Let's Go Jays!

DHL Wealth Advisory - Oct 24, 2025

- Investment Services

- Portfolio Management

- Special Reports and Newsletters

- Total Client Experience

- Wealth Management

After a six-month steady move higher, the S&P 500 and Canadian TSX have faced an up-tick in volatility in recent weeks...

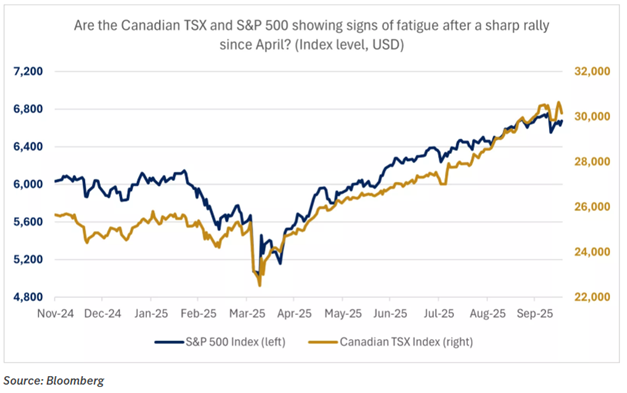

After a six-month steady move higher, the S&P 500 and Canadian TSX have faced an up-tick in volatility in recent weeks. Reasoning can be chalked-up to ongoing trade tensions between the U.S. and global partners, the ongoing U.S. government shutdown, and emerging concerns about small regional banks' credit quality. But the reality is that markets were due for a pause and a much-deserved breather.

Nonetheless, in our view a period of consolidation in the market should not morph into a deep or prolonged bear market. Favourable factors like central-bank rate cuts, positive corporate earnings growth, and supportive fiscal policies point to a solid fundamental backdrop heading into 2026.

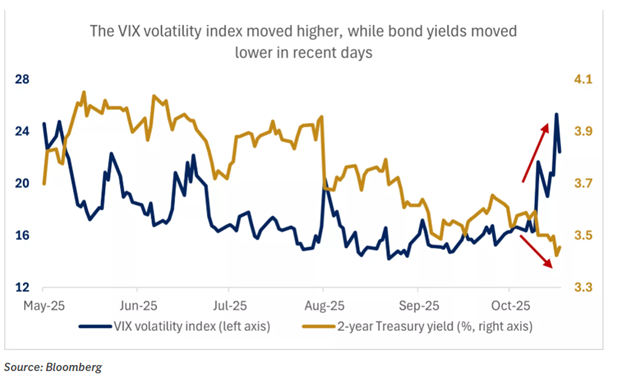

As the markets have digested uncertainties around tariffs, the U.S. government shutdown, and emerging concerns around small regional-bank credit quality, we have seen some signals of fatigue in the ongoing rally. First, the VIX volatility index, often referred to as the Wall Street fear gauge, has climbed above 20, after spending much of the last few months in the mid-teens. We have also seen larger one-day and intraday swings in markets overall, with the S&P logging its first 2% drawdown in one day since April on October 10. And third, we have seen a bid for safe-haven assets, with both U.S. and Canadian government bond yields moving lower and prices moving higher. The 2-year U.S. Treasury yield, for example, hit its lowest level since 2022 last week, reflecting in part the growing uncertainty in markets and the economic backdrop.

While the market rally may be tested – especially given uncertainty around trade, the U.S. government shutdown, and emerging credit concerns – we don't see any pullback or correction turning into a deep bear market. Why is that? We continue to see a number of favourable factors on the horizon, especially as we head toward 2026. These include a Federal Reserve that is on track for multiple interest-rate cuts (and a Bank of Canada that may have one additional rate cut ahead), a U.S. tax bill that should kick in and be supportive of capital expenditures and R&D spending, and ongoing positive corporate earnings growth in the U.S. and Canada.

In fact, third-quarter earnings season is now underway, and thus far earnings growth is on pace to exceed expectations. Forecasts call for full-year 2025 earnings to be about 10.5%, while 2026 earnings growth may accelerate to about 13%. And while earnings in the current year have been driven by technology and AI sectors, we think this is set to broaden in the year ahead, which may be supportive of a broader set of sector leadership as well.

In our view, investors can use any bouts of market volatility as opportunities to consider three actions: 1) Rebalancing: As equity markets have rallied, we may have seen parts of portfolios grow beyond their strategic allocation. For example, a balanced portfolio with 60% equities and 40% bonds may now be much more heavily weighted in equities. This is a good opportunity to consider rebalancing this portfolio to get aligned with the desired equity and bond risk balance. 2) Diversifying: Similarly, given the outsized rally in a few key sectors, including technology and AI in the U.S., investors may want to consider diversification of their portfolios, especially into those parts of the market that have more scope for catch-up. This could come by trimming gains in winners and reallocating, or by putting new money to work as well. 3) Adding quality investments at better prices: If markets do experience a correction or pullback, we believe investors should consider being prepared. Have a list of potential quality investments that align with your strategic allocations ready in order to use market corrections as opportunities to add to portfolios. While regularly employing dollar-cost averaging to make investments is a great strategy, there may be times that call for more opportunistic investment as well.

Lastly, any possible drama surrounding the Federal Reserve’s decision on Wednesday was fully drained from the markets by Friday’s relatively mild CPI result for September. An abrupt slowdown in the broad rental components helped hold core prices to a 0.2% monthly rise and clipped the yearly rate a tick to 3.0%. Headline inflation similarly came in at 3.0% even with a slightly heavier 0.3% monthly rise. While 3% inflation would hardly be cause for relief in pre-pandemic days, this first major official data release in weeks was warmly greeted by investors. Coming in a tenth below expectations, it all but locked in 25 bp Fed rate cuts both next week and in early December.

Looking a bit further ahead into 2026, BMO’s economics team suspects that the near-absence of serious tariff-related inflation sets the stage for additional cuts. After all, core goods prices, the very area one would expect tariffs to affect, rose a moderate 0.2% last month and 1.5% in the past year. True, that’s up from essentially no inflation in this category in the decade up to 2020, but it’s not the shape-shifting pace that many analysts expected in the wake of double-digit tariffs. And now with shelter cost inflation steadily moderating—to 3.6% y/y, less than half the 2023 peak, and nearly back to pre-2020 trends. Accordingly, the team continues to expect a follow-up 75 bps of further rate cuts in 2026, eventually bringing the fed funds rate to just below 3% from just above 4% now. All positive tailwinds for investors.

Source:BMO Economics Talking Points: On with the Show, This Is It

The opinions, estimates and projections contained herein are those of the author as of the date hereof and are subject to change without notice and may not reflect those of BMO Nesbitt Burns Inc. ("BMO NBI"). Every effort has been made to ensure that the contents have been compiled or derived from sources believed to be reliable and contain information and opinions that are accurate and complete. Information may be available to BMO Nesbitt Burns or its affiliates that is not reflected herein. However, neither the author nor BMO NBI makes any representation or warranty, express or implied, in respect thereof, takes any responsibility for any errors or omissions which may be contained herein or accepts any liability whatsoever for any loss arising from any use of or reliance on this report or its contents. This report is not to be construed as an offer to sell or a solicitation for or an offer to buy any securities. BMO NBI, its affiliates and/or their respective officers, directors or employees may from time to time acquire, hold or sell securities mentioned herein as principal or agent. NBI will buy from or sell to customers securities of issuers mentioned herein on a principal basis. BMO NBI, its affiliates, officers, directors or employees may have a long or short position in the securities discussed herein, related securities or in options, futures or other derivative instruments based thereon. BMO NBI or its affiliates may act as financial advisor and/or underwriter for the issuers mentioned herein and may receive remuneration for same. A significant lending relationship may exist between Bank of Montreal, or its affiliates, and certain of the issuers mentioned herein. BMO NBI is a wholly owned subsidiary of Bank of Montreal. Any U.S. person wishing to effect transactions in any security discussed herein should do so through BMO Nesbitt Burns Corp. Member-Canadian Investor Protection Fund.