Monthly Trade Note. K.C.C.O…

DHL Wealth Advisory - May 01, 2025

- Investment Services

- Portfolio Management

- Special Reports and Newsletters

- Total Client Experience

- Wealth Management

Growth slump or recession? Despite the U.S. reciprocal tariffs falling to a blanket level of 10% for most countries, the U.S. effective tariff rate on U.S. imports has gone from 2% to around 21%...

Global economy

Growth slump or recession? Despite the U.S. reciprocal tariffs falling to a blanket level of 10% for most countries, the U.S. effective tariff rate on U.S. imports has gone from 2% to around 21%. This is a tenfold increase that the global economy cannot absorb, especially supply and production chains. The risk is that bilateral trade negotiations extend beyond the 90-day pause as the Trump administration seeks trade deals whereby foreign countries not only reduce tariffs on U.S. goods and remove non-tariff barriers but also commit to either purchasing U.S. goods, making strategic investments in the U.S., or both.

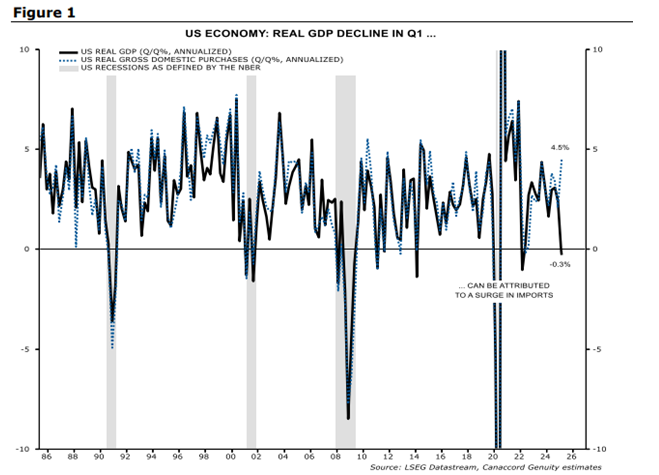

For now, the contraction of the U.S. economy in the first quarter of 2025 does not necessarily imply an imminent recession, in our view. The surge in U.S. imports in the first quarter is such that investors should fade the Gross Domestic Product (GDP) contraction. As scene below, the Growth in Gross Domestic Purchases was very healthy at 4.5%.

In the second quarter, an easing in financial conditions (i.e., decline in bond yields and U.S. dollar depreciation) and tariff front-running may boost U.S. consumption and keep the gap between strong hard data and weak soft data wider for longer. Nevertheless, a slowing in growth outside the U.S. is underway and more softness should be expected due to tightening financial conditions and reduced U.S. imports. To be clear, the economic backdrop is not as dire as through the last recession scare in 2022, but an additional period of weakness should not be ruled out.

Asset Mix

Bonds (Overweight)

Is growth more concerning than inflation? A downshift in global growth is underway and contrary to past growth scares, the Japanese yen is strengthening, hence prompting the Bank of Japan (BoJ) to halt its sales of U.S. Treasuries. Thus, we think conditions are in place for the U.S. 10-year Treasury yield (US10Y) to break below 4% as growth outweighs inflation concerns. This flight to safety should resume the uptrend in credit spreads.

Commodities (Neutral)

Consolidation time for gold? As a group, commodity prices are stuck in a range with strength in precious metals offset by losses in industrial commodities. The price of gold is stretched relative to copper and oil. Tack on an oversold U.S. dollar and the negative seasonality for gold in May-June, and we think further consolidation is likely before the bullion resumes its advance. Buy pullbacks.

Equities (Neutral)

Sitting tight with non-U.S. stocks. We believe Canadian, EAFE Index (Europe, Australasia, and the Far East) and Emerging Market equities can hold up if there is further U.S. dollar depreciation potential and further headroom for US-World valuation convergence. On the former, we see the USD Dollar basket (DYX) bottoming around the 90-support level, and on the latter, US-World valuation gaps remain much above historical averages and a narrowing in US-World earnings per share (EPS) growth expectations should drive further convergence.

Our analysis of S&P 500 historical returns around 1) top-10 S&P 500 daily returns, 2) 20% drawdowns and 3) relief rallies during bear markets suggests a market churning phase to begin. While the February-April decline was tariff-related or policy induced, the next consolidation catalyst is likely around the second-order impact of tariffs, which we think is a slowdown with the Fed standing ready to provide a different type of backstop vs prior market corrections. This time around the Fed needs to be cognizant of inflation while trying to balance employment.

While a policy-driven correction provides no precedent for stocks, a replay of the 2000-02 and 2008-09 deep bear markets seems unlikely because there is no disequilibrium at the corporate and consumer levels. In 2000-2002, there was excessive corporate debt due to the dotcom capex boom and in 2008-09 there was excessive consumer debt because of the housing bubble. This time, it is the government that is levered up, so it is the U.S. dollar and bonds (eventually) that should bear the brunt of the fiscal indiscipline.

Sector Rotation/Themes

Stick to defensives over cyclicals. Our analysis of relative performance and relative valuation across sectors suggests defensives are neither overbought nor overvalued enough to rotate into cyclicals, which are also neither oversold nor undervalued enough to be bought. Through the 1990-91, 2001-02, 2008-09 and 2020 recessions, the defensives-to-cyclicals price and valuation ratios reached much higher levels.

Energy (MW):

Lowering our year-end target range to $50-65/bbl on rising supply and waning demand.

Fertilizers (OW):

Lift from market weight to overweight on rising prices confirming an upturn in fundamentals.

Golds (OW):

Further liquidation likely through the negative May-June seasonality but dips should be bought.

Machinery (UW):

Sell any strength as April regional capex surveys signal a further slowing in industry sales.

U.S. Pharmas (OW):

Will the awakening of Pfizer turn investors’ attention to brightening fundamentals?

Cdn. Banks (MW):

Fade results from property and casualty (P&C) and capital markets and focus on loan-loss provisions.

U.S. Technology (UW):

Relative industry fundamentals and first quarter results reinforce software over semis.

Trades

Added

Aritzia (ATZ-TSX) & Amazon (AMZN-NASQ)

We were opportunistic on both names following the substantial correction surrounding the “Liberation Day” tariff announcement. Both names traded down over 20% from their highs and overshot to the downside, in our opinion. We added to both of our positions near their April lows.

Cash

We raised our cash weighting from a neutral 2% position, to an overweight of roughly 8%.

Sold

Salesforce (CRM-NASQ)

We excited our position in Salesforce the last day of April, taking a small loss. We felt the market recovery from the April bottom was warranted, but future weakness in U.S. tech is the more likely outcome in the next few quarters. As such, we may revisit this name on weakness.

Trimmed

Artemis Gold (ARTG-TSX), Kinross (K-TSX), AltaGas (ALA-TSX), Nutrien (NTR-TSX), Pembina Pipeline (PPL-TSX), Peyto (PEY-TSX), TC Energy (TRP-TSX), Telus (T-TSX), Uber (UBER-NASQ)

Again, on the final day of April we were opportunist on strength in most of these stocks to trim a small 25-50bps off each around new-highs. We have not exited any of these positions, as we continue to like their fundamental outlook. Rather, we felt that raising an additional 5-6% in cash was the prudent approach.

Source: Canaccord Genuity Capital Markets Portfolio Strategy Incubator | Mid-Week Market Observations (US$ Corrections vs. Asset Classes and Global Equities)

The opinions, estimates and projections contained herein are those of the author as of the date hereof and are subject to change without notice and may not reflect those of BMO Nesbitt Burns Inc. ("BMO NBI"). Every effort has been made to ensure that the contents have been compiled or derived from sources believed to be reliable and contain information and opinions that are accurate and complete. Information may be available to BMO Nesbitt Burns or its affiliates that is not reflected herein. However, neither the author nor BMO NBI makes any representation or warranty, express or implied, in respect thereof, takes any responsibility for any errors or omissions which may be contained herein or accepts any liability whatsoever for any loss arising from any use of or reliance on this report or its contents. This report is not to be construed as an offer to sell or a solicitation for or an offer to buy any securities. BMO NBI, its affiliates and/or their respective officers, directors or employees may from time to time acquire, hold or sell securities mentioned herein as principal or agent. NBI will buy from or sell to customers securities of issuers mentioned herein on a principal basis. BMO NBI, its affiliates, officers, directors or employees may have a long or short position in the securities discussed herein, related securities or in options, futures or other derivative instruments based thereon. BMO NBI or its affiliates may act as financial advisor and/or underwriter for the issuers mentioned herein and may receive remuneration for same. A significant lending relationship may exist between Bank of Montreal, or its affiliates, and certain of the issuers mentioned herein. BMO NBI is a wholly owned subsidiary of Bank of Montreal. Any U.S. person wishing to effect transactions in any security discussed herein should do so through BMO Nesbitt Burns Corp. Member-Canadian Investor Protection Fund.