From Tariffs to Triumph: How Markets Sleighed 2025

DHL Wealth Advisory - Dec 05, 2025

- Investment Services

- Portfolio Management

- Special Reports and Newsletters

- Total Client Experience

- Wealth Management

North American markets put together a decent week of gains to open the final month of the year. Throughout 2025, it's been easy to get caught up in skepticism. Markets have navigated policy shifts, global uncertainty, and valuation concerns...

North American markets put together a decent week of gains to open the final month of the year. Throughout 2025, it's been easy to get caught up in skepticism. Markets have navigated policy shifts, global uncertainty, and valuation concerns. Some of these worries will likely carry through next year. But this season is about gratitude, and we think markets have given us plenty to be thankful for. Here are five drivers that have helped shape 2025.

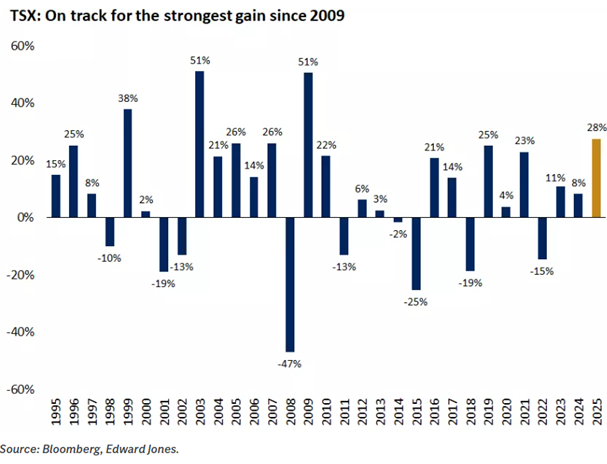

1. Strong equity gains

The TSX is on track for its strongest calendar-year return since 2009 and the S&P 500 is on pace for a third consecutive year of double-digit returns, up ~16%. An impressive feat despite a near 20% correction in April, rewarding investors who stayed the course through volatility.

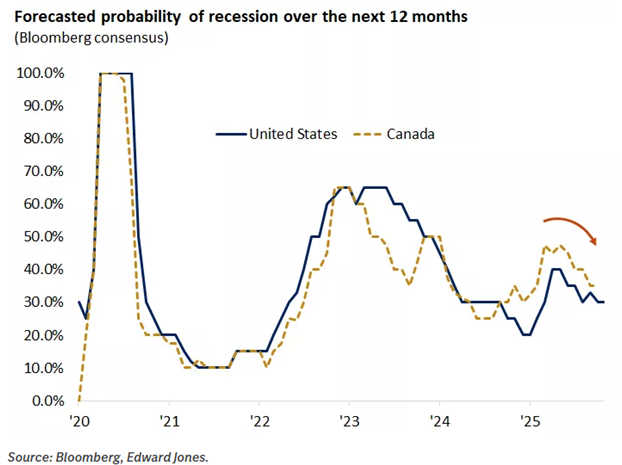

2. Fading recession fears

Economic resilience continued in 2025, with growth holding up and recession calls fading into the background. While the Canadian economy contracted in the second quarter due to declines in exports and business investment as the U.S. imposed tariffs, economic activity stayed resilient, supported by solid consumer spending. Yes, Canadian consumer confidence remains subdued, but spending has held up, highlighting a disconnect between sentiment and behavior. Perhaps more interestingly was this morning’s release of Canadian jobs data for the month of November.

Canadian employment jumped 53,600 last month, extending a three-month string of solid job growth and washing away the weakness seen during the summer. The real eye-popper in today's report is the massive 4-tick drop in the jobless rate to 6.5%, following a 2-tick drop the prior month. Put it this way, the last time we saw a 6-tick drop in the unemployment rate in a two-month span (aside from the wildness around COVID) was during the last tech boom in 1999. Even the jobless rate for youth is suddenly collapsing, plunging 1.3 ppts last month alone to 12.8%, and now at its lowest level in more than a year—well, that de-escalated quickly!

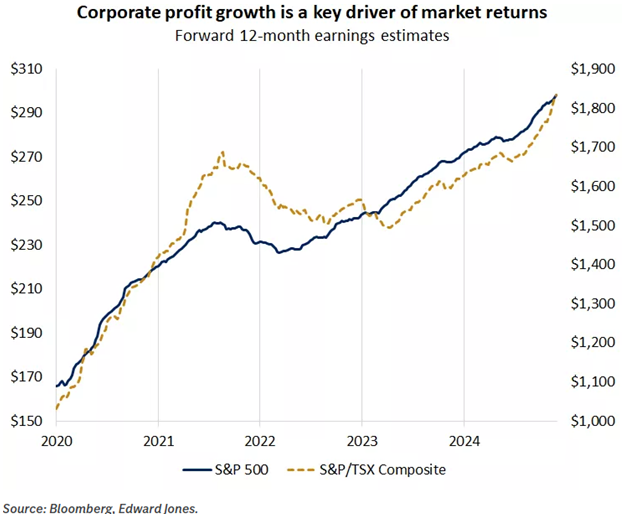

3. Rising corporate profits

Ongoing economic growth provided a solid backdrop for corporate earnings to not only grow but also consistently surpass expectations throughout the year. Both Canadian and U.S. large-cap companies significantly outperformed GDP growth, with TSX profits on track to rise about 12% year-over-year and with S&P 500 profits on track to rise about 11% year-over-year. While tariffs posed a challenge, U.S. companies offset the impact through cost-cutting, productivity gains, supply-chain adjustments, and selective price increases. With likely limited room for further valuation expansion, we believe earnings growth will remain the primary driver of stock prices next year.

4. AI and tech Innovation

The launch of ChatGPT in late 2022 sparked billions of dollars in AI investment and fueled a powerful rally in the tech-heavy Nasdaq that has persisted through this year. This wave of innovation has the potential to reshape the economy, unlocking new growth opportunities and boosting productivity. However, it also brings risks, such as overconcentration, stretched valuations, and possible disappointments if AI adoption falls short of expectations. We believe that AI trends remain durable and that technological adoption will continue to serve as a positive market catalyst. That said, we emphasize the importance of portfolio diversification, valuation discipline, and risk management. The AI trade remains intact, in our view, even as market leadership broadens beneath the surface.

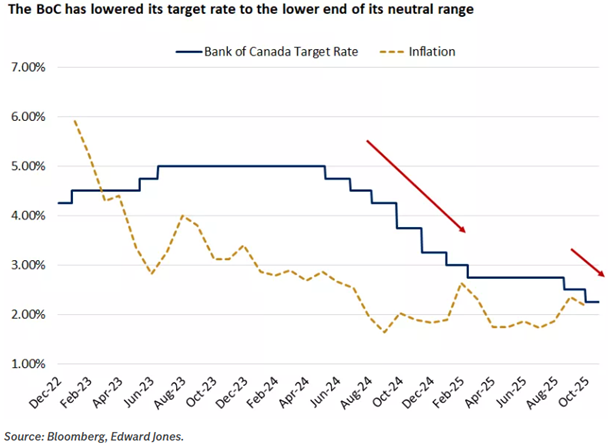

5. Modest central bank policy and inflation relief

Throughout the year, the Bank of Canada continued cutting its policy rate, bringing it down to the lower end of its neutral range at 2.25%. South of the border, after considerable debate and several shifts in interest-rate expectations, the Fed resumed its easing cycle this year following a prolonged pause. While questions remain about the future path of rates, we expect the Fed to ease cautiously, with the overall trend pointing lower through 2026, in our view, providing support for economic growth and financial markets.

2025 homestretch

The TSX posted its seventh straight month of gains in November, while the S&P 500 managed to cut most of its losses after a brief wobble tied to AI worries. Seasonal trends appear to point to a strong year-end finish: historically, the post-Thanksgiving period has delivered solid returns for the S&P 500. Over the past 30 years, December has averaged a gain of about 1%, with markets rising roughly 70% of the time.

As we wrap up 2025, markets have navigated a complex landscape — policy shifts, global uncertainty, and valuation concerns — yet we believe have delivered meaningful progress for investors. The five drivers we’ve highlighted underscore a powerful theme: resilience. From strong equity gains and fading recession fears to innovation and income opportunities, these forces remind us that staying invested and disciplined pays off over time, in our view. We think 2026 offers a constructive backdrop, even as risks persist. In our view, elevated valuations will require vigilance, but steady growth, lower rates, and rising profits provide reasons for optimism.

Source: BMO Econoimcs: Two Banks, Two Directions

The opinions, estimates and projections contained herein are those of the author as of the date hereof and are subject to change without notice and may not reflect those of BMO Nesbitt Burns Inc. ("BMO NBI"). Every effort has been made to ensure that the contents have been compiled or derived from sources believed to be reliable and contain information and opinions that are accurate and complete. Information may be available to BMO Nesbitt Burns or its affiliates that is not reflected herein. However, neither the author nor BMO NBI makes any representation or warranty, express or implied, in respect thereof, takes any responsibility for any errors or omissions which may be contained herein or accepts any liability whatsoever for any loss arising from any use of or reliance on this report or its contents. This report is not to be construed as an offer to sell or a solicitation for or an offer to buy any securities. BMO NBI, its affiliates and/or their respective officers, directors or employees may from time to time acquire, hold or sell securities mentioned herein as principal or agent. NBI will buy from or sell to customers securities of issuers mentioned herein on a principal basis. BMO NBI, its affiliates, officers, directors or employees may have a long or short position in the securities discussed herein, related securities or in options, futures or other derivative instruments based thereon. BMO NBI or its affiliates may act as financial advisor and/or underwriter for the issuers mentioned herein and may receive remuneration for same. A significant lending relationship may exist between Bank of Montreal, or its affiliates, and certain of the issuers mentioned herein. BMO NBI is a wholly owned subsidiary of Bank of Montreal. Any U.S. person wishing to effect transactions in any security discussed herein should do so through BMO Nesbitt Burns Corp. Member-Canadian Investor Protection Fund.