McCreath Group - May 2017 Client Newsletter

James McCreath - May 10, 2017

Hello to all:

As we move into spring and summer, we wanted to share with you the latest version of our client newsletter (PDF version attached). We continually strive to put clients in a better financial and personal situation and this newsletter is an extension of our efforts to communicate ideas, trends and investment market themes with clients.

We have been consistently bullish on equities for a number of years and we continue to see stocks as the asset class of choice from a relative value perspective, especially given persistently low inflation and interest rates. With most indices at or near record highs, stocks no longer have the margin of safety they did five years ago. Yet we still see pockets of value, particularly among: financials, infrastructure, utilities, energy and real estate. It is a stock pickers market, highlighting the importance to identify great ideas and then making them count.

The McCreath Group’s mission statement is to provide clients with superior wealth planning on a timely basis while exceeding their expectations for service, portfolio management, trust and integrity. As Scott often likes to say, “Whether you’re a barber, dentist, teacher or lawyer, everyone needs assistance setting sail for retirement.”

Should you ever have any concerns or questions about your investments we’re always here to help, so please email or call any time. And most importantly, we thank you for being clients … Alison, Ashley, Rob, Lila, Steve, Brendon, James and Scott

Included in this edition is information on:

-

Commentary from BMO Nesbitt Burns’ Portfolio Advisory Team: Trump’s First 100 Days

-

The McCreath Group Market Overview … Focusing on Oil

-

Planning For Your Income Tax Refund

-

Commercial Banking Support

-

Quote of the Month … “Don’t count your money daily”

BMO Nesbitt Burns’ Portfolio Advisory Team: Trump’s First 100 Days

As abbreviated from information prepared by Stephane Rochon, CFA, BMO Nesbitt Burns Equity Strategist

Donald Trump has now been President for more than 100 days, since taking the oath of office on January 20, 2017. While it is fair to say that his vision and rhetoric have been polarizing, in our view, this, rather than being a new phenomenon, is emblematic of the increasingly partisan nature of U.S. politics over the last several years. Trump is a very different President from previous ones, coming into office with no government experience. Rather, he has built a successful real estate business through numerous discrete deals. Seen in this light, he is far more transactional-orientated than previous Presidents and will look for high profile victories on issues that are important to him. From a market perspective, his ability to successfully pass tax reform is the single most important issue for the “Trump rally” to have lasting power.

We want to emphasize that our team remains bullish on stocks over the long term. While the market is not particularly expensive, at 18 times forward earnings, we do not believe it is cheap either. Consequently, we believe investors should act defensively right now and emphasize specific sectors and stocks (especially high quality dividend growth names), rather than buying broad market indices.

This brings us to the 10%+ rally that we’ve seen in the S&P 500 Index (the S&P/TSX Composite Index is up 8% in Canadian dollar terms), and the 11%+ tightening of corporate bond credit spreads since the November 8, 2016 election. While economic data has certainly been supportive (with the Institute for Supplier Management and Consumer Confidence at multi-year highs), at least some of the rally can be attributed to Trump’s promises.

Since quantifying the exact impact of these variables on the market will always be an approximation, assuming he gets credit for half of the rally (i.e., 5% or 110 points on the S&P 500 Index), this is the amount that is at risk as investors start discounting a lower probability of “equity-friendly” measures passing. Of course, this assumes that all things are equal (which is seldom the case) and does not account for the additional political uncertainty that more Russian interference allegations might create.

While much remains uncertain as we pass Trump’s first 100- day mark, as always, investors are best served by diversifying their investment portfolio and staying focused on their long-term investment objectives.

The McCreath Group Market Overview … Focusing on Oil

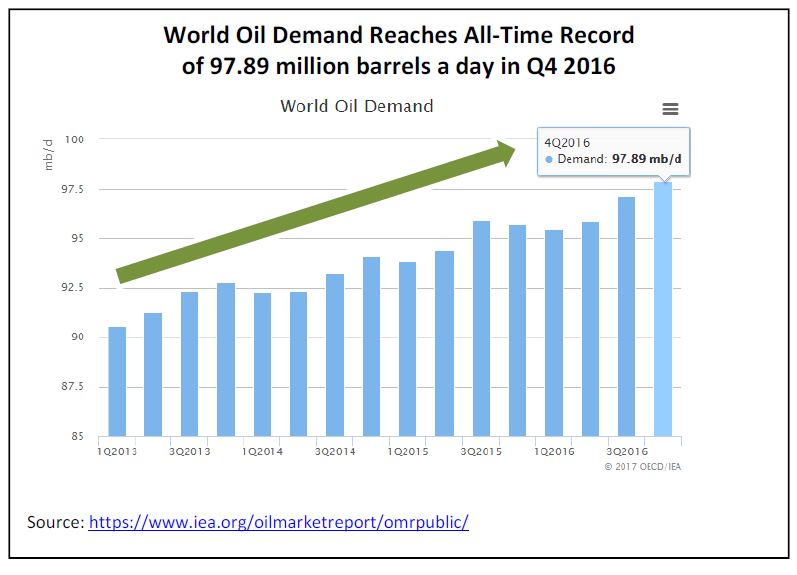

The price of oil remains an intense focus for investors. Day-to-day predictions on oil prices may be alluring; however our interest is the longer-term impact of the 2015/2016 price drop that’s leading to a supply deficit.

In early March, the International Energy Agency (IEA) released its five-year oil market forecast. A large supply deficit may take hold around 2020, “as demand growth is consistently forecast to outstrip projected increases in global oil supplies,” said IEA senior oil economist Matt Parry.

The IEA report said demand and supply trends point to a tight global oil market and spare production capacity may fall to a 14-year low by 2022. “We are witnessing the start of a second wave of U.S. supply growth, and its size will depend on where prices go,” Dr. Fatih Birol, the IEA’s executive director, said in a statement. “But this is no time for complacency. We don’t see a peak in oil demand any time soon.”

Oftentimes the true bottom of an oil-price cycle is set when supermajors sell assets at discounted prices. For example, this was highlighted in March when Canadian Natural Resources bought oil sands (200,000 b/d of production) and refining assets from Shell and Marathon for $12.7 billion, less than the cost to build the assets organically. In the March 21, 2017 edition of the Wall Street Journal, the publication highlighted the allure of investing in Canadian oil sands companies:

“Today shale (in locales such as the Permian basin in West Texas) offers the prospect of growth but also safety for oil companies still licking their wounds from the recent slump. By contrast, new investments in oil sands are prohibitively expensive, as much as US$45 a barrel above current prices, but cash returns on existing ones could be vastly superior if oil prices meet analyst expectations. Canadian Natural and Suncor, the two big Canadian producers, are expected to throw off free cash flow of US$7.9 billion combined in 2018, according to analysts polled by FactSet. With a combined market value just under US$90 billion, their combined free cash flow yield is nearly 9%. By contrast, shale behemoth EOG Resources, worth US$57 billion, is seen producing just US$1 billion in free cash flow in 2018 as it is forced to plow much of its cash into sustaining and growing production.

Not only do oil sands projects generate lots of cash at current prices but those costs are very stable and fields don't require much investment to keep output steady for several years. Recent buyers of oil sands not only got great deals but they will benefit disproportionately if oil prices rise. For investors truly bullish on crude in the long run, the best place to invest may be the unpopular fields north of the border.”

A March report by RBC Capital Markets stated the danger of using US-related oil data as a measuring stick for the global energy outlook:

While the bearish overhang bulging US stocks continues to cling to the market like a wet blanket, we caution against using US inventories as a proxy for or indicator of the global rebalancing act given that stocks are drawing in less visible regions within Organization for Economic Co-operation and Development (OECD) countries. The fixation on US oil data is natural since the US government and other third-party sources provide the most prolific reporting schedule, ranging from rigs to storage to estimates on production. The US data is the most frequent and transparent data source, whereas data in much of the rest of the world is lagged, opaque, or non-existent.

The recency and locational bias toward US storage data often leads industry participants to draw false parallels, particularly if the data is being used as a proxy for what the storage picture looks like in the rest of the world.

For example, weekly Japanese data suggest that stocks have fallen to multi-year lows on both a notional basis and on a days forward demand cover basis. Outright crude stocks currently reside at levels not seen since at least before 2010. Data has suggested that crude inventories in OECD Europe peaked last July before steadily declining through the balance of the year. In fact, the July through December decline represents the steepest six-month drawdown of any period for the region dating back to the turn of the decade.

As reported by the Financial Post last week, GMP FirstEnergy analyst Martin King presented to Canadian oil and gas executives and suggested years of capital project under-investment could lead to $75 USD per barrel of oil before 2020.

“The U.S. cannot drown the world in oil – it’s fundamentally impossible,” said King. “We think the data in the coming weeks and months should begin to put more of a positive spin on the resetting of the global oil market to more reasonable levels, but it will still take time.”

Another issue weighing on Canadian equity valuations is U.S. President Donald Trump’s musings about a border adjustment tax and his growing list of North American Free Trade Agreement grievances with Canada. King said Canada and the U.S. have the most productive energy trading relationship in the world and Trump “cannot, by himself, kill NAFTA by executive order.”

Planning For Your Income Tax Refund

The Canada Revenue Agency’s (CRA) stated goal is to issue a Notice of Assessment, including any applicable refund, within two weeks of receiving an electronically filed tax return, or eight weeks after receiving a paper filed return. To check the status of your federal tax refund, you can use the My Account (http://www.cra-arc.gc.ca/quickaccess/) or MyCRA service, or call CRA’s Telerefund phone service.

The following are recommendations for using your tax refund to build your net worth:

-

Contribute to your RRSP/TFSA – If you have unused RRSP contribution room, build your retirement savings by making an RRSP contribution. In addition, making your 2017 RRSP contribution now, instead of waiting until the deadline next year, will allow you to benefit from several extra months of tax-deferred growth. The maximum RRSP contribution limit for 2017 is $26,010. Alternatively, topping up your TFSA contribution now will also enable you to grow your money tax-free. The annual TFSA contribution limit for 2017 is $5,500.

-

Manage credit card debt – Pay down credit card debt, beginning with those cards that carry the highest interest rate.

-

Make a lump sum mortgage payment – If you have a mortgage, check the terms of your mortgage and consider using your tax refund to make a lump sum payment. Applied directly to your principal, a lump sum payment could save you significant money in interest costs over the life of your mortgage.

-

Build an emergency fund – Having money set aside in case of an emergency is not only a good financial strategy, but also helps you sleep easier at night. A good rule of thumb is to have at least three months’ salary saved as a safety net.

-

Save for your child’s education – A post-secondary education is becoming increasingly expensive. Contributing to a RESP can help alleviate some of the pressure that all parents feel when planning for their children’s future education. By maximizing your contributions every year you could earn up to $7,200 in lifetime CESGs for each of your children.

Commercial Banking Support

As BMO Nesbitt Burns clients, we can help you find and navigate numerous other elements of your financial situation:

-

Mortgages and Personal Borrowing

-

Insurance and Estate Planning

-

Commercial Banking

-

Personal Banking

For example, if you are a business owner and need assistance with your commercial banking needs (bank accounts and electronic cash management services or lending facilities), we have partnered with Senior Relationship Manager, Scott Murayama to assist our clients. Scott has worked at BMO for 17 years and specializes in helping secure financing needs for business owners requiring $3 million to $20 million. Scott has business experience in many sectors including agriculture, hospitality, wholesale, manufacturing, retail, non-profits and real estate.

Over the next 5-10 years there is expected to be an increased rate of business succession events and more than $2 trillion in inter-generational wealth transfer in Canada.

Our commercial banking team most often wins business by providing:

-

Enhanced customer service compared to our peers

-

Increased cash management support

-

Lending facilities including: operating lines, term loans, CapEx lines, corporate MasterCards, treasury risk management lines for foreign exchange and swaps.

-

Cross-border support given BMO’s footprint in the United States through BMO Harris Bank

Quote of the Month

“If owning stocks is a long-term project for you, following their changes constantly is a very, very bad idea. It’s the worst possible thing you can do, because people are so sensitive to short-term losses. If you count your money every day, you’ll be miserable. - Daniel Kahneman, noted psychologist and best-selling author.

Thank you for being clients ... and please contact us any time with questions, concerns or feedback ... The McCreath Group … (403) 261-9552