2024 Personal Tax Calendar

BMO Private Wealth - Mar 05, 2024

While most Canadians are aware of the April 30 personal income tax filing deadline, there are other important tax deadlines that must be observed over the course of the year – especially if you want to take advantage of certain tax deductions and cre

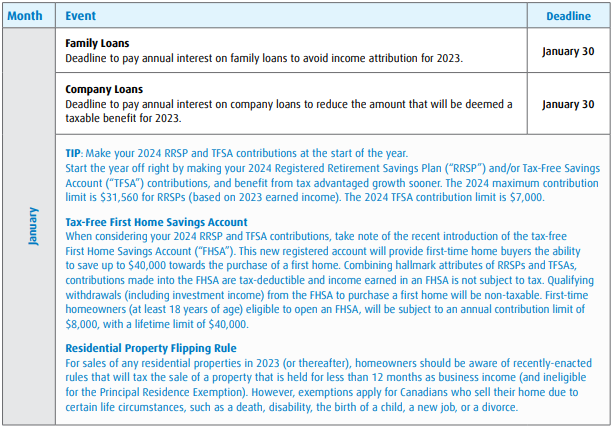

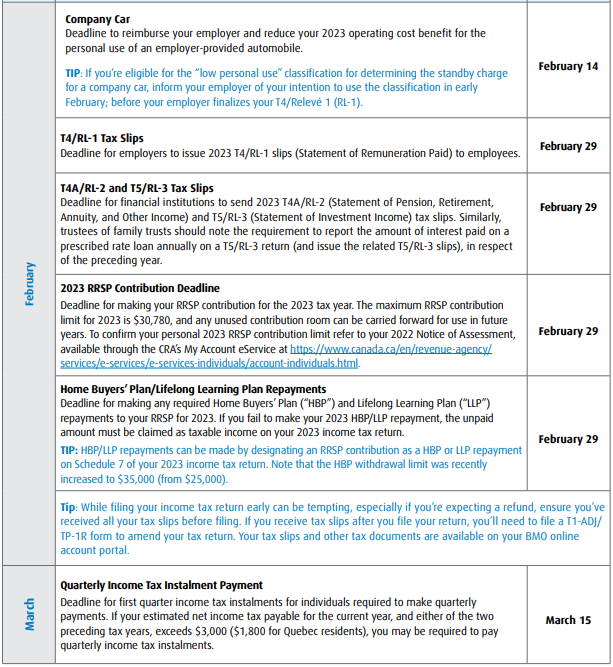

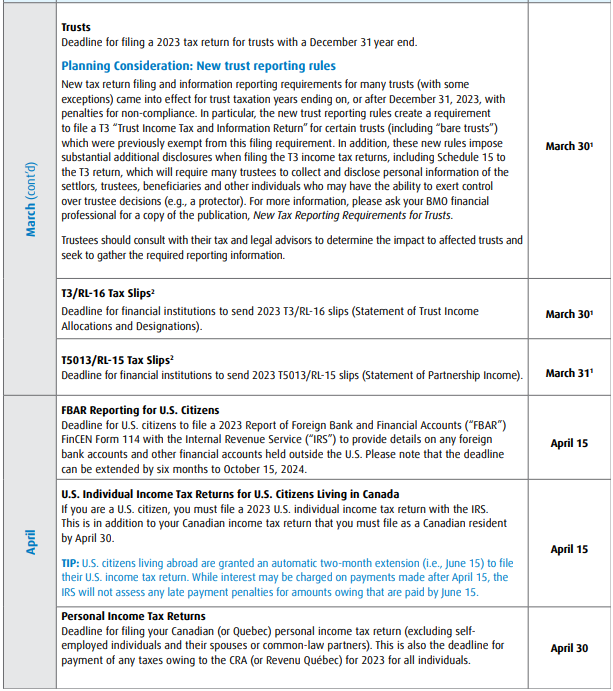

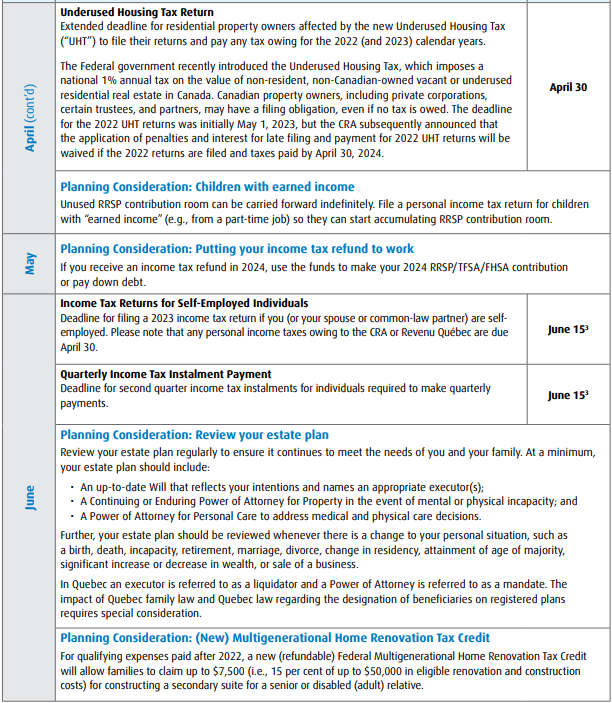

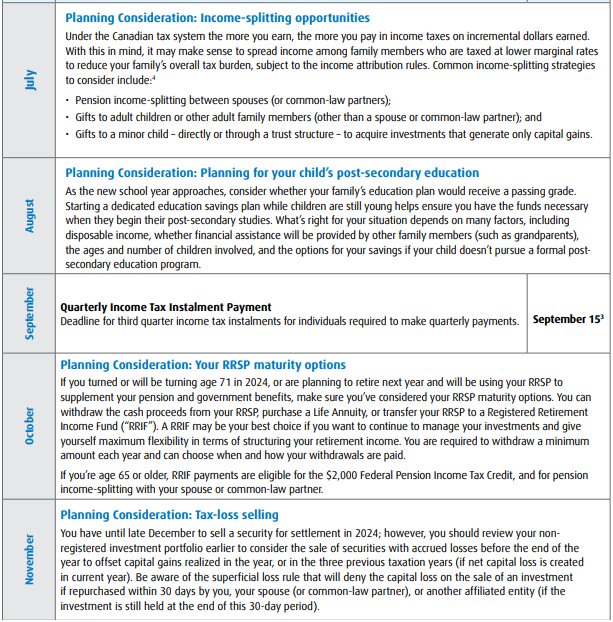

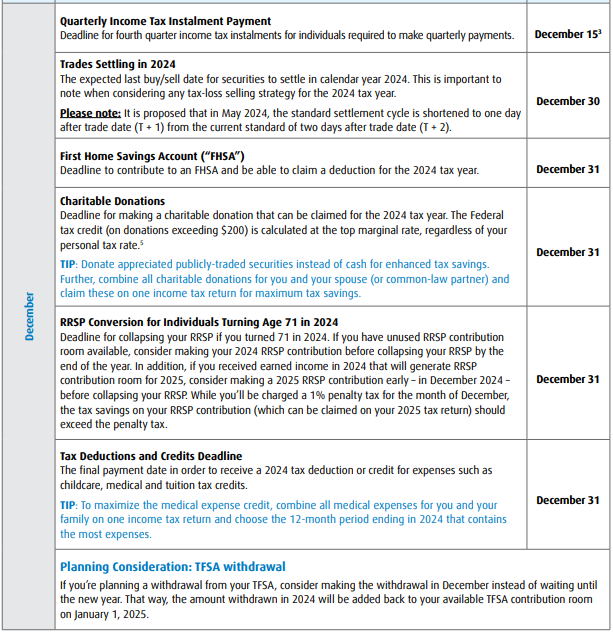

While most Canadians are aware of the April 30 personal income tax filing deadline, there are other important tax deadlines that must be observed over the course of the year – especially if you want to take advantage of certain tax deductions and credits. This calendar summarizes several important dates on the tax calendar and offers some tips to help you with your overall wealth planning. Where a deadline falls on a weekend or a holiday recognized by the Canada Revenue Agency (“CRA”), the deadline is generally extended to the next business day.

By not considering tax planning until the end of the year – or when filing your annual tax return – you may limit the opportunities available to help you minimize your overall tax bill. Talk to your BMO financial professional and your personal tax advisor about the planning considerations and tips included in this calendar to determine if you’d benefit from incorporating them into your 2024 wealth planning.

This Tax Calendar is neither a comprehensive review of the subject matter covered, nor a substitute for specific professional tax advice. The tax strategies discussed in this publication may or may not be appropriate for you. We encourage you to consult with an independent tax professional to confirm the relevant deadlines and the anticipated implications to your particular situation (with respect to the current tax legislation) in developing and implementing any tax strategies.

1 Extended to the following Tuesday, April 2, 2024, as the 2024 deadline falls on the weekend.

2 Please note, BMO makes every effort to ensure that tax slips are mailed by the stated deadline. However, in the event that an issuer does not supply the necessary information in time or makes amendments, tax slips will be processed on an individual security basis and mailed under separate cover as soon as available. Please ensure you’ve received all tax slips prior to filing your tax return.

3 Extended to the following Monday, as the 2024 deadline falls on the weekend.

4 On a related note, be aware that the tax legislation was amended to expand rules that seek to limit income-splitting with certain adult family members involving private companies. For more information, please ask your BMO financial professional for a copy of our publication, Tax Changes Affecting Private Corporations: Tax on Split Income (“TOSI”).

5 For donations made after 2015 that exceed $200, the calculation of the Federal charitable donation tax credit allows higher income donors to claim a Federal tax credit at a rate of 33% (versus 29%), but only on the portion of donations made from income that is subject to the 33% top marginal tax rate that came into effect on January 1, 2016.

BMO Private Wealth is a brand name for a business group consisting of Bank of Montreal and certain of its affiliates in providing private wealth management products and services. Not all products and services are offered by all legal entities within BMO Private Wealth. Banking services are offered through Bank of Montreal. Investment management, wealth planning, tax planning, philanthropy planning services are offered through BMO Nesbitt Burns Inc. and BMO Private Investment Counsel Inc. If you are already a client of BMO Nesbitt Burns Inc., please contact your Investment Advisor for more information. Estate, trust, and custodial services are offered through BMO Trust Company. BMO Private Wealth legal entities do not offer tax advice. BMO Trust Company and BMO Bank of Montreal are Members of CDIC.