Canadian Exceptionalism.

DHL Wealth Advisory - Mar 27, 2025

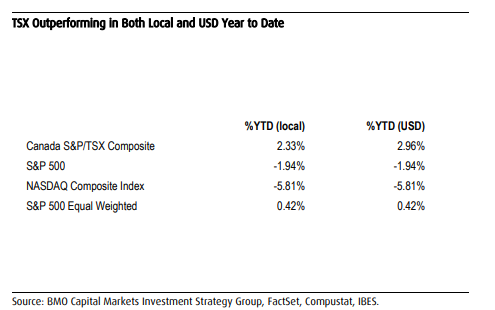

Despite extreme levels of pessimism, fear, and elevated rhetoric to say the least, the S&P/TSX has climbed the proverbial wall of worry and is now up 1.5% year to date, outperforming the S&P 500, which is down 3.2% as of mid-day March 27th...

Despite extreme levels of pessimism, fear, and elevated rhetoric to say the least, the S&P/TSX has climbed the proverbial wall of worry and is now up 1.5% year to date, outperforming the S&P 500, which is down 3.2% as of mid-day March 27th. As we cue our broken record, we believe Canada’s strong relative value position, returning equity flows, and overall broadening of US equity performance are all helping Canada outperform its neighbour to the south – period.

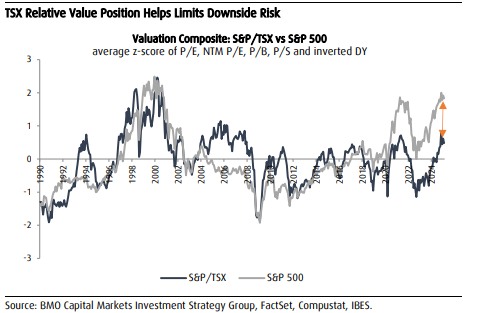

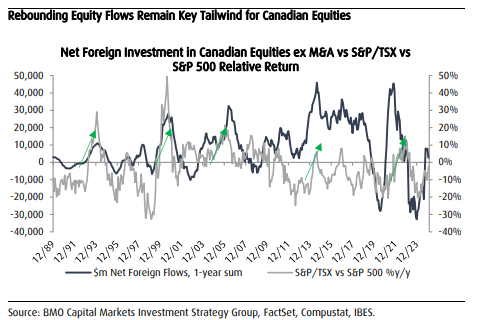

From our perspective, none of these core drivers have changed. Canada remains a strong relative value play that can and will continue to converge with the US. In fact, we believe the value proposition that Canadian stocks offer will continue to act as a strong buffer during down days, thereby limiting the downside of the TSX relative to the US. Furthermore, we have seen a sharp reversal in net foreign equity flows into Canada over the last six months, with 12-month trailing net equity flows turning positive for the first time since 2022. Overall, our view on Canada remains resolute. Canadian equities remain well-positioned for normalization and will likely continue to outperform as North American equity performance broadens out, valuations normalize, and earnings growth trends stabilize.

Highlights:

- Canada’s Strong Relative Value Position Has Created a Downside Performance Buffer

- As we have been saying for some time, Canadian equities’ attractive relative value position creates downside protection, being a major factor for Canada’s recent outperformance. We continue to expect this valuation spread versus the US to narrow as the TSX earnings recovery continues.

- Foreign Flows Into Canada Have Clearly Rebounded, Adding Continued Support for Canadian Equities

- On a one-year sum basis, equity flows into Canada have turned sharply positive since the fourth quarter of 2024. This has aligned with the sharp improvement in Canadian equity relative performance versus the US.

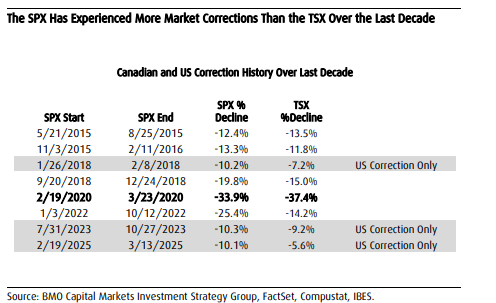

- The S&P 500 Has Experienced More Corrections Over the Last Decade Than the S&P/TSX

- There has been no Canadian correction or bear market that wasn’t also a US correction or bear market over the last decade, but there have been three US corrections that did not result in a Canadian correction

Implementation Strategies:

- BMO’s Chief Investment Strategist Brian Belski highlights some high-quality Canadian brands that fit the theme: SHOP, WCN, ATD, ATZ, RY, TD, MFC, BN. If you would like additional commentary on these names, please reach out.

Source: Canadian Strategy Snapshot: Yes, Facts Are Facts – Canada Is Outperforming

The opinions, estimates and projections contained herein are those of the author as of the date hereof and are subject to change without notice and may not reflect those of BMO Nesbitt Burns Inc. ("BMO NBI"). Every effort has been made to ensure that the contents have been compiled or derived from sources believed to be reliable and contain information and opinions that are accurate and complete. Information may be available to BMO Nesbitt Burns or its affiliates that is not reflected herein. However, neither the author nor BMO NBI makes any representation or warranty, express or implied, in respect thereof, takes any responsibility for any errors or omissions which may be contained herein or accepts any liability whatsoever for any loss arising from any use of or reliance on this report or its contents. This report is not to be construed as an offer to sell or a solicitation for or an offer to buy any securities. BMO NBI, its affiliates and/or their respective officers, directors or employees may from time to time acquire, hold or sell securities mentioned herein as principal or agent. NBI will buy from or sell to customers securities of issuers mentioned herein on a principal basis. BMO NBI, its affiliates, officers, directors or employees may have a long or short position in the securities discussed herein, related securities or in options, futures or other derivative instruments based thereon. BMO NBI or its affiliates may act as financial advisor and/or underwriter for the issuers mentioned herein and may receive remuneration for same. A significant lending relationship may exist between Bank of Montreal, or its affiliates, and certain of the issuers mentioned herein. BMO NBI is a wholly owned subsidiary of Bank of Montreal. Any U.S. person wishing to effect transactions in any security discussed herein should do so through BMO Nesbitt Burns Corp. Member-Canadian Investor Protection Fund.