Go Jays; Happy Halloween!

DHL Wealth Advisory - Oct 31, 2025

- Investment Services

- Portfolio Management

- Special Reports and Newsletters

- Total Client Experience

- Wealth Management

Last week marked the 3-year anniversary of the current bull market. It was October 22, 2022 when North American equities bottomed, having declined nearly 25% in the U.S. and 18% in Canada...

Last week marked the 3-year anniversary of the current bull market. It was October 22, 2022 when North American equities bottomed, having declined nearly 25% in the U.S. and 18% in Canada. The cause of the 2022 correction was the global fight against rampant inflation caused by excess fiscal and monetary stimulus following Covid. Central banks around the world were increasing interest rates at the fastest pace in generations. Now, this past week saw a pair of interest rate cuts by the Bank of Canada and US Federal Reserve.

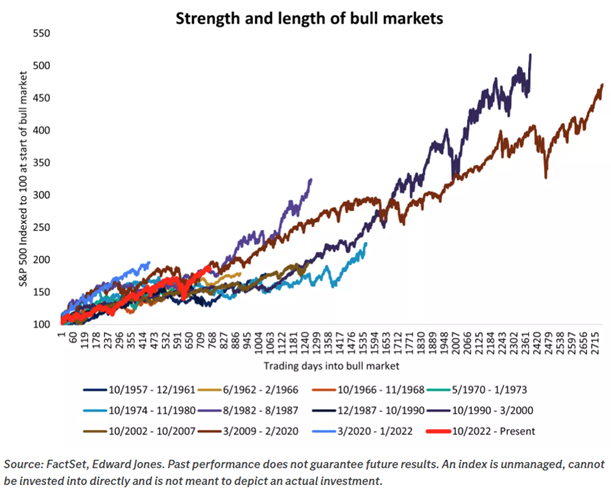

The folks at Edward Jones have found that since the October 2022 low, the S&P 500 has gained 90% (98% including dividends), while the TSX has advanced 67% and 83%, respectively. No doubt it’s been an impressive run, but this bull market isn’t an outlier in terms of strength or length. Looking back over the past 80 years, the 12 prior S&P 500 bull markets (excluding the current one) have averaged a gain of about 200% and lasted five years. Notably, eight of those made it past the three-year mark, with the longest (2009 to 2020) stretching 11 years.

So, this bull market is neither a toddler nor a senior citizen — it’s somewhere in the middle.

While history provides helpful context, it’s the fundamental conditions that will shape what comes next. As the saying goes, bull markets don’t die of old age — they end from recessions or central bank tightening. We believe neither is likely in 2026.

Last Friday we saw US Core CIP inflation that clearly and convincingly moderated in Setepber, which opened the door for the US Fed to cut their overnight rate 0.25% on Wednesday to a target range of 3.75-4.00%. The headline and core CPI both came in a tenth of a percentage point lower than the consensus view, at 0.3% and 0.2% in the month. The inflation pressures seen in the August CPI report appear to have dissipated in September.

In Canada, headline CPI rose to 2.4% in September, with core measures also edging higher. Despite the slight uptick in inflation, the BoC went ahead and cut their overnight rate 0.25% to 2.25%. That’s likely it, for now, for Bank of Canada easing. The Bank appears to believe that the easing to date will offer support; inflation is steadily on its way back to 2%; and the usefulness of monetary policy is somewhat limited in this unique economic environment. That said, we believe that ongoing softness in the job market leaves the door open for some further support, and another 25 bp rate is still on the table for early-2026.

Barring a late-year correction, the S&P 500 is on track to notch its third consecutive year of double-digit returns, pushing its price-to-earnings ratio to cycle highs. Valuations are likely approaching a ceiling, as investors may be reluctant to pay the lofty multiples seen during the tech bubble. Corporate earnings will need to take the lead in driving further market gains and extending the bull run.

Fortunately, the backdrop remains supportive. U.S. corporate profits continue to grow at a healthy pace, despite trade disruptions and a cooling labor market. So far, management commentary has emphasized consumer resilience, particularly among high-income households, along with stable credit quality and a pickup in mergers and acquisitions (M&A) activity. As tech giants begin to report, investors will be watching closely for updates on AI-related spending.

There will always be uncertainties, that’s simply part of investing. However, the foundation of the bull market remains solid, and 2026 is shaping up to be another constructive year for the market, in our view. Supporting this outlook are:

- Resilient and rising corporate earnings

- Modest fiscal stimulus via tax refunds and increased business investment

- A continuation of Fed and BoC rate cuts aimed at policy normalization

- Ample investor dry powder in cash-like investments.

Bottom line: A near-term pause could be healthy, allowing earnings to catch up to valuations. While the ride may become bumpier and leadership may evolve, we believe the bull market still has room to run.

Sources:BMO Economics: Fed Eases, But Mum on December, BMO Economics: BoC Decision and MPR — Cut and Done?

The opinions, estimates and projections contained herein are those of the author as of the date hereof and are subject to change without notice and may not reflect those of BMO Nesbitt Burns Inc. ("BMO NBI"). Every effort has been made to ensure that the contents have been compiled or derived from sources believed to be reliable and contain information and opinions that are accurate and complete. Information may be available to BMO Nesbitt Burns or its affiliates that is not reflected herein. However, neither the author nor BMO NBI makes any representation or warranty, express or implied, in respect thereof, takes any responsibility for any errors or omissions which may be contained herein or accepts any liability whatsoever for any loss arising from any use of or reliance on this report or its contents. This report is not to be construed as an offer to sell or a solicitation for or an offer to buy any securities. BMO NBI, its affiliates and/or their respective officers, directors or employees may from time to time acquire, hold or sell securities mentioned herein as principal or agent. NBI will buy from or sell to customers securities of issuers mentioned herein on a principal basis. BMO NBI, its affiliates, officers, directors or employees may have a long or short position in the securities discussed herein, related securities or in options, futures or other derivative instruments based thereon. BMO NBI or its affiliates may act as financial advisor and/or underwriter for the issuers mentioned herein and may receive remuneration for same. A significant lending relationship may exist between Bank of Montreal, or its affiliates, and certain of the issuers mentioned herein. BMO NBI is a wholly owned subsidiary of Bank of Montreal. Any U.S. person wishing to effect transactions in any security discussed herein should do so through BMO Nesbitt Burns Corp. Member-Canadian Investor Protection Fund.