Lest We Forget

DHL Wealth Advisory - Nov 10, 2023

As Starbucks holiday cups usher in the “holiday season” this week and, perhaps, so too has the market welcomed an early dose of a “Santa Claus Rally”. Global equities continued to march higher this week as Monetary policy remains firmly...

As Starbucks holiday cups usher in the “holiday season” this week and, perhaps, so too has the market welcomed an early dose of a “Santa Claus Rally”. Global equities continued to march higher this week as Monetary policy remains firmly behind the wheel for financial markets. The Fed held rates steady at its meeting last week (as expected), but it struck a more balanced tone around its outlook for upcoming rate decisions, which we think supports our view that the Fed rate-hiking cycle can be complete.

Markets have been under pressure for much of the last three months (and 2-years really), as resurgent rates soured the market's mood. We're not entirely surprised by last week's turn in rates and the resulting rally in the market. As we have been writing to in prior editions, the run-up in the US Treasury market was extreme in historical standards. Much of that move higher in rates had been due to temporary factors (higher for longer message and U.S. Treasury bond issuance) versus a structure change in the inflation outlook.

We don't think we've seen the last of interest-rate worries spooking equities, but we continue to hold the view that the recent market correction was more of a compelling opportunity than the beginning of something more sinister or prolonged. While we can't set our watch to a year-end market rally in the same way we can for Starbucks holiday cups, we do think there is a credible case for both stocks and bonds to round out the year on a more favourable path than we experienced through September and October.

Last week's Fed meeting provided the primary fuel source for stock- and bond-market gains. The policy rate (fed funds rate) was held steady for the second straight meeting, with Powell striking a more balanced tone around future policy decisions. We have been saying for weeks now that we feel there is a sufficient case for the Fed and the BoC to be done with rate hikes. However, as we saw yesterday, we also suspect that US Fed officials will continue to use commentary that emphasizes their willingness to hike further as a way of preventing markets and financial conditions from getting too far ahead of themselves in anticipating looser policy ahead.

We think the continuation of this equity bull market will ultimately become more tethered to the outlook for rate cuts (which we don't expect until later in 2024). But for now, confidence that the central banks can remain on pause will be a key element of support for financial markets. In fact, if the bond market is correct, the Fed will continue to hold rates at that level when it meets again in December (only a 5% probability of a hike), a dovish shift from a week ago (19% probability of a hike) and a month ago (47% probability of a hike). Here are the current market expectations for the path of the Fed Funds rate:

- Dec 13, 2023: Pause

- Jan 31, 2024: Pause

- Mar 20, 2024: Pause

- May 1, 2024: 25 bps Cut to 5.00-5.25%

- Additional cuts to 4.06% by Nov 2025

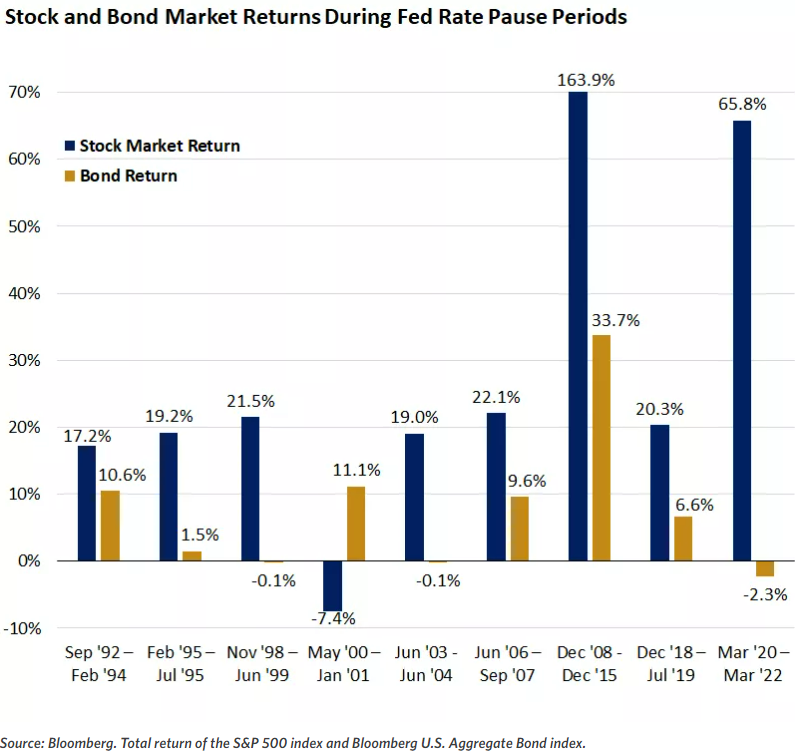

What does a period of prolonged pauses mean for the market? Well, as the chart below illustrates, over the last 30 years, periods in which the Fed has kept its policy rate unchanged have largely been accompanied by strong gains in both stocks and bonds.

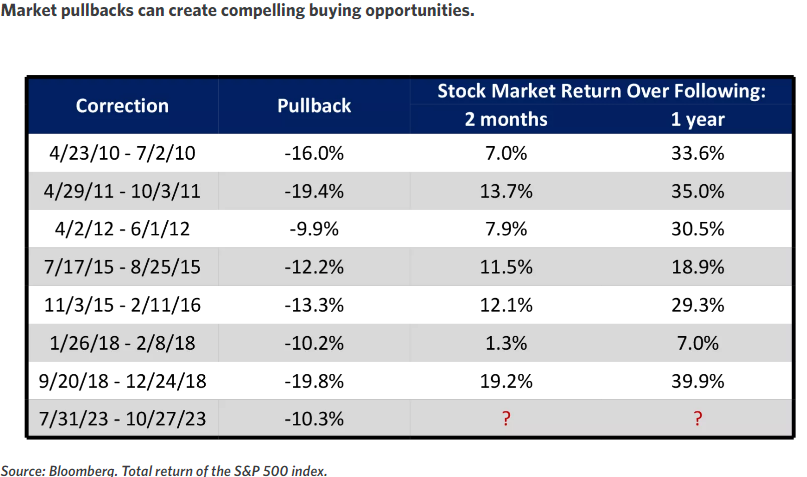

There's no guarantee that the 10% pullback we saw through October was the end of the soft patch for equities, but with think it tipped the risk-reward balance in investors' favor. As the table below highlights, prior corrections have averaged a 14% decline, followed by an average two-month gain of 10% and a one-year return of 28%. This highlights both the opportunity created by short-term declines as well as the importance of disciplined, longer-term portfolio decisions during spates of market volatility.

The opinions, estimates and projections contained herein are those of the author as of the date hereof and are subject to change without notice and may not reflect those of BMO Nesbitt Burns Inc. ("BMO NBI"). Every effort has been made to ensure that the contents have been compiled or derived from sources believed to be reliable and contain information and opinions that are accurate and complete. Information may be available to BMO Nesbitt Burns or its affiliates that is not reflected herein. However, neither the author nor BMO NBI makes any representation or warranty, express or implied, in respect thereof, takes any responsibility for any errors or omissions which may be contained herein or accepts any liability whatsoever for any loss arising from any use of or reliance on this report or its contents. This report is not to be construed as an offer to sell or a solicitation for or an offer to buy any securities. BMO NBI, its affiliates and/or their respective officers, directors or employees may from time to time acquire, hold or sell securities mentioned herein as principal or agent. NBI will buy from or sell to customers securities of issuers mentioned herein on a principal basis. BMO NBI, its affiliates, officers, directors or employees may have a long or short position in the securities discussed herein, related securities or in options, futures or other derivative instruments based thereon. BMO NBI or its affiliates may act as financial advisor and/or underwriter for the issuers mentioned herein and may receive remuneration for same. A significant lending relationship may exist between Bank of Montreal, or its affiliates, and certain of the issuers mentioned herein. BMO NBI is a wholly owned subsidiary of Bank of Montreal. Any U.S. person wishing to effect transactions in any security discussed herein should do so through BMO Nesbitt Burns Corp. Member-Canadian Investor Protection Fund.