Portfolio

To Preserve & Protect Your Legacy

Managing the Health of Your Wealth by Building Smarter Portfolios

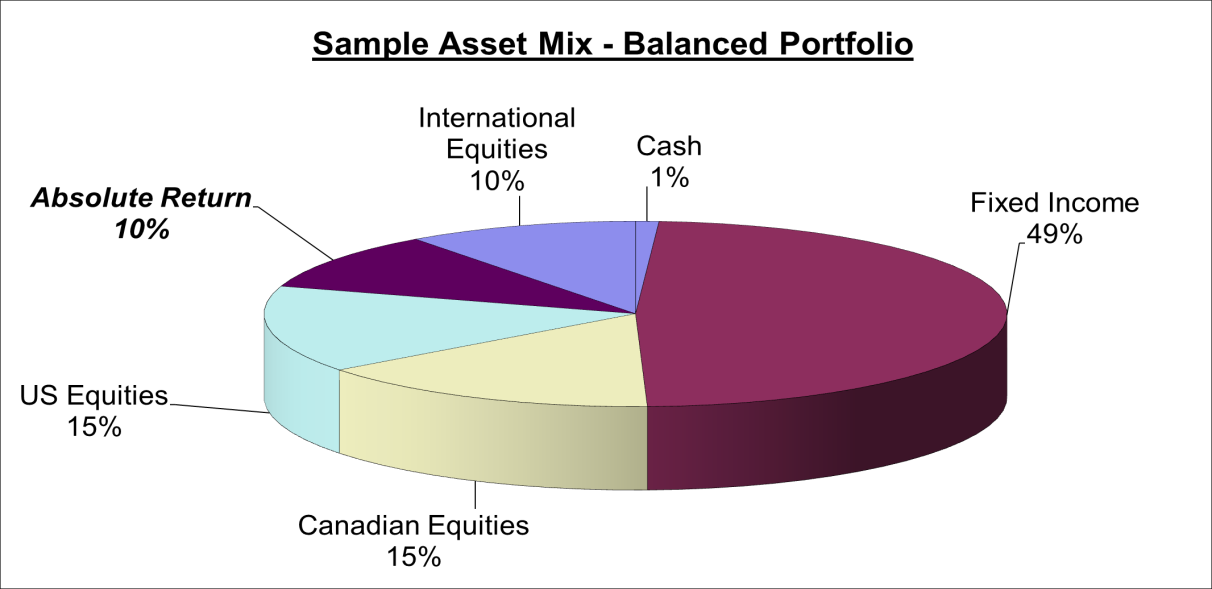

We believe the greatest opportunity for clients to achieve their investment objectives and to realize optimal risk-adjusted returns is by using a well-constructed portfolio combining active, passive and alternative strategies allocated to meet their unique needs. Given all of these factors, we believe portfolio construction efforts should focus on seeking a balance between growth potential and downside protection. This means being sensitive to stock valuations, ensuring wide-ranging diversification and focusing on income.

In its broadest sense, diversification means exposure to a variety of asset classes that have historically had lower correlations to each other. For many investors, this could mean adding real estate, international exposure and alternative strategies (such as long-short, absolute return, and market neutral mandates) to their portfolios.

Our Portfolio construct provides adequate and prudent diversification to global equity markets and fixed income, while incorporating an allocation to Absolute Return managers.

Please contact us to learn more about our portfolio construct and historical performance.