30 Days of Peace

DHL Wealth Advisory - Feb 07, 2025

- Investment Services

- Portfolio Management

- Special Reports and Newsletters

- Total Client Experience

- Wealth Management

Following a 2.5% decline in December, the S&P 500 posted a gain of 2.7% during January with the index closing the month only 1.3% from a record level. However, the path proved to be a bumpy one...

Following a 2.5% decline in December, the S&P 500 posted a gain of 2.7% during January with the index closing the month only 1.3% from a record level. However, the path proved to be a bumpy one. December’s weakness spilled over during the early part of the month as it seemed like the “good news is bad news” narrative had taken over again given that a series of stronger-than-expected economic data points had put a damper on aggressive market expectations for multiple Fed rate cuts this year which resulted in a sharp increase in bond yields. The S&P 500 managed to shake off its early January malaise during the second half of the month as a cooler-than-expected CPI report and strong bank earnings tempered the anxiety but the tech stock rout towards the end of the month was a reminder that there remains a decent amount of headline risk, especially considering that the expectation bar is much higher this year compared to the previous two years (and specifically for AI-driven investment themes).

Source: US Strategy

Despite recent volatility, we remain confident in our bullish outlook for 2025 and have not seen any material changes in the fundamental backdrop of US equities yet to suggest there is significant trouble on the horizon. Nonetheless, given current market dynamics, we do believe price swings and bouts of volatility will become more frequent in the coming months, and will require further discipline and perspective from investors, in our view. As such, we have been highlighting two of our most favored investment strategies, dividend growth and quality, as potential ways to navigate the current and anticipated conditions. Our work shows that these sorts of strategies have outperformed in a variety of market environments and can benefit those investors looking to protect portfolios, as well as those investors looking to bolster performance.

Source: US Strategy

While most investors have been focused on the headlines and overall market levels, we believe some important developments may have been overlooked last month, some of which we believe will become trends throughout the year and help to support our market outlook. First and foremost, technology performance concentration worries have been a mainstay throughout this bull market yet the S&P 500 managed to deliver an above average monthly gain even though technology was the only sector to post a loss last month. In fact, January was only the second month during this bull market where the S&P 500 posted a gain with a loss for Technology shares, and it also represented the sector’s largest monthly underperformance since 2016. While we do expect Technology to bounce back, we believe this can be an early indication that investors are starting to rotate into other underappreciated areas of the market with more reasonable valuation levels. Indeed, the S&P 500 equal weight index, Russell 1000 Value, S&P 400, and S&P 600 all outperformed last month, which has been a relatively rare occurrence since late 2022, while 356 S&P 500 stocks registered a monthly gain about 30% higher than the historical average. We continue to believe that these broadening participation trends will continue throughout 2025 and represent an excellent opportunity for more active vs. passive strategies.

Source: US Strategy

Now our regularly scheduled content would not be complete without an update on Tariffs. The lingering risk of trade tariffs being introduced by the U.S. and Canadian governments has injected uncertainty into the economic and investment outlook, though there may be long-term opportunities despite financial market volatility. In a whirlwind of trade policy, U.S. President Donald Trump went from ordering a 25% tariff on all Canadian goods and a 10% duty on Canadian energy to pausing them on Monday for 30 days. The threat of U.S. tariffs and retaliation by Canada has upended economic projections and caused businesses and investors to revisit their strategies.

Source: Tariff Pause: What’s Next? Economics and Markets Impact

One way for Canada to lesson the blow is to reduce interprovincial trade barriers. Deputy Chief Economist and Michael Gregory believes this could add anywhere between 4.5% and 8% to Canada’s GDP over the long run. As for currency Gregory is forecasting that the Bank of Canada will likely cut more to help support the economy. While there are a variety of regulations that would need to be reworked, breaking down those barriers would be “powerful,” he noted. “What we’re facing might compel us to make those changes.”

Source: Tariff Pause: What’s Next? Economics and Markets Impact

At the same time, Canada needs to diversify globally, he said. In the latter half of the 2010s, the country signed free trade agreements with Europe and countries in the Pacific Rim, so there are other markets to consider. Gregory believes it’s easier to focus on the U.S., but now is the time we need to look at other options.The markets may have overreacted to the tariff news. This sort of market volatility can lead to opportunities for disciplined investors. For example, the stocks for auto component makers reacted to the tariffs falling by 6% prior to Monday, and an additional 7% on Monday. The sector has now rebounded by as much as it has lost. BMO’s Chief Investment strategist Brian Belski believes that these pullbacks provide long-term opportunities, and that investors must stay disciplined in volatile situations. His advice to investors is to not react but instead act and employ discipline.

Source: Tariff Pause: What’s Next? Economics and Markets Impact

BMO is sticking to its target of 28,500 and earnings of $1,600 for the S&P/TSX and 6,700 and $275 in earnings for the S&P 500. While there may be periods of increased volatility there will be entry points in the market for those buying good businesses. We remain optimistic for 2025 as both the Canadian and U.S. stock markets remain fundamentally sound.

Source: Tariff Pause: What’s Next? Economics and Markets Impact

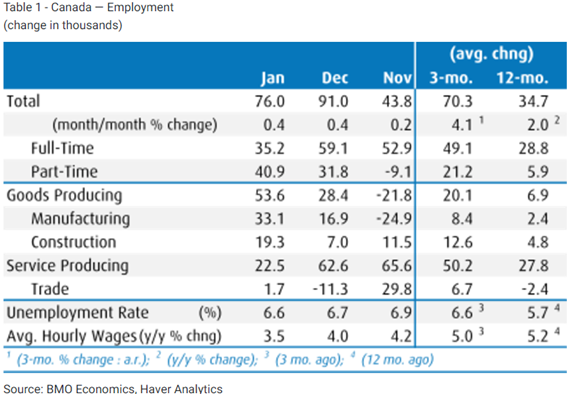

Pivoting to the job market Canadian employment rose by a sturdy 76,000 in January following the rollicking 91,000 advance in the prior month. In the past three months alone, overall employment is up 1.0%, or 211,000 net new jobs, a pace of growth that's usually only seen during a healthy expansion. The details of the report were equally robust, with full-time jobs up a hearty 35,200 and total hours worked advancing a strong 0.9% m/m. Moreover, unlike some of the gaudy headline job gains driven by blowout population growth in the past few years, the underlying working age population growth is simmering down—it was up "just" 56,000 last month versus +100,000 for most of last year. This combination of cooling labour force growth and still-strong job gains has helped bring the unemployment rate down, clipping it a tick to 6.6% and well down from November's 6.9% peak.

Source: (Trade) War, What Is It Good For?

Bottom Line: If we weren't all absorbed with the possibility of a trade war, we would be talking about the comeback in the Canadian domestic economy in recent months. The turnaround in job growth, even amid cooler population trends, reinforces the message from firmer auto and home sales that the economy was turning a corner thanks to the heavy-duty drop in interest rates in the past eight months. Alas, we still need to contend with the lingering uncertainty on the trade front, which casts a cloud over these sunny jobs figures. For the Bank of Canada, there is little here crying out for further near-term rate relief, but the clear and present trade risks will keep rate-cut hopes alive. The moderation in wages does give the BoC a bit more room to manoeuvre should a trade war erupt.

Source:(Trade) War, What Is It Good For?

The opinions, estimates and projections contained herein are those of the author as of the date hereof and are subject to change without notice and may not reflect those of BMO Nesbitt Burns Inc. ("BMO NBI"). Every effort has been made to ensure that the contents have been compiled or derived from sources believed to be reliable and contain information and opinions that are accurate and complete. Information may be available to BMO Nesbitt Burns or its affiliates that is not reflected herein. However, neither the author nor BMO NBI makes any representation or warranty, express or implied, in respect thereof, takes any responsibility for any errors or omissions which may be contained herein or accepts any liability whatsoever for any loss arising from any use of or reliance on this report or its contents. This report is not to be construed as an offer to sell or a solicitation for or an offer to buy any securities. BMO NBI, its affiliates and/or their respective officers, directors or employees may from time to time acquire, hold or sell securities mentioned herein as principal or agent. NBI will buy from or sell to customers securities of issuers mentioned herein on a principal basis. BMO NBI, its affiliates, officers, directors or employees may have a long or short position in the securities discussed herein, related securities or in options, futures or other derivative instruments based thereon. BMO NBI or its affiliates may act as financial advisor and/or underwriter for the issuers mentioned herein and may receive remuneration for same. A significant lending relationship may exist between Bank of Montreal, or its affiliates, and certain of the issuers mentioned herein. BMO NBI is a wholly owned subsidiary of Bank of Montreal. Any U.S. person wishing to effect transactions in any security discussed herein should do so through BMO Nesbitt Burns Corp. Member-Canadian Investor Protection Fund.