Taking Money Out of an RESP

BMO Marketing - Aug 28, 2023

As the new school year begins, many students are preparing to take the next big step in their educational journey by heading off to university, college, or another continuing education program aligned with their interests and career aspirations.

As the new school year begins, many students are preparing to take the next big step in their educational journey by heading off to university, college, or another continuing education program aligned with their interests and career aspirations. Fortunately, if you’ve planned ahead and contributed to a Registered Education Savings Plan (“RESP”), your child, grandchild, or another qualifying beneficiary of the plan, will have the means to fulfil their post-secondary education goals and start to withdraw funds from their RESP.

This article provides information on how, and when, to withdraw funds from an RESP, as well as information on qualifying educational institutions and programs. In situations where the RESP beneficiary decides not to pursue post-secondary studies or leaves before completing a qualifying program, the subscriber of the plan must decide what to do with the money that has accumulated in the RESP.

Educational Assistance Payments

An Educational Assistance Payment (“EAP”) is a withdrawal from an RESP used to finance post-secondary education costs of an RESP beneficiary. An EAP consists of the growth on the principal contributions to the RESP, as well as the Canada Education Savings Grant (“CESG”), the Canada Learning Bond (“CLB”), and any other amounts paid under a designated provincial program. EAPs are reported on the beneficiary’s T4A slip (Box 42) in each year that they attend a qualifying postsecondary program and receive EAPs from the RESP.

Educational Assistance Payments can be paid to the beneficiary of an RESP when:

- They are enrolled in a qualifying educational program at a qualifying post-secondary educational institution. This includes long-distance and online education courses – such as a correspondence course – that are provided by such institutions; or

- The beneficiary has reached the age of 16, and is enrolled in a specified educational program

Qualifying vs. specified educational programs

A qualifying educational program is a full-time post-secondary school level program that runs for a minimum of three consecutive weeks, and requires the student to spend not less than 10 hours per week on program courses or curriculum work.

A specified educational program is a part-time program at the post-secondary school level that runs for a minimum of three consecutive weeks, and requires the student to spend not less than 12 hours per month on courses in the program.

Post-secondary educational institutions that offer qualifying and specified educational programs include:

- A university, college, CEGEP, trade school or another designated educational institution in Canada;

- An educational institution in Canada certified by Employment and Social Development Canada (“ESDC”) as offering non-credit courses that develop or improve skills in an occupation; or

- A university, college, or other educational institution outside Canada that offers courses at the post-secondary school level, where the student is enrolled on a full time basis in a course that runs for a minimum of 13 consecutive weeks. (Three weeks for full-time attendance at university programs.)

A beneficiary is entitled to receive EAPs for up to six months after ceasing enrolment in a post-secondary educational institution, as long as the payments being received would have qualified as EAPs had they been made immediately before the student’s enrolment ceased.

Limit on EAPs

For RESPs set up after 1998, the maximum EAP that can be made to a student upon qualifying to receive such payments depends on their enrolled educational program.

Maximum EAPs

For the first 13 consecutive weeks of enrolment in a qualifying educational program, the maximum EAP is $8,000. After completing 13 consecutive weeks, there is no limit on the amount of the EAP, as long as the beneficiary continues to qualify to receive payments. If, at any time, there is a 12-month period in which the beneficiary is not enrolled in a qualifying educational program, the maximum for the first 13 weeks of enrolment will again apply.

The maximum EAP for a specified educational program is $4,000 for the 13-week period, whether or not the student is enrolled in such a program throughout the 13-week period.

Accumulated Income Payments

An Accumulated Income Payment (“AIP”) is a withdrawal of accumulated income from the RESP – usually by the subscriber – in situations where the beneficiary of the RESP does not attend a qualifying or specified educational program. The subscriber may withdraw the income that has accumulated in the RESP if the following conditions are met:

- The subscriber is a Canadian resident;

- The RESP has existed for at least 10 years; and

- All beneficiaries under the plan are 21 years of age or older, and will not be pursuing a post-secondary education.

The accumulated income may be withdrawn by the subscriber without meeting conditions (ii) or (iii), if all of the RESP beneficiaries are deceased.

The Canada Revenue Agency may also allow an Accumulated Income Payment to the subscriber without meeting conditions (ii) or (iii), if a beneficiary will be unable to pursue postsecondary studies due to a severe and prolonged mental impairment, or if the plan is being closed at the end of the 35th year after which it was originally set up.

When the accumulated income is returned to the subscriber, it is taxed in the subscriber’s hands as ordinary income at their normal tax rate, plus an additional tax levy of 20 per cent (12% in Quebec). The income tax can be deferred, and the 20 per cent tax avoided if the subscriber (excluding someone who became the subscriber as a result of the death of the original subscriber) has sufficient contribution room in their Registered Retirement Savings Plan (“RRSP”). Up to $50,000 of the accumulated income may be used to make a regular or Spousal RRSP contribution. As a result, if $50,000 of RRSP contribution room is available, and the subscriber makes a $50,000 RRSP contribution using the accumulated income in the RESP, they would only be assessed for the 20 per cent tax on any remaining growth in the RESP in excess of the $50,000.

If the RESP beneficiary is also the beneficiary of a Registered Disability Savings Plan (“RDSP”)1 and has RDSP contribution room available, an AIP can be transferred on a tax-deferred basis to the beneficiary’s RDSP, if certain conditions are met.

Post-Secondary Education Payments

If the beneficiary’s education expenses exceed the amount available through EAPs, you may want to consider a PostSecondary Education Payment (“PSE”) to supplement the EAPs. A PSE represents a return of the original RESP contributions made by the subscriber, which can be withdrawn at any time, with no tax consequences. Generally, subscribers use the RESP contributions, along with EAPs, to pay for educational expenses. If the original beneficiary of the RESP does not pursue post-secondary studies, and another beneficiary is not named to replace the original beneficiary, all contributions to the RESP can be returned to the subscriber with no tax consequences. However, this may trigger a requirement to repay any CESGs remaining in the plan.

Subscribers may not want to be too hasty with respect to their decision to collapse an RESP, as it’s possible that the beneficiary may return to school at a later date. It is also important to note that an RESP can be kept open for a maximum of 35 years. In addition, the Canada Education Savings Grant can be shared with other siblings if they have grant room available. Otherwise, it must be returned to the Government of Canada.

RESP payments to a designated educational institution

Generally, any amount that is left in the RESP after maximizing EAPs and returning the capital to the subscriber (and the conditions for an EAP or AIP cannot be met) can be paid (i.e., bestowed) to a designated educational institution in Canada.

Consider your RESP as part of your estate plan

Since RESPs can be kept open for such a lengthy period, it is important that RESP subscribers consider their RESPs as part of their estate plan. For further information, please ask your financial professional for a copy of our publication, Considering RESPs As Part of Your Estate Plan.

RESP payment types

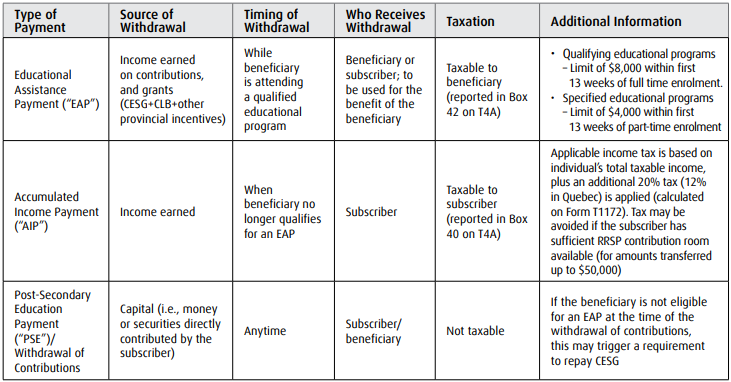

The table below provides a summary of the three types of payments that can be received from an RESP.

1 Because BMO Nesbitt Burns is not an RDSP provider, we are unable to facilitate a direct transfer from a BMO Nesbitt Burns RESP to an RDSP

BMO Private Wealth provides this publication for informational purposes only and it is not and should not be construed as professional advice to any individual. The information contained in this publication is based on material believed to be reliable at the time of publication, but BMO Private Wealth cannot guarantee the information is accurate or complete. Individuals should contact their BMO representative for professional advice regarding their personal circumstances and/or financial position. The comments included in this publication are not intended to be a definitive analysis of tax applicability or trust and estates law. The comments are general in nature and professional advice regarding an individual’s particular tax position should be obtained in respect of any person’s specific circumstances.

BMO Private Wealth is a brand name for a business group consisting of Bank of Montreal and certain of its affiliates in providing private wealth management products and services. Not all products and services are offered by all legal entities within BMO Private Wealth. Banking services are offered through Bank of Montreal. Investment management, wealth planning, tax planning, philanthropy planning services are offered through BMO Nesbitt Burns Inc. and BMO Private Investment Counsel Inc. If you are already a client of BMO Nesbitt Burns Inc., please contact your Investment Advisor for more information. Estate, trust, and custodial services are offered through BMO Trust Company. BMO Private Wealth legal entities do not offer tax advice. BMO Trust Company and BMO Bank of Montreal are Members of CDIC.

® Registered trademark of Bank of Montreal, used under license.

All rights are reserved. No part of this publication may be reproduced in any form, or referred to in any other publication, without the express written permission of BMO Private Wealth.