Greenland is Iceland; Iceland is Greenland

DHL Wealth Advisory - Jan 23, 2026

- Investment Services

- Portfolio Management

- Special Reports and Newsletters

- Total Client Experience

- Wealth Management

Anyone hoping for an orderly tiptoe into a post-holiday new year has been sorely rattled. First came a barrage of headlines (Venezuela, oil, Iran, a cap on credit card rates, limitations on housing ownership, criminal investigation of the Fed...

Anyone hoping for an orderly tiptoe into a post-holiday new year has been sorely rattled. First came a barrage of headlines (Venezuela, oil, Iran, a cap on credit card rates, limitations on housing ownership, criminal investigation of the Fed, and a potential war amongst NATO allies), which markets in aggregate mostly looked past despite an uptick in volatility to start the week. With the NATO/Greenland uncertainly hopefully in the rearview mirror, investor focus will shift to fundamentals with a Q1 earnings season now underway.

There’s an old adage that you’ll never get rich off a savings account. The saying illustrates the fundamental relationship underpinning markets: risk of some sort is implied if you are seeking a higher return – no free lunches here. The key is understanding the various types of risk and working to ensure that your expected return adequately compensates for it.

Investor lens is that of a part owner, participating in the ongoing cashflows of a business. Focus is therefore on those factors that will juice growth – lower interest rates, healthy and resilient consumers, a supportive regulatory framework, competitive differentiators, and reasonable cost inputs.

Potential return comes from share price appreciation and dividends. The upside is theoretically unlimited, meaning equities can be a solid hedge against the ravages of long-term inflation. We all relearned over the past five years that inflation is an insidious thief, steadily chipping away at purchasing power, year in and year out.

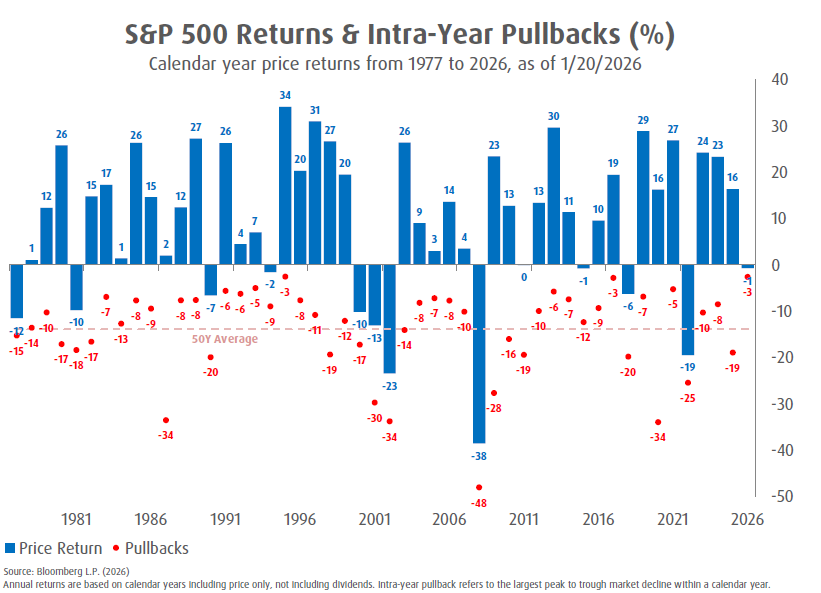

Potential risk comes from the possibility of losing some or all of your investment. It’s helpful for us to revisit this lesson from time to time: Equity markets can be – and often are – prone to short-term fluctuations. Such volatility is the rule not the exception even in years featuring strong uptrends (chart below). In fact, looking at the S&P500 here is the breakdown:

≥ 5% pullback: Happens in almost every year (≈95%+ of years)

≥ 10% correction: Occurs in more than half of all years

≥ 15% drawdown: Roughly one out of every three years on average

≥ 20% bear‑market decline: About once every 5–6 years historically.

Despite these regular declines, the S&P 500 finishes the year positive about 70–75% of the time. In the past ~40–45 years, the index ended higher in roughly 3 out of every 4 years, even though those same years still experienced double‑digit pullbacks. Since 1955, intra-year declines have averaged ‑13.9%, while annual returns were positive in 51 of 70 years.

The most recent round of volatility hit after an especially long run (over nine months) of very low intraday price moves. With broader stock markets hitting new highs just last Friday, investor emotions were high, nerves raw and fingers itchy to pull the rip cord. Therefore, while the rapid escalation in Greenland tit-for-tat played out in broad social media daylight, markets initially adopted a rapid risk off response – only to reverse much of the decline the following day as comments re Greenland were softened. In order to sort out which aspects might be lasting after this week’s market-moving issues and which might end up being noise, we opine on the following:

- For President Trump, everything is a win-lose transaction. His normal operating style is to float a number of ideas on a wide variety of topics – simultaneously – to flood the zone and keep opponents off balance. The opening volley is typically super high to establish a ceiling from which negotiations can work back or be walked back. (This will be an especially important point to keep top of mind entering into USMCA/CUSMA renegotiations over the next few weeks.)

- Congress has begun to show signs that members are willing to step in on certain issues. For example, several Senate Republicans questioned the Justice Department’s investigation of Fed Chair Powell. Louisiana Senator John Kennedy noted last week that “even a 9th grader knows it would be weapons-grade stupid to try to invade Greenland.”

- The underlying U.S. economy remains strong; GDP and productivity are hinting at growth in the 4% range. Now that earnings season is getting underway, we should see plenty of valuable info nuggets that either support or challenge that economic confidence – as well as another quarter of aggregate double-digit earnings growth.

- Large cap indexes closed 2025 up double digits for the third year in a row and at all-time highs. Their growth in 2025 was just a tick or two above earnings growth (through the third quarter), meaning valuations did not expand as much as perceived. A bit of backing and filling near current levels would help to push the valuations a bit lower.

- Investors should understand the wisest reaction to a surprising headline is often to take a deep breath and give the situation a bit of time to marinate. Markets of all stripes are playing an important feedback mechanism for global leaders.

It can be tempting to get caught up in chasing the next hot thing or conversely trying to avoid an interim pullback. Our brains are literally hard-wired for the dopamine hit such activities produce. It’s important to take a step back and assess your cash flow needs (short- and long-term), plus any potential changes to your time horizon or tolerance for price movement. We are here to help clarify your goals, risk tolerance and the allocation recipe that suits you best. Never hesitate to reach out!

Sources:Weekly Strategy Perspectives – A BMO Private Wealth Publication / Perspectives — stratégie hebdomadaire – une publication de BMO Gestion privée

The opinions, estimates and projections contained herein are those of the author as of the date hereof and are subject to change without notice and may not reflect those of BMO Nesbitt Burns Inc. ("BMO NBI"). Every effort has been made to ensure that the contents have been compiled or derived from sources believed to be reliable and contain information and opinions that are accurate and complete. Information may be available to BMO Nesbitt Burns or its affiliates that is not reflected herein. However, neither the author nor BMO NBI makes any representation or warranty, express or implied, in respect thereof, takes any responsibility for any errors or omissions which may be contained herein or accepts any liability whatsoever for any loss arising from any use of or reliance on this report or its contents. This report is not to be construed as an offer to sell or a solicitation for or an offer to buy any securities. BMO NBI, its affiliates and/or their respective officers, directors or employees may from time to time acquire, hold or sell securities mentioned herein as principal or agent. NBI will buy from or sell to customers securities of issuers mentioned herein on a principal basis. BMO NBI, its affiliates, officers, directors or employees may have a long or short position in the securities discussed herein, related securities or in options, futures or other derivative instruments based thereon. BMO NBI or its affiliates may act as financial advisor and/or underwriter for the issuers mentioned herein and may receive remuneration for same. A significant lending relationship may exist between Bank of Montreal, or its affiliates, and certain of the issuers mentioned herein. BMO NBI is a wholly owned subsidiary of Bank of Montreal. Any U.S. person wishing to effect transactions in any security discussed herein should do so through BMO Nesbitt Burns Corp. Member-Canadian Investor Protection Fund.