So Much For Dog Dayzzz

DHL Wealth Advisory - Aug 09, 2024

Escalator up, elevator down. This old trading cliche aptly describes recent stock market action in our view...

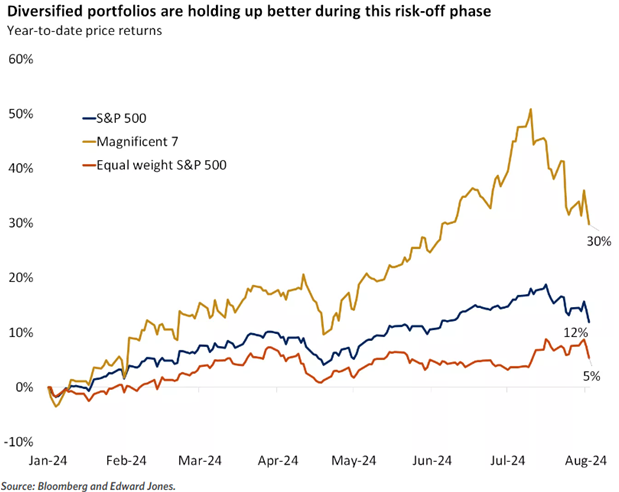

Escalator up, elevator down. This old trading cliche aptly describes recent stock market action in our view. After a relentless ascent led by the “Nifty AI Five” (Nvidia, Microsoft, Meta, Amazon, and Google) and a few other names, market volatility has shot up and prices have come down quickly over the last few weeks. It is important to note, however, that this negative price action has seen enormous variance.

Source: The first will be last and the last will be first

The worst performers (by far) have been expensive mega cap tech stocks and cyclical sectors (Consumer Discretionary, Industrials, Energy, and Basic Materials), which are more exposed to the economic cycle. On the other hand, defensive sectors such as Healthcare, Consumer Staples, Utilities and REITs, have so far weathered the storm quite well. Lower interest rates have also acted as a tailwind for them as it makes their higher dividend yields all the more attractive.

Source: The first will be last and the last will be first

As we often point out: Corrections in equity markets are a normal part of investing, it just doesn’t feel like it when it happens. It’s good news that pockets of overvaluation saw weakness and other areas saw strength. However, we are in the volatile, low attendance, and low liquidity part of the calendar year, so more rocking and rolling may lie ahead.

Source: The first will be last and the last will be first

The proximate causes of this pullback were a weakening labour market south of the border and underwhelming results from the bluest of the blue-chip tech stocks, such as Microsoft, Amazon, and Google (and a few other friends). We hasten to add that their numbers were far from disastrous, but they failed to meet elevated expectations.

Source: The first will be last and the last will be first

This brings us back to the importance of stock valuations. While a notoriously poor timing tool, valuations (e.g., how expensive stocks are based on price to earnings, cash flow or sales ratios) do provide insights on embedded expectations. The higher they are, the higher the bar for companies when they report quarterly results. Conversely, inexpensive stocks face considerably lower downside risk even in the face of mediocre results.

Source: The first will be last and the last will be first

What’s interesting, however, is that a tough summer for U.S. stocks is overshadowing Corporate America’s best-received earnings season in years. Despite big selloffs for the likes of Tesla, Nvida, and Amazon, etc, the median reaction for S&P 500 firms that beat profit estimates outperformed the benchmark by 1.7% on the day of reporting results — the widest margin going back to 2019 — while the median reaction for stocks missing forecasts trailed the index by just 1.1%, one of the narrowest margins over the same period.

So, while the S&P 500 is down more than 7% since JPMorgan Chase & Co. reported its results on July 12, the unofficial start to the quarterly earnings season, the market is also rewarding individual companies that are delivering on their promises. The trends are in response to the strongest profit growth for U.S. firms in over three years in absolute terms. Already facing a high bar coming into the reporting season, S&P 500 firms have still managed to beat expectations overall with a 13% leap in second-quarter profits. That’s the sharpest increase since the fourth quarter of 2021.

The point being made here is that despite the fear gripping headlines this week of an imminent recession, it is not evident in corporate fundamentals, and fundamentals are what ultimately dictate the direction of stocks.

As noted above, a weakening labour market also acted as a catalyst for the weakness with many bears dusting off the old “Sahm Rule,” which is based on the view that an increase of over 0.5% in the unemployment rate from its 12-months low has preceded every recession since the 1970s. We find this conclusion overly simplistic since the jobs market has been amazingly strong with the unemployment rate still close to its historical low. So, a normalization – far from a sinister turn of events – was to be expected and will, in fact, make the Fed’s fight against inflation that much easier. It could also accelerate the pace of interest rate cuts which has historically been a tailwind for equities and other risky assets.

Source: The first will be last and the last will be first

Things can change of course, but we are not detecting a looming financial torpedo as we write this missive. Again we turn back to fundamentals: Public companies in Canada and the U.S. are still expected to deliver double-digit earnings per share growth in the next year.

Source: The first will be last and the last will be first

The bottom line is that the current bout of weakness is likely to yield attractive buying opportunities. Being selective will be crucial, however, and financial history has proven that leading sectors and stocks can change considerably depending on the economic and interest rate cycle. Our focus will continue to be on identifying companies with strong competitive advantages, excellent management teams, fortress balance sheets and proven track records of growing cash flow and dividends.

Source: The first will be last and the last will be first

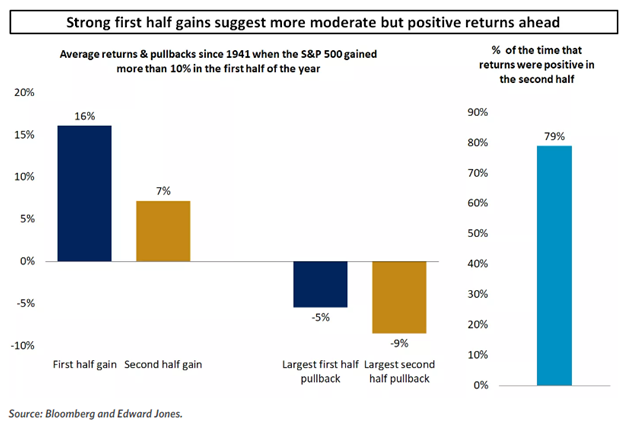

When it doubt, it’s always helpful to look back to history as a guide. Afterall, while history doesn’t repeat, it often rhymes. Going back to 1941, whenever the S&P 500 rose by 10% or more in the first six months of the year, it has risen by 7% on average in the second half. And the percentage of time that returns were positive in the second half of the year was almost 80% vs. 66% for any given period. The one caveat is that pullbacks in the second half tend to be deeper than the first half, averaging 9%. For context, at the low this week the pullback was just a hair shy of 9%.

The opinions, estimates and projections contained herein are those of the author as of the date hereof and are subject to change without notice and may not reflect those of BMO Nesbitt Burns Inc. ("BMO NBI"). Every effort has been made to ensure that the contents have been compiled or derived from sources believed to be reliable and contain information and opinions that are accurate and complete. Information may be available to BMO Nesbitt Burns or its affiliates that is not reflected herein. However, neither the author nor BMO NBI makes any representation or warranty, express or implied, in respect thereof, takes any responsibility for any errors or omissions which may be contained herein or accepts any liability whatsoever for any loss arising from any use of or reliance on this report or its contents. This report is not to be construed as an offer to sell or a solicitation for or an offer to buy any securities. BMO NBI, its affiliates and/or their respective officers, directors or employees may from time to time acquire, hold or sell securities mentioned herein as principal or agent. NBI will buy from or sell to customers securities of issuers mentioned herein on a principal basis. BMO NBI, its affiliates, officers, directors or employees may have a long or short position in the securities discussed herein, related securities or in options, futures or other derivative instruments based thereon. BMO NBI or its affiliates may act as financial advisor and/or underwriter for the issuers mentioned herein and may receive remuneration for same. A significant lending relationship may exist between Bank of Montreal, or its affiliates, and certain of the issuers mentioned herein. BMO NBI is a wholly owned subsidiary of Bank of Montreal. Any U.S. person wishing to effect transactions in any security discussed herein should do so through BMO Nesbitt Burns Corp. Member-Canadian Investor Protection Fund.