, its affiliates, officers, directors or employees may have a long or short position in the securities discussed herein, related securities or in options, futures or other derivative instruments based thereon. BMO NBI or its affiliates may act as financial advisor and/or underwriter for the issuers mentioned herein and may receive remuneration for same. A significant lending relationship may exist between Bank of Montreal, or its affiliates, and certain of the issuers mentioned herein. BMO NBI is a wholly owned subsidiary of Bank of Montreal. Any U.S. person wishing to effect transactions in any security discussed herein should do so through BMO Nesbitt Burns Corp. Member-Canadian Investor Protection Fund.