MWW - New Year; Same Issues... Dodgers Snag ANOTHER Player From The Jays.

DHL Wealth Advisory - Jan 16, 2026

- Investment Services

- Portfolio Management

- Special Reports and Newsletters

- Total Client Experience

- Wealth Management

The headlines in the first two weeks of 2026 may have been dominated by Venezuela and Iran, but financial markets forged on. While much of the debate focused on how long and by how much oil production could be ramped back up in Venezuela...

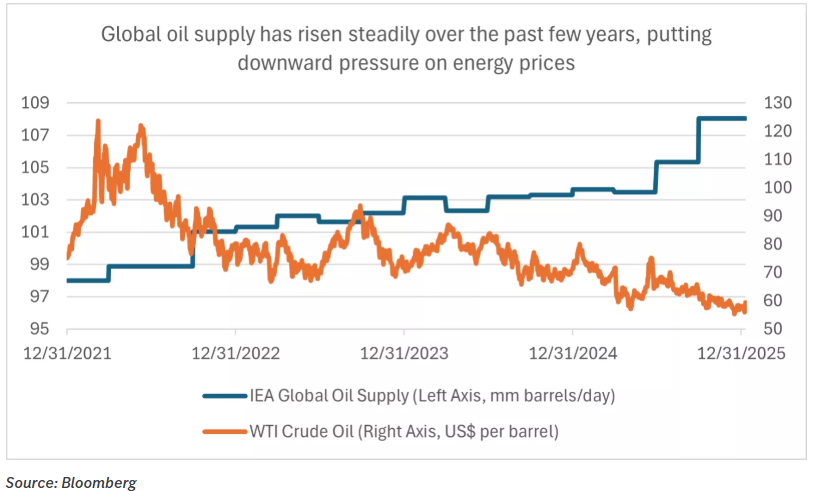

The headlines in the first two weeks of 2026 may have been dominated by Venezuela and Iran, but financial markets forged on. While much of the debate focused on how long and by how much oil production could be ramped back up in Venezuela, oil prices firmed by roughly 3% on net to just above $59/barrel—suggesting the answers were “not anytime soon” and “only with great difficulty and cost.” In fact, taking a look at the chart below, you’ll see that the world is already flooded with oil—something you may have guessed by observing the prices at the pump. Meantime, equity markets mostly picked up where they left off last year, with both Canada’s TSX and the S&P 500 hitting new record highs this week.

In general, the latest slate of economic data has not stood in the way of the equity rally, suggesting that U.S. growth remains solid, while job gains have nudged back up to a modest pace. A sudden surge in productivity in recent quarters—averaging a towering 4.5% in Q2 and Q3—helps explain the seeming conundrum of hearty GDP results amid sluggish employment. The headline report of the week ended up being a bit of a staid affair, with December payrolls just missing consensus with a tidy 50,000 gain, although the prior two months were revised heavily lower. Arguably more meaningful was the pullback in the jobless rate to 4.4% (also from a downwardly revised 4.5% the prior month). While the employment data have been messy and heavily revised in the past year, two figures probably accurately capture something close to reality—the jobless rate is up 0.3% from a year ago, and payrolls are up just a modest 0.4% y/y; both indicate that the job market has been sluggish, but not overly weak.

At the same time, this week’s raft of indicators suggested that economic activity is nonetheless holding up better than expected. Even with all the (very real) concerns around unaffordability, U.S. vehicle sales topped expectations in December at 16.4 million, slightly above the average for all of 2025 (16.3 million) and leaving them with their best full-year results since 2019. And, perhaps most notably, the U.S. trade deficit on goods & services improved massively in November to just $29.4 billion, the smallest gap since 2009 and a third of the average over the past year. While there were some special factors involved, the big narrowing prompted some heavy-duty upgrades to Q4 GDP estimates—the Atlanta Fed estimated 5.1% growth; we’re now at 2.1%.

The bigger point is that the economy continues to manage well through all the policy noise and geopolitical shifts. Economists now look for U.S. GDP growth to pick up this year to 2.5% from 2.2% in 2025, both a bit above the economy’s 20-year average growth (of 2.0%). That’s also above consensus, which is closer to 2.1% for the coming year, but even that’s been upgraded by nearly a full percentage point since the height of the trade war last spring. That trade uncertainty has scarcely been fully doused, with this week bringing no news on the Supreme Court’s ruling on the emergency tariffs. The solid growth backdrop and the tariffs have not inflamed inflation, with low oil prices providing a dampener, so Treasury yields barely nudged this week and remain near the lower end of the range of the past year.

In contrast, we have seen nothing to disrupt the call that the Bank of Canada will stay on the sidelines this year. Friday’s highly anticipated Canadian employment report turned out to be a non-event, with jobs increasing a mild 8,200, but the unemployment rate backing up three ticks to 6.8%—mostly unwinding the stunning 0.4% drop in November. Probably the biggest surprise is that the job market held onto most of the late-year strength, with the unemployment rate up just 0.1% from a year ago and employment managing to churn out a decent 1.1% y/y rise for all of 2025.

Still, not unlike the U.S., the bigger story for Canada’s economy is that it has hung in there in the face of deep trade uncertainty and hefty tariffs on some key industries. Heavy support from both monetary policy—the BoC did, after all, cut 100 bps in 2025, despite many protestations that they could not fix a trade war—and fiscal policy helped keep the economy on the rails. Even trade flows showed signs of stabilizing late last year, as the net goods & services deficit was just $59 million in October (basically balanced), with exports managing to rise slightly from year-ago levels. And, like the U.S., vehicle sales churned out a small 2% rise for all of 2025, leaving them at their best annual level since 2019.

Overall, despite our hope for a more tranquil 2026, the first few weeks of the year saw much the same events unfold as 2025—from a geopolitical, economic data, and policy perspective. However, we think the good news is that markets remain focused on key drivers.

U.S. and Canadian earnings growth are expected to rise in 2026, to about 14.7% in the U.S. and 15.5% year-over-year in Canada, driven by a broad set of sectors. And economic growth should continue to be positive, with U.S. first-quarter GDP growth forecast to be 2.5% annualized, and Canadian GDP growth expected to be about 1.4%, according to Bloomberg.

In our view, given where we are in this cycle, the case for diversification in equity markets is compelling in 2026. We continue to favour Canadian cyclical/materials stocks, but have also been adding to our fixed income positions while picking up exposure in the undervalued healthcare sector—a touch of defense.

Sources: BMO Economics Talking Points: Happy New Sphere… of Influence

The opinions, estimates and projections contained herein are those of the author as of the date hereof and are subject to change without notice and may not reflect those of BMO Nesbitt Burns Inc. ("BMO NBI"). Every effort has been made to ensure that the contents have been compiled or derived from sources believed to be reliable and contain information and opinions that are accurate and complete. Information may be available to BMO Nesbitt Burns or its affiliates that is not reflected herein. However, neither the author nor BMO NBI makes any representation or warranty, express or implied, in respect thereof, takes any responsibility for any errors or omissions which may be contained herein or accepts any liability whatsoever for any loss arising from any use of or reliance on this report or its contents. This report is not to be construed as an offer to sell or a solicitation for or an offer to buy any securities. BMO NBI, its affiliates and/or their respective officers, directors or employees may from time to time acquire, hold or sell securities mentioned herein as principal or agent. NBI will buy from or sell to customers securities of issuers mentioned herein on a principal basis. BMO NBI, its affiliates, officers, directors or employees may have a long or short position in the securities discussed herein, related securities or in options, futures or other derivative instruments based thereon. BMO NBI or its affiliates may act as financial advisor and/or underwriter for the issuers mentioned herein and may receive remuneration for same. A significant lending relationship may exist between Bank of Montreal, or its affiliates, and certain of the issuers mentioned herein. BMO NBI is a wholly owned subsidiary of Bank of Montreal. Any U.S. person wishing to effect transactions in any security discussed herein should do so through BMO Nesbitt Burns Corp. Member-Canadian Investor Protection Fund.