High Five?

DHL Wealth Advisor - Jul 14, 2023

A year after hitting a peak of 9.1%, US inflation has now fallen for twelve consecutive months. Wednesday’s June Consumer Prince Index (CPI) report saw US inflation come in lower than expected at 3% and down a full 1% from the 4% reading in May. ...

A year after hitting a peak of 9.1%, US inflation has now fallen for twelve consecutive months. Wednesday’s June Consumer Prince Index (CPI) report saw US inflation come in lower than expected at 3% and down a full 1% from the 4% reading in May. The 3% number is the smallest yearly increase since March 2021, while on a monthly basis, prices rose 0.2% following a 0.1% increase in May.

Source: BMO Economics EconoFACTS: U.S. Consumer Price Index (June)

A key reason for the slowdown in the overall measure is that the latest figure is compared to June 2022, when a rapid run-up in energy prices following Russia’s invasion of Ukraine helped drive inflation to a 40-year high. Now, energy prices (just not at the Vancouver pump) are trading below pre-war levels.

The report underscores the progress of reducing price pressures, aided by more than a year of interest-rate hikes and easing demand. Inflation has now fallen by about two-thirds since its peak but bringing down annual consumer price increases the rest of the way - to the more normal 2% level sought by central banks - is going to take more time. That said, markets celebrated the report as perhaps for the first time in this rate-hike campaign, the light of price stability is starting to shine more brightly at the end of the tunnel. We think this is the prerequisite for an eventual, lengthy, Fed policy pause.

Closer to home, the Bank of Canada continued to play catch-up to our neighbours to the South and increased the overnight rate another 25 basis points on Wednesday to 5%, the highest level since 2001. While the move was widely expected, it was not viewed as a lock; that, along with a relatively stern message, further buoyed the Canadian dollar, which has now hit its highest level against the USD since last summer.

The accompanying statement was mostly in line with expectations, highlighting firmer US growth, and softening in Europe and China. On the domestic economy, the Q1 strength in consumer spending was highlighted once again (the 5.8% surge must have really hit a nerve in Ottawa!), while the rebound in housing garnered two sentences as well. It’s no coincidence that when the BoC stopped hiking rates in January, the housing recovery kicked into gear. Strong population/immigration flows were noted as a driver of strength in demand but also as a supply of workers. On balance, the GDP growth forecast was revised markedly higher for 2023 to 1.8% (from 1.4%), while 2024 and 2025 were cut a tick to 1.2% and 2.4%. Both Q2 & Q3 are now forecast at 1.5%—the former is in line with estimates.

Source: BMO Economics EconoFACTS: BoC Policy Announcement and Monetary Policy Report

On inflation, the Bank suggests that the headline has been mostly as expected, but calmer energy has been countered by persistent underlying inflation. They again highlight that the three-month core measures are in the 3.5%-to-4.0% range—still sticky. The Bank helpfully, and correctly, points out that base effects will be more challenging in the near-term (after June), so the easy ride down in headline inflation from 8.1% a year ago to around 3% is almost over. One key shift in their call is that the Bank now sees inflation only back to target in mid-2025, six months further out than previous forecasts. This shift in view may further help explain Wednesday’s decision, and the still-tough language.

Source: BMO Economics EconoFACTS: BoC Policy Announcement and Monetary Policy Report

The last paragraph of the statement is almost a carbon copy of June's effort, as the Bank is keeping its options open. Critically, the Bank did not commit to a pause, having learned a lesson from January, when a clear-cut pause message helped reignite the housing market. Yet, while the statement was generally hawkish, we'll need to see a continued run of strong data and likely some high-side disappointment on inflation to prompt the BoC to move again. Our base case at this point is that we're now likely in for a lengthy pause. So, after one more hike out of the US Fed next week, we could very well be done with hikes in this cycle…

Source: BMO Economics EconoFACTS: BoC Policy Announcement and Monetary Policy Report

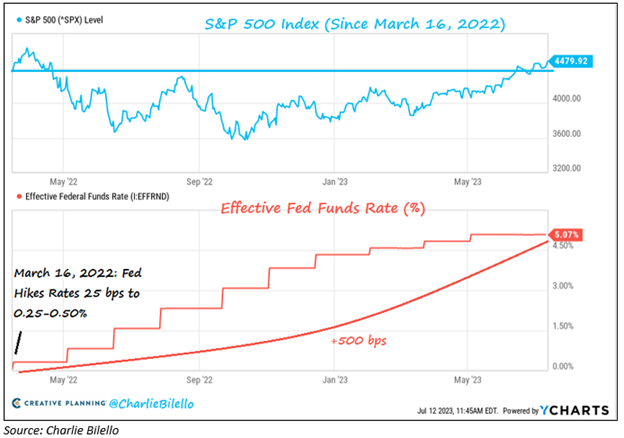

And as a pause relates to the market… Since the 1950s, inflation peaks have almost always been followed by double-digit equity gains, according to data compiled by the Leuthold Group. The S&P 500 has gained more than 20% since it bottomed out in October, placing it up about 15% since the peak CPI data was released last year. Those investors that went to the sidelines waiting for a retest of last October’s lows are now well in the rear-view mirror (this is why we always talk about “time in the market”, not “timing the market”). Interestingly, the S&P 500 is now 3% higher than where it was when the US Fed first starting increasing rates in March 2022.

Looking forward from a market perspective, there are many implications of this "higher for longer" view for both bonds and stocks. In the bond market, yields have climbed higher, as 10-year yields hit highs of the year, with the U.S. 10-year near 4% and the Canadian 10-year near 3.6%. Given the inverse relationship between yields and prices, this has put downward pressure on bond prices, with most aggregate bond indexes down slightly for the year, and that’s after a world of pain in 2022.

Meanwhile there has been some weakness in bond-proxy income stocks and high-growth tech, as higher interest rates over compelling returns elsewhere and put pressure on valuations. It’s no secret that the lions share of gains in the S&P 500 have been more concentrated among its largest stocks than in any six-month period since the turn of the millennium, resulting in expensive valuations for the index’s biggest names. But it’s our view that the resilience in the labour market makes the case for a recession or downturn in the near term unlikely. We continue to see some scope for a softening labour market in the months ahead, perhaps driven by a cooling in services demand. But the key for financial markets will likely be the direction of inflation, which evidence largely suggests will continue to moderate further. In this backdrop, where inflation is moderating and the central banks are potentially moving to the sidelines and, over time, cutting rates, we would recommend using any volatility to position for a broader and potentially more sustainable market recovery ahead.

The opinions, estimates and projections contained herein are those of the author as of the date hereof and are subject to change without notice and may not reflect those of BMO Nesbitt Burns Inc. ("BMO NBI"). Every effort has been made to ensure that the contents have been compiled or derived from sources believed to be reliable and contain information and opinions that are accurate and complete. Information may be available to BMO Nesbitt Burns or its affiliates that is not reflected herein. However, neither the author nor BMO NBI makes any representation or warranty, express or implied, in respect thereof, takes any responsibility for any errors or omissions which may be contained herein or accepts any liability whatsoever for any loss arising from any use of or reliance on this report or its contents. This report is not to be construed as an offer to sell or a solicitation for or an offer to buy any securities. BMO NBI, its affiliates and/or their respective officers, directors or employees may from time to time acquire, hold or sell securities mentioned herein as principal or agent. NBI will buy from or sell to customers securities of issuers mentioned herein on a principal basis. BMO NBI, its affiliates, officers, directors or employees may have a long or short position in the securities discussed herein, related securities or in options, futures or other derivative instruments based thereon. BMO NBI or its affiliates may act as financial advisor and/or underwriter for the issuers mentioned herein and may receive remuneration for same. A significant lending relationship may exist between Bank of Montreal, or its affiliates, and certain of the issuers mentioned herein. BMO NBI is a wholly owned subsidiary of Bank of Montreal. Any U.S. person wishing to effect transactions in any security discussed herein should do so through BMO Nesbitt Burns Corp. Member-Canadian Investor Protection Fund.