Merry Christmas and Happy Holidays! See you in 2026

DHL Wealth Advisory - Dec 10, 2025

As we enter the final few weeks of 2025, and our last market commentary of the year, markets have delivered double-digit gains across all major U.S. and Canadian indexes. We are watching three key catalysts heading into 2026...

As we enter the final few weeks of 2025, and our last market commentary of the year, markets have delivered double-digit gains across all major U.S. and Canadian indexes. We are watching three key catalysts heading into 2026.

1) Fed cuts, while BoC remains on hold

Perhaps the biggest catalyst left in 2025 was the widely expected interest rate cut by the US Federal Reserve on Wednesday. The FOMC reduced policy rates by 25 bps, lowering the target range for federal funds to 3.50%-to-3.75% and marking the third consecutive action (to total 75 bps). And the Fed signaled a more tentative tilt going forward.

In the Statement, the forward guidance was softened… “In considering the extent and timing of additional adjustments to the target range for the federal funds rate, the Committee will carefully assess incoming data, the evolving outlook, and the balance of risks.” (The underline is ours.)

In the Summary of Economic Projections (SEP) and its ‘dot plot’, there was no change to the median forecast for fed funds. It still has quarter-point rate cuts in each of 2026 and 2027, to range midpoints of 3.375% and 3.125%, respectively. The FOMC appears in no hurry to get rates back to neutral, with the latter remaining at 3.00% (median call). And why no hurry? The median forecast for real GDP growth has an above-potential run in the 2026-2028 interval, including a 0.5 ppt upgrade to next year at 2.3% with inflation only getting back to 2.0% during 2028 (same as before).

Recall this year began with a nine-month hold that followed 100 bps of rate cuts over the final three confabs of 2024. Next year is looking like it could begin similarly, after 75 bps of easing over the last three meetings of 2025, although economists doubt the coming hold will prove to be as prolonged… perhaps as short as only one huddle.

It is important to note that the reason for the Fed's rate cuts is to return the fed funds rate to a more neutral level, not because the economy is in imminent danger of a recession or downturn. Historically, when the Fed is cutting rates and the economy is holding up, stock markets perform better; conversely, if the Fed is cutting rates because the economy has weakened, market performance tends to suffer.

In Canada, the BoC held rates steady on Wednesday having already cut rates seven times this cycle, starting in June 2024, bringing its policy rate to 2.25%. Given the recent economic data in Canada has surprised to the upside — including a better-than-expected GDP report for September and a strong jobs report for November — we believe the BoC will likely keep rates on hold for now.

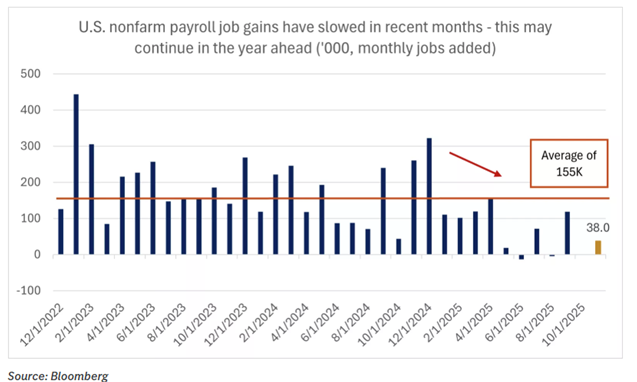

2) The U.S. nonfarm jobs report will provide insights on the labor market

The second data point to watch are the November jobs reports in both the U.S. and Canada.

In the U.S., investors will get the first complete reading of the U.S. nonfarm jobs report since the government shutdown began in early October. On December 16, investors will get the November jobs report data, which should help clarify the state of the U.S. labor market.

The expectations for the November jobs report remain relatively soft. Forecasts call for total jobs added to be 38,000, well below the September reading of 119,000. The unemployment rate is expected to tick higher, from 4.4% to 4.5%, while wage growth is expected to tick lower from 3.8% to 3.6% year-over-year. Notably, wage growth should continue to outpace the inflation rate, helping households and consumers receive positive real wages.

Overall, while U.S. labor market data has been mixed, the broader direction has been slower demand for labor and lower supply of labor. On the demand side, employers have been easing their hiring activity, with job openings moving lower and the private payrolls falling to negative job gains last month.

Meanwhile, on the supply side, we have seen some pressure on labor supply given trends like the aging U.S. demographic, stagnant labor force participation, and ongoing immigration reform. In our view, while lower demand and supply of labor could keep the U.S. unemployment rate contained, investors will likely also have to get used to seeing lower average job gains in nonfarm payrolls report as a new normal.

In Canada, the November jobs report was released last week, and the data surprised nicely to the upside. Net change in employment (new jobs added) totaled 53,600 — well above the forecast of a decline of 2,500 jobs, and modestly below last month's 66,600 reading. The unemployment rate ticked lower to 6.5% from 6.9%, also below forecasts of 7.0%. Meanwhile, the wage growth figure remained steady at 4.0% year-over-year, also above Canadian CPI inflation rates of around 2.1%. Overall, the job market in Canada seems to be steadying after a period of below trend growth.

3) A Santa Claus rally has occurred 73% of the time since 1980

Finally, the third catalyst to watch in December is whether Santa Claus will come to town for investors again this year. Historically, December has been a good month for investors. Traditionally, the last five trading days of the year plus the first two trading days of January are known as the "Santa Claus rally" period. According to Edward Jones, since 1980, this period has been positive 73% of the time, with an average S&P 500 gain of 1.1%.

More broadly, the stock market has had a nice run since the April lows. As we approach year-end, investors are likely considering how to position for the year ahead. After three years of stock market gains, a portfolio of 60% stocks and 40% bonds may now look more like 70% stocks or higher. If that feels a little uneasy, we always recommend speaking with us to review your portfolio and consider rebalancing to ensure alignment with your intended asset allocations.

Have a fantastic Holiday season and speak with you again in 2026!

Sources: BMO Economics BoC Rate Decision — Whole Lotta Hold, BMO Economics FOMC Policy Announcement & SEP — Shifting Gears… Again

The opinions, estimates and projections contained herein are those of the author as of the date hereof and are subject to change without notice and may not reflect those of BMO Nesbitt Burns Inc. ("BMO NBI"). Every effort has been made to ensure that the contents have been compiled or derived from sources believed to be reliable and contain information and opinions that are accurate and complete. Information may be available to BMO Nesbitt Burns or its affiliates that is not reflected herein. However, neither the author nor BMO NBI makes any representation or warranty, express or implied, in respect thereof, takes any responsibility for any errors or omissions which may be contained herein or accepts any liability whatsoever for any loss arising from any use of or reliance on this report or its contents. This report is not to be construed as an offer to sell or a solicitation for or an offer to buy any securities. BMO NBI, its affiliates and/or their respective officers, directors or employees may from time to time acquire, hold or sell securities mentioned herein as principal or agent. NBI will buy from or sell to customers securities of issuers mentioned herein on a principal basis. BMO NBI, its affiliates, officers, directors or employees may have a long or short position in the securities discussed herein, related securities or in options, futures or other derivative instruments based thereon. BMO NBI or its affiliates may act as financial advisor and/or underwriter for the issuers mentioned herein and may receive remuneration for same. A significant lending relationship may exist between Bank of Montreal, or its affiliates, and certain of the issuers mentioned herein. BMO NBI is a wholly owned subsidiary of Bank of Montreal. Any U.S. person wishing to effect transactions in any security discussed herein should do so through BMO Nesbitt Burns Corp. Member-Canadian Investor Protection Fund.