Only Bear Market Here is Elias Petterson's Production...

DHL Wealth Advisory - Apr 26, 2024

After a 25% run higher in the S&P 500 from Oct23-Mar24, the tone in the markets in recent weeks seems to have shifted. The S&P 500 was on the cusp for a fourth straight losing week, while the technology-heavy Nasdaq just posted its first gain in...

After a 25% run higher in the S&P 500 from Oct23-Mar24, the tone in the markets in recent weeks seems to have shifted. The S&P 500 was on the cusp for a fourth straight losing week, while the technology-heavy Nasdaq just posted its first gain in five. The magnitude of the pullback thus far has been relatively contained: The S&P 500 is down about 5.5% from recent highs, while the Nasdaq is down around 7%. However, the interest-rate-sensitive parts of the market, including small-cap stocks and the real estate sector, have pulled back more. And the VIX volatility index, sometimes referred to as the "fear index," has climbed toward highs of the year.

Our readers shouldn’t be taken by total alarm over this period of market consolidation. We had been warning for several weeks to expect some form of market volatility following such a dramatic period of unrelenting strength. In our view, volatility has been sparked by a trifecta of recent data and news. First, the market has repriced Fed rate cuts and is now expecting just one rate cut in 2024, and it is adjusting to this new "higher for longer" interest-rate regime. Second, geopolitical tensions have been rising, particularly in the Middle East, which has also put upward pressure on oil and commodity prices in recent weeks. And third, S&P 500 first-quarter earnings season is underway, and while companies are beating forecasts, the outlooks they are offering have been softer than expected.

Against the backdrop of rising long-term interest rates year to date, ALL the Canadian yield-heavy sectors have underperformed. However, from our perspective each of these areas are excessively oversold and are extremely overdue for a sharp reversal to the upside once interest rate concerns stabilize. While we do subscribe to the “higher-for-longer” interest rate narrative, history shows that these sectors can post solid absolute returns and, in some cases, even outperform when long-term interest rates are in a range.

Indeed, the Real Estate sector typically posts its best absolute and relative performance when interest rates are range bound and is historically one of the least interest rate sensitive high-yielding sectors in the TSX. While the Communication Services sector is interest rate sensitive, we believe the sector should be doing much better on an absolute basis given we are likely at or near peak long-term interest rates. Utilities is historically the most correlated with interest rates, but typically sees a clear inflection of performance once long-term interest rates peak and is generally a Market Perform in range-bound rate environments. Lastly, Canadian banks have become too interest rate sensitive in our view. Historically, while there IS a relationship, particularly on the tails of interest rate moves, the sector can outperform in most interest rate environments and typically posts its best absolute performance when interest rates are range bound or rising gradually. Overall, while we continue to urge income investors to focus on dividend growth, we believe many of these sectors are oversold and can rebound sharply when interest rate concerns subside.

Circling back to the ongoing market volatility, we often say that corrections are natural, normal, and healthy until you actually get one. It’s important to remember that market volatility after a strong run is not unexpected. While calling the bottom of a pullback is notoriously difficult, we know that corrections in the 5% - 15% range are typical in any given year. In fact, as the chart below illustrates, the S&P 500 averages 4.6 5% market corrections in a calendar year.

The more important consideration is whether a pullback could morph into a deep or prolonged bear-market environment (typically with 20% or higher losses). Bear markets are much less common and happen on average once every 5.1 years. The last one we had was in 2022 when the S&P 500 dropped 25% from its highs. We don't see current bout of volatility turning into a bear market for two primary reasons:

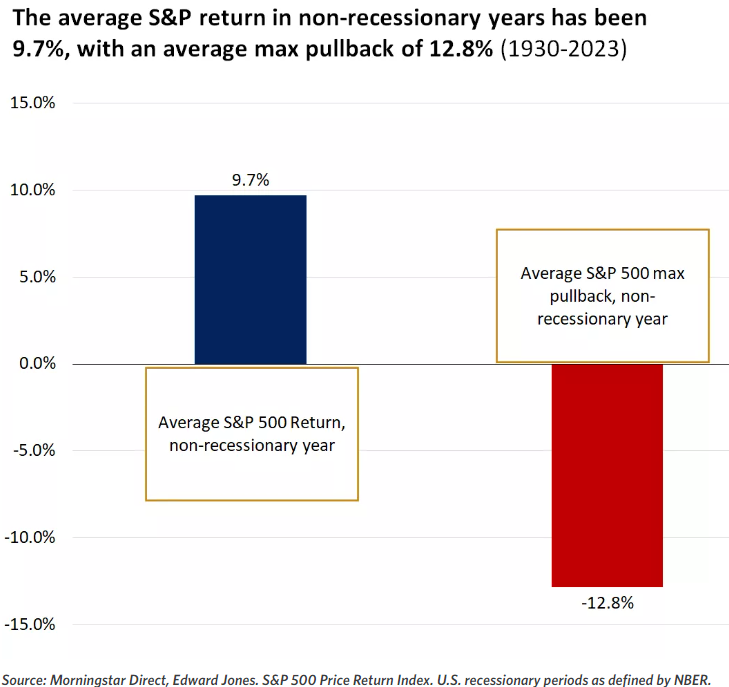

First, bear markets tend to occur when the economy is in a recession or entering a recession. We see neither of those conditions in place today. In fact, the US economy continues to remain resilient, and yesterday’s GDP figures show a slowing, but still growing US economy at 1.6% annualized supported by strong consumer demand and a healthy labor market. Interestingly, the average S&P 500 max pullback in non-recessionary years is 12.8%, but the index still manages to do deliver returns of 9.7%.

Second, bear markets also tend to occur when the Fed is hiking rates. The opposite is true today where US Fed officials have openly stated their expectation for cuts in 2024. In our view, the bar for rate hikes remains high for the Fed, and while inflation has been persistent, we don't yet see conditions in place for it to reignite sustainably. We believe the Fed will be patient but will likely still consider a rate cut as its next move.

Thus, investors could use this pullback to rebalance, diversify and dollar-cost average into weakness, especially those that hadn't fully participated in the recent rapid rally.

The opinions, estimates and projections contained herein are those of the author as of the date hereof and are subject to change without notice and may not reflect those of BMO Nesbitt Burns Inc. ("BMO NBI"). Every effort has been made to ensure that the contents have been compiled or derived from sources believed to be reliable and contain information and opinions that are accurate and complete. Information may be available to BMO Nesbitt Burns or its affiliates that is not reflected herein. However, neither the author nor BMO NBI makes any representation or warranty, express or implied, in respect thereof, takes any responsibility for any errors or omissions which may be contained herein or accepts any liability whatsoever for any loss arising from any use of or reliance on this report or its contents. This report is not to be construed as an offer to sell or a solicitation for or an offer to buy any securities. BMO NBI, its affiliates and/or their respective officers, directors or employees may from time to time acquire, hold or sell securities mentioned herein as principal or agent. NBI will buy from or sell to customers securities of issuers mentioned herein on a principal basis. BMO NBI, its affiliates, officers, directors or employees may have a long or short position in the securities discussed herein, related securities or in options, futures or other derivative instruments based thereon. BMO NBI or its affiliates may act as financial advisor and/or underwriter for the issuers mentioned herein and may receive remuneration for same. A significant lending relationship may exist between Bank of Montreal, or its affiliates, and certain of the issuers mentioned herein. BMO NBI is a wholly owned subsidiary of Bank of Montreal. Any U.S. person wishing to effect transactions in any security discussed herein should do so through BMO Nesbitt Burns Corp. Member-Canadian Investor Protection Fund.