Cue The Rate Cutting Campaign

DHL Wealth Advisory - Sep 12, 2025

- Investment Services

- Portfolio Management

- Special Reports and Newsletters

- Total Client Experience

- Wealth Management

Yes. It was yet another week of record highs for North American benchmarks with Canada’s TSX adding to its lead over our counterparts to the South...

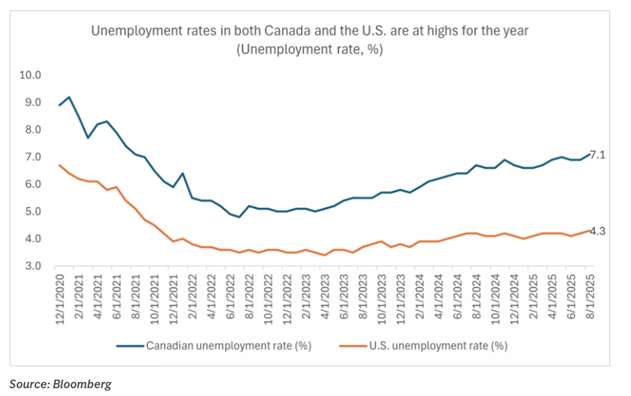

Yes. It was yet another week of record highs for North American benchmarks with Canada’s TSX adding to its lead over our counterparts to the South. These gains were made in the face of data that shows clear signals of softening in the Canadian and U.S. labour market. In Canada, the net change in employment for August was -65,500, well below the forecast of 5,000, and the unemployment rate ticked higher to 7.1%. In the U.S., the August jobs reported indicated 22,000 jobs added last month, well below the expectations of 75,000. The U.S. unemployment rate also ticked higher from 4.2% to 4.3%.

The reasons for market gains, however, is markets are now expecting both the Bank of Canada (BoC) and the Federal Reserve to lower interest rates this year – next week, in fact. The rising expectation of central-bank rate cuts has pushed government bond yields lower, which is supportive of consumer and corporate borrowing over time.

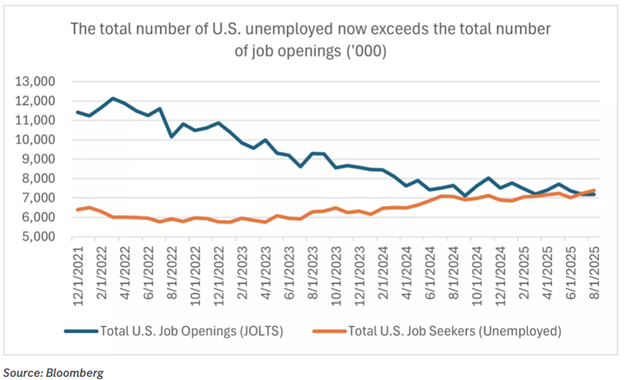

For the first time since 2021, the total number of U.S. job openings fell below the number of those seeking jobs. In fact, job openings overall fell to the lowest level since 2020, implying that employers are pulling back on hiring, in part by removing existing job postings.

Given the weakening labour-market data, we would expect the Fed and BoC to step in and provide monetary-policy support. Keep in mind that Fed Chair Jerome Powell noted just last month at the Jackson Hole symposium that a shift in monetary policy may be warranted, especially as the labour market has the potential to more quickly deteriorate.

A key question now for investors, in our view, is not only will the Fed and BoC cut rates, but by how much and how often.

After holding its target rate steady for nearly 9 months, markets are now expecting 100% probability of a rate cut in September, according to CME FedWatch. In fact, markets now see about a 12% chance that the Fed will cut rates by an outsized 0.5% rather than the more traditional 0.25% rate cut. Overall, markets are now forecasting six total rate cuts by the Fed, bringing the fed funds rate to around 3.0% in 2026, according to the CME data.

The Bank of Canada’s decision is not a foregone conclusion, although most believe that the pronounced weakness in employment in recent months and the heavy drop in Q2 GDP have weighed the scales to a 25 bp cut next week. There was really no major new news on the domestic front for the Bank to chew on this week. While the unveiling of five new “nation-building projects” was intriguing, the reality is that these were all already on the books and unlikely to move the macro needle. Next week’s calendar is much heavier, as the Bank will get a raft of new info in the days prior to the rate decision, highlighted by Tuesday’s CPI, but also including home sales and starts for August.

BMO’s economics team expects the Bank of Canada to trim rates and keep the door open for more. Their call stands at a total of three cuts, taking the overnight rate down to 2.0%. The stickiness of core CPI is the strongest argument against a more aggressive rate cut campaign and may even prompt the BoC to move in staggered steps. But bigger picture, with the jobless rate pushing above 7% and the housing market listing sideways, there’s a good case for the Bank to bring rates to the low end of their neutral range (officially 2.25%-to-3.25%), or even a bit below. True, monetary policy can’t ‘fix’ the trade war, but it can set the conditions for the rest of the economy to prosper.

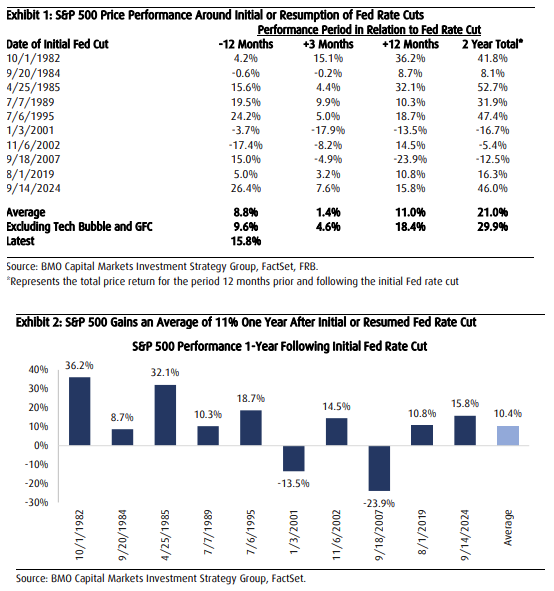

Obviously, we have received many questions about what this could mean for market performance going forward so we thought it would make sense to put out a quick note analyzing historical performance patterns following an initial or the resumption of a rate cut(s). BMO’s Chief Investment Strategist Brian Belski identified ten such cycles going back to 1982 when the Fed started officially announcing its policy actions.

According to his analysis, the S&P 500 delivered positive returns in the 12 months following such rate cuts for eight of the ten cycles with an average gain of 10.4%. However, the macro context behind the moves mattered a great deal, which is why performance varied so significantly around these turning points ranging from -23.9% to 32.1%. In cycles where rate cuts were able to prolong economic expansion and keep corporate earnings on an upward trend, stocks performed quite well. However, in cycles where monetary stimulus was unable to prevent an economic downturn (i.e., 2001 and 2007), stocks recorded losses in the following year as earnings growth struggled.

Fortunately, the current environment appears to fall into the former category. Yes, labor markets have certainly cooled but jobs are still being added and leading job indicators (i.e., jobless claims) remain well behaved when put into a historical context. In addition, GDP is still tracking slightly above trend according to the GDP Now estimate from the Atlanta Fed, while S&P 500 earnings are expected to grow at a double-digit clip for all upcoming quarters through the end of 2026. Therefore, Belski believes investor debate about the size and depth of the upcoming rate cuts somewhat misses the point – so long as nothing breaks in the economy US stocks remain firmly within a bull market, but with significantly strong trailing one-year performance headed into this potential rate cut, future gains may to be more muted relative to historical norms, in his view.

Sources: BMO Economics Talking Points: The Cutting Crew… Goes to 11, BMO Capital Markets: US Strategy Comment Fed Rate Cuts and Market Performance

The opinions, estimates and projections contained herein are those of the author as of the date hereof and are subject to change without notice and may not reflect those of BMO Nesbitt Burns Inc. ("BMO NBI"). Every effort has been made to ensure that the contents have been compiled or derived from sources believed to be reliable and contain information and opinions that are accurate and complete. Information may be available to BMO Nesbitt Burns or its affiliates that is not reflected herein. However, neither the author nor BMO NBI makes any representation or warranty, express or implied, in respect thereof, takes any responsibility for any errors or omissions which may be contained herein or accepts any liability whatsoever for any loss arising from any use of or reliance on this report or its contents. This report is not to be construed as an offer to sell or a solicitation for or an offer to buy any securities. BMO NBI, its affiliates and/or their respective officers, directors or employees may from time to time acquire, hold or sell securities mentioned herein as principal or agent. NBI will buy from or sell to customers securities of issuers mentioned herein on a principal basis. BMO NBI, its affiliates, officers, directors or employees may have a long or short position in the securities discussed herein, related securities or in options, futures or other derivative instruments based thereon. BMO NBI or its affiliates may act as financial advisor and/or underwriter for the issuers mentioned herein and may receive remuneration for same. A significant lending relationship may exist between Bank of Montreal, or its affiliates, and certain of the issuers mentioned herein. BMO NBI is a wholly owned subsidiary of Bank of Montreal. Any U.S. person wishing to effect transactions in any security discussed herein should do so through BMO Nesbitt Burns Corp. Member-Canadian Investor Protection Fund.