MWW - Last Call: Don't Forget Your RRSP & TFSA Contributions!

DHL Wealth Advisory - Feb 13, 2026

- Portfolio Management

- Retirement

- Special Reports and Newsletters

- Total Client Experience

- Wealth Management

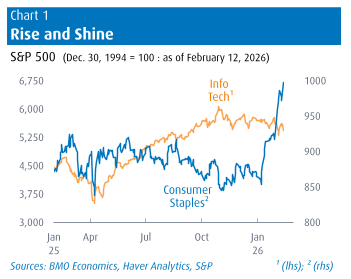

Well, it’s certainly been a fluid couple of weeks. Forget about coming for your job, Wall Street has decided that AI may be coming for your entire industry. Various sectors are being singled out, one by one, as being particularly vulnerable to AI advances, and are getting thrashed. And even the mega tech companies are not immune, with the Nasdaq stumbling a bit more than 5% in the past two weeks, and unable to crack above the record high set way back in late October. However, other somewhat forgotten and quieter corners of the market are doing just fine, highlighted by the Dow’s recent trip above the 50,000 mark for the first time ever. The relative strength there is led by staples, utilities and industrials, arguably the slowest-growing, most “boring” sectors. In short,we are witnessing a classic rotation from the sizzling to the silent. More on this later.

The stock market likes its stories to have black and white actionable clarity (more along the lines of See Spot Run versus War and Peace) and has a tough time digesting nuance on the fly. As we have seen in technicolor these past couple weeks, full valuations, narrow but crowded leadership and surprising shifts in competitive fundamentals can prompt a “sell first, sort later” reaction.

Equity markets in particular are not very adept at handling nuance. They are discounting mechanisms, which means they want to race to the bottom line and move on. Take economic numbers for example: markets often react on the initial release of the Consumer Price Index, non-farm payroll reports or GDP. They rarely respond when the final revision is announced many months later – even if it’s a large change that potentially alters the original thesis.

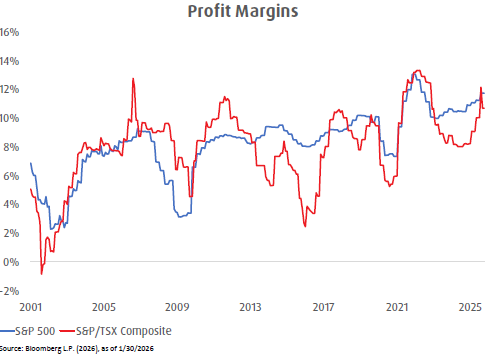

With 70% of S&P 500 earnings results in, Bloomberg is reporting that aggregate revenues are up 9% while earnings are up over 13%. Importantly, the results are widespread, with 10 of 11 sectors showing revenue increases. Nine of the 11 have bottom line increases (four in the 18 to 38% range). Results in aggregate are coming in better than expected.

Though TSX earnings have yet to fully blossom, the 27% that have reported are posting revenue growth of 8% and earnings increases of nearly 11%. Bottom line – despite the variety of challenges that companies faced in 2025, the overarching results show resilience, adaptability and an economy girded for growth.

Meanwhile, the long-awaited market rotation may finally be here...

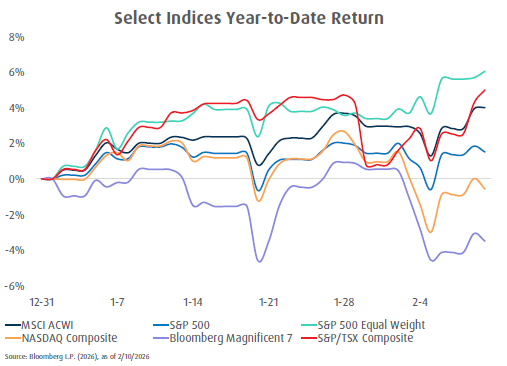

The Mag 7 have dominated market psychology for much of the past several years. A significant broadening in market performance and participation began last fall and has gained momentum in 2026 (chart below). The Mag 7 index is down nearly 4% year to date, while the broader (though still tech-heavy) NASDAQ is down less than a percent. The S&P 500 is up over 1%, but illustrating a broadening in size, the equal-weighted index is up nearly 6%. The Russell 2000 (small cap) and Russell 2500 (mid cap) are up 8% and 9% respectively. This broader participation, supported by the breadth of earnings progress, should help support the market’s overall durability. That said, we have warned that this type of leadership handoff could bring heightened volatility – and indeed it has.

Global markets also continue their outperformance. The S&P/TSX is up ~5%, Nikkei (Japan) is up 15%, South Korea (KOSPI) up 31% and MSCI All Country World Index up 4%. Global bourses are benefiting from the promise of increased fiscal stimulus in many parts of the world plus increased defense and infrastructure spend.

During the Q2 and Q3 reporting seasons, investors began to question when viable use cases, growth and/or margin enhancement from the billions in AI spending would emerge. Careful analysis of spend relative to cash flow and/or margins crept into the equation.

This quarter, equity investors are pushing back even harder on the spend itself, especially after the four hyperscalers (Microsoft, Amazon, Meta, Alphabet) announced plans to push their aggregate CapEx (capital expenditures) past $650 billion in 2026 alone. Note: that level is larger than Germany’s annual budget and is only slightly less than Japan’s total expenditures. While stock investors gulped hard, it’s also worth noting that part of the spending will be funded in the debt markets. Investment grade (Invest Grade) bond issuance from Oracle last week and Google this week was in heavy demand. Offerings from both companies were oversubscribed (more demand than supply) by factors of at least 5:1.

In a throwback to early 2025’s DeepSeek technological surprise, new AI modules introduced by Anthropic in the past couple of weeks caused great consternation among a variety of specialty software companies in the legal services, wealth management, real estate and insurance industries. For good measure, in the initial frenzy traders threw all software companies out with the bath water. The presumption seemed to suggest that corporations would wholesale abandon processes and existing software to incorporate the new advances – by next Friday.

Can we all just take a collective breath here? Anyone who works in a regulated industry (e.g., legal, wealth management, insurance) knows how difficult it is to get new enterprise software and processes approved and implemented.

Bottom line: a few quarters ago, investors began begging for use cases, but now that viable advances are showing up, they’re punishing a broad swath of companies quite indiscriminately. It will take some nuance and sorting to figure out new valuation levels and viable paths forward. However, we suspect that in the long run AI will be complementary to many of the existing methods – helping leverage the drudge work and leaving those that lean into the change in a better position to innovate and contribute.

Case in point: BMO’s Chief Economist started in this industry pre-PC, meaning they hand calculated 30-day moving averages and hand plotted data points on green graph paper – and wrote their reports in pencil on yellow legal pads. Cut and paste was literally scissoring the sentence out and taping it into place somewhere else. Yet they are still here and working more efficiently than ever thanks to all the software and technology that we now have at our fingertips. More a case of adapting vs breaking.

Sources: Weekly Strategy Perspectives – A BMO Private Wealth Publication

The opinions, estimates and projections contained herein are those of the author as of the date hereof and are subject to change without notice and may not reflect those of BMO Nesbitt Burns Inc. ("BMO NBI"). Every effort has been made to ensure that the contents have been compiled or derived from sources believed to be reliable and contain information and opinions that are accurate and complete. Information may be available to BMO Nesbitt Burns or its affiliates that is not reflected herein. However, neither the author nor BMO NBI makes any representation or warranty, express or implied, in respect thereof, takes any responsibility for any errors or omissions which may be contained herein or accepts any liability whatsoever for any loss arising from any use of or reliance on this report or its contents. This report is not to be construed as an offer to sell or a solicitation for or an offer to buy any securities. BMO NBI, its affiliates and/or their respective officers, directors or employees may from time to time acquire, hold or sell securities mentioned herein as principal or agent. NBI will buy from or sell to customers securities of issuers mentioned herein on a principal basis. BMO NBI, its affiliates, officers, directors or employees may have a long or short position in the securities discussed herein, related securities or in options, futures or other derivative instruments based thereon. BMO NBI or its affiliates may act as financial advisor and/or underwriter for the issuers mentioned herein and may receive remuneration for same. A significant lending relationship may exist between Bank of Montreal, or its affiliates, and certain of the issuers mentioned herein. BMO NBI is a wholly owned subsidiary of Bank of Montreal. Any U.S. person wishing to effect transactions in any security discussed herein should do so through BMO Nesbitt Burns Corp. Member-Canadian Investor Protection Fund.