Happy Thanksgiving!

DHL Wealth Advisory - Oct 10, 2025

- Investment Services

- Portfolio Management

- Special Reports and Newsletters

- Total Client Experience

- Wealth Management

Perhaps it was gold breaking the $4000 barrier, or maybe it was the series of record equity market highs even in the teeth of a normally tough season for stocks. It could be the fact that analysts have little economic data to chew on...

Perhaps it was gold breaking the $4000 barrier, or maybe it was the series of record equity market highs even in the teeth of a normally tough season for stocks. It could be the fact that analysts have little economic data to chew on, and Q3 earnings season is just about to gear up. Whatever the cause, the persistent, steady, and forceful rally in pretty much everything over the past six months finally hit the collective consciousness this week. Suddenly everyone from the IMF to the WTO to the head of some U.S. banks were saying things may have run a little too far, a little too fast. But then China’s late-week clampdown on rare earth exports and President Trump’s return fire of new tariff threats and canceling a proposed meeting with Xi threw a blanket on the rally, sending stocks, the dollar and yields into the red. In fact, it had been almost 2 months since major benchmarks saw a daily move lower of 1%.

But before we start fretting about the possible hit to the economy that a possible serious drawdown in equities could inflict, let’s focus on the implications of the current state of market affairs. Even with the Friday stumble, the S&P 500 is still up 15% from a year ago and about 83% from three years ago. Adjusting for inflation, that’s a stunning comeback (Chart 1). And, even if one does accept the contention that we have been in an unsustainable rise, the long history of bubbles and manias shows that they can go on a lot longer and go a lot higher than anyone can imagine—that’s what makes them bubbles, after all. Just as a reminder, then-Fed Chair Alan Greenspan’s (in)famous irrational exuberance comment landed in December 1996, more than three years before tech stocks would crest in March 2000. And as many have noted, valuations are not nearly as stretched as in the 1990s, and the major movers are mostly highly profitable companies with robust business models.

From an economic standpoint, the current tech boom has significant effects both directly—through the strength in business investment in anything remotely related to AI—and indirectly—through the wealth effect of thriving equity markets. While economists have spent much of 2025 gaming out different impacts from the tariff flurry and the “One-Big-Beautiful-Bill”, the tech boom has been quietly running the show in the background. And this may help explain the seeming dichotomy between a clearly softening U.S. employment picture (albeit less clear in the past month with the government shutdown) and the resiliency of overall GDP. The last we heard from the Atlanta Fed’s GDP Nowcast model was for an estimate of 3.8% annualized growth in Q3, matching the rebound in Q2 to the decimal point. BMO’s economics team have pencilled in 2.8%, but the point is that even with all of the intense policy uncertainty of the past year and a marked slowdown in hiring, the U.S. economy has managed to grind out 2% y/y GDP growth, right in line with its 20-year average.

If the economy can stay on track through the many dramas of the past year with average growth, imagine what may lie ahead with less policy uncertainty, a Fed in easing mode and the massive tailwind of buoyant financial markets. This thought process appears to be making an impact on the consensus. The latest Blue Chip Survey, conducted just this week, finds that the average GDP growth call for next year has risen by 3 ticks to 1.8% (moving exactly in line with BMO’s call) after an expected 1.9% average advance this year. The 2026 consensus has been slowly grinding higher since being battered by Liberation Day in April, but the big step up this month is quite notable. Barring a geopolitical shock or a nasty turn in the trade war, it seems that the risks to next year’s growth call are to the high side, and it has been a long while since pundits have been able to confidently say that. The point we are trying to make here is that this is one of those long-overdue, healthy pauses for a bull market. Every now and then investors need a reality check that markets don’t go up every single week – as they have basically been doing since the first week of April.

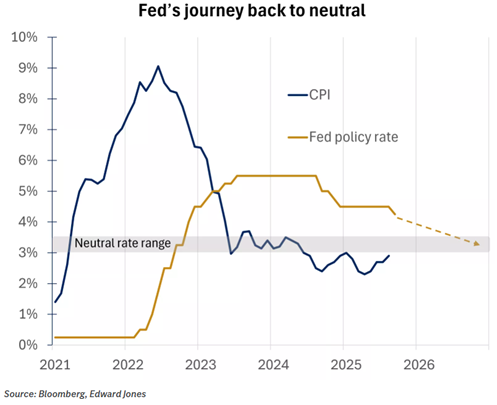

So where does that leave the Fed, whose monetary easing is a focal point of the current bull cycle. Even without the guidance of official data, and a few cautionary notes by some Fed speakers and the FOMC Minutes this week, markets continue to almost fully price in a 25 bp cut in the October meeting and are leaning heavily to a repeat in December. Where things seem to be shifting a bit is on what happens then in 2026, with the market slightly dialing back expectations for cuts next year. At this point, pricing is a bit lighter than BMO’s call of another 75 bps of cuts in 2026, with the overnight rate seen bottoming out around 3%. Of course, a significant wildcard on the Fed call for next year will be the makeup of the FOMC, and the fact that a new Chair will be in place by May (one appointed by the US President...) The flashpoint for markets next year may be the possibility of a dovish Fed running up against an economy that is powered by an ongoing tech boom.

Canada has been riding the tech (and gold) boom higher as well. Not unlike the U.S., the economy has held up a bit better than widely expected, especially compared with the dark days in early spring. The September jobs report Friday morning saw a nice rebound from a weak summer, snapping back by 60,400. But looking beyond the big swings in the headline results, the steadier unemployment rate held fast last month and is up by half a point in the past year to 7.1%.

While Canada has certainly not seen the business investment boom tied to the AI backbone, it has been supported by the wealth effect of rollicking equity markets. Even with the step back this week, the TSX is still up 23% y/y. And, of course, Canada’s wealth effect can’t be gauged simply by looking at the domestic market, since Canadian investors are also heavily tied into U.S. markets. In just the two years to mid-2025, for example, Canadians poured more than $100 billion into foreign equities, even as foreign investors shed more than $60 billion of Canadian stocks. (Seems like Buy Canada only applies to goods and services.)

Driving at night with headlights suddenly off is unsettling, but swerving in panic rarely leads to good outcomes. Similarly, making abrupt investment changes in response to a government shutdown or a particular social media post may not be prudent. We think the combination of a growing economy, rising corporate profits and declining interest rates supports a positive outlook for stocks. This won’t eliminate bouts of volatility along the way, but against this backdrop, we’d view market pullbacks — particularly any weakness spurred by geopolitics — as a compelling buying opportunity.

Source: BMO Economics: Echoes of 1999

The opinions, estimates and projections contained herein are those of the author as of the date hereof and are subject to change without notice and may not reflect those of BMO Nesbitt Burns Inc. ("BMO NBI"). Every effort has been made to ensure that the contents have been compiled or derived from sources believed to be reliable and contain information and opinions that are accurate and complete. Information may be available to BMO Nesbitt Burns or its affiliates that is not reflected herein. However, neither the author nor BMO NBI makes any representation or warranty, express or implied, in respect thereof, takes any responsibility for any errors or omissions which may be contained herein or accepts any liability whatsoever for any loss arising from any use of or reliance on this report or its contents. This report is not to be construed as an offer to sell or a solicitation for or an offer to buy any securities. BMO NBI, its affiliates and/or their respective officers, directors or employees may from time to time acquire, hold or sell securities mentioned herein as principal or agent. NBI will buy from or sell to customers securities of issuers mentioned herein on a principal basis. BMO NBI, its affiliates, officers, directors or employees may have a long or short position in the securities discussed herein, related securities or in options, futures or other derivative instruments based thereon. BMO NBI or its affiliates may act as financial advisor and/or underwriter for the issuers mentioned herein and may receive remuneration for same. A significant lending relationship may exist between Bank of Montreal, or its affiliates, and certain of the issuers mentioned herein. BMO NBI is a wholly owned subsidiary of Bank of Montreal. Any U.S. person wishing to effect transactions in any security discussed herein should do so through BMO Nesbitt Burns Corp. Member-Canadian Investor Protection Fund.