Let's Go Jays!

DHL Wealth Advisory - Oct 03, 2025

Global stocks have been repeatedly hitting new highs, leaving investors looking over their shoulders for the bubble-bursting bogey man to appear. The bad news...

Global stocks have been repeatedly hitting new highs, leaving investors looking over their shoulders for the bubble-bursting bogey man to appear. The bad news: extremes have been part of the economic cycle since before the days of hyper-priced tulip bulbs; some sort of pullback would be the norm, not the exception. The good news: pullbacks tend to be short lived (particularly when economic fundamentals remain largely intact) and equity markets are upwardly biased by nature. Preparation and a constructive mindset can help smooth the way if/when wobbles occur.

A long list of stock market indexes made headlines yet again this week with simultaneous drives to all-time highs. The Dow Jones Industrial Average, S&P 500, NASDAQ and S&P/TSX all set records. In an important nod to breadth and depth, even the equal-weighted S&P 500 (which neutralizes the impact of size)and Russell 2000 (an important small-cap yardstick) scaled new peaks.

This year, markets have done a laudable job of looking past many frightening developments and policy shifts – didn’t the US government just shut down? They have remained focused on corporate and economic fundamentals, which have been surprisingly hardy. Evidencing this, aggregate S&P 500 earnings have increased by double digits for the last three consecutive quarters. Robust spending on data centers and the energy infrastructure to power them, plus the spreading use of AI, have also enabled participants to cling to an optimistic thesis. While the market’s advance has been underpinned by better-than-expected profits, earnings multiples have also expanded, leaving valuations high compared to recent history.

We are not immune to the growing sense of anxiety. Having lived (and invested) through multiple downturns. We are well aware of the current environment’s similarities and differences to prior exuberant periods. Calls to revise valuation metrics to fit a new technological age, plus assertions that it should all be viewed through a shiny new lens, trigger Spidey-sense warning bells. Yet, in much the same way that every demographic cohort is shaped by their collective experiences, a number of factors are uniquely shaping the current environment and may well influence the shape of things to come. In this week’s edition we will focus on questions we are fielding.

#1) “Valuations are high – how much better can it get?”

Yes, valuations are rich. But valuations alone don’t kill bull markets (nor do they revive bear markets). Stocks can remain overpriced or underpriced for longer than fundamentals dictate. On the other hand, there is plenty of structural support undergirding the current economy. We see potential for earnings to surprise to the upside since much of the tariff adaptation is already in progress, for instance, and a host of pro-growth factors are picking up steam (reduced regulation, faster permitting, more lenient review of mergers and acquisitions, favorable tax treatment of research and development and construction expenditures). S&P 500 earnings are projected to continue their double-digit growth pattern moving into 2026, with a number of industries outside of tech participating. There are encouraging signs down the market cap scale, too, as 2026 earnings expectations for smaller companies (e.g., S&P 600) are turning decisively positive.

#2) “Markets are too concentrated.”

It’s true that the averages have become highly concentrated in the technology and communication services sectors – but so has the economy as we transition from the dominance of manufacturing that was prevalent until mid-last century. Donald Trump’s multi-faceted actions designed to bring key manufacturing back to the U.S. may eventually shift this over time, though the change will likely be gradual. In the meantime, recent market action has revealed a healthy broadening of market participation – a key factor we will be monitoring. This bull market to date has been one of the most distrusted in recent memory because broad exuberance has been lacking, rotating recessions in various sectors have occurred (housing, consumer staples, manufacturing) and investor cash on hand has been ample.

#3) “Spending on data centers and tech personnel is out of hand.”

Bull markets/economic bubbles don’t end from valuation or old age. More often they fray due to a number of factors:

• Financial excess – typically, it’s financed with debt (housing bubble, railroad buildouts in the U.S., Canada, and U.K. in the 1800s) and/or entails new instruments (portfolio insurance in 1987 crash, packaged mortgage-backed securities in the 2008/9 GFC)

• Over concentration in a single sub-sector that has unsustainable underpinnings (e.g., dotcoms where many of the companies never achieved profitability or revenue positive status).

It’s accurate to say that eye watering levels of investment are going into data centers and companies are poaching each other’s technical talent. But a vital differentiator is that (as of now) these expenses are being funded by a relatively narrow cast of players who are using cash flow to pay as they go. That cash flow is being generated by other highly profitable, revenue-generating segments within those companies.

Similar to other infrastructure buildouts (e.g., railroads, satellite, cable TV, internet 1.0 and undersea cable), there may eventually be interim overcapacity that will negatively impact a company or subsector. In these examples, however, that capacity was eventually put to solid use as technology advanced, prices dropped and new applications became viable. In the current race to build out data center and cloud computing resources, an argument could be made that should excess capacity appear, it could similarly push down costs for users and facilitate substantial upticks in usage. This is precisely what happened in the early 2000s when we saw an overbuild in initial internet infrastructure. That over-capacity was eventually leveraged when the iPhone launched in 2007 and plummeting data-processing costs put minicomputers in our palms.

#4) “Economic statistics are softening.”

Recent economic numbers do bear watching, particularly relative to employment. It is constructive that the Federal Reserve is also keenly attuned to readings here – the U.S. economy relies heavily on the willingness of consumers to spend (and spend freely). Many of the data series we rely on are backward looking and complicated by business’s preoccupation in recent quarters with adapting to shifting regulations and policies. We do think the shift of focus toward settling many of the trade-related issues, plus reducing regulatory and transactional frictions, could stabilize/turn the tide constructively for many.

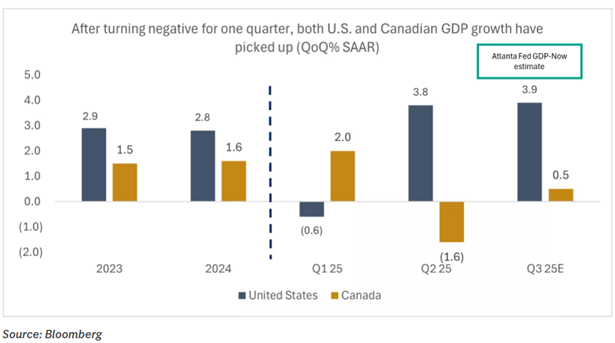

Meanwhile, over the last week, economic data in the U.S. and Canada have pointed to economies that seem to be holding up better than expectations. In the U.S., the final estimate of second-quarter GDP growth was revised higher to a robust 3.8% annualized, versus forecasts of 3.3%. This is well above trend growth rates in the U.S. of 1.5% to 2.0%. Of note is that consumption, which drives about 70% of economic growth, also came in above expectations, at a healthy 2.5%, compared to forecasts of 1.7%.

In Canada, GDP growth in July was positive for the first month after three months of contraction. Monthly GDP came in at 0.2%, versus forecasts of 0.1%, while yearly GDP growth was 0.9% versus expectations of 0.7%. In part, the better growth figures may have been driven by an easing of tariff uncertainty, which was weighing heavily on the goods sector of the Canadian economy.

Implications for investors

Heeding Mr. Buffet’s admonition that “investors wanting to do well had better learn how to deal” we offer a few suggestions:

Remember TIME IN the market is more important than TIMING the market – multiple academic studies and decades of experience point to the futility (and cost) of trying to get it right when deciding to either “sell it all” or “put me back in.” The power of compounding only works if the money is at work.

It's not what you make, it’s what you keep – regular rebalancing is the best course (trimming back assets that have done well to align with long-term targets and using proceeds to round up those that have underperformed but still have reasonable fundamentals). Regular readjustment course-corrects you toward your long-term strategic goals and can help smooth the peaks and troughs in specific investments. Given the forward-looking bias of the markets, an asset class may start moving long before the fundamentals are widely recognized. Another action that some find psychologically reassuring is to peel back gains (or a percentage of gains) earned over a certain period. In effect, it’s taking the house money off the table and putting it to strategic use (or saving) elsewhere. In fact, this is what we have been doing the last 6-weeks in our discretionary mandates.

Diversify investment exposure – while the headlines focus on AI, data center and cloud spend, interesting things are going on in energy, utilities, drug discovery, defense, and space plus a host of other industries. Geographic diversification can also be helpful. The changing trade, immigration and geopolitical policies of the U.S. are creating interesting arrangements, deals and joint ventures elsewhere.

Learning to lean into volatility – a long-term focus can turn short-term moves into fruitful opportunities to put some of that sidelined cash to work.

Overall,the U.S. and Canadian economies appear to be stabilizing after a period of uncertainty. While there are near-term risks that could put a pause to the positive momentum, we believe these will prove temporary given the improving fundamentals of the economy.

Source: BMO Private Wealth: Weekly Strategy Perspectives: Capital Market (R)Evolution

The opinions, estimates and projections contained herein are those of the author as of the date hereof and are subject to change without notice and may not reflect those of BMO Nesbitt Burns Inc. ("BMO NBI"). Every effort has been made to ensure that the contents have been compiled or derived from sources believed to be reliable and contain information and opinions that are accurate and complete. Information may be available to BMO Nesbitt Burns or its affiliates that is not reflected herein. However, neither the author nor BMO NBI makes any representation or warranty, express or implied, in respect thereof, takes any responsibility for any errors or omissions which may be contained herein or accepts any liability whatsoever for any loss arising from any use of or reliance on this report or its contents. This report is not to be construed as an offer to sell or a solicitation for or an offer to buy any securities. BMO NBI, its affiliates and/or their respective officers, directors or employees may from time to time acquire, hold or sell securities mentioned herein as principal or agent. NBI will buy from or sell to customers securities of issuers mentioned herein on a principal basis. BMO NBI, its affiliates, officers, directors or employees may have a long or short position in the securities discussed herein, related securities or in options, futures or other derivative instruments based thereon. BMO NBI or its affiliates may act as financial advisor and/or underwriter for the issuers mentioned herein and may receive remuneration for same. A significant lending relationship may exist between Bank of Montreal, or its affiliates, and certain of the issuers mentioned herein. BMO NBI is a wholly owned subsidiary of Bank of Montreal. Any U.S. person wishing to effect transactions in any security discussed herein should do so through BMO Nesbitt Burns Corp. Member-Canadian Investor Protection Fund.