Happy Anniversary Bull Market

DHL Wealth Advisory - Oct 20, 2023

It was yet another mixed week in the markets as the situation in the Middle East and US Treasury market continue to dominate headlines. Entering Friday trading, the S&P TSX was exactly flat thus far in 2023, an unfortunate reflection...

It was yet another mixed week in the markets as the situation in the Middle East and US Treasury market continue to dominate headlines. Entering Friday trading, the S&P TSX was exactly flat thus far in 2023, an unfortunate reflection of the type of year witnessed by market participants. To put it simply, investors are largely sitting to the sidelines following the carnage witnessed in 2022, waiting for clarity around peak interest rates and a sustained path lower in inflation. Regarding these two points, US Fed Chair Jerome Power provided an update on their outlook Thursday.

For the most part, Powell hit all the right notes for investors. Short-term Treasury bond yield declines accelerated in the aftermath of the speech. The probability of a November 1st rate hike from the Fed Committee fell to 3.6% in the Fed Funds futures market, while the probability of a December rate hike slipped to 28%. While not breaking a lot of new ground, his comments hint at a pause in November, but they also leave the door open for another rate hike at some point should growth and inflation fail to moderate. He said the policy-setting committee is “proceeding carefully”, and that “significant tightening" in financial conditions, largely caused by higher bond yields, "can have implications for policy.” A nod to the sharp rise in long-term Treasury yields may be doing the work for the Fed, so less of a need to hike again.

Source: BMO Economics EconoFACTS: Powell Hits All the Right Notes

He also reiterated that the extent of additional policy firming and how long to keep policy restrictive will “depend on data, outlook, and balance of risks”. He believes the "return to 2% inflation ...is likely to require a period of below-trend growth and some further softening of labor market conditions.” At the same time, he noted the recent resilience in economic growth, retail sales, and labor demand, and that the September inflation data were “somewhat less encouraging” and “inflation still too high”. "Additional evidence of persistently above-trend growth, or that tightness in the labor market is no longer easing, could put further progress on inflation at risk and could warrant further tightening of monetary policy."

Source: BMO Economics EconoFACTS: Powell Hits All the Right Notes

Bottom Line: The Powell speech, while keeping his options open, did little to change our view that the Fed will pause their rate hikes again at the upcoming Oct 31-Nov. 1 FOMC Meeting. They still believe the economy will slow despite a surprisingly strong third quarter. With Fed policy now firmly in restrictive territory, a strong case can be made to take a wait-and-see approach, until we get more clarity on the economic and inflation outlook.

Source: BMO Economics EconoFACTS: Powell Hits All the Right Notes

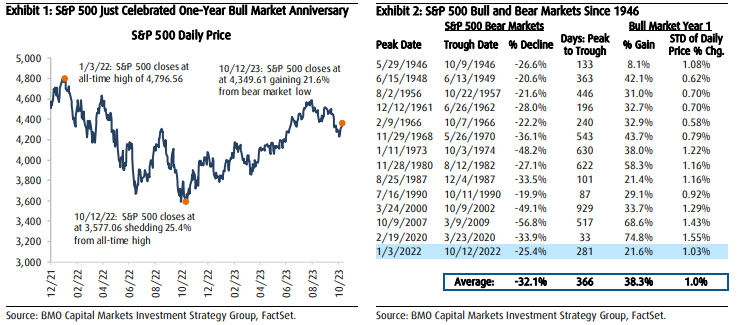

Separately, this past Thursday, October 12, 2023, marked the one-year anniversary of the S&P 500 price low stemming from the Fed’s most aggressive rate hiking campaign since the early 1980s (Exhibit 1). As a reminder, the S&P 500 hit an all-time closing high of 4,796.56 on January 3, 2022, then proceeded to plunge 25.4% through October 12 alongside the 300 bps increase in the Fed Funds rate that occurred during the period. In bear market terms, the damage was slightly better than average for both price deterioration and duration (Exhibit 2). However, as it has become increasingly clear over the past yea that the economy has held up much better than expected while inflation has cooled closer to normal levels, the S&P 500 gained 21.6%. While this one-year gain is certainly not impressive by bull market standards, we believe it is notable since many entered the year prognosticating doom-and-gloom for US stocks. In addition, we think it is also important to point out how orderly the rally has been judging by the standard deviation of daily returns, which aside from the beginning of the early 1990s bull market, was at its lowest level since the 1960s. As we have stated quite frequently in recent reports and media appearances, we continue to believe this bull market is alive and well.

Source: Belski - US Strategy Comment - Happy Birthday Bull Market

Now, what should investors expect going forward? Our work shows that the S&P 500 has historically gained an average of 11.1% during year two of bull markets, much smaller than the 38.3% average gain seen in year one, but still a double-digit return, nonetheless (Exhibit 3). In fact, the 12/4/1987 to 7/16/1990 bull market was the only one going back to 1945 where the second year outpaced the first year in terms of performance (29.3% vs. 21.4%). Our work also shows that price returns tend to be notably less volatile during the second year of bull markets with the standard deviation of daily price changes for the S&P 500 roughly 25% lower in year two versus year one (Exhibit 4). In addition, the frequency of 1% moves or greater in either direction has typically been lower in year two compared to year one with the only exception occurring during the 6/13/1949 to 8/2/1956 bull market.

Source: Belski - US Strategy Comment - Happy Birthday Bull Market

The Fed’s tightening campaign over the past 18+ months has been nearly unprecedented in its rapidity and especially when compared to previous policy actions during the past 30 years. The bear market of 2022 was a direct response to the uncertainty surrounding what higher rates would mean for the economy and stocks going forward, in our view, and that negativity hung around for a good part of 2023 as well. While there is certainly no perfect historical comparison that can be used to lay out the road map for stocks in the future, we are confident that the secular bull market can continue to roll on, especially given the current fundamental states of US stocks and the economy.

Source: Belski - US Strategy Comment - Happy Birthday Bull Market

The opinions, estimates and projections contained herein are those of the author as of the date hereof and are subject to change without notice and may not reflect those of BMO Nesbitt Burns Inc. ("BMO NBI"). Every effort has been made to ensure that the contents have been compiled or derived from sources believed to be reliable and contain information and opinions that are accurate and complete. Information may be available to BMO Nesbitt Burns or its affiliates that is not reflected herein. However, neither the author nor BMO NBI makes any representation or warranty, express or implied, in respect thereof, takes any responsibility for any errors or omissions which may be contained herein or accepts any liability whatsoever for any loss arising from any use of or reliance on this report or its contents. This report is not to be construed as an offer to sell or a solicitation for or an offer to buy any securities. BMO NBI, its affiliates and/or their respective officers, directors or employees may from time to time acquire, hold or sell securities mentioned herein as principal or agent. NBI will buy from or sell to customers securities of issuers mentioned herein on a principal basis. BMO NBI, its affiliates, officers, directors or employees may have a long or short position in the securities discussed herein, related securities or in options, futures or other derivative instruments based thereon. BMO NBI or its affiliates may act as financial advisor and/or underwriter for the issuers mentioned herein and may receive remuneration for same. A significant lending relationship may exist between Bank of Montreal, or its affiliates, and certain of the issuers mentioned herein. BMO NBI is a wholly owned subsidiary of Bank of Montreal. Any U.S. person wishing to effect transactions in any security discussed herein should do so through BMO Nesbitt Burns Corp. Member-Canadian Investor Protection Fund.