Happy Thanksgiving!

DHL Wealth Advisory - Oct 11, 2024

North American markets hit new highs this week as investors digested slightly hotter-than-expected US inflation data on Thursday...

North American markets hit new highs this week as investors digested slightly hotter-than-expected US inflation data on Thursday. Inflation still has some spark as consumer prices rose more than expected in September, by 0.2%, despite a large decline in gasoline prices. Even food and auto prices, which had calmed down of late, perked up. Clothing prices popped 1.1%, the most in five months. A wider range of services contributed to the upside surprise, notably education, auto insurance, airfares and medical care (after two monthly declines).

The data comes as questions mount that the Federal Reserve may slow the pace of future cuts, and ahead of the central bank’s first policy meeting after September’s super-sized move. Fed funds futures suggests a 80% likelihood of a quarter-point cut. However, there is still a solid case to be made for further rate cuts, despite the latest developments. US consumers are growing tired, as noted by a drop in sentiment in October. The recent back-up in long-term interest rates, which has seen 10- and 30-year yields jump by almost 50 bps in four weeks, will keep the housing market on ice. And, a rise in initial jobless claims, even if distorted by hurricanes, will cast some doubt on the strength of the job market.

Source: BMO Economics Talking Points: 25 or Stick to More

Drawing these factors together, we’re still quite comfortable with BMO economists call of a steady series of 25 bp Fed cuts over the next four meetings, taking short-term rates just below 4% by next spring. After that point, they look for the cadence to slow to a cut every other meeting, until Fed funds gets just below 3% in early 2026. Given the volatility of the economic data, it may not be quite that neat and tidy, but the key point is that we look for short-term rates to drop by roughly 200 bps over the next 18 months.

Source: BMO Economics Talking Points: 25 or Stick to More

Meanwhile, the 25 or 50 debate remains very much alive and well in Canada, fuelled this week by a dovish view from a former Bank of Canada Deputy Governor. Said former official may well have been a perma-dove, so it’s not obvious this adds much to the cause for 50. There is certainly a case for a more aggressive BoC, including an economy struggling to break out of a 1% growth path, a headline inflation rate back at the 2% target (and expected to drop below it in next week’s CPI report), and a big rise in the jobless rate in the past year—all on top of the Fed opening the way with its own 50 bp cut.

Source: BMO Economics Talking Points: 25 or Stick to More

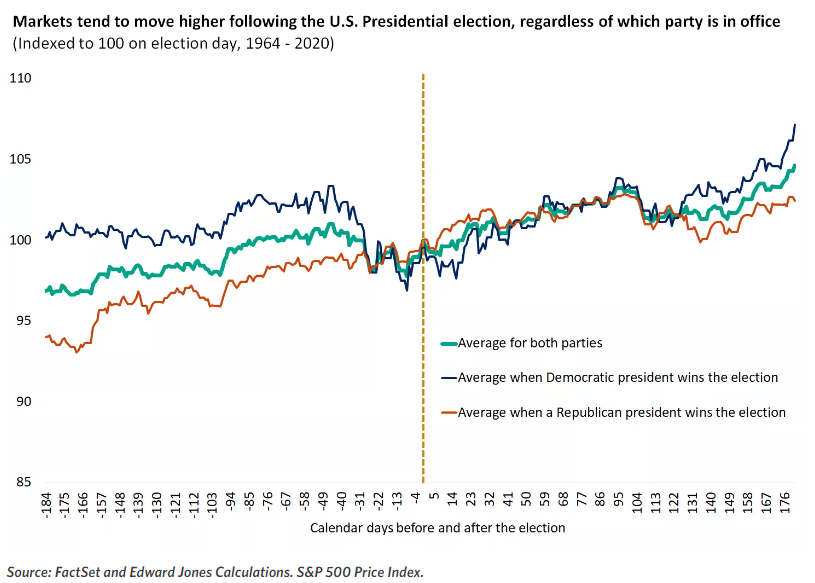

Elsewhere, the U.S. presidential election remains an ongoing area of focus, with roughly four weeks remaining until the November 5 election day. Markets have not yet seen any meaningful reactions from U.S. presidential election uncertainties. We suspect they may emerge as November approaches and a focus on policy proposals (and differences) intensifies. Volatility typically rises ahead of U.S. election day but often subsides quickly, as investors turn their attention back to the prevailing economic and market trends, which we'd posit won't shift dramatically based simply on the White House's new tenant.

The larger takeaway for investors is that markets have performed well under both U.S. political parties, a condition that we don't think is under threat this time around. In particular, we suspect a divided Congress will limit the potential for any extreme policy implementations, allowing the markets to take their cues from what we expect will be an extended economic expansion and ongoing cycle of rising corporate earnings – factors that throughout history have principally governed market performance.

In our view, after a strong rally in the first three quarters of the year, and with uncertainty around politics and geopolitics remaining, we could still see bouts of volatility in the weeks ahead. Nonetheless, we would lean into any pullbacks or volatility as an opportunity to diversify, rebalance, and add quality investments at better prices.

We believe the fundamentals of the bull-market expansion remain intact: The Fed and BoC are on paths to ease interest rates, inflation continues to gradually moderate, and the U.S. and Canadian economies look poised for a "soft landing" (no recession). In addition, S&P 500 earnings growth is on pace for double digits this year, and perhaps next year as well. We see both equity and bond markets remaining well supported in this backdrop, especially as markets continue to climb past near-term uncertainties.

The opinions, estimates and projections contained herein are those of the author as of the date hereof and are subject to change without notice and may not reflect those of BMO Nesbitt Burns Inc. ("BMO NBI"). Every effort has been made to ensure that the contents have been compiled or derived from sources believed to be reliable and contain information and opinions that are accurate and complete. Information may be available to BMO Nesbitt Burns or its affiliates that is not reflected herein. However, neither the author nor BMO NBI makes any representation or warranty, express or implied, in respect thereof, takes any responsibility for any errors or omissions which may be contained herein or accepts any liability whatsoever for any loss arising from any use of or reliance on this report or its contents. This report is not to be construed as an offer to sell or a solicitation for or an offer to buy any securities. BMO NBI, its affiliates and/or their respective officers, directors or employees may from time to time acquire, hold or sell securities mentioned herein as principal or agent. NBI will buy from or sell to customers securities of issuers mentioned herein on a principal basis. BMO NBI, its affiliates, officers, directors or employees may have a long or short position in the securities discussed herein, related securities or in options, futures or other derivative instruments based thereon. BMO NBI or its affiliates may act as financial advisor and/or underwriter for the issuers mentioned herein and may receive remuneration for same. A significant lending relationship may exist between Bank of Montreal, or its affiliates, and certain of the issuers mentioned herein. BMO NBI is a wholly owned subsidiary of Bank of Montreal. Any U.S. person wishing to effect transactions in any security discussed herein should do so through BMO Nesbitt Burns Corp. Member-Canadian Investor Protection Fund.