The Pause That Refreshes: Markets Take Five, Fundamentals Take Over?

DHL Wealth Advisory - Sep 26, 2025

- Investment Services

- Portfolio Management

- Special Reports and Newsletters

- Total Client Experience

- Wealth Management

After almost nine weeks of consecutive gains and all-time highs, we finally saw a week where markets took a long-overdue breather. Nothing in particular led to the week where major indexes were roughly 1% in the red...

After almost nine weeks of consecutive gains and all-time highs, we finally saw a week where markets took a long-overdue breather. Nothing in particular led to the week where major indexes were roughly 1% in the red. In fact, we had a string of positive developments on the economic front.

On Thursday, U.S. real GDP growth was revised up to 3.8% in the final reading for Q2—the fastest pace in two years. That was a meaningful bump from the previous estimate of 3.3%, thanks to the mighty consumer. Never underestimate the U.S. consumer’s willingness and ability to spend. Real GDP climbed at an average annual pace of 2.4% from 2019 to 2024—unchanged from previous estimates. Overall, the figures underscore that the economy bounced back nicely from the pandemic recession and maintained above-trend growth.

Meanwhile, U.S. initial jobless claims bucked expectations, falling 14k to 218k in the week ending September 20. The drop suggests companies remain reluctant to lay off workers, even as the job market cools. Labour market conditions continue to reflect a low-hiring yet low-firing environment. Durable goods orders also compounded expectations, rebounding 2.9% in August. Core capital goods orders—a gauge for business investment—jumped for a second straight month, up 0.6%.

On the home front, Friday saw Canadian July GDP rise 0.2%, beating expectations by one-tenth and breaking a string of three consecutive 0.1% contractions. Goods-producing sectors led the gains in July, driven by mining, oil & gas, and manufacturing. Services eked out a modest 0.1% rise overall, powered by wholesale trade, transportation & warehousing, and finance. The rebound in housing market activity (sales have risen five months in a row) added to growth as well.

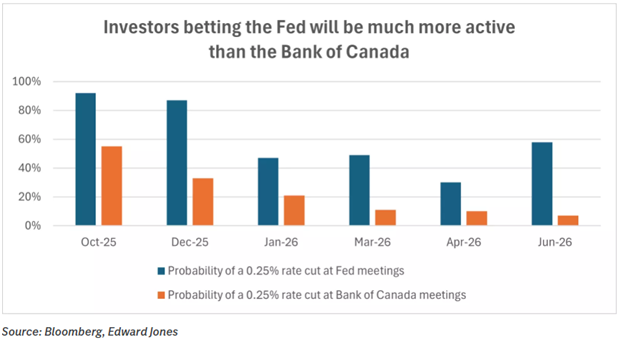

Bottom Line: The Canadian economy continues to hang in there, suggesting no increased urgency for the BoC to cut rates. Still, underlying softness in the economy will likely drive further easing. BMO is forecasting a pause in October, followed by 25 bp rate cuts at the December and March meetings.

Circling back to the markets, BMO’s Chief Investment Strategist Brian Belski provided a market outlook for the balance of 2025—and the “chase” is on.

Belski is prepared for the cynicism that will most certainly come his way as he revised his S&P 500 year-end price target to the bull case he first published in November 2024. After all, investing is not a formula. Rather, it is a journey—one with process and discipline, much like life itself. For his part, Belski has always defaulted to a process and discipline of how stocks, industries, and sectors define markets and portfolios—and prefers not to live and die by the academic sword of index price targets. After all, the stock market is a market of stocks—a core belief that has fueled his broader conclusion that the U.S. stock market remains in the midst of a 25-year secular bull market—a published “call” he has maintained for over 15 years.

So yes, Belski says let the bull run. In fact, he believes the 7,000 target might end up being too low. However, markets are rarely linear for long, and a blow-off top followed by a settling-in phase at 7,000 is a more prudent and likely result. This is something we’ve been saying ourselves in recent weeks. Expect periods of consolidation and healthy pullbacks, but broadly, the backdrop is strong. With central banks cutting interest rates, earnings solidifying, AI nowhere near bubble territory, and stock market performance broadening out, the believability and comfort level with U.S. stocks is back in full swing, in his view.

To his credit, the Canadian stock market recovery—once widely panned and loudly doubted when he first published the view that Canada was entering a prolonged period of outperformance relative to the U.S. in mid-2024—has reached heights even he thought were lofty. Yes, the TSX has eclipsed Belski’s base case of 28,500, in part due to surprising economic strength and sustained gold momentum. However, MACRO does not lead—FUNDAMENTALS do. That’s why he has been prioritizing the improving and consistent fundamental conditions of Canadian stocks with respect to earnings growth, revisions, and operating performance.

To that end, Belski has raised his 2025 year-end price target for the TSX to 31,500 from 28,500, which implies another 6% return in the final three months of the year. This is based on a broadening positive revision cycle that his models have shown over the last six months. This now positions the TSX to exhibit low double-digit earnings growth by the end of 2025, implying a higher earnings multiple that is likely to remain above the long-term historical average. After all, you pay for what’s working—and Canadian equities are working.

Sources: BMO Capital Markets: Canadian Strategy Snapshot The Bull Case Has Arrived, BMO Capital Markets: US Strategy Comment

The Bull Run, BMO Economics EconoFACTS: U.S. Economy Showcases Resiliency

The opinions, estimates and projections contained herein are those of the author as of the date hereof and are subject to change without notice and may not reflect those of BMO Nesbitt Burns Inc. ("BMO NBI"). Every effort has been made to ensure that the contents have been compiled or derived from sources believed to be reliable and contain information and opinions that are accurate and complete. Information may be available to BMO Nesbitt Burns or its affiliates that is not reflected herein. However, neither the author nor BMO NBI makes any representation or warranty, express or implied, in respect thereof, takes any responsibility for any errors or omissions which may be contained herein or accepts any liability whatsoever for any loss arising from any use of or reliance on this report or its contents. This report is not to be construed as an offer to sell or a solicitation for or an offer to buy any securities. BMO NBI, its affiliates and/or their respective officers, directors or employees may from time to time acquire, hold or sell securities mentioned herein as principal or agent. NBI will buy from or sell to customers securities of issuers mentioned herein on a principal basis. BMO NBI, its affiliates, officers, directors or employees may have a long or short position in the securities discussed herein, related securities or in options, futures or other derivative instruments based thereon. BMO NBI or its affiliates may act as financial advisor and/or underwriter for the issuers mentioned herein and may receive remuneration for same. A significant lending relationship may exist between Bank of Montreal, or its affiliates, and certain of the issuers mentioned herein. BMO NBI is a wholly owned subsidiary of Bank of Montreal. Any U.S. person wishing to effect transactions in any security discussed herein should do so through BMO Nesbitt Burns Corp. Member-Canadian Investor Protection Fund.