Thank You 2025; Your Constant Drama Made For Easy Titles...

DHL Wealth Advisory - Jan 08, 2026

- Investment Services

- Portfolio Management

- Special Reports and Newsletters

- Total Client Experience

- Wealth Management

Resilience and feedback are two words that best sum up 2025. The year may also go down as the “t” year...

Resilience and feedback are two words that best sum up 2025. The year may also go down as the “t” year: tariffs, tensions, trade, TACO and Trump all featured prominently. However, “t” words also dominated the latter half of the year: turnaround, terrific and all‑time highs. Most of the world’s stock market indices posted positive returns—some spectacular and surprising. Among the world’s top performers were benchmark stock indices in Canada (+28.3%), Mexico (+29.9%), and Korea (+75.6%)—three countries that are heavily reliant on U.S. trade.

In our opinion, the single most important development of the year was the crucial feedback the U.S. bond market delivered to the Trump administration in the first week of April, paving the way for a recalibration of its tariff policies. Since governments don’t own stocks, equity market declines are tangential feedback and easier to dismiss. However, disturbances in currency and bond markets bring immediate and forceful consequences. Governments borrow money in the bond market—and the U.S. borrows a lot. In response to the tariff shock, U.S. bond yields rose sharply, which would directly affect government finances.

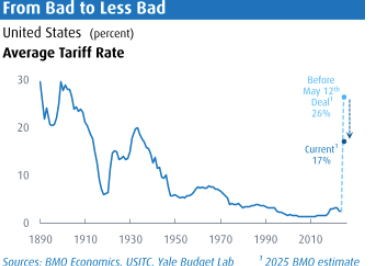

The ‘Liberation Day’ tariffs didn’t last long as financial markets convulsed, and all countries were temporarily reset at 10% while trade deals were crafted. All except for China, which ignited a tit‑for‑tat war that pushed bilateral levies to 125% and America’s average tariff rate to its highest level in more than 120 years. A temporary pact with China, along with other bilateral deals and sector duties, has resulted in a roughly 17% rate. U.S. Customs is currently collecting around 11% as businesses find ways around the taxes. Even so, $31 billion collected monthly is nothing to sneeze at and is helping to limit a rise in the massive budget deficit.

Resilience is the only way to describe households that continued to spend and businesses that continued to invest despite all the change and widespread uncertainty in 2025. While the rewiring of trade and geopolitical relationships is challenging, it has set changes in motion that lean positive. Capital markets embraced the prospect of long overdue defence spending in Europe, Canada and elsewhere; an attitude shift toward government efficiency (the concept behind DOGE); and government spending increasingly used to stimulate productive investments (e.g., infrastructure and Canada’s nation‑building initiatives).

Some of the resilience is genuinely amazing. Real GDP growth for the global economy is on track to reach 3.2% for the year. Growth is beating forecasts in numerous places—including, and forcefully, in Canada. Stunningly, world trade is estimated to grow roughly 5% in volume terms. That’s not only a solid outcome in a year of trade stress and uncertainty but also the best increase in four years. Globalization isn’t dead; it’s retooling. The rest of the world carries on as scores of nations are forging and strengthening ties (just look at Carney’s visit to China next week).

Around the middle of 2025, it likely began to dawn on many analysts that they may have been looking the wrong way on what was truly driving the global economy. After spending much of the first half of the year focused on (obsessed with?) the trade war, it became increasingly apparent that the ongoing and accelerating boom in AI spending was blowing past trade uncertainty and, in fact, was keeping the U.S. and global economy on a solid footing. It was also right around mid‑year that the S&P 500 recouped its deep tariff‑related losses and then began climbing to new highs, culminating in a solid full‑year return for equities. In turn, this resiliency set off worldwide debates on the need for further monetary easing heading into 2026.

The two big forces for the economy and markets in the past year—the trade war and the AI spending boom—will still be apparent in 2026. The debate is whether the balance will tip the same way as it did in 2025. We suspect that while trade uncertainty will linger, and even flare at times, it won’t be nearly as intense as in 2025. On the flip side, while the AI investment boom may intensify, the rate of increase may wane and its power over the equity market may relent—as hinted at in recent weeks. Despite concerns about a sudden reversal in tech and about the tariff impact on global trade, economists expect the global economy to post another year of GDP growth just above 3% in 2026, not far off 2025. While a bit below the long‑run average, this is still quite resilient in the face of deep policy uncertainties.

The coming year will still bring plenty of trade drama, even if it ranks a bit lower on the wildness scale (fingers crossed). The U.S. Supreme Court is expected to rule on the legality of the IEEPA tariffs early in the year. While the Administration has avowed that it can replace those revenues with other trade avenues, a ruling against them will limit the flexibility and scale of future tariffs. The ruling could also indirectly affect the highly anticipated USMCA review slated for mid‑2026: Canadian (35%) and Mexican (25%) goods that aren’t USMCA‑compliant face hefty IEEPA tariffs. It’s widely expected that the U.S. will use the threat of walking away from the agreement during negotiations. As well, the U.S. has yet to reach a lasting deal with China, although the two seem to have settled on a medium‑term truce, however uneasy that may be. And note that some of the earlier “deals” with others are fraying at the edges—Indonesia is the latest example.

If it was a surprise that China’s economy held its own in the trade war, it comes as a shock that Canada has apparently done so as well. Arguably, the most surprising economic statistic of 2025 is that the number of unemployed Canadians has managed to decline in the past 12 months—recall that trade uncertainty has been rolling for over 12 months, with the President first threatening Canada with tariffs in November 2024. Along with an upgrade to GDP growth to around 1.7% for this year, Bank of Canada Governor Macklem was inspired to suggest that the “R” word was thus no longer recession, but resilience. Accordingly, the BoC signalled last month that it is on hold and noted that the risks are now more symmetric. With trade/USMCA uncertainty lingering, we believe there is a greater chance of another rate cut than a hike in 2026, but the most likely outcome is no BoC move.

Canada’s sturdiness in the face of existential trade threats was driven by a variety of factors. Canada needed “elbows up” through the spring election period and the harshest trade rhetoric toward Canada. Tariffs and Trump’s threats galvanized and awakened us to the need for greater self‑reliance in our defence and trading relationships. What followed was constructive debate over how we do business in this country. Currently, Canada has some of the most favourable access to U.S. markets. Future trade negotiations will require intense effort, but the conversations at home feel less panicked and more optimistic that we can move forward on measures designed to drive economic growth, investment, and productivity.

Canada’s situation was reflected in our capital markets. As it relates to the equity market, Canada’s TSX had one of its best years of this century in 2025, with a total return nearing 30%, even as headlines were mostly filled with economic gloom. This seeming conundrum was often explained away by the fact that the TSX is not very representative of the economy, as the index is heavily weighted in mining, materials, energy and financials—a relatively small portion of GDP. Yet the TSX has actually been a very good leading indicator. While the fit is far from perfect, periods of strong returns usually presage strong economic growth, which means the robust 2025 market performance is a tantalizing hint that the economy may exceed expectations in 2026. At the very least, we can say that it is almost unheard of to have the economy slump when equities are forging higher.

Our currency strengthened (up 4.8% to US$0.729 from US$0.701) and the S&P/TSX Composite bested many markets, including the S&P 500. Ten out of 11 sectors posted gains; seven notched double‑digit upswings. Earnings growth underpins much of the gain, but the showstopper was the 98% advance in the materials sector, driven by rising prices for precious metals. The surge in financial asset values pushed net household wealth back above 10 times incomes—double the ratio of 35 years ago.

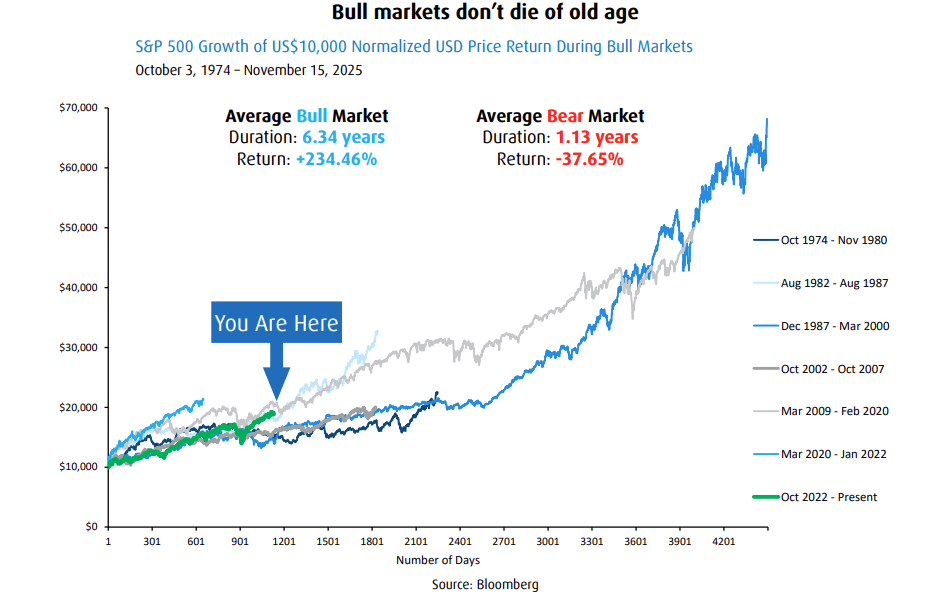

One area we have yet to address is the flip side of this conversation: bubble risk. In a prolonged bull market, rising prices reward risk‑takers, making investors feel brilliant and leading them to believe risk has vanished. This self‑deception can cause people to take on excessive risk. But when the situation sours, they suffer losses they cannot tolerate.

Bull‑market genius at the individual level is one thing, but bubbles and manias require crowds of investors to pile in recklessly. On an individual level, we work together with our clients to avoid complacency and keep risk exposures in line with expectations. As for the broader crowd, it’s encouraging that the question of bubbles is so prevalent. Manias require a blindness of faith that prices will forever go up with no limits. Everywhere we go — from TV studios to Ubers, Bay Street to Main Street — people are asking if we’re in a bubble. That’s a good thing — it means that investors are aware of a potential bubble and are on guard against the dangers of that happening.

And it isn’t just about asking the question. The price action in equity markets also points to healthy discipline. If the “Magnificent Seven” stocks in the S&P 500 are the centrepiece of the bubble talk, recall that as a group they have endured two sharp selloffs (17% and 28%) over the last 18 months. Individually, investors cut Tesla shares in half in early 2025. Oracle saw its shares rally from $220/share to $345 in a period of two weeks this October. By the end of 2025, the shares were trading around $190. Shares of all the others (except Microsoft) have experienced drawdowns of 30% or more in 2025 alone. It’s sensible — not mania or bull‑market‑genius behaviour — to question debt levels and circular financing arrangements within AI‑related businesses.

Simply because some stocks have enjoyed significant gains and some areas may be overextended with enthusiasm doesn’t mean we should paint the entire equity‑market universe with a broad brush of, “Oh my, everything is overpriced or priced to perfection.” We should not fear what equity markets are supposed to do. Nor should we shy away from investing in stocks because the outcomes have delivered on the long‑term promise of why we invest in stocks in the first place: the demonstrated ability to grow wealth over time and protect our wealth from inflation.

We were only three years into the bull market then, a late teenager by historical standards. Comparing the current bull run to the six bull markets of the past 50 years, only one has been shorter.

Again, we suspect — and hope — that there will be fewer fireworks on the trade‑policy front in the second year of the U.S. administration. Admittedly, there is significant uncertainty over the renegotiation of the CUSMA agreement scheduled for 2026. President Trump has threatened to leave the deal he signed back in 2020 that underpins the majority of North American trade. Further grandstanding is to be expected during these negotiations, but we expect these discussions will lead to modifications of this trade deal, as opposed to any drastic rewriting or collapse.

However, as we have learned the hard way over the last several years, it is important not to overreact to noise on the policy front or allow personal views around politics to dictate investment strategies, in our view. Instead, investors should keep their focus on building a well‑diversified portfolio aligned with their financial goals.

Sources: BMO Economics North American Outlook: 2026 Outlook: Resilience and Risks, BMO Nesbitt Burns Global Markets Commentary Report - January 2026

The opinions, estimates and projections contained herein are those of the author as of the date hereof and are subject to change without notice and may not reflect those of BMO Nesbitt Burns Inc. ("BMO NBI"). Every effort has been made to ensure that the contents have been compiled or derived from sources believed to be reliable and contain information and opinions that are accurate and complete. Information may be available to BMO Nesbitt Burns or its affiliates that is not reflected herein. However, neither the author nor BMO NBI makes any representation or warranty, express or implied, in respect thereof, takes any responsibility for any errors or omissions which may be contained herein or accepts any liability whatsoever for any loss arising from any use of or reliance on this report or its contents. This report is not to be construed as an offer to sell or a solicitation for or an offer to buy any securities. BMO NBI, its affiliates and/or their respective officers, directors or employees may from time to time acquire, hold or sell securities mentioned herein as principal or agent. NBI will buy from or sell to customers securities of issuers mentioned herein on a principal basis. BMO NBI, its affiliates, officers, directors or employees may have a long or short position in the securities discussed herein, related securities or in options, futures or other derivative instruments based thereon. BMO NBI or its affiliates may act as financial advisor and/or underwriter for the issuers mentioned herein and may receive remuneration for same. A significant lending relationship may exist between Bank of Montreal, or its affiliates, and certain of the issuers mentioned herein. BMO NBI is a wholly owned subsidiary of Bank of Montreal. Any U.S. person wishing to effect transactions in any security discussed herein should do so through BMO Nesbitt Burns Corp. Member-Canadian Investor Protection Fund.