MWW - As legendary Gold Investor, Goldfinger, Said it Best: "I LUV Goooold".

DHL Wealth Advisory - Jan 29, 2026

- Investment Services

- Portfolio Management

- Special Reports and Newsletters

- Total Client Experience

- Wealth Management

Four weeks into it, how’s your 2026 going so far? Let’s just say we are one month down, but it could be felt like a year thus far...

After a banner 2025, gold was up ~30% in 2026 and broke through $5,600/oz on Thursday. As a reminder, it was sitting around $2,600 a year ago. If you thought gold was impressive, silver has been on an even bigger rampage, hitting ~$120 on Thursday, or more than 70% in 2026 and more than quadruple the level of a year ago. While spectacular, the surge in these metals has precious little impact on the economy.

Despite the geopolitical and market machinations that have been driving the precious metals sector, the economy soldiers on, and to a firmer degree than widely expected. Ahead of Davos, the International Monetary Fund (IMF) released its latest forecasts, and the main point there was another round of upward revisions, leaving global growth still chugging along at a perfectly normal pace of 3.3%, or so.

For the U.S., BMO’s economics team has revised up their estimate for both 2025 and 2026 GDP growth by a tick, following an upward revision to Q3 GDP to 4.4% and news that real consumer spending retained solid momentum heading into the turn of the year. To wit, Q4 spending is now on track for just over a 3% pace, and they have nudged up our call for GDP to 2.6% for this year. Jobless claims remain lodged at a low level near 200,000, and even consumer sentiment is edging up, according to the University of Michigan. It seems that even as the political noise has been seriously amped up to start the year, consumers—and the economy as a whole—are doing an admirable job of separating the signal from the noise.

Few have been better able to ignore the noise than Canada’s equity market, with the TSX reaching yet new heights this week despite the swirling storms all around. Of course, the latest surge in metals prices provided support for materials, assisted by the spike in gas and a firming in crude oil to US$65/barrel. The Canadian dollar also had a strong week, rising 3% to 74cents. It benefitted both from a broad softening in the U.S. dollar, but also from the double-barreled strength in both gold and oil prices. After all, those two commodities are currently the number 1 and number 2 largest Canadian exports. True, the production and mining of gold may not be huge movers for the Canadian economy, but the metal is increasingly weighing into the currency's future.

Mostly overshadowed in the midst of the NATO/Iran tempest was the mundane reality that we had both an FOMC and Bank of Canada rate decision on Wednesday. They have been somewhat overlooked in part because neither central bank is expected to do anything. And nothing they did.

The Bank of Canada kept its key interest rate unchanged at 2.25% for the second meeting in a row, as was universally expected. The tone of the statement and the updated forecasts also provided few surprises, as the Bank suggests that the outlook is too uncertain to seriously revise the economic view and/or to give much guidance on when and where rates are going next. There is really nothing here to shift the call that the Bank will be on hold for the rest of 2026, although economists continue to assert that if there is a move, it's much more likely to be a rate cut rather than a hike this year.

Bottom Line: The Bank of Canada remains quite comfortable with where policy rates are for the time being, but vows that is "prepared to respond", if need be. The opening statement reiterates that "elevated uncertainty makes it difficult to predict the timing or direction of the next change in the policy rate." It's clearly going to require a material shift in the outlook to prompt a change in rates, but given the highly uncertain trade backdrop, a material shift is quite possible.

Looking to the US Federal Reserve, they too left policy rates unchanged with the target range for the fed funds rate at 3.50%-to-3.75%. This follows quarter-point cuts in each of the past three meetings.

The policy statement was a bit more upbeat on the economy. For example, it said “economic activity has been expanding at a solid pace” versus “moderate” before. And “the unemployment rate has shown some signs of stabilization” versus having “edged up” before. Indeed, last meeting’s conclusion that the Committee “judges that downside risks to employment rose in recent months” was dropped. Meanwhile, “inflation remains somewhat elevated.”

Less downside labour market risk plus still somewhat sticky inflation seems to have reduced the Fed’s sense of easing urgency, particularly with policy rates in the “range of plausible estimates of neutral.” Bottom Line: The US Fed may join the Bank of Canada and hold rates steady heading into the Spring.

Otherwise, the earnings season has already kicked off, with around 75% of the early reporters in the S&P 500 beating profit estimates so far, a touch below the 10-year average of 76%.

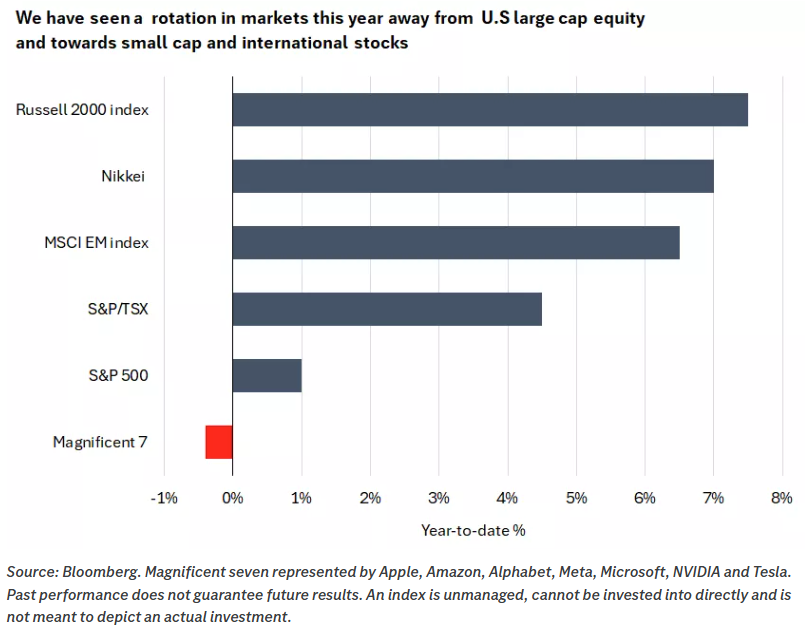

We expect these results to provide the latest litmus test of the translation of heavy AI investment into revenue growth and profits. Markets have shown signs of a rotation away from some of these names this year, with the 'Magnificent 7' stocks broadly flat on the year so far, in contrast to better performance from international stocks, other large-cap companies and significantly lagging small-cap stocks. Still, the technology sector is expected to deliver the strongest earnings growth across the S&P 500 this year, even if the gap with other sectors is seen narrowing.

Alongside a health check on the AI story, we believe it will be important to look for confirmation that an improving economic backdrop as lower interest rates are passing through into rising profitability across broader segments of the market. The outperformance of smaller companies and pro-cyclical sectors this year suggest that investors are becoming increasingly confident around their earnings potential, in our view. We remain constructive on the outlook for stocks and see potential for a broadening in market leadership this year, likely helped by improving growth, lower interest rates, and strong corporate profitability.

Sources:BMO Economics Talking Points: From Greenland to Goldland, BMO Economics EconoFACTS: Bank of Canada Rate Decision and Monetary Policy Report

he opinions, estimates and projections contained herein are those of the author as of the date hereof and are subject to change without notice and may not reflect those of BMO Nesbitt Burns Inc. ("BMO NBI"). Every effort has been made to ensure that the contents have been compiled or derived from sources believed to be reliable and contain information and opinions that are accurate and complete. Information may be available to BMO Nesbitt Burns or its affiliates that is not reflected herein. However, neither the author nor BMO NBI makes any representation or warranty, express or implied, in respect thereof, takes any responsibility for any errors or omissions which may be contained herein or accepts any liability whatsoever for any loss arising from any use of or reliance on this report or its contents. This report is not to be construed as an offer to sell or a solicitation for or an offer to buy any securities. BMO NBI, its affiliates and/or their respective officers, directors or employees may from time to time acquire, hold or sell securities mentioned herein as principal or agent. NBI will buy from or sell to customers securities of issuers mentioned herein on a principal basis. BMO NBI, its affiliates, officers, directors or employees may have a long or short position in the securities discussed herein, related securities or in options, futures or other derivative instruments based thereon. BMO NBI or its affiliates may act as financial advisor and/or underwriter for the issuers mentioned herein and may receive remuneration for same. A significant lending relationship may exist between Bank of Montreal, or its affiliates, and certain of the issuers mentioned herein. BMO NBI is a wholly owned subsidiary of Bank of Montreal. Any U.S. person wishing to effect transactions in any security discussed herein should do so through BMO Nesbitt Burns Corp. Member-Canadian Investor Protection Fund.