More Back and Forth Than a Jays Game.

DHL Wealth Advisory - Oct 17, 2025

- Investment Services

- Portfolio Management

- Special Reports and Newsletters

- Total Client Experience

- Wealth Management

“There are many kinds of risks… but volatility may be the least relevant of them all.” - Legendary investor, Howard Marks. Probably the first time we have ever opened our weekly comment with a quote...

“There are many kinds of risks… but volatility may be the least relevant of them all.”

- Legendary investor, Howard Marks.

Probably the first time we have ever opened our weekly comment with a quote, but thought it fitting after months of relative calm, market volatility has resurfaced. Having gone nearly seven weeks without a +1% market pullback, investors have endured nearly six consecutive trading days where markets have moved 1% or more intraday. With markets at all-time-highs, it doesn’t take much to revive volatility, but in this case it was China and US trade relations.

On what should have been a peaceful drift toward a long holiday weekend, equity markets turned decidedly sour last Friday afternoon – even though they’d spent most of the morning in the green. Markets were pulled down by a social media post from U.S. President Donald Trump suggesting “massive tariffs” on China would be coming soon and noting that he saw no need to follow through on a previously planned early November meeting with Chinese President Xi Jinping. This put the trade war back on a front burner. President Trump’s post was in direct response to China’s notice on Thursday that it would greatly expand export controls on a variety of rare earth materials and intermediate products. Continued barbs and suggestions of tangential actions from both countries have kept market participants on edge despite more moderate rhetoric over the weekend that prompted a partial rebound this week, but not without a few bumps along the way.

We’ve written before about investors’ propensity to minimize potential blemishes in a solidly up-trending market; when things are going well and prices are rising, the focus is on a point far in the future. If something unexpected comes along, however, the collective gaze can quickly be yanked back into the present moment, popping open the door to a closet full of worries that have been conveniently stashed for later consideration.

Such is the state we find ourselves in this week. For months, key stock indexes had been powering past a litany of potential concerns (e.g., immigration crackdowns, new trade policies, geopolitical and political pivots, sticky inflation) to hit continued new highs. Helping drive the strong performance were constructive fundamentals – resilient global economies, declining inflation (relative to the post-pandemic surge of 2021 and 2022), sturdier-than-expected consumer spending and central banks in rate-cutting mode. Oddly enough, things had been so constructive for so long that participants were starting to get just a bit nervous: they questioned whether excitement had morphed into euphoria and feared what would “inevitably” come next. This growing sense of unease re the rally’s sustainability primed the pump for what seemed like an unduly harsh reaction to a mere social media post.

When the worry closet door swings open, many of the fears that had been discounted as single-point events tumble out in a worrisome heap that needs to be sorted. During uptrends, a long-term view is generally prevalent. But perspective tends to shift into near overwhelm when so many concerns pile up in close proximity. We believe it’s far too early to fret unduly, despite the fitful trading of the last few sessions. What follows is our perspective on a few of the highest-profile concerns, plus some of the fundamental signposts we will be watching that will help frame the path forward.

Worry #1: Is AI spending sustainable? – Though much of the excitement has been around the buildout of data centers and hyperscalers, plenty of other contributors and beneficiaries are worthy of consideration. From robots to autonomous vehicles, healthcare applications to manufacturing, it will take many technologies and substantial grid and infrastructure enhancements to power the coming 4th industrial revolution. Overbuilding of new infrastructure is actually the historical norm (railroads, undersea cable, cell phone, internet 1.0 capacity). Such abundance rarely goes to waste for users, though it may prove problematic for those building it out since excess capacity ultimately drives prices down and usage up. That said, there are threads to untangle and analyze in the increasingly frenetic pace of activity:

• To date, cash flow from highly profitable businesses has funded much of the AI spending. More recently, a complex series of cross investments, new investment vehicles, creative vendor financing/equity arrangements and off-balance-sheet debt underwritten by new funders has emerged. It will be challenging but necessary to follow the financing and ensure it stays reasonable.

• Do the largest companies, given their increasingly entwined financing arrangements, become too big to fail – particularly while the Trump administration seeks to lower regulatory hurdles, encourage rapid innovation and look favorably on large mergers?

What we will be watching – So far, balance sheets are still in pristine shape, margins are ample and provisions in the “One Big Beautiful Bill” are helpful. We (and all of Wall Street) will be watching for signs of deterioration here and, we suspect, asking plenty of questions to better gauge the level of off-balance-sheet financing, debt, contract bookings and backlogs for coming periods.

Worry #2: Can consumers continue to power the economy? – The Atlanta Federal Reserve’s GDPNow estimate of Q3 gros domestic product currently pegs it at 3.8%. This is partly predicate on consumers’ willingness and ability to continue to spend – especially the top 10%, who are responsible for an estimated half of all consumption. The ability and willingness to consume is based on both employment status and how wealthy we feel. The wealth effect itself is tied to housing appreciation and market gains – both of which have obviously been ample for those blessed with one or both. While home ownership rates in the U.S. and Canada have declined in recent years, market participation has increased. A recent Gallup poll showed that nearly two-thirds of U.S. households now own stocks – an all-time high.

What we will be watching – Canadian consumers are proving a bit sturdier than projected at the start of the year. Spending plans outlined by Prime Minister Mark Carney’s government could put a floor under Canadian GDP. In the U.S., however, there is some evidence that strains are mounting and sentiment is souring. Thanks to the government shutdown, full-bodied employment data will be spotty, so determining progress will require extra digging

Worry #3: Trade policy – Despite the recent high-profile China kerfuffle, negotiations between two of the U.S.’s largest trading partners – Canada and Mexico – are actually going quite well. This North American trading bloc is 500 million people strong, representing 30% of global GDP. It is an important relationship to get right: Canada bought $350 billion in U.S. exports last year – 150% more than the COMBINED total of China and UK purchases. Outlines of trade agreements with other key areas are largely in place, helping alleviate at least a portion of the unknowns that plagued the first part of the year.

What we will be watching – We’ll monitor continued progress and/or stance-softening between the U.S. and China and continued progress on renegotiation of the USMCA/CUSMA.

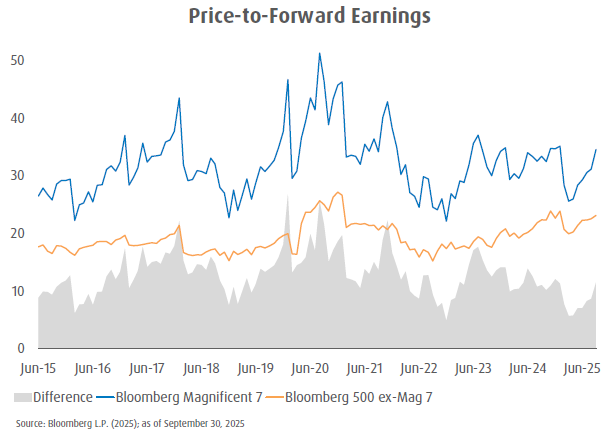

Worry #4: Valuations are high – Agreed, earnings multiples have moved up – but so have margins, earnings and productivity metrics. Remember: valuations don’t kill a bull market or revive a bear market; things can stay seemingly mispriced for much longer than fundamentals (or prior history) would deem likely. It’s also possible for companies to grow into their valuations via accelerating earnings – much like the MAG 7 have done in recent periods.

As we warned in prior pieces, stretched valuations can make markets more prone to volatility should unexpected events hit. Friday was the exclamation point on this observation. The highest growth, more tech-oriented indexes were down the most (NASDAQ down nearly 4%). Further, the most speculative investments sold off even more sharply: $3 billion in bitcoin was liquidated after the market closed and Bloomberg noted an unwind of over $130 billion of the most aggressive alt-coin assets in the subsequent 72 hours.

Obviously, we have touched on just a handful of the many out of-the-closet concerns that are capable of prompting continued volatility. Yet volatility isn’t a risk in and of itself when fundamentals remain sturdy. We think many of the trends that brought us through so far are well enough established to continue to support. Viewing volatility as price movement, rather than fundamental inevitability or structural breakdown, can allow it to be put to constructive use in portfolio maintenance.

Recall that headlines do not exist to make you feel comfortable about your investment (or life) choices. They are optimized to generate clicks (a.k.a. activity that will compensate the creators and advertisers). Volatility is a normal part of investing – particularly when the worry closet’s door opens enough to let some or all of them slip out. Having a plan for moving through (or better yet, taking advantage of) volatility provides a helpful perspective.

Source: Weekly Strategy Perspectives 2025-10-17 A BMO Private Wealth Publication

The opinions, estimates and projections contained herein are those of the author as of the date hereof and are subject to change without notice and may not reflect those of BMO Nesbitt Burns Inc. ("BMO NBI"). Every effort has been made to ensure that the contents have been compiled or derived from sources believed to be reliable and contain information and opinions that are accurate and complete. Information may be available to BMO Nesbitt Burns or its affiliates that is not reflected herein. However, neither the author nor BMO NBI makes any representation or warranty, express or implied, in respect thereof, takes any responsibility for any errors or omissions which may be contained herein or accepts any liability whatsoever for any loss arising from any use of or reliance on this report or its contents. This report is not to be construed as an offer to sell or a solicitation for or an offer to buy any securities. BMO NBI, its affiliates and/or their respective officers, directors or employees may from time to time acquire, hold or sell securities mentioned herein as principal or agent. NBI will buy from or sell to customers securities of issuers mentioned herein on a principal basis. BMO NBI, its affiliates, officers, directors or employees may have a long or short position in the securities discussed herein, related securities or in options, futures or other derivative instruments based thereon. BMO NBI or its affiliates may act as financial advisor and/or underwriter for the issuers mentioned herein and may receive remuneration for same. A significant lending relationship may exist between Bank of Montreal, or its affiliates, and certain of the issuers mentioned herein. BMO NBI is a wholly owned subsidiary of Bank of Montreal. Any U.S. person wishing to effect transactions in any security discussed herein should do so through BMO Nesbitt Burns Corp. Member-Canadian Investor Protection Fund.