Tech Stumbles; Canadian Jobs Rumble.

DHL Wealth Advisory - Nov 07, 2025

- Investment Services

- Portfolio Management

- Special Reports and Newsletters

- Total Client Experience

- Wealth Management

Following a near-continuous upward march since the spring, equity markets stumbled somewhat this week on valuation concerns in the Artificial Intelligence space and the now-record long U.S. government shutdown...

Following a near-continuous upward march since the spring, equity markets stumbled somewhat this week on valuation concerns in the Artificial Intelligence space and the now-record long U.S. government shutdown. As we noted last, the latter is slowly but steadily making more of an impact on the real economy—although the full extent of the damage may not be known due to the absence of data, which is perhaps ironically due to the shutdown.

The stumble is still relatively minor, with the S&P 500 off little more than 3% since last Tuesday’s record close, but it’s broken below its 50-day moving average (and it hadn’t done so since February!). Here's an interesting statistic for you which speaks further to how relentless the run-up from the early April low has been: This 3% pullback in the S&P 500 is ranks as the worst seven day sell-off since the April swoon. Of course, that probably speaks to why so many in the media appear to be losing their minds over the recent slide in the mega-cap tech stocks despite what looks to be nothing more than a routine short-term pullback within an otherwise healthy (and relatively new) cyclical bull market. Here in Canada the S&P/TSX Composite is much further along in its corrective process thanks in large part to the recent weakness in precious metals stocks.

But it wasn’t all bad news on the week, Friday morning saw the release of Canadian jobs data for the month of October. Canadian employment rose by 66,600 in the month —a wickedly appropriate figure for Halloween —following a solid 60,400 advance in September and thus fully reversing the nasty two-month decline in mid-summer. The details of the report were much more nuanced than the rollicking headline would suggest, but even with some caveats this is a welcome result.

On the firmer side, the unemployment rate fell two ticks to 6.9%, with one of the largest declines in the number of unemployed (-49k) on record, aside from the pandemic. Even the youth jobless rate tumbled 6 ticks to 14.1%. The headline figure has held near 7% since the spring, and is still up half a point from a year ago, suggesting the Canadian economy continues to tread water amid the trade uncertainty. And, wage growth perked up a touch to 3.5% y/y (all workers).

Bottom Line: Even if the solid headline jobs tally received a temporary fillip from the Jays, it's an encouraging result overall, especially in light of the weight from the Alberta teachers strike. With the jobless rate dipping back below 7% and wages staying firm, it appears that the Bank of Canada will indeed pause in December.

Meanwhile, the Q3 earnings season continues to roll on and naturally the prominent theme throughout the earnings season is related to tech: AI and data centers, robots, driverless vehicles, defense, cybersecurity and cloud spend/migration for example. Investors are becoming more discriminating, rewarding those generating profits and/or converting AI into use cases but punishing those who are spending less discriminately or productively. This is especially true if the company has a record of investing significant sums in moonshot activities only to subsequently withdraw and write down. Investors are also punishing companies having difficulty executing well and/or seeing margins bogged down by inability to compete.

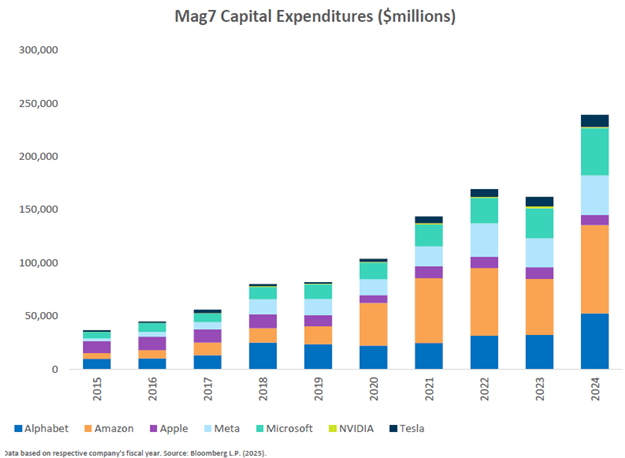

So far, six (Tesla, Meta, Apple, Microsoft, Alphabet and Amazon) of the Mag 7 have reported results. Their capital expenditures – already spent and pending – have shown large increases over prior periods. We see investors applying increased scrutiny to who is partnering with whom and the circularity of some deals. OpenAI, for example, has announced nearly $1.5 trillion in deals with all the primary cloud providers (Microsoft, Amazon, Google). Scrutiny is also increasing over how CapEx and joint ventures are being funded – from cash flow or financed by debt.

Despite the large numbers, companies are noting that they are substantially backlogged for every megawatt of compute they can bring online – giving investors and lenders alike some level of reassurance. Construction of data centers, reshoring of manufacturing activity and upgrading/expansion of grid and infrastructure needed to power the facilities is producing ripple effects in tangential industries such as materials, machinery, electricity and other utilities.

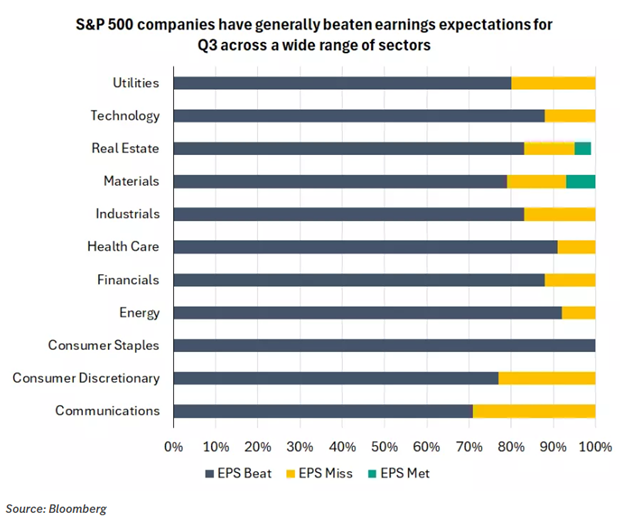

In fact, corporate profitability looks to be providing another marker of resilience in the U.S. economy. Around two-thirds of S&P 500 companies have now reported, and the vast majority of these companies delivered stronger-than-expected earnings. These upside surprises suggest that companies continue to perform well in the face of higher tariffs and slower growth.

While bumps are inevitable, we remain optimistic on the outlook. From a macroeconomic perspective, we see scope for an improvement in economic activity through 2026, likely helped by less restrictive interest rates, looser fiscal policy, and an easing drag from trade-policy disruptions.

Sources: BMO Economics:A Vladdy Good Month for Ye-Service Jobs, BMO Economics Both Sides Now, BMO Private Wealth: Weekly Strategy Prespectives Week Ended November 7, 2025

The opinions, estimates and projections contained herein are those of the author as of the date hereof and are subject to change without notice and may not reflect those of BMO Nesbitt Burns Inc. ("BMO NBI"). Every effort has been made to ensure that the contents have been compiled or derived from sources believed to be reliable and contain information and opinions that are accurate and complete. Information may be available to BMO Nesbitt Burns or its affiliates that is not reflected herein. However, neither the author nor BMO NBI makes any representation or warranty, express or implied, in respect thereof, takes any responsibility for any errors or omissions which may be contained herein or accepts any liability whatsoever for any loss arising from any use of or reliance on this report or its contents. This report is not to be construed as an offer to sell or a solicitation for or an offer to buy any securities. BMO NBI, its affiliates and/or their respective officers, directors or employees may from time to time acquire, hold or sell securities mentioned herein as principal or agent. NBI will buy from or sell to customers securities of issuers mentioned herein on a principal basis. BMO NBI, its affiliates, officers, directors or employees may have a long or short position in the securities discussed herein, related securities or in options, futures or other derivative instruments based thereon. BMO NBI or its affiliates may act as financial advisor and/or underwriter for the issuers mentioned herein and may receive remuneration for same. A significant lending relationship may exist between Bank of Montreal, or its affiliates, and certain of the issuers mentioned herein. BMO NBI is a wholly owned subsidiary of Bank of Montreal. Any U.S. person wishing to effect transactions in any security discussed herein should do so through BMO Nesbitt Burns Corp. Member-Canadian Investor Protection Fund.