Odds of September Cut Are the Same As A Biden Victory.

DHL Wealth Advisory - Jul 12, 2024

It was yet another week of record gains for major US indexes and Canada’s S&P TSX finally joined in on the party following a 3-month absence. Moving markets this week was lower-than-expected US inflation data for the month of June...

It was yet another week of record gains for major US indexes and Canada’s S&P TSX finally joined in on the party following a 3-month absence. Moving markets this week was lower-than-expected US inflation data for the month of June.

For the second month in a row, U.S. CPI Inflation came in below consensus with headline prices outright falling 0.1% month-over-month. This was the best monthly CPI performance for the U.S. economy since May 2020 and it opens the door wide open for a September rate cut from the Fed. The report makes a very convincing case that consumer inflation has swiftly resumed its downward path after an unanticipated surge in the first quarter and is likely well on its way to a sustainable 2.0%. The Fed funds futures market is solidifying around a September rate cut in the wake of the report with around a 91% chance of a 25-basis point cut.

Source: BMO Economics EconoFACTS: U.S. Consumer Prices (June)

Elsewhere, Core CPI inflation, excluding food and energy, increased a modest 0.1% last month, below the consensus forecast of 0.2%, and the best monthly performance since January 2021. The three-month moving average of the core and super-core CPI inflation rates are looking much better, slipping to 2.1% annualized on the core and 1.3% on the super-core. The Fed will likely need to see only relatively tame inflation in July (in line with a 2.0% medium-term target) to give the all-clear to cut interest rates in September with these new numbers in their pocket.

Source: BMO Economics EconoFACTS: U.S. Consumer Prices (June)

Bottom Line: The CPI inflation report for June extends and solidifies the moderation trend in the second quarter following the disappointing readings at the start of the year. It will keep Chair Powell’s dovish slant in this week’s Humphrey-Hawkins testimony alive and materially improves the chances the FOMC actually pulls the trigger on their first rate cut in September with more to follow.

Source: BMO Economics EconoFACTS: U.S. Consumer Prices (June)

Meanwhile it’s been no secret that the US stock market's performance has been extremely impressive so far in 2024 with the S&P 500 gaining 14.5% during 1H, which puts it in the 82nd percentile for all years from 1950. Yet, some investors are still worried that stocks are way overvalued and are due for a severe correction in the coming months. While we would agree that there is always a risk of a pullback, we feel that any such weakness is likely to come from higher levels than today given market analysis that shows 1H starts to calendar years of this magnitude typically lead to above-average 2H returns.

Source: US Strategy Comment: Select 2H Market Observations

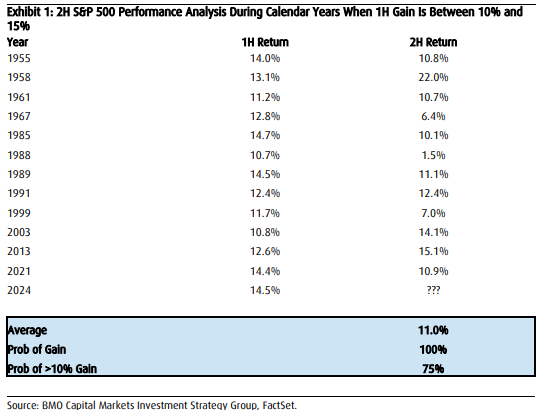

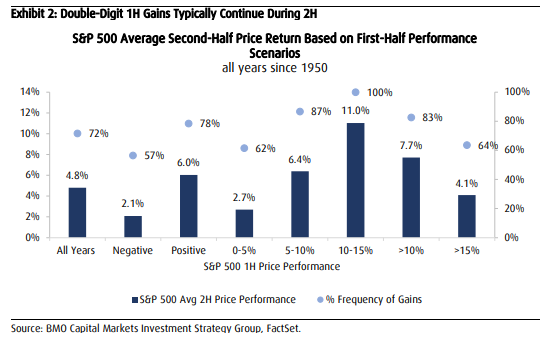

For instance, there have been 12 calendar years where the S&P 500 gained 10-15% during the 1H since 1950 (Exhibit 1). The average 2H return for those years was 11%. More important, in none of those years did the S&P 500 register a 2H loss with gains ranging from 1.5% to 22%. In addition, a 10-15% 1H gain appears to be the “sweet spot” as it is the only range where the average 2H gain is in double-digit territory (Exhibit 2). Therefore, BMO’s recently revised S&P 500 base case target of 5,600 (which remains amongst the highest based on the Bloomberg strategist survey) could prove to be too conservative while their bull case target of 6,000 certainly appears more feasible should historical trends wind up prevailing.

Source: US Strategy Comment: Select 2H Market Observations

History tells us markets can continue to do well in an environment of cooling but positive economic growth, moderating inflation and a Fed that may be poised to cut interest rates. This is in part because, over time, lower rates and lower inflation can lead to increased economic activity and positive revisions to earnings growth as well.

From an equity perspective, with economic growth potentially softening, we may continue to see the mega-cap technology and growth parts of the market — especially those that can deliver on earnings — continue to perform well. The more cyclical parts of the market — those sectors leveraged to economic growth — are more dependent on a reacceleration of personal consumption, which will be more reliant on lower rates. However, this week’s CPI report would suggest those lower rates may not be far away. We continue to favour equities over the medium term, which we believe have scope to continue their bull market phase, albeit not in a straight line higher. As always, corrections are likely and perhaps healthy in any market cycle.

The opinions, estimates and projections contained herein are those of the author as of the date hereof and are subject to change without notice and may not reflect those of BMO Nesbitt Burns Inc. ("BMO NBI"). Every effort has been made to ensure that the contents have been compiled or derived from sources believed to be reliable and contain information and opinions that are accurate and complete. Information may be available to BMO Nesbitt Burns or its affiliates that is not reflected herein. However, neither the author nor BMO NBI makes any representation or warranty, express or implied, in respect thereof, takes any responsibility for any errors or omissions which may be contained herein or accepts any liability whatsoever for any loss arising from any use of or reliance on this report or its contents. This report is not to be construed as an offer to sell or a solicitation for or an offer to buy any securities. BMO NBI, its affiliates and/or their respective officers, directors or employees may from time to time acquire, hold or sell securities mentioned herein as principal or agent. NBI will buy from or sell to customers securities of issuers mentioned herein on a principal basis. BMO NBI, its affiliates, officers, directors or employees may have a long or short position in the securities discussed herein, related securities or in options, futures or other derivative instruments based thereon. BMO NBI or its affiliates may act as financial advisor and/or underwriter for the issuers mentioned herein and may receive remuneration for same. A significant lending relationship may exist between Bank of Montreal, or its affiliates, and certain of the issuers mentioned herein. BMO NBI is a wholly owned subsidiary of Bank of Montreal. Any U.S. person wishing to effect transactions in any security discussed herein should do so through BMO Nesbitt Burns Corp. Member-Canadian Investor Protection Fund.