Black Friday: Trampling Others For Sales Exactly One Day After Being Thankful For What You Already Have.

DHL Wealth Advisory - Nov 24, 2023

Continuing a streak of gains not seen since the depths of the pandemic, North American markets moved higher for a fourth consecutive week as data continues to show a slowing of inflation. After a brief acceleration in late summer, U.S...

Continuing a streak of gains not seen since the depths of the pandemic, North American markets moved higher for a fourth consecutive week as data continues to show a slowing of inflation. After a brief acceleration in late summer, U.S. and Canadian inflation resumed its downward trajectory in October.

Last week we learned the US headline consumer price index (CPI) was unchanged for October, with the annual rate falling from 3.7% to 3.2%, helped by a sizable drop in gas prices. And this week we saw Canadian CPI edge up just 0.1% in October, mild enough to carve the headline inflation rate to 3.1% from 3.8% the prior month. In seasonally adjusted terms, prices fell 0.1%, the first such decline since the opening months of the pandemic in 2020. This was a snick below consensus expectations, and even a tad better than the benign U.S. result a week ago.

A look under the surface reveals some encouraging trends. Prices for goods outright declined in October for the fifth consecutive month, largely driven by falling used car and truck prices. Private wholesale data suggest further declines in used car prices ahead. Outside of autos, the improvement in supply chains and lower transportation costs are consistent with decreasing prices for other goods. Elsewhere, shelter inflation remains the biggest contributor to overall CPI, but there was a notable stepdown in the pace of monthly increases in October. The steep decline in price increases for newly signed leases should continue to pull housing inflation lower through most of 2024.

Bottom Line: While no one expected inflation to go gentle into that good night, this is a generally good news step in the right direction. Note that three provinces now have an inflation rate below 2%, while only three are above 3%, so much of the country is already seeing serious signs of stabilization. Overall, the result drives home the point that there is no need for further BoC tightening, especially with the economy already struggling to grow at all and underlying inflation calming. The same could likely be said for the US Fed and the release of minutes this week hit home how close the Fed is to the end of this high-rate saga.

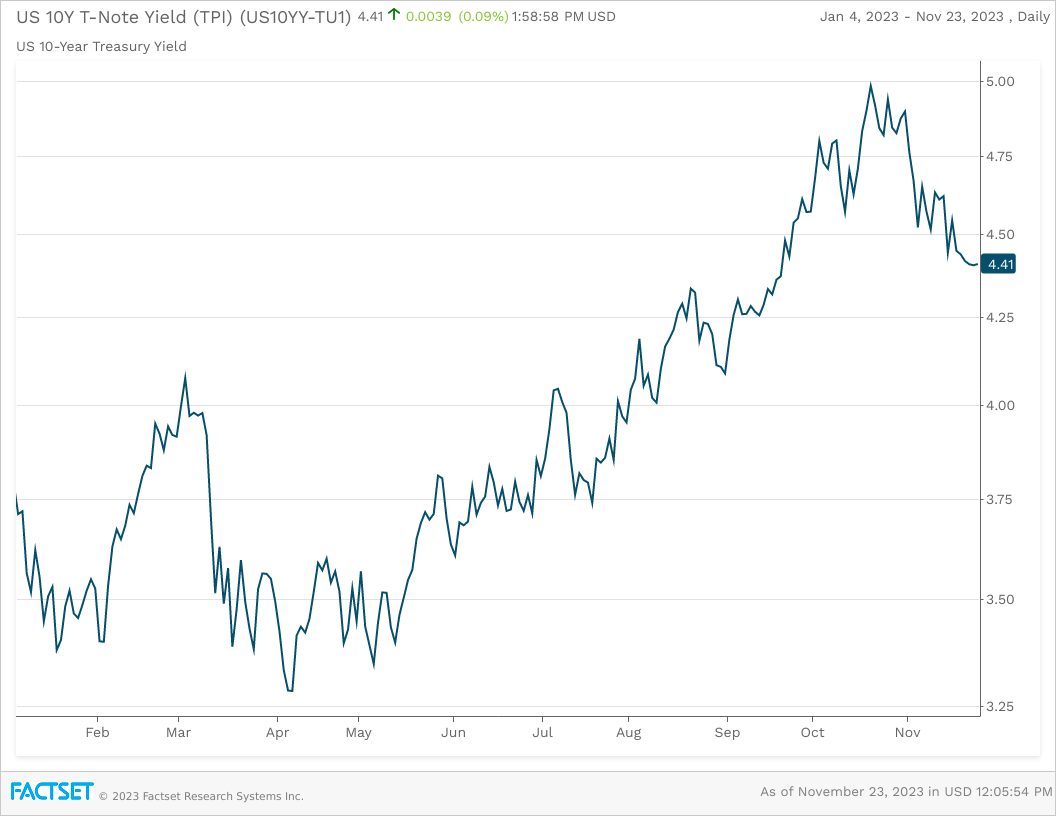

A key reason why both equity and bond markets have rallied in November is that the easing inflation pressures, together with signs of a cooling labour market, increase confidence that the Fed and BoC are likely done hiking rates. After core inflation hit its lowest reading in more than two years, U.S. markets were quick to price out a December hike and price in an earlier start to rate cuts. The policy-sensitive 2-year yield declined below 5.0% in the U.S. and 4.5% in Canada, while the growth-sensitive 10-year yield declined below 4.5% in the U.S. and 3.7% in Canada.

What does a potential peak in rates mean for investors? It’s no secret that lower rates are tailwinds for investments. Well, the below table shows the bulk of investment returns have historically happened now, if we are indeed at peak rates. The first half of interest rate peaks have generated the best returns for investors with returns normalizing the proceeding six months. The results aren’t necessarily surprising given the challenging headwinds faced by investors with elevated rates. And outside of the “magnificent seven”, much of the market remains mired in a 2-year trading range. So the takeaway for investors is that it’s usually when rates peak in a cycle, it's better to buy stocks than stash your cash.

This is a chart of the US 10-year Treasury yield, which is back below 4.4% this week.

We think that last month's surge in rates might have marked the peak for this cycle, as the incoming data support an extended central bank pause and potentially the start of rate cuts in the second half of 2024 (could be earlier for the BoC if growth remains weak). Be mindful that policymakers will likely push back against aggressive expectations for easing, so there is a limit to how much and how fast yields can fall from here. But if price pressures continue to moderate in 2024 as we expect, real policy rates (after adjusting for inflation) will become more restrictive, which the Fed will likely try to offset by cutting rates more than the two times it is currently projecting.

As we've articulated in our prior notes, the ingredients for a year-end rally are in place, helped by the right balance of moderating, though still resilient, economic data. However, we always need to remind readers that markets don't move in a straight line, and stocks could pause to digest the recent gains.

Looking into 2024, the lagged effects of high interest rates will continue to filter through the economy, driving softer growth, which could trigger periods of volatility. Still, we think that lower rates and modestly rising earnings will help equities build on this year's gains and help the battered bonds rebound.

The opinions, estimates and projections contained herein are those of the author as of the date hereof and are subject to change without notice and may not reflect those of BMO Nesbitt Burns Inc. ("BMO NBI"). Every effort has been made to ensure that the contents have been compiled or derived from sources believed to be reliable and contain information and opinions that are accurate and complete. Information may be available to BMO Nesbitt Burns or its affiliates that is not reflected herein. However, neither the author nor BMO NBI makes any representation or warranty, express or implied, in respect thereof, takes any responsibility for any errors or omissions which may be contained herein or accepts any liability whatsoever for any loss arising from any use of or reliance on this report or its contents. This report is not to be construed as an offer to sell or a solicitation for or an offer to buy any securities. BMO NBI, its affiliates and/or their respective officers, directors or employees may from time to time acquire, hold or sell securities mentioned herein as principal or agent. NBI will buy from or sell to customers securities of issuers mentioned herein on a principal basis. BMO NBI, its affiliates, officers, directors or employees may have a long or short position in the securities discussed herein, related securities or in options, futures or other derivative instruments based thereon. BMO NBI or its affiliates may act as financial advisor and/or underwriter for the issuers mentioned herein and may receive remuneration for same. A significant lending relationship may exist between Bank of Montreal, or its affiliates, and certain of the issuers mentioned herein. BMO NBI is a wholly owned subsidiary of Bank of Montreal. Any U.S. person wishing to effect transactions in any security discussed herein should do so through BMO Nesbitt Burns Corp. Member-Canadian Investor Protection Fund.